Think back to the first time you found out that early retirement was possible.

The idea of walking away from your job in your 30s or 40s may have never crossed your mind but once you learn that other people have done it, you decide to investigate further.

After doing a bit of research, you realized that early financial independence (FI) is in fact possible and may not even be as difficult as it first seemed.

You simply need to save up 25 times your annual expenses and then you can live off your portfolio for the rest of your life (e.g. if you spend $40,000 a year, you can retire when you have a million bucks).

At this point, your life changes forever.

That’s what happened to me, anyway.

Once I realized that I could escape the world of bosses, commutes, and pointless hour-long meetings, I knew I had to dedicate all of my energy into achieving that goal.

Birth of the Mad Fientist

To speed up my journey to FI and help others do the same, I launched the Mad Fientist in early 2012 with the following two objectives:

- Talk to others who retired early to find out how they did it

- Research and write about innovative ways to achieve financial independence quicker

Since early retirees are so different from the standard work-until-65 employee, the normal financial advice you always hear doesn’t apply.

So rather than regurgitate the same information I was used to reading at the time, I decided to dive into the actual numbers. I ran experiments to test my strategies. I created software tools and calculators to use. And when I don’t know something or didn’t have experience with a specific topic, I asked experts who knew better.

It worked.

On August 1st, 2016, at the age of 34, I walked away from my full-time job as a software developer for good.

Financial Independence, Not Early Retirement

Early retirement wasn’t actually the main goal for me though.

I enjoy working hard and I derive a lot of happiness from being productive so the idea of sitting on the beach all day didn’t appeal to me.

I just wanted full control over what I spent my time on.

So even though I left my job, I still don’t consider myself retired because I’m now working harder than ever.

The difference is, I’m working on things that are important and exciting to me, rather than what my boss tells me to work on.

Financial independence provides freedom. What you do with that freedom is up to you.

There’s no right answer but having the freedom to do whatever you want is the most valuable thing that money can buy.

What will you do? What will your days look like when you have full control over your life?

Financial Independence Podcast

As I mentioned, one of my goals when I started the Mad Fientist was to talk to people who already achieved FI to find out how they did it.

Since I didn’t know anyone in real life who retired early, I started the Financial Independence Podcast to give me an excuse to interview the people I wanted to learn from.

I launched the podcast in May of 2012 and my very first guest was Mr. Money Mustache.

I’ve since gone on to interview dozens of early retirees, including the blogger behind the first blog I ever read (JD Roth of Get Rich Slowly) and the author of the FI classic, Your Money or Your Life (Vicki Robin).

Important Lesson #1: When you want to do something, find others who have already done it and learn everything you can from them.

Investing Optimizations

For my second goal of researching ways to reach financial independence faster, I first thought that I could achieve that by figuring out how to become a better investor.

I began studying financial theory to see if there were ways to optimize and here’s what I found…

Diversification

When looking into the relationship between risk and returns, I discovered that you can lower your risk while potentially increasing your expected returns through diversification.

I also discovered that the best way to get the risk-reducing benefits of diversification while maintaining as high of returns as possible is to invest in a minimum-variance portfolio.

Luckily, it’s really cheap and easy to invest in a minimum-variance portfolio…you just invest in the market portfolio (i.e. all the stocks in the market) and you can do that by buying a low-cost, total-market index fund from a company like Vanguard.

Around the time I reached this conclusion, I chatted with another intelligent investor, JL Collins (author of The Simple Path to Wealth), and was pleased to learn he recommended the same strategy.

Important Lesson #2: The best way to invest is to just pump as much money as possible into low-cost, total-market index funds and then leave it there.

Investor Psychology

In addition to studying investment strategy, I also studied investor psychology.

What I found was that there are hundreds of Cognitive Biases that threaten to sabotage your investment plans.

To combat this, I set up automated investing so that I invested no matter what the market valuations (or my feelings about the market) were at the time.

Important Lesson #3: Figure out your investing plan (e.g. asset allocation, etc.) then take yourself out of the equation as much as possible so that you don’t get in your own way.

Portfolio Tracking

Although I wanted to keep my brain out of investing as much as I could, I still wanted to keep an eye on things and track my progress to financial independence.

I was able to monitor my asset allocation and investment fees with this free online portfolio manager and I kept track of my expenses with a custom spreadsheet that I built.

There wasn’t a good way to keep track of my progress to financial independence though so I used my software-developer skills to build a web application to do it!

![]()

I created an app called the FI Laboratory and now over 50,000 other people are using it to track their progress to financial independence!

Click here to sign up for a free FI Laboratory account and start tracking your own progress to FI.

Tax Avoidance

After the FI Laboratory was completed, I felt like I had everything in place from an investment standpoint.

The problem was, I still wanted to take action and speed up my journey to early retirement.

That’s when I started looking into new ways to optimize.

