Important Note: Due to tax code changes that were introduced by the Tax Cuts and Jobs Act of 2017, this strategy is NO LONGER VALID! Please see this post for more information on how the new tax legislation affects this and other early retirement tax avoidance strategies.

I have a strategy the guarantees you’ll make a fortune betting on horse races.

It’s very simple, actually. The idea is you bet a certain amount of money (x) on the horse that is favored to win. If the horse wins, great! You walk away with x and you can go home happy.

If the horse loses, however, you have to bet 2x on the next race’s top horse. If that horse wins, you’ll win back what you lost in the first race and you can go home with x winnings. If the horse loses, you’ll have to double your bet again and continue doing that until you eventually win.

The favored horse has to win eventually so this strategy guarantees you’ll walk away with x. Just make sure x is big enough so that you can retire as soon as you win that race!

Don’t Do That

Since you are a Mad Fientist reader, and are therefore one of the smartest people on the internet, you probably realize the strategy I just described shouldn’t be taken seriously. In order to guarantee success, you’d need to have an extremely large amount of capital to deal with the inevitable long string of losses.

There is one type of horse race, however, that can save you some money even if you don’t have a bottomless bank account.

Roth IRA Conversion Ladder

I’ve spoken frequently about Roth IRA Conversion Ladders because they allow future early retirees to take full advantage of tax-advantaged accounts and access the money in those accounts prior to standard retirement age (check out this post and this post for more info). Roth IRA Conversion Ladders are the main reason I’ll be able to Retire Even Earlier so they are an important part of my own personal plan.

Today, I’m going to describe an advanced strategy that you can use to supercharge your conversion ladder – the Roth IRA Conversion Horse Race.

Roth IRA Horse Race

When you convert from a Traditional IRA to a Roth IRA, you have the option of undoing the conversion before you file your tax return (this is called a Roth recharacterization). That means, you could execute the conversion in January and then rewind the conversion by April 15th of the following year (or October 15th, if you file an amended return) and the IRS treats it as though the conversion never happened.

To explain how we can use this to our advantage, let’s explore an example…

Suppose you just quit your full-time job and want to start building your Roth IRA Conversion Ladder. You expect to only use qualified dividends and long-term capital gains for income during your first year of retirement so that means you have $10,000 of tax space you can use for a completely tax-free conversion (the standard deduction and personal exemption amounts for 2014 add up to more than that but I’ll just use $10k to make the numbers cleaner).

For simplicity, assume your Traditional IRA consists of an equal amount of Total Stock Market and Total Bond Market index funds. To start building a normal Roth IRA Conversion ladder, you’d just convert $10,000 of your balanced portfolio to your Roth IRA ($5,000 of Total Stock Market and $5,000 of Total Bond Market).

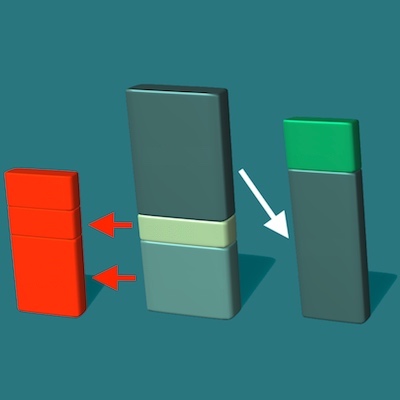

To build a Roth IRA Horse Race, you’d instead do two different conversions into two separate (and empty) Roth accounts. So in this example, you’d convert $10,000 worth of Total Stock Market index fund into it’s own Roth account and $10,000 worth of Total Bond Market index fund into a separate Roth account (segregating the funds like this will make the recharacterization process much easier). This will result in converting twice as much as you would actually like to convert for the year.

Decisions

Assume that after building the Roth Horse Race at the beginning of year one, the two different Roth account balances in April of year two are as follows:

Total Stock Market – $18,000

Total Bond Market – $6,000

To maximize the value of the conversion, you would keep the Total Stock Market account and recharacterize the Total Bond Market account. This would allow you to get $18,000 of funds converted for the “price” of $10,000. Had you simply converted your entire portfolio, you’d only have $12,000 in your Roth by April of year two ($9,000 Total Stock Market and $3,000 of Total Bond Market).

Other Benefits

Increase Conversion

What if the Total Bond Market fund also grew significantly?