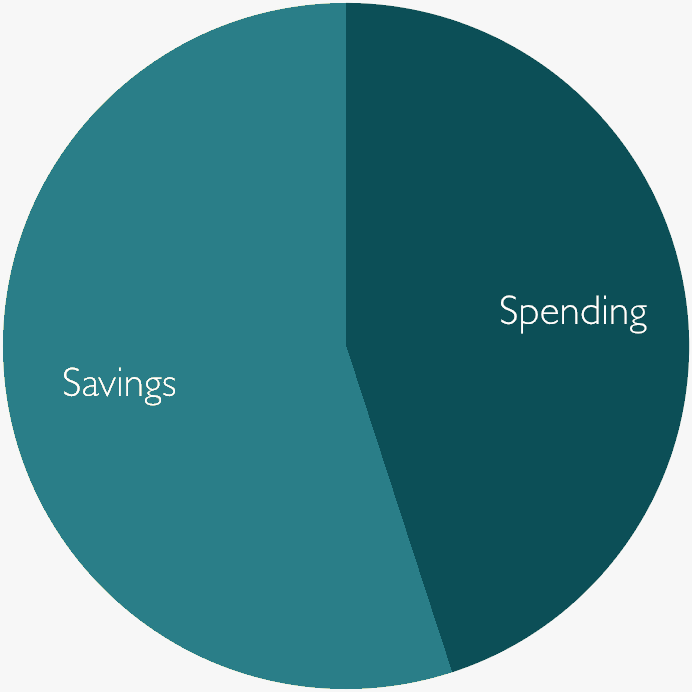

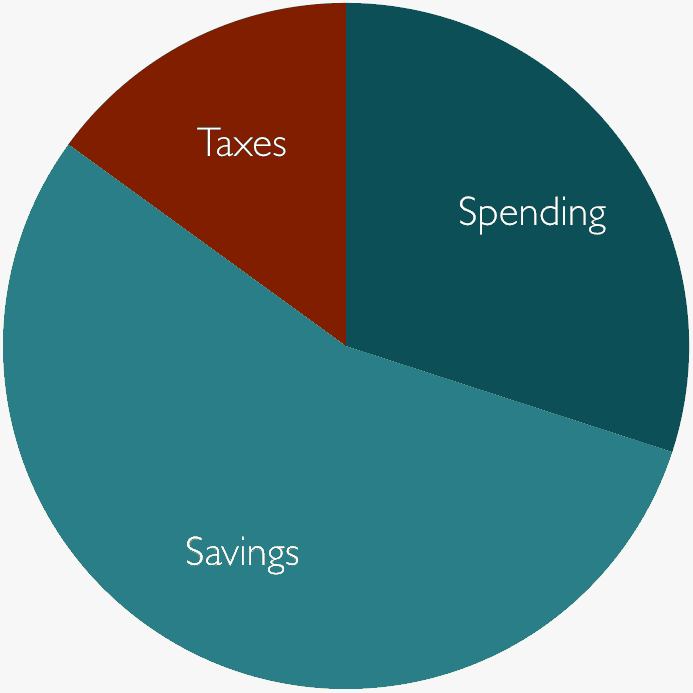

When people try to increase the amount they save, they usually focus on reducing their spending or increasing their income (preferably both).

Reducing the “Spending” slice of the pie or making the entire pie bigger (by increasing your income) will help you save more but focusing on just these two things misses the one area that has the most opportunity to be optimized…taxes!

Here’s what the pie actually looks like:

Legally reducing your taxes is a great way to save more without negatively impacting your quality of life so that’s where I decided to focus next.

Throughout my career, I always took advantage of tax-advantaged accounts because I knew they had the power to triple the value of my income.

It wasn’t until I started investigating tax-avoidance methods specifically for future early retirees though that I realized how powerful tax avoidance really is.

This is also when I realized that most financial advice doesn’t apply to early retirees.

For example, mainstream financial media usually recommends Roth IRAs but my research found that Traditional IRAs are a far better option if you plan to retire early.

In fact, choosing traditional retirement accounts over Roth accounts can allow you to retire years earlier!

Experiments

To test the optimizations I was writing about, I started a real-time Guinea Pig Experiment.

The experiment follows two theoretical scenarios – one that utilizes the strategies I write about here and one that doesn’t.

The experiment has been running for over three years now so check out the experiment’s homepage.

Spoiler Alert: The Optimized Guinea Pig is over two years closer to financial independence than the normal Guinea Pig, despite earning and spending the same exact amount!

Access Retirement Funds Early

A big objection to utilizing tax-advantaged accounts is that they tie your money up until you’re in your 50s or 60s so they aren’t good for people who want to retire early.

I too thought this was the case but I contributed to tax-advantaged accounts anyway because it was the most efficient way to save for standard retirement.

People forget that early retirement actually contains standard retirement so you still need to save for age 59.5 and above!

Once I got to the point where my standard retirement savings were fully funded though, I began looking into ways of accessing retirement funds early so that I could keep utilizing the tax benefits of retirement accounts.

Not only did I find great strategies for accessing retirement accounts early, I realized that early retirement allows you to potentially save a ton of money and pay no tax on the money ever!

After I realized that, I made it my mission to investigate and utilize as many tax-advantaged accounts as I could.

For example, I showed that a Health Savings Account is actually the ultimate retirement account and can be used for completely tax-free saving!

Important Lesson #4: Legal tax avoidance can drastically reduce your time to FI without impacting your quality of life.

Other Tax-Reduction Strategies

Once I had maxed out all the tax-advantaged accounts I could, I explored other strategies to lower my tax burden even more.

I discovered that maxing out your retirement accounts as early in the year as possible could increase your expected returns.

I also found that you could use Tax-Loss Harvesting to further reduce your taxable income and Tax-Gain Harvesting to lock in gains without paying taxes (while making future tax-loss harvesting even more beneficial).

Note: Set up your investment accounts to use the Specific Identification of Shares accounting method to make tax-loss harvesting and tax-gain harvesting easier.

Help from Experts

I realized that real-estate investing could provide even more tax-avoidance opportunities but I didn’t have any experience investing in real estate so I asked a real-estate expert to share some of his best real estate tax-avoidance strategies.

Extreme Strategies

Once I exhausted the low-hanging tax fruit, I then began exploring even more extreme strategies.

For example, there’s a trick to contribute over $50,000 to your Roth IRA every year (see Mega Backdoor Roth) and there’s a way there used to be a way to make your Roth IRA conversion ladder even more tax-efficient (see this post for how the 2017 tax reform legislation impacted some popular tax avoidance strategies).

I even started thinking about alternatives to early retirement that would be even more tax efficient but just as fun, like Semiretirement.

Minimize Spending

Reducing your taxes is great because you increase the amount you can invest without cutting back on things you enjoy spending money on.

Luckily, there are ways to reduce your normal spending that won’t negatively impact your quality of life either.

In fact, being frugal can be even more enjoyable than being a big spender, if you approach it in the right way.

Since I’ve always been a naturally frugal person, my expenses were already low so I had to get more creative to reduce my spending further.

Travel Hacking

Travel was my biggest discretionary expense so my first goal was to decrease my travel costs.

I planned to use Geographic Arbitrage to further lower my expenses after FI so the first thing I did was talk to perpetual travelers like Retire Early Lifestyle and Go Curry Cracker to see how they were doing it (I also chatted with others who were utilizing geographic arbitrage while still working).

I then dove into the world of travel hacking.

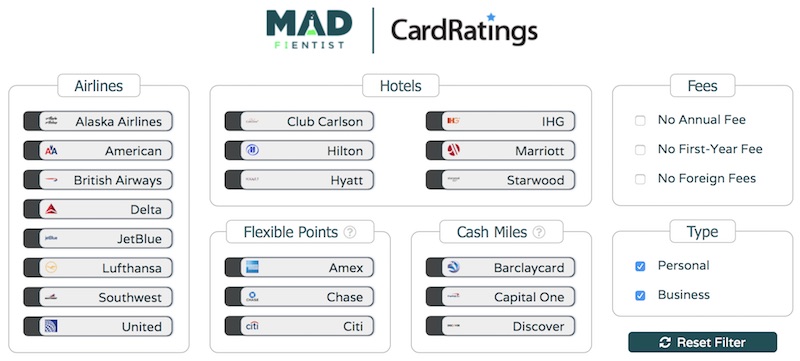

Realizing how valuable miles and points were, I focused on building up my Other Portfolio and was able to accumulate hundreds of thousands of miles/points for free.

Over the years, I used some of those points to take incredible trips for very little money. For example, we traveled all the way around the world for less than $1,000 each and also spent 3 months living in Southeast Asia!

After travel hacking for a while, I became frustrated that there was no good way to find the best

The software keeps track of which points transfer to which airlines/hotels (and at what ratios) and it automatically displays the most valuable signup bonuses for the program(s) you want to earn points in.

Increasing Income

Minimizing your expenses will help you reach financial independence sooner but increasing your income can do the same thing while being even more fun.

Real Estate

Real estate is a popular income-increasing pursuit and I’ve talked to many people over the years who have done it successfully.

From live-in flips, to income-producing residential properties (see here, here, and here), to even investing in hotels…there are plenty of opportunities to increase your income with real estate.

It can be a lot of work though and it’s definitely not for everyone so do your research before diving in.

Entrepreneurship

Besides real estate, entrepreneurship seems to be the next most popular income-increasing pursuit.

Starting your own side hustle can be a great way to speed up your journey to early retirement (but only if you start and build your business the right way) and it can provide you with something enjoyable to spend your time on after you retire.

If you don’t want to create your own business from scratch, there are now ways to buy online businesses. While internet-business investing can be profitable, it can also be very risky so make sure you learn how to mitigate the risks of website investing before you get started.

Dark Times

So by this point in my story, I had sorted out my investments, minimized my taxes, reduced my expenses, and started building up additional sources of income.

I was on the fast-track to FI but there was one big problem…I was miserable.

My obsession with reaching financial independence as quickly as possible caused my healthy frugality to morph into harmful deprivation.

I was aware that I wasn’t happy but I figured it wasn’t a big deal because I would be happy eventually once I reached FI.

What I didn’t realize though is that this seemingly-harmless unhappiness was actually turning into depression.

My wife and I were living in the woods of Vermont at the time and I was busy pursuing a Free Ivy League Degree so in addition to my full-time software-developer job and all the Mad Fientist research/writing I was doing, I was enrolled in a demanding academic program.

Although I was learning cool things, I was very busy and always had something I needed to do so that busyness gave me the perfect excuse to stay in the house all the time.

I would stress about spending money when I was out anyway so I figured staying in and getting stuff done was better.

That self-imposed isolation, however, made the depression worse and eventually it got to the point where I was never happy.

The shift from happy to depressed was gradual though so I didn’t realize what had been happening. It wasn’t until my wife got fed up and decided to sit me down and explain exactly what had been going on that I realized how big the problem had become.

From that point on, I started focusing on increasing my present happiness again instead of putting happiness off for some time in the future.

Important Lesson #5: Don’t put off happiness until FI.

Lessons Learned on Happiness

To get out of the funk I got myself into, I began focusing more on the emotions of financial independence, I started researching the science behind happiness, and I talked to people who successfully increased their own happiness.

It turns out humans are terrible at predicting what will make us happier, which is why people who spend a lot of money to be happy are rarely successful.

We are good at realizing what makes us unhappy though so it’s possible to increase your happiness by removing the things that make you unhappy.

Luckily, having a lot of savings in the bank makes it much easier to easily remove things from your life that you don’t like!

We realized that being isolated in the woods of Vermont wasn’t good for us so we decided to remove that negative from our lives by moving back to Scotland (where my wife is from).

It was at this time that I discovered the Power of Quitting, which I believe is one of the most underutilized but most incredible powers that saving for FI gives you.

I had crossed my 4% FI finish line by this point (see this interview for more on the 4% rule) so I planned to just quit my job when we moved back to Scotland.

When I told my bosses I was moving though, they immediately asked me if I’d be interested in working remotely. I agreed, and in one 10-minute conversation, I successfully removed most of the things I hated about my job – the commute, being stuck in the office all day, attending pointless meetings, etc.

It was fantastic!

Important Lesson #6: Use the power that your increasing net worth gives you to make positive changes in your life so that the journey to FI is more enjoyable.

Spouse and Money

By this point in the story, my wife had also come around to the idea of financial independence.

When I first started on this journey, she wasn’t interested in saving the majority of her paycheck because she loved her job and also enjoyed spending more than I did so she had no reason to save so much.

Thankfully, we both earned roughly the same amount of money and just kept our accounts separate so it never caused any arguments but we weren’t exactly working towards the same goals.

After years of writing and talking about financial independence though, she surprised me one night with a letter she wrote.

Turns out that a conversation on our honeymoon about figuring out what our perfect life would look like caused her to see the real value of financial independence.

FI wouldn’t force her to quit a job she enjoyed but it would give her the freedom to do other things that are also really important to her, like traveling and spending time with family and friends.

Once it clicked for her, she did a complete 180 and is now even more hardcore than I am (as she shared when I interviewed her for an episode of the podcast).

Important Lesson #7: Don’t try to force FI on anyone. If you want to convince someone of the benefits of saving towards financial independence, frame the benefits in a way that will motivate the person you are trying to convince (and realize that their motivations may be much different than your own).

Financial Independence is for Everyone

Just as people’s motivations for FI are different, their paths to FI are different as well.

From teachers who became millionaires through agressive saving to other teachers who were able to retire in 5 years thanks to real-estate investing.

I’ve talked to a military man who retired early after leaving the Navy, an engineer who amassed a million dollars in a decade by saving consistently, and a person who started pursuing financial independence after experiencing a personal tragedy.

Whether it’s an early retiree who has been retired for over a decade or a couple of millennials just starting on their FI journies, there’s a lot to learn from everyone on this path.

These money conversations have also shown that financial independence and early retirement is possible no matter what your income or situation (even if you have 13 kids)!

Interesting Post-FI Lifestyles

What people decide to do after they retire is just as varied as the paths they take to get there.

Whether it’s retiring to an outdoor life in the mountains or selling everything and living/traveling full-time in an RV, the important thing to realize is that after FI, anything is possible.

So challenge your assumptions, question everything, and start working towards the life that will be most meaningful and enjoyable to you.

And if that new life happens to be in outer space, maybe I’ll see you there :)

Finally Pulling the Plug on Work

After leaving Vermont and moving back to Scotland, I continued working remotely for another two years. Since I didn’t mind the job as much after leaving the office, I was in less of a hurry to quit.

It actually would have been difficult to quit such an easy and well-paying gig but thankfully the decision was made for me in 2016.

My HR department found out I was working from Scotland, and not the US like they had incorrectly assumed, so I was told I’d either need to move back to the States or resign.

Since I had enough money saved up and didn’t want to move back to the States, I told them I would be leaving and in August of 2016, I finally walked away from my full-time job for good.

Freedom

Since “retiring” from my career as a software developer, my life has completely changed.

My first year of freedom was an incredible ride and the second year is shaping up to be even better.

Although the experience has been overwhelmingly positive, there have been some challenges.

When you have the freedom to do anything, you have to decide how to best spend your time. This leads to being confronted by heavy topics like your purpose and the meaning of life.