Total Stock Market – $18,000

Total Bond Market – $14,000

You may find it worthwhile to keep both Roth conversions and take a small tax hit (since you’d only be paying tax on the extra $10,000 of conversion but you’d be getting an extra $14,000 into your Roth).

Obviously you couldn’t have predicted what the market was going to do back in January of year one, so you wouldn’t have thought to double your Roth conversion, but now that you’ve seen how the market has performed, having a Roth Horse Race gives you the option to convert more.

Decrease Conversion

What if the market tanks and both of your funds actually decrease?

Total Stock Market – $6,000

Total Bond Market – $9,000

You may decide to recharacterize both of the Roth accounts and instead use the tax-free space you have available to tax-gain harvest instead (note: you’d have to make this decision before the end of the calendar year, since you wouldn’t be able to wait until year two to harvest your gains).

Conclusion

I realize some of you may feel the additional hassle of recharacterization isn’t worth it but for those of you who want to get as much of their money converted into a Roth as quickly and cheaply as possible, a Roth Horse Race could be a great way to accomplish that.

What do you think? Do the benefits outweigh the potential hassle?

Do you have a page/post of basic tax guidelines? I feel like this is over my head because I thought, for example, that you couldn’t convert more than $5,500 a year without paying major penalties. But is that just the contribution limit and the conversion limit is different? I’m confused!

It’s clear you do a lot of intricate thinking about tax loopholes for aspiring fientists, which is an awesome service. I, for one, would gladly pay for an eBook version that explained how the different concepts build on each other. Heck, it’s probably all on the site already and I just don’t know how to find the right things in the right order. I’d even pay a recurring fee for a summary of changes in the laws and loopholes from year to year, and I hate recurring fees!

The IRS $5.5K limit is an annual contribution limit to Roth/IRA-

Conversion of existing IRA accounts- funded by prior contributions (or 401K/403B rollover) to Roth does not have a limit- however you pay tax on any conversion to Roth- as these are pretax funds and have not had taxes assessed on them.

What Mad Fientist is suggesting is to perform 2 IRA to Roth conversions and re-characterize the lowest performing of the 2 to lock in the max gains or harvest max losses- depending on the way of the market.

The reason why you’d only re-characterize one is to get around paying taxes in a higher tax bracket on your income limits

Hope this helps.

Hi Lindsay,

As Michael pointed out, the $5,500/year limit is a contribution limit, not a conversion limit.

I’ve actually thought about putting a book together because a lot of this stuff is very difficult to explain in one short post so I think having a complete collection of all of the strategies and how they relate to each other is an excellent idea. Now that I’ve completed my free master’s degree, I have a lot more time on my hands so I hope to start on this project soon. I’ll keep you posted!

Great! And I appreciate the clarification. I’m kind of an awkward mix between a fientist and an aspiring entrepreneur, but I’m definitely of the mindset that more knowledge is better than less knowledge. I think fientists would really benefit from a resource like this book, though it could be a disaster if non-fientists think the advice is for them!

Mind = blown.

This is just brilliant. Where do you come up with this stuff???

Haha, thanks! I think I actually stumbled upon this strategy a while ago over in the Bogleheads forum when I was researching another idea. I’ve been wanting to write about it for a while now but other things kept taking priority. Glad you enjoyed it!

Great idea which I hadn’t thought of before. Just wanted to add another strategy I’ve witnessed. Similar to your front-loading ideas, it makes sense to convert from T.IRA to Roth on January 1 each year to take advantage of the gains inside your Roth vs. your T.IRA. However, if your holdings decline substantially in value at any point during the year, simply perform a Roth Re-characterization to undo the conversion, then convert again at the lower value to decrease your tax burden.

Love the blog, keep the posts coming.

I’ve seen people talk about doing what you speak of Cheddar Stacker. They max out 3 new Roths at the beginning of the year invested in various ways. Then before the end of the year they recharacterize the 2 losers back to just taxable investments. I haven’t done this myself so I do not know the complexity involved. Sounds like a task for 2015 for me.

Moose,

Could you mention what blogs you’ve read this from?

Thanks,

Mark

It was a thread on the bogleheads forum:

http://www.bogleheads.org/forum/viewtopic.php?f=10&t=129471

I need to go back and read some more on it.

MooseOutFront, so you’re saying people contribute 3x the annual contribution limit and then withdraw 2x the annual contribution limit within the same year (so that they don’t exceed the contribution limit)? Do they not run into issues if all three accounts go up?

If all three accounts go up, you’ll have to withdraw the associated earnings as well as the base contribution from 2 of the three accounts. You’ll then have to pay the 10% penalty on those earnings if you’re under 59.5. If you’re over 59.5, no penalty.

If you would have to pay 15% capital gains tax (or more) on those earnings in a taxable account then the 10% penalty is better.

While this is technically legal (IANAL), I consider it a grey area and wouldn’t do it myself.

As long as you are just recharacterizing the conversion back to the traditional IRA and it is done before the deadline it is just like you never made the conversion. The earnings are just treated like earnings in the traditional IRA.

If you are contributing directly to a Roth IRA then you can withdraw the contribution and earnings by the tax deadline and just pay capital gains on the earnings, there is no penalty tax.

In any situation where you would pay the 10% penalty on the earnings, you are also going to owe ordinary income taxes as well, so there will not be any tax savings.

I think what Garrett is referring to is MooseOutFront’s suggestion that you can implement a similar strategy for Roth contributions (i.e. from your taxable accounts). This scenario gets a bit tricky if you have gains in all of your Roth accounts, as Garrett describes.

Cheddar Stacker! I’ve been waiting for you to make an appearance over here. When I see some traffic come over to my site from forum.mrmoneymustache.com, I sometimes go take a look and many times it’s because of a post you’ve written. As someone who hates self promotion, I really appreciate when other people share my articles so thanks a lot for being so kind to me over in the MMM forums!

Great call with recharacterizing after a big drop, by the way. Even if people don’t want to do all the work to set up a horse race, they could at least recharacterize whenever it makes sense to do so. I should point out that you can only reconvert either 30 days after the recharacterization or the year following the year of the conversion, whichever is later (see this IRS FAQ for more info).

Thanks again!

Long time reader/lurker/admirer, first time poster here. Thanks for the clarification. Keep cooking up the experiments!

I don’t know if I’d trust myself to do this recharacterization, but I still have several years ahead of me to learn how and watch others. Also, without the burden of a day job, I imagine I’d have more than sufficient time on my hands to make sure I did this right.

This is incredible, and I’m in awe of how you come up with this stuff!

I’ve not done it but based on everything I’ve read, I think it’s a pretty straightforward process with Vanguard so just set a reminder on your calendar and I’m sure you’d be fine!

Great article, I’ll keep it in mind when get to this stage. However, that’s still many years away for me and I’m hoping for some more basic advice. I’m a graduate student with very limited income. I’ve saved $21k in a Roth IRA over the past few years, but reading the MadFIentist, I’m considering opening a Traditional IRA which will enable me to invest the taxes I would pay on a Roth. Trouble is, Vanguard’s minimum is $3000 for the VTSMX and VTI, which is a hefty sum for me in this stage of life and it will take me a long time to save that chunk. My option is to re-characterize $3000 of my existing Roth into a Traditional IRA, or find a fund with a lower initial cost. Anyone have suggestions? Thanks.

You could always let the money sit in a Target Date Retirement fund until you have the necessary $3000. They have a buy in of $1000.

So in the first example when your stocks grow and your bonds fall, you keep the stocks in the Roth and recharacterize the bonds. If you only have $6000 in bonds, do you get to recharacterize your original $10,000 that you had in bonds? Or just the $6000 now?

AdZ, I would suggest you ask that question here: http://forum.mrmoneymustache.com/index.php

With all due respect to the madfientist and what he might suggest, you will get many more responses to a question like this in a forum full of like-minded people.

You can invest in vanguard ETF’s through a brokerage account, which have no minimums and are actually cheaper on than the $3,000 minimum mutual funds (they are about on par with the $10,000 minimum admiral funds).

Hey AdZ,

As James said, you could open a Vanguard brokerage account and invest in the ETFs instead of the mutual funds. Just make sure you sign up for electronic document delivery so you can avoid any fees that would be charged to accounts with low balances.

Cheddar Stacker’s advice is also good as well…the MMM forum is great for getting a lot of quick, quality feedback.

Sorry, posted this as a reply to someone on accident.

So in the first example when your stocks grow and your bonds fall, you keep the stocks in the Roth and recharacterize the bonds. If you only have $6000 in bonds, do you get to recharacterize your original $10,000 that you had in bonds? Or just the $6000 now?

You are recharacterizing your $10000 conversion, which only moves the $6000 back to the traditional IRA but reduces the taxable conversion by the full $10000.