Even though these thoughts can be intimidating at first, it’s a privilege to be able to tackle some of these tough questions when you’re still young enough to change course and it’s incredibly exciting to have the money and time to fully pursue your passions.

When Will You Reach Financial Independence?

So that’s my story up until this point.

Hopefully it’s shown you what’s possible and has provided you some new strategies to help you reach your own financial goals quicker.

If you’re just getting started on the path to FI, the first thing you should do is calculate your net worth. You need to know where you are before you can know where you’re going.

Once that’s done, start tracking your progress to FI for free in the FI Laboratory. You only need to enter a single month’s worth of information to learn when you can expect to achieve financial independence so find out today!

When you get a little bit more hardcore, download a copy of the spreadsheet I used on my journey to financial independence and start figuring out which expenses are delaying your progress the most and try to reduce or eliminate them.

To stay motivated along the way, subscribe to the Financial Indepenendence Podcast and hear tips from others who have already crossed the finish line.

And if you want to even hear more details about my own story, check out this podcast-takeover interview or this live Q&A session from Camp Mustache.

The Future

As for my future plans, I feel like the most interesting part of this story is just beginning.

I have a lot of great Mad Fientist stuff lined up so the best way to stay up to date with what’s going on around here is to sign up to the email list.

I only send out one or two emails a month and over 100,000 people are currently subscribed so it must not be too bad :)

Thanks for joining me on this incredible journey and I look forward to helping you make your path to FI as quick and enjoyable as possible!

Wow, what an epic post!

I can’t wait to hear about your first year of ER, and see what’s next! :D

Incredible post!! I’ve been a postcast listener since 2012 and really appreciate all your work! Question is can’t figure out on my own yet: we are above $120k/ as a couple filing jointly and both have employer sponsored retirement plans which means we accidentallybocer contributed to our IRA. I’ve looked and looked and I’m unclear on what should we do with contributions to avoid the 6% penalty and still putbas much as possible into retirement accounts.

Sorry for the Newb question – it’s taken us a long time to get to this income level and this is a wrench in our plans! Any tips appreciated!

Hello Adrianne,

You actually have an awesome opportunity there. With an IRA you can still make contributions but do NOT deduct them on your taxes. Instead, you can use those “after-tax contributions” and roll them over at the end of the year into a Roth IRA.

This is called a “Backdoor Roth” & I personally use it.

Thanks to the Mad Fientist for consolidating all of this info into one place.

I too have an IRA/Roth conversion situation that I’m trying to sort out…I’ve made several non-deductible contributions to my traditional IRA over the years and thought I could convert them to a Roth at some point without tax consequences because I had already paid the taxes in those contribution years. I then read the details on the pro rata rule and it seems to me that if I attempt to convert these after tax contributions then I am going to end up paying more taxes.

Can anyone provide specific details on how this might work for my scenario?

Total IRA account balances: $115000

Non-deductible contributions: $16000

Married Filing Jointly (24% Tax Bracket)

Thanks

Ron

Ron,

If you are still working see if your employer allows you to roll your existing tIRA account/funds into your 401(k). If so you may be able to roll just your deductible contributions/earnings into your 401(k) and the be free to convert your non-deductible contributions to a Roth IRA.

It’s been just over a year since I quit my job. We reached financial independence doing all the things you listed. Maxing out traditional 401k plans, reducing expenses, and targeting our spending on things that really make us happy.

Since I left we have been doing a lot more travel than I expected. With help from some of your posts, we’ve hacked over $10k in free travel over the last year. We just got back from a free trip to Spain :)

I’ve also been gardening, biking, and just having fun doing whatever I want. I’ve been having a hell of a year, and will be looking forward to hearing your thoughts on a year of freedom :)

Nice!! Glad you’ve been enjoying ER (and travel hacking)!

I’ve actually travelled less than I expected and plan to cut back even more. Normal life is just so good now that I don’t feel the need to go anywhere :)

I want to know and do research about travel hack. But right now me and my husband put aside the traveling and save save save more money so that we can have more cash to invest in our brokerage.

Can you please share how you start doing the travel hack to the point you get free tickets or travel less pay??? Thank you very much..

This is awesome! Very interesting journey, I find it fascinating how you went through a “dark time” and needed to work to remove things in life that made you unhappy. Looking forward to what is to come!

And thank you for all of the amazing posts, podcasts and resources so far. Your site has been a goldmine for Mr. Adventure Rich and I.

I’m so glad you put this post together. I’ve been a huge fan from the beginning and it’s nice to have a reference for others that catches them up in one post.

I also totally agree with your take on the RE part of FIRE, I prefer FIT – Financially Independent Traveler. At least that’s what I’m aiming for.

Keep up the great work and I look forward to what’s to come on your site and podcast!

I thought I was going to be FIT but I’m more FIGWWRHOATSHRPA (Financially Independent Guy Who Works Really Hard On All The Shit He’s Really Passionate About), haha

It just rolls off the tongue!

This is what we’re planning to do as well! FIT – I like it!

Awesome post MF! I think this’ll be a great primer for people looking for specific posts/interviews that they want to dig into further.

My favorite piece:

“It turns out, humans are terrible at predicting what will make them happier (which is why people who spend a lot of money to be happy are rarely successful).

We are pretty good at realizing what makes us unhappy though so it’s possible to increase you happiness by removing the things that make you unhappy.”

I think once that clicked for me it became so much easier to make FI a priority and to cut out the unnecessary expenses that were holding back my savings rate.

Hi Brandon,

What an amazing wealth of experience and knowledge you share here! You’re so right that it’s all about FI and not just retiring early and avoiding work.

I’ve gotten a taste of what it’s really like as just 6 weeks ago I transitioned to working 3 days a week. This has propelled my understanding of what FIRE really is all about. I feel like I’m getting closer and closer to finding my Ikigai every day now.

My favorite part of your post here was your sharing of your dark times. So important for couples pushing for FIRE to realize this possibility and learn from your experiences.

I can’t wait to meet you again as I feel so much differently about life and FIRE than I did when we met last year in SF. May our travel paths cross again soon.

– Trip

By the way, you were brought up at the most recent Austin Mustachians meetup this past weekend. We were discussing some of your best posts and tools that would benefit the group at large.

Nice, congrats on dropping down to 3 days a week!

Thanks for the message and hopefully we can get together for a few beers again soon!

This is a perfect- a nice, organized Cliffs Notes of the best of Mad Fientist!

Some of your early articles actually got the wife and I started on our own journey- we’ll be joining you in the FI club next year! Thanks for all the kick ass content. Hoping to see more now that you are free from traditional employment!

Cheers

That’s really cool to hear some of my early stuff had that impact. Congrats on being so close and look forward to welcoming you into the club next year :)

This is probably one of the best posts I think I’ve ever read! Thanks for putting this together and being so open about everything.

We’re closing in on FI in the next few years and I’m getting super excited. My wife has gotten on board with the whole concept of FI over the past couple of years as well, which is making the journey much easier.

I like to hear about the personal aspects you’ve been through like the depression and not figuring out happiness right away. It’s very easy to think that money will just solve everything, but I believe that the trick is actually more about finding yourself and what truly makes you happy.

Thanks again for the great post!

— Jim

Wow, glad to hear you liked it that much, Jim! Thanks for the comment

Brandon,

I agree with everyone out here that this is an amazing article. You have had an amazing journey. It is interesting to read about what you learned along the way.

Good luck in your continued journey!

DGI

After reading your blog, I took the knowledge to work and got my coworkers to max out all of their retirement accounts.

Thank you for all of the advice!

This is amazing. I’ve opened up tabs for the links I haven’t read yet.

Love this summary! I thought I had dug into the depths of your website, but of COURSE there are links here that I hadn’t seen before.

My acronym would be FI-WOLO. Financially Independent, Waiting On Lay-Off. I plan to engineer a lay-off for myself in Q4 of this year (can’t do it earlier for a host of reasons, so I’m waiting to approach my boss for another 6 weeks or so). The lay-off provides 7 months of severance for my tenure, and will be a bit of a windfall to further boost our taxable savings account that we’ll live from while we build our conversion ladder. Husband plans to follow me into FIT in about a year.

Really appreciate everything I’ve learned from your site, and the things I’m still learning!

Awesome post – I especially appreciate how open you are about the dark times in your quest for FI. Sometimes we get so focused on the metrics and process that we miss the bigger goal – building a happy life with intention! Thanks for the reminder and all the awesome links in this post!

Nice post! It definitely brought back some good memories. I remember your post about how to access traditional IRA and 401k funds early was what finally got me started maxing out these accounts. I have enjoyed all of the podcast episodes and all the great content.

I must say, I was a bit disappointed to hear Duke was just first choice for college :)

Haha, glad it all turned out okay in the end though :)

Your site has been very entertaining, I could use some more articles to read while I am in the trenches accumulating for my ER. Do you feel anxiety as you are so new to actually pulling the trigger?

I am feeling a bit of unrest lately oddly enough it came when my wife and I started to really hit our stride saving. How did you balance the journey along the way?

Stay tuned for the upcoming article that I mentioned in this post.

This is an awesome post…. So glad that you are enjoying your life. This is something the Mrs and I have discussed quite a bit. It’s not about sitting on the beach with Margaritas, It’s 100% about doing what we want to do, when we want to do it.

Good on you and keep it up!!

Wow! This is a great synopsis and thank you for all the cool tools and ideas you have created. I listen to your podcast while I do cardio and appreciate your in depth tax strategies and plan to employ some of them as I move into my official FIRE life (3 days from now!). Further, my husband and I have both used your travel hacking tool to optimize some point earning opportunities. We are currently taking a break from being super active on the travel hacking but you know that when we are ready, we are going to dive back into your tool! Looking forward to hearing about your reflections after a year in this new chapter of your life… And Cheers!

Thank you for all your fantastic articles. I learned on this site that HSAs were as magical as unicorns and that backdoors were things I should aspire to traipse through as often as I possible could, and I will always be grateful that you helped me accelerate my journey to FI.

Hey MF, Thank you for this. I’ll be bookmarking and referring back. You’ve given a lot of yourself and for me, it’s much appreciated.

Thanks Brandon,

Your podcast got me on the journey to FI and forever grateful!

Even though I’m based in Australia there are plenty of principles that relate across

to our system :)

My wife works up to 100 hours a week as a corporate attorney at a law firm. Your emails and those of MMM are ones that she will still make time to read despite her insane schedule. I actually introduced her to the MF and MMM in the hopes that she would have a change of heart similar to your wife. Thank you for your work and guidance!

On a separate note, I run a podcast for veterans, active military, first responders, and their families. I wonder if you would consider appearing as a guest. So many who work/worked for the government are entrenched with the idea of a pension, but I think that your work would be enlightening for them.

Great article. Thank you! One and a half year into FIT and it is great. Your website is inspiring and full of helpful info. Appreciate it all.

Brilliant post, so clearly written.

Don’t suppose you have an knowledge of the British system, what with your wife being Scottish an all?! We have a few FI bloggers over, but not many. Obviously our ISAs are very important, but travel hacking is more difficult as American Express isn’t really accepted. Some points available on visa.

Anyway, keep up the ‘now’ desired hard work.

Yes they are harder to find, however I do have a Virgin Atlantic Amex/Visa combo, and a Marriott Rewards mastercard– both UK based.

Just what I needed!

I’m a recent convert to FI through MMM, but being based in the UK (like TeamGB) I’m not sure I’ve got all the nuances of the UK system down like you guys in the US. Will keep searching.

Thanks!

Love this summary! Thank you!

I certainly going to listen to your podcasts. Hipe to learn some more feom you.

Keep up the good work!

Great post MadFientist (I abbreviated your name to MF, but realised that was inappropriate hehe)

I have been following your site for a quite some time, and have got myself very close to a FI position, but am a year away from emigrating to the UK (I am in South Africa currently).

Unfortunately, our economic situation is not great, due to political uncertainty, and a lot of my savings are tied up in retirement products that only start to mature in 12+ years. This obviously has caused much anxiety, as I have gone through the hard yards to make it happen once, and will probably have to do a fair bit all over again. However, having a clean slate, and the knowledge to ensure I don’t fall into the traps of consumerism, I am pretty confident I can make it happen again. @DrJess, I hear you, the majority of the FIRE information out there is US specific, but the principles are universal, and will produce results. Find the tax advantaged options, max them out, and ensure you stay a mile away from lifestyle creep, and unnecessary debt, and it take off like a rocket.

Thanks for all the input over the years, it is great to just feel part of a community of people that get it.

Thanks, @Grant, will do! New to this so all feedback is awesome. Am currently dithering over public sector company pension scheme that is tax-deferred and invested in a range of products, including stock market and property but which I have little control over, and aggressive savings (post tax) put into index funds.

Hope things work out for you sooner rather than later!

No dithering – if you’ve got the chance of a public sector pension scheme, grab it! You’ll get your tax back, so immediate increase of 25%, and you’ll probably get employer’s contribution as well. Then use any extra money to invest through an ISA, so you don’t pay capital gains or dividend tax.

Moneysavingexpert is a good source for UK-based saving info, although there isn’t a lot of investment advice. There is an investment forum, though.

Hey Mad Fientist,

I love the way you cover the FI space. It’s motivated my wife and I to pursue it ourselves. We’re 10 years away from achieving FI, but if we have the ability to step away and choose to use our time the way we want to at 45, I’m happy with that. Thanks for sharing all of the amazing research that helps so many of us pursue and achieve FI. I always look forward to reading/listening to your latest work.