Thanks, that’s what I figured must be happening. This is a pretty cool strategy.

Hey Kyle, you would just recharacterize all the shares in that particular Roth account (so in this case, it would be $6,000 worth at the time of recharacterization). So at the end of the day, you would have moved x shares from your Traditional into your Roth and then moved x shares back (the value of those shares is irrelevant since you just hit the undo button) so the IRS just ignores the entire thing.

Michael’s reply explains it perfectly (thanks, Michael!)

I think is important to remember that only the converted amount can be withdrawn from the Roth conversion ladder before 59.5. This means that this method is not going to let you withdraw extra funds in early retirement. This would still have the advantage of avoiding losses in the account occurring in the first year, but during the five year waiting period before withdrawal those should be recovered by gains anyway. It would also still leave more in the Roth if your goal is solely to get that tax free conversion even though you cannot spend it until 59.5.

If your goal is to get as much out of the IRA system as possible before 59.5, I wonder if it would be better to recharacterize the reduced amount instead. This leaves the unwithdrawable gains in the traditional IRA to be converted again some other year, while leaving the lower or reduced amount in the Roth where it could free up future market increases for conversion ladder withdrawal.

Michael it seems you are looking at this backwards. The best possible scenario is you convert $100 and it turns into $1,000,000 since you would only pay tax on the $100. You want to convert assets that have low values, or that increase quickly in value after conversion. You are correct that you can only draw the principal before 59.5 in most cases. However you can take SEPP in the Roth and access the earnings before 59.5, or you can live off other assets/income until you reach 59.5.

I actually addressed both goals in my post. While growing as much in the Roth as possible with minimal taxes is a good goal if you don’t need the money before retirement, the point of building the Roth conversion ladder is to gain access to those funds early with minimal taxes. SEPP is not an effective way to get money out of the Roth, so if you are relying on the gains before retirement age maximizing the amount of money that can be withdrawn early, including gains, is important. It all comes down to where your money is located and your goals.

I definitely see what you’re saying Michael but I doubt it’d be worth going through the hassle of the horse race if you’re going to choose the losing horse. You might as well just plan for a certain growth rate and then convert the amount you want to withdraw from the Roth after the five years. Thanks for pointing out that this strategy will “lock in” more of your money though, since I didn’t address that in the post.

It probably wouldn’t be. Much like in Jesse’s comment below, I was initially thinking of a scenario where the traditional IRA would be depleted anyway and it was being used during accumulation as a way to retire faster by avoiding taxes, but would be needed in ER. The situation where the Horse Race is most useful is where the traditional IRA is growing faster than the withdrawal (conversion) rate and you want to simply avoid taxes in the future but won’t need the money before 59.5.

On the other hand, if most of your money is in a traditional IRA and you have just enough total savings that with expected growth to meet your needs, then your saved money and its growth need to be accessible. This means only converting what is needed for withdrawal and leaving as much of the gain as possible in the traditional IRA to be extracted later. Choosing the losing horse lets you use previous gains in the Roth (I believe, I am not a tax expert) because withdrawal from the Roth occur based off of total value and not based on individual accounts. Therefore, if you already have gains in the Roth and you make a conversion that falls in value, then after the 5 year period you can still withdraw the full converted amount as long as the entire balance of all your Roth IRA’s are above the combined amount contributed and converted. Basically this method can be used to unlock gains in the Roth IRA before you reach 59.5 if they are needed.

I have not actually run any scenarios so I don’t know how much value this provides though and I am at the beginning of my accumulation phase so I don’t know yet what the final balance of traditional, Roth and taxable will be when I retire yet.

You wrote: “You expect to only use qualified dividends and long-term capital gains for income during your first year of retirement so that means you have $10,000 of tax space you can use for a completely tax-free conversion”

Isn’t that a rather high bar? What about non-qualified dividends? Surely if you have any of those in your investments, you will have to pay taxes on them. So the amount of “entirely tax-free” conversion space could be less than you think, no?

I’m not dissing the strategy; in fact I think Roth conversions where they aren’t “tax-free” but at low tax brackets make sense. Just wanted to make sure I understood how you were thinking you’d only have qualified dividends and long-term cap gains as income. Is there some way you can guarantee this? (I presume in this ER phase you’re keeping your income low enough to get 0% tax rate on qualified dividends and LTCG.)

I’m sure there’d be some non-qualified dividends but the majority would be qualified and since there’d be no short-term capital gains and all long-term gains would be taxed at 0% (by staying within the 15% tax bracket), I bet it would be pretty close to $10k.

You’re absolutely right though that even at a low tax rate this strategy is still appealing but it’s always more fun to assume no tax at all :)

Another awesome post from the Mad Fientist! In practice, it’s all the same idea as you described very well…just more asset classes and accounts.

In your last example (market value decreased), what would you do? Let’s assume those are the values as of 12/31 and you have to make a decision.

I think I would stick with the Roth conversion to watch the last 9.5 months of the horse race…I think I’d be fine with the outcome of the race if I knew I didn’t pay anything for the bet (no tax) and might win. In today’s tax environment, I think I would be more concerned with converting all of the traditional funds to a Roth account at 0% than LTCG’s.

Thanks, Nick!

To answer your question, I think I’d do the same as you (especially if I was planning on using the conversion ladder for income after 5 years). Although, I’d probably just let it ride until April rather than October, so that I wouldn’t have to worry about filing anything in the fall (worrying about that garbage once a year is enough for me).

Or, even better than letting it ride (if both accounts are losers near the end of the year), re-characterize both accounts, and convert a fresh $10,000 from your Traditional IRA to yet another new Roth IRA account.

Fresh money avoids the 30 day wait on re-conversions, since it is different money. To make it cleaner, you could open a new Traditional IRA for the funds you re-characterize, so that is is clear that the new $10,000 conversion is new, and never co-mingled back to your main Traditional IRA it came from (not required, but easier for the IRS to see it was new money being converted at year end).

This way, you maximize your $10,000 of free tax space for the year, rather than having only $9,000 working for you from the earlier total bond market fund conversion, at the conversion “price” of $10,000.

For only the $1,000 extra that you will be able to get in the Roth IRA in this example, versus just letting the $9.000 total bond market fund conversion account ride, it is not a big win, but it is the route I would take.

Like many of your posts Madfientist, I will end up reading this over and thinking about it off and on for the next week, so job well done sir.

That’s a great compliment so thank you very much!

I would *love* the concept of converting a traditional IRA to a Roth, but we’re at our highest earning potential (and therefore taxes) at the moment. I also vaguely remember that there also used to be some funky rules about paying taxes on a percentage of *all* your IRA balances, not just what you converted, which at the time would have socked us with an extremely large tax bill, so I moved on and forgot about it.

You definitely don’t want to do any of this stuff when you’re in a high tax bracket. Just wait until after FI and then you can have fun with all of this.

Wow, after thinking through all the scenarios, it seems like there is pretty much no downside to this method. If one or both funds go positive for the year, you come out with some great tax benefits. If both go negative for the year, you have the ability to perform TGH, which is an equally valuable tax avoidance tool. Basically, you get to maximize any part of the outcome matrix. Awesome!

My question: how do you handle rebalancing when implementing this strategy? In the first example where A goes positive and B goes negative for the year, then you recharacterize B, all of a sudden assets in A have preferential tax treatment, effectively overbalancing you towards the funds held in A (although on its face it wouldn’t seem that way). Is there value in rebalancing early the next year to re-align the tax status of the different assets?

Really, the only downside is a bit of extra work.

As far as rebalancing is concerned, I treat that as a completely separate activity and only worry about that after taxes have been minimized. You can always figure out ways to shuffle things around later but I’d focus on minimizing the taxes first.

In your scenario, A doesn’t really have preferential tax treatment over B until you start trying to withdraw from A so hopefully by then you would have already figured out a way to get everything over into B, tax free :)

Just added a link to this one to your guest post on my site: http://jlcollinsnh.com/2013/12/05/stocks-part-xx-early-retirement-withdrawal-strategies-and-roth-conversion-ladders-from-a-mad-fientist/

Brilliant and original. Kudos.

Thanks, Jim! Hope you guys are having a great time on your trip

First time commenter here, but have been following for awhile. I’m learning so much from these tax posts. Thank you for sharing your strategies with us. I still have a couple years to FI, but I will probably be doing some Roth conversion this year, as we added a solar system to our house and have some sizable nonrefundable credits coming. Even though we changed our withholdings early in the year, I think we will not owe enough to take full advantage of the credits. But thanks to what I’ve learned here, they won’t be going to waste.