– J

Brandon, what an amazing post!. I’ve been following you and listening to your podcasts from day 1. Your content is incredible and is one I direct my small (but hopefully growing) list of readers to go check out.Keep up the good work and I’m very much looking forward to reading your thoughts about RE on your 1-year anniversary.

“I was on the fast-track to FI but there was one big problem…I was miserable.

I was so focused on saving for FI, I completely disregarded my happiness.”

You nailed it, right here. I’ve been reading a lot of FI bloggers and 99% of them are focusing on what and how, instead of “why”. That’s why I love your blog and podcast, because you share a message, you share your vision and dream. And by spreading “Why” topic you don’t forget about “what” and “how”

Great post, sir!

Really enjoying my Mad Fientist t-shirt! I get lots of quirky looks.

Hi MFI!

As someone who lives south of the border (London), being in Scotland makes you the perfect person to ask. Personal Capital and YNAB seem more geared to US and Canadians. I’m finding it difficult to find anywhere that pulls data from UK banks and financial institutions. Do you know of any similar sites for the UK/Europe (ideally for both US and UK accounts)?

Cheers

Sadly I don’t. Anyone else out there from the UK using anything cool?

Great post. I can’t believe this blog has been running since 2012 . . . makes me feel old! Glad you are still creating quality content. I look forward to your next posts.

Prob8! Great to hear from one of my first commenters again :) Hope you’ve been doing well!

Hey Brandon – great to see your story laid out like this even if I have been reading the blog since back in 2012-13! For those of us who are still on the path to FI it’s great that you’re comfortable enough to highlight some of the issues you’ve faced along the way…I definitely struggled with the frugality/happiness tradeoff right out of college where I had more student loans than I knew what to do with. Ultimately I think I’ve found the right balance at this point where I’m not living anywhere near like Jacob at ERE or even MMM but still pursuing my own “comfortable” form of frugality. It definitely helps that the food here in Tokyo is cheap as can be but still really good! Looking forward to seeing you guys out here again sometime.

We’d love to get back out there for a visit so hopefully soon!

Stellar stuff these last five-plus years – definitely a major accomplishment with all the great content you have provided. It has helped make such a positive impact on my life and so many others’ lives (+57,000 email subscribers? Nice!). Keep up the great work!

Well done, Brandon! This post is epic!

It sounds like you’ve been working on this content audit for a while, and this is such a cool way to pull it all together. I’m on the early stages of mine, but you’ve inspired me to do my own summary post with links to all the important stuff. I think it will also pull it all together for me.

Keep up the good work!

Definitely recommend it, Chad. It was a lot of work but now I feel like the site is much more focused (and I also have a better idea of where there are gaps in the story that I still need to write about).

Thanks mad fientist for formulating a ready made index where all your great posts are contained in one article. Ever since I found your site it has been one of the few sites I’ve returned to many times and, to quote a cliche, it’s been life changing for me. The podcasts are really brilliant and some of them I’ve listened to multiple times as they are so inspirational. Thanks also for your honesty in the ups and the downs of being a FI person and an owner of a very busy blog site. You most definitely are a perfectionist, we have all in the FI community benefitted from your efforts. I’m so glad you have been able to recognise the need to get a bit of life balance and also for having the honesty to tell us all about it. Thank you from the bottom of my heart for a wonderful site.

Wow, thanks very much, Lesley!

Amazing post! I was hoping you or someone else would be able to take some time to answer question I’m having as I’m still a bit confused about the articles regarding TIRAs and Roth IRAs.

I just graduated college and will be making 65k/yr, have no college debt, and will have ~23k/year in expenses (a very rough estimate as I have just started tracking expenses a month ago). With that out of the way, my question is in regards to whether I should use a Roth or TIRA. I know your research says TIRAs are better for early retiree’s, but I am planning to actively manage my investments, using stocks and options, and therefore will be hit with a lot of short-term capital gains taxes if I were to use a TIRA, right? In this case, would it be better for me to utilize the Roth as I will be able to withdraw it all completely tax-free?

And as a follow up, do you think it’s feasible to max out a 401k and whichever IRA I decide to go with on 65k? Would you prioritize one over the other?

Choosing to actively manage your investments will affect your returns much more than the Traditional vs. Roth choice so I would reconsider that before doing anything else.

I’ve returned 20%+ each of the last three years, while being mainly short deltas. With that said, I plan on continuing to be active but would greatly appreciate some input on Roth vs TIRA.

MrMF:

I’m 56 and behind in my retirement savings. Tim Ferriss lead me to MMM who lead mr to explore more and I found you. At my age my focus needs to be intensified and your site has several interviews that made me search deeper into tax advantageous opportunities. Your site is inspirational to all ages. I have found an opportunity for my wife’s small business to use a Solo 401K via Vanguard allowing us additional pre-tax $. I have found that I was not taking full advantage of various income streams to increase my savings rate this year. At full out I could see over $60K in savings but I have to balance out some home repairs so my goal is $45K.

I am also a blogger of a different sort, for the baritone ukulele player. I love the way that you ave pieced everything together in a single post. That’s a great advantage to all readers to have such an index added into your full story. On my blog I have tabs and page links.

Lastly, the mighty ukulele, can be a great instrument for FI. $200 and you can make your own music for life! And cheer you up from the blues and intensity life sometimes gives us. I have a second blog that is just a group of playlists for of various bari uke players. It gets its name from a MMM inspiration, “The Bad-Ass Baritone Ukulele.”

I really like that you included the part about becoming depressed while on the journey to FI. It can be hard to admit, but it really is something we all need to watch out for, no matter what we’re pursuing. Sometimes we give up ourselves in the pursuit of something greater, which kind of defeats the purpose altogether. I feel guilty sometimes whenever we eat out (which isn’t very often) or spend money on things we “don’t really need.” But there needs to be a healthy balance between pursuing FI and enjoying life today.

Thanks for the post, hope the next year is even better!

Thanks for sharing the journey! Didn’t know you went through a period of depression. Was it being isolated in the woods in Vermont or the focus on getting to FI the bigger factor?

“My HR department found out I was working from Scotland, and not the US like they had incorrectly assumed, so I was told I’d either need to move back to the States or resign.” – Man, can’t believe HR didn’t realize you were in Scotland! Maybe you couda told them, “Hey guys, my managers brought me all the way over here… if you want me to come back, you’ll have to pay me XYZ!”

Sam

Hey Sam, thanks for stopping by. I’d say it was the isolation that played a bigger role but the extreme frugality definitely increased the isolation.

My bosses and colleagues all knew I was in Scotland but HR thought I was in Florida because I got all my mail sent to my parent’s house there. Had I cared about keeping the job, I would have fought the decision but I just took it as the perfect opportunity to finally call it quits (and I’m definitely glad I did).

I laughed out loud when I heard how clueless they were. Apparently it didn’t matter – you had been doing fine for two years!

I just found your site and am enjoying your style. Great work!

Mike

Great meta-post, and generous of you to share your depression story. As FI approaches I’ve put alot of thought into how to spend time once I FIRE. This post I think will trigger others to do just that. Keep up the great work.

Thanks MadFi for the update!

My Journey is somewhat similar in that I am at the stage of learning about happiness and focusing on happiness. FI is a great philosophy and there are so many topics to explore other than just Finance, including Tax, Happiness, Side hustles, investing, psychology, personal development, travel, Minimalism, Diet. It is like a way of life and I can definitely see the similarities in the topics explored by most of the other FI bloggers.

Do continue to share with us the Post FI journey, as I am sure the journey does not end at FI but there will be a new beginning and perspective post FI.

Really chuffed for you and your wife!

Fireplanter

Great post! Have enjoyed listening to your podcast for a few months now and just crossed the 100% completion mark. Looking forward to learning more, thanks for all you do!

Thanks for the history of your journey, bumps and bruises included. It’s always instructive to see how other like minded folks weather the storm of life and come out the other side intact and, perhaps, better for the experience.

I recently discovered your blog. Your journey is nothing less than awe inspiring. I am in IT as well, and i went to Scotland a few times, so beautiful. Unfortunately, my company won’t allow me to work outside of US. Any travel plan 2017?

Wow, what an insightful post! I took away so much useful information. I’ve been devouring your podcasts but am a new reader of the blog. Do you have any posts for those who have lucked into FI or received a windfall?

The path to FI that seems most common is to combine a high savings rate with frugality and investing. Before I discovered that FI is a thing, I tried to save and invest, to varying degrees of success and without much focus. I’ve increased these efforts since discovering the FI movement. I live in a very expensive city, and my almost-paid-off house has appreciated considerably. I am tempted by the thought of selling it next year, moving to a less expensive city with my family, and quitting full-time work. It feels like cheating in a way, but I keep running the numbers, and I think it would work. Are there any special considerations, financial or otherwise, for this kind of approach? For instance, is it a good idea to invest a huge windfall in index funds all at once? What are the capital gains tax implications of cashing in on one’s primary residence? Any advice or suggested reading you could share would be much appreciated. Thanks!

Most states do not tax gains on a house. I doubled in 16 years and sold with no cap gains in NC. I think the exclusion at the federal level is at least a half million, but research for your area, then impair the asset value with the costs of the sale in your net worth statement.

This is not cheating, it is practical. Cutting costs is tax free, raising income is not. Real estate is not a windfall, it is a return on the dead money tied up in equity all those years. I invested 400k in 2015 and have 2 years running at about 25% return a year while I joyfully rent in a poverty stricken new england town.

Do an allocation over all your accounts/assets, plan the positions, and then average in every month. Spread it over at least 3 buy ins. Enjoy!

Hi Mad Fientist,

I really enjoyed your article and now I’m all inspired to gain FI quickly too!

However, I’ve run into a bit of a hurdle. I can’t sign up for a Personal Capital account without a US phone number.

I’m a UK resident and all my income currently comes in £. Which alternative would you recommend instead of Personal Capital?

Thanks,

Calum

Hi there MadFientist: I tried to get your free download spreadsheet but perhaps I mistyped? It didn’t arrive. Not sure if you’re still doing this but would love to see it

Got it thanks!

This has really been insightful, rich experience in there.

I desire something (FI) like this @ age 45.

But the continent I am coming from don’t seem to have these investment opportunities all we do is save and wait for pension schemes as we retire @ age 60. But i choose to be different!

Will love to get your spreadsheet.

Thanks

Hey good story and recap of the content that’s on the podcast. Its good to read great advice on reaching FI. I like the 2 points you mentioned, do not push FI on anybody and Do not put off happiness. I will continue to pursue it and 1 day convince others the FI life is not that hard. Good luck in FI.

First visit to this site. We did FIRE, before we knew FIRE was “a thing”. The mechanics of getting there came pretty intuitively to me. This probably sounds stupid but getting FIRE-d was the easy part.

What Im struggling with now is the “Now What?” question, before pulling the trigger on retirement. Are there some good tools that focus more on what to do with your life once you’ve “made it”. This is a rare opportunity to have several decades of complete freedom and ability to literally do whatever one wants, and its a bit overwhelming as I want to make the most of it.

I’ve come across the FI online community in the past few months, and am currently in the stage of “I want Financial Independence, Not Early Retirement.”

I think, though, when I reach FI (which may be delayed due to a new person coming into this world next April…) I’ll be able to do the whole “retire to” not “retire from” thing. I plan on getting my PhD so maybe academia will be the place for me.

I’m going to have to come back to this post because there’s a lot of good info here!

Wow! My boyfriend left your page open on the laptop so I started reading, and read the entire post!

I’m a 23yo bartender but doing my best to invest, save and set myself up to be closer so when I do increase my income I’ll already be on a good path with good habits to FI. The way you wrote your story makes everything feel so much more attainable. Keep it up!

Hi,

Do you give specific financial advice? I am just getting started and all of this info is kind of overwhelming. Also we just purchased a house and it is a fixer upper. Is it better finance the renovation projects by taking out loans, or try to save up and pay cash?

Most places house value grows slower than interest rates and taxes, so you should not borrow (or buy). They print money in DC and SF has cruel zoning restrictions that subsidize current homeowners with higher returns, you could probably borrow there.

I doubled my house in Raleigh in 16 years, serious mess of a fixer upper. But careful analysis in Excel showed I would have been better off renting and investing, even with 2 stock market collapses. Lets be careful out there.

My fiancée has been reading your page today and forwarded it to me. I already signed up for the emails and we are both working toward financial independence. Big question though, it may not apply to you living in Scotland, but what do you do about Health care? Emergencies? Dental? Having worked for a Swedish Retailer here in the states for 12 years, our health insurance is amazing. I’m just concerned that once we decide to leave the corporate world, that security will vanish.

Enjoying what I read so far but there is much more I need to look up!

Look up Direct Primary Care (DPC). This will cover 90% of your needs at a reasonable rate. Dental is half price without insurance, just like vision coverage, and you can negotiate or travel for bargains. Free Market Medical Association.

Dump obama care for high deductible health plan. Save and invest to build your cash fund for emergencies.

Insurance is only for expenses you can’t afford, basically cancer/stroke/heart attack/major illness. Everything else pay cash and get the discount. I am headed from new england to the Oklahoma Surgical Center for an ACL surgery. Only $9k there, almost $20k here.

Wow and excellent post and very timely. Over the last month we (my wife and I) have spent a lot of time talking about FI and your post have been a god send. Thanks.