Knowing that I’ve played a part in you taking full advantage of a non-refundable tax credit, when some of it would have otherwise possibly gone to waste, is extremely motivating to keep doing what I’m doing so thanks for making the metamorphosis from reader to commenter :)

Oh, this is such a great plan! I’ve been frustrated by our state’s nonrefundable tax credits for solar, since our tax situation is essentially at zero. Now I would just need to time it around college financial aid years for the kids, so the increased AGI wouldn’t skew the EFC.

This is ridiculously clever and something I couldn’t dream up in a million years, but to offer a dissenting opinion (and correct me if something went right over my head), I’ve come to the conclusion the IRA Horse Race might not be worth the effort in most circumstances– particularly if the tax-free withdrawal rate is sufficient to drain your pretax accounts on its own.

The Horse Race essentially converts your Traditional IRA to a Roth IRA more quickly (but doesn’t allow earlier withdrawal as far as I can tell). Speeding up conversion is a benefit if your Traditional IRA is large enough for a “run-away” balance even after making the maximum tax-free conversions. This is an awesome benefit, but my suspicion is it will rarely apply. Here’s why:

The Traditional IRA is effectively a Roth IRA unless you must convert more than the annual tax-free amount to drain it. To apply the 4% rule, the pretax account balances would have to be greater than $507,500 for an MFJ filer or $253,750 for a single filer. Each additional dependent adds $98,750 to either. These estimates are based on the 2014 standard deduction and personal exemption multiplied by 25.

Among the FI crowd, such high pretax balances would be an oddity with the IRS limits for contributions. In my own circumstance, about 60% of my FI portfolio will be after-tax– meaning I would not benefit from this strategy unless my FI number is greater than $1,515,625 ($606,250/40%). Obviously everybody’s situation is different, but I think this is a great strategy for those looking at a 7-figure FI or FI after age 40.

Hopefully some food for thought at the very least. Looking forward to many more great posts!

When calculating the potential value of a traditional IRA in early retirement don’t forget that an employer plan, such as a 401(k) or 403(b), can be rolled into an IRA after leaving the company. This gives a contribution limit of $23000, plus any employer contributions. The IRA also should have gains that increase its value at the time of conversion. This can break the $253,750 number for the 4% rule for single filers in under ten years of work.

This will probably get lost in the nesting, but there are benefits to leaving funds in an old 401k also, such as being able to access the funds at 55 (vs. 59.5) and better creditor protection (hopefully not a concern). I happen to have good, low cost options in my emploryer’s plan, so I’m not going to chase these horses. I-orp.com is the place to get started cracking the tough nut of optimal tax planning, there are different things to consider during accumulation vs. distributiin. If you go in blind and roll over a large 401k – even this Horses strategy could cost you in the long run if you pay tax on what seemed to be a good over-conversion only to have the markets pull a 2008 a few years later. But I look forward to being ER to have more tax space to play these games!

Sorry about the typos, shouldn’t try to type stuff like this on a phone :)

The point about the different tax treatment of 401(k) and traditional IRA is important. I haven’t looked into it much since I am still at the beginning of my accumulation years and haven’t had to decide whether to make a 401(k) roll over or not yet.

Steve, you can only access 401(k) funds at age 55 without penalty if you leave the job your 401(k) is associated with after you turn 55 or older.

Here’s what the IRS says about it:

“The 10% tax will not apply if distributions before age 59½ are made…to a participant after separation from service if the separation occurred during or after the calendar year in which the participant reached age 55.”

Therefore, for most early retirees, a 401(k) and an IRA are quite similar when it comes to withdrawal age restrictions.

A married couple can have $46,000 going in each year to traditional 401k and traditional IRA (more if they are over 50). I plan to be >90% pretax when I hit FI, I’d much rather defer taxes now when I can save a ~30% marginal rate.

When you say you are 60% after-tax, is that in Roth or a taxable account?

You are correct that a married couple can contribute a maximum of $46,000 annually. There are a couple of caveats though. The first is having a dual-income situation where both can fully load their 401ks. The second is the Traditional IRA phase-out for those covered by an employer plan. Combining these two creates a somewhat narrow salary sweet spot where the full $46,000 can be realized. Both my SI and I cannot contribute pretax to a Traditional IRA due to our incomes. I imagine this will be the case for many people who are capable of maxing out their 401k.

The 60% after-tax money will be about 3/4 taxable and 1/4 Roth due to the low Roth contribution limits.

You wrote: “Speeding up conversion is a benefit if your Traditional IRA is large enough for a “run-away” balance ….”