The good news is that we already live way below our means and have passive income from 2 rental properties. We also have an FI number in mind, which I think we can reach in the next 5 years. But we do have a question? Would you consider the equity in our homes (2 rental + our home) as part of the net worth to get to FI?. Having part of our net worth in illiquid assets can pose a challenge when you are trying to draw down 4% (we have some ideas). But Curious to see if you or your readers have come across this before and how you have tackled it.

Can you send me the link to all your advice that you had your brother pulled together from all your podcast?

Fantastic read Mad Fientist, I feel a lot of similarities in your own story to mine about happiness. I personally decided I wanted to create enough online income to sidestep the corporate saving part of FI and jump straight to the freedom part after while working a minimum wage retail job. The problem was I had to work so hard for that year that I shunned a lot of my friends, didn’t make enough time for my wife, gave up a lot of my hobbies and was generally pretty unhappy. But thankfully I got to a point where enough of my income is passive that I quit my temp job and am able to reconnect with friends and fun again.

It’s also nice to have someone else doing this in Scotland! I thought I was the only one! Though I’m a Scottish person in Scotland so it’s almost but not quite the same…

Is there a difference whether you front-load tax advantaged accounts during the year? We have two Roth IRAs, two 401Ks, and a taxable account. My 401K (TSP) does not have matching. My current setup is to get the IRAs maxed out in the first 3 months, and my TSP is complete in the first 6 months with the rest of the year devoted to the taxable account. It has no effect on my disposable income how I do it. In theory I could probably max out my TSP inside of 4 months instead. Is there a math/financial difference in whether I front-load these investments or in which order I do so?

I’m 30 about to turn 31. Your post has definitely inspired me to start my own journey to be FI. However, being married with a son, I feel like it’s already too late. i spent my younger years unwisely :(

Hi,

Question about the FI table and graph. Should I be including the savings I am putting into my kids 529 plans? I don’t see an easy way to make this change without editing all my prior entries.

I like the tools and checking once or twice a year how things are looking.

Thanks!

Are there any other ways to reduce taxes for my family since my wife doesn’t work-I’m doing a spousal IRA but was just wondering if there is a way I could deduct more.

Are there any ways other than spousal IRA to deduct taxes on investments since my wife doesn’t formally work (she stays at home and educates our children)

Hello, thank you for the explanation of minimum-variance portfolio. Could you please also explain CAMP, that you mentioned in one of the articles. And the two fund separation theorem.

Thank you in advance

Can I sign up for a personal capital account from the UK ? it won’t recognise my telephone number on sign up

Hi Mad –

I’ve been reading and listening to your podcast along with Chose FI and MMM over the past 12 months and i just now realized your wife is Scottish and you moved there from the USA!

So i feel like we need to have a conversation about Scotland vs USA both from a FI perspective and culturally as I have the opposite situation (Scotsman with American wife living in USA)

For example:

USA wins – Gas prices

Scotland wins – Healthcare

USA wins – if you like sunshine!

Scotland wins – if you like rain!

Hit me up for a serious or philosophical chat, or if not, your next spreadsheet should be a comparison of Scotland vs USA advantages :)

Keep up the great work – I love your meticulous style and the templates you create.

I have listened to several of your podcasts now. I really like them because I do not think you have a hidden agenda like so many of the other financial podcasters

out there, and you do a good job at interviewing.

I particularly enjoyed your podcast with the happy philosopher. It was an incredible interview.

Thanks for sharing in an open and honest way.

Your podcast has been very helpful! I have shared it with many friends.

One question: I am not a spreadsheet guy. My head spins. I love all of these resources you provide including the spreadsheet and FI Lab but I am finding it hard to get them both set up. I have a Mint account…my finances are in great shape. And now I am ready to take the next step to tracking my progress to FI…but I am stuck.

Do you offer any kind of training or service on getting the spreadsheet and FI Lab set up? I am going to assume the answer is “no” but perhaps considering adding on a training service for those of us who need help getting this stuff set up. I would do it! And I feel like once I was set up and trained that I would be fine to manage it.

Thanks!

Thanks for the information, really practical.

i love the content hope this too will help you achive financial freedom

Excellent post. I learn something new every time I visit your site. Just a few short years ago I was starting to except that I would be paying on my $200,000 student loan’s for the rest of my life and working for someone else for the rest of my life. After I discovered your podcast along with a few of the other blogs that you mentioned, I found there were possibilities that I never even dreamed of. I never even knew there was such a thing as financial independence. Despite many financial setbacks in the past few years, I have already smashed my student loan problem and I am well on my way to some wonderful investment possibilities. I hope that someday I can help others the way that you have helped me.

After binge listening to every podcast released since 2012 during my daily commute starting in early January this year, I am now diving into your blog posts.

Lots of great guests on the podcasts to discuss various aspects of FIRE, but the interview with your brother and all of the buckets in his apartment was by far the strangest and most entertaining. Financial Mentor may have been my favorite, at least top 5.

Thanks for making this information available to those of us still on the journey to FI and look forward to more of your content in 2020!

Hello Brandon (Mad Fientest),

I feel like I am having a hard time knowing what to do with my Traditional IRA funds. Keeping them in the Traditional IRA will allow the funds to grow up to 1Mill. by the time I retire. When I retire I will be in the same high tax bracket of 24%or maybe even higher if taxes go up. I am currently earning 122k (job income + survivor benefits) taxable income which is in the 24% tax bracket and when I retire I will be earning 110K (pension+survivor benefits) which is in the same 24% tax bracket.

If I start Roth Conversions now until retirement my funds will no longer grow as they did in the Traditional IRA so I would not reach the 1Mill by 60years of age. If I keep my funds in my Traditional IRA they will grow nicely but I will be forced to RMD’s (Required Minimum Distributions) which will increase my tax bracket to 32% or 35%. I know it is recommended to do Roth IRA conversion ladder for those that are going to be in a lower tax bracket upon retirement, but what about those that are going to be in the same tax bracket or higher once RMD’s are required.

I feel stuck on knowing what to do. Brandon you mentioned you are not doing the Roth IRA conversion and neither is Scott Trench. So I am not sure what to do, leave funds in Traditional and let them keep growing tax-differed and then have RMD’s or do the Roth IRA conversion ladder and not reach my 1Mill goal at 60.

I have listened to many podcasts and watched many videos on this topic and I just can’t figure out which way to go. I watch and listen to Bigger Pockets Money, ChooseFI, and have read the JL Collins book, Set for Life, Lifeonaire, Little book of common sense investing. I have many more to read.

Please help if you can.

Thanks

Awesome post! I’ve been pursuing FI for a few years but still have a ton to learn – especially related to tax optimization and travel hacking. I’m planning on reading through your whole blog and optimizing my finances along the way. Thanks in advance!