This is a crucial point. I think I fall into the “oddity” population you refer to, and it might not be as rare as you think. It’s not just because I’m older than 40. The darn trad IRA increased in value while I was contributing to it!

I like your description of a trad IRA balance as being potentially “run-away.” I think you mean that at a certain point, it can’t be drawn down using low-tax or no-tax Roth conversions. And then its continued growth could mean one ends up with RMDs whose size threatens or actually does push you into a higher tax bracket, changes your LTCG rate, and causes more Soc Sec to be taxed, etc.

But I agree, the horse race might not be worth obsessing about if tax-free Roth conversions can handily convert your entire trad IRA into Roth IRA within the time period you want it to.

Yep, a nice bull market can definitely bring this strategy into scope as well.

And your description is exactly what I meant by “run-away”. I tried to stick with the Horse Race theme!

Great discussion, guys. I agree that if you will have no trouble draining your Traditional IRA, you might as well save yourself the hassle and just roll over normally. As the others have mentioned though, it’s possible you could have quite a bit in your Traditional by the time you finally pull the plug on work so this strategy would be useful in those cases.

This is an awesome strategy… I desire to build a ROTH ladder for my early retirement plans, but never thought of converting more than just a small amount over my current expenses (to cover future inflation). This allows you to minimize your future taxes on the traditional IRA’s by taking the best return each year! I am not sure on all of the required processes involved with the re-characterization, but I have quite a few years before I need to know.

An important note is that as long as you are under age 59 1/2 you cannot draw more out as just contributions and conversions (after 5 years) are available for withdraw tax and penalty free.

Thank you for the informative post!

From what I’ve read, the recharacterization isn’t too complicated, assuming you keep the rollovers separate, so hopefully it wouldn’t be too big of a hassle.

Glad you enjoyed the post!

Incredible explanation of this strategy. Love it.

Thanks a lot, Joe! Hope you’re doing well

Hello Brandon,

Are you going to FinCon 2014? Love to have your opinion…

We have always been big fans of yours.

That’s why I wanted to personally invite you to participate in GOBankingRates and FINCON 14 Summer Savings Challenge.

We’re asking bloggers and experts to share their best money-saving tip in a short video 1 min maximum clip. (It can be something you easily shoot on your SmartPhone!

No savings idea is too small or too crazy and I’m positive will be great!

The grand prize winner will receive $1,000, acknowledgement in a national press release and featured with the other three finalist at FINCON 14.

Please let me know if you will be able to participate and if you have any questions.

I’m excited to see what your favorite money saving tip is! (:

Hi Juanita,

Yes, I will be going to FinCon this year so I look forward to meeting you there!

I already have a Erlenmeyer flask so assuming I can track down some dry ice and a lab coat before your deadline (which is very soon!), I’d be happy to submit my favorite money-saving tip :)

I clicked thru the Bogleheads link provided, which led me to this https://www.fidelity.com/viewpoints/retirement/how-to-reverse-a-roth-conversion – Seems like the big guys recommend this strategy.

With this being the case, should I be putting money into a standard IRA instead of a Roth? 24yo $60k/yr, not maxing 401k. Seems to go against what I’ve read nearly everywhere else but seems to make sense if I will have plenty of time to convert it.

For future early retirees, I think a Traditional IRA is a much better choice than a Roth. In fact, I wrote an entire post on the topic so check it out here.

Looks like we get another 6 months to play the horse race!

Per IRS website: The deadline to recharacterize is Oct 15- Independent of whether or not you file an extension.

If you recharacterize after April 15 -you will have to file an amended return to account for the recharacterization.

http://www.irs.gov/Retirement-Plans/Retirement-Plans-FAQs-regarding-IRAs-Recharacterization-of-Roth-Rollovers-and-Conversions

Per IRS Website-

What is the deadline to recharacterize a Roth rollover or conversion?

You generally can recharacterize your rollover or conversion by October 15 of the following year, regardless of whether you requested an extension to file your tax return. For example, for your conversion to a Roth IRA in 2013, you have until October 15, 2014, to recharacterize. This deadline applies even if:

1) You did not request an extension to file your 2013 tax return, and

2) You file your return on or before April 15, 2014.

Good catch, Michael. I’ve updated the post to say you have until October 15th “if you file an amended return” rather than “if you file an extension”.

Trying to get clear on this strategy… So you convert on Jan 1, 2014 into 2 separate Roths (one for total stock index fund and one for total bond index fund, lets say). Jan 1, 2015 you want to do the next year’s conversion (before you recharacterize the 2014 conversion). Is that 2015 conversion into the same 2 Roths, or 2 MORE Roths? I’m obviously missing something important as I don’t know if the separation of the Roths is by year, or by asset class, and why. thanks!

You would need to separate by both year and asset class so you’d have to open two more Roths in January of 2015.

Hi,

I just wanted to see if you would be willing to do an article about funding early retirement through a 409a deferred comp plan. I admit, I am lucky to have one because I FINALLY earn enough to be considered highly compensated where I work, at age 38. I figure that although this account is meant for withdrawal at age 55 or later (lol), I can use it to my advantage to fund year one of early retirement without a penalty, instead of waiting to age 55. The reason is because I will only put enough in this account to fund up to my 15% tax bracket max for one year. This could eliminate the need to save after tax dollars for one full year of early retirement, if not MORE. The plan states that, upon termination, any dollars in a 409a plan are to be lump sum liquidated. I am sure all these plans work this way.

Very few of your readers may qualify to participate in these plans, but I am sure that a few or more do. This can be a very penalty, lucrative way to fund early retirement, simply quit in January and fund year one with this taxable account, but pay no penalties to the IRS for doing so, only regular income tax. It’s like a 401k early retirement present.

“The favored horse has to win eventually so this strategy guarantees you’ll walk away with x.”

Interestingly, this is one of the reasons casinos have a maximum bet. After you’ve doubled your bet a half dozen times or so, the strategy fails.

It appears a similar strategy can be utilized when initially contributing to a IRA.

The result is “free” money in the Roth IRA, while still getting the full deduction for the traditional IRA. This is due to different share prices between when the contribution was first made and the re-characterization date.

For example:

Share price when contributing to Roth IRA: $100 * 55 shares = $5,500 IRA contribution.

Share price when re-characterizing to Traditional IRA: $110 * 50 shares = $5,500 re-characterization.

Since the share price has increased by $10 on the re-characterization date, only 50 shares (instead of 55) will be transferred to the Traditional IRA, but one is still able to deduct the original purchase price of $5,500. As a result, 5 shares will remain in the Roth IRA now completely tax free.

This seems too good to be true, but I saw this happening when doing a re-characterization.

Any thoughts?

It is too good to be true. When you recharacterize, any loss or gain goes with it.

Thanks for posing this useful article. Any thoughts on using this with the Roth Back door strategy? I’m curious as to the mechanics how this might work..

The horse-race strategy is generally not applicable to solely back-door Roth contributions, since the back-door Roth contributions are non-deductible.

Extending this – could you use this technique to “time” a market bottom?

Say I want to convert $10K this year. What if instead of one $10K conversion, I did one at the beginning of each month – convert $120K over the course of the year. Then recharacterize 11 of them and only keep the one where I got the best price.

Yes, but it would be best to open 12 seperate Roth accounts. And it would probably be more advantageous to recharacterize only enough to get your marginal tax rate into the lower brackets.

This may have already been answered, but what if you are already contributing to Roth IRAs and have a Roth 401k through work? Does this change the conversion at all? I am in my mid twenties and am working towards financial freedom. I have been contributing into my 401k at work with my contributions being Roth and also have a Roth IRA through Vanguard that I max out. I have always maxed out roth due to tax free growth, but never knew about the conversion ladder. So I guess my real question is do the contributions need to be in a traditional to take advantage of this? Thanks!

Yes, your contributions need to be into a Traditional 401(k) or a Traditional IRA to take advantage of this concept. And yes, you are probably better off doing that.

Is there any reason to need multiple accounts? Is doing the recharacterization that much easier?

Daren,

My understanding, is that custodians handle IRS Form 5498 at the account level. Therefore, if you use only one account, any losers in that one account will be aggregated with any winners. Obviously, this would negate the whole purpose of this strategy, which is to recharacterize your losers.

Hi, we’re in 2017 and I’m getting older, did you write a book or any other papers on Roth conversions?

Roth Recharacterization – R.I.P.

FYI, starting in 2018 this tactic is forbidden. https://www.nerdwallet.com/blog/investing/investors-need-know-tax-reform-plan/

Can’t you still do this with regular Roth IRA contributions? e.g. Create four separate Roth IRA accounts, max out the contribution to each and then undo the three worst performers at the end of the year to avoid being over the Roth contribution limit.