A few months ago, I wrote a couple of articles about harvesting investment gains/losses for tax purposes.

In the Tax-Loss Harvesting post, I described how it can be beneficial to sell investments for a loss in order to use that loss to reduce your taxable income.

Conversely, in the Tax-Gain Harvesting article, I showed that in some situations it may be a good idea to sell your investments for a gain to increase your cost basis.

What I didn’t tell you is how to structure your taxable portfolio so that you can easily sell the investments that have depreciated in some years and those that have appreciated in others.

Today, I will do that.

Cost Basis

When you buy an investment, the price you bought the investment for is the cost basis (note: the cost basis can be adjusted for stock splits, dividends, etc.).

The cost basis is important because it is used to calculate how much tax is owed when an investment is sold.

Accounting Methods

When you sell an investment, there are various accounting methods that can be used to determine the cost basis.

The three types that Vanguard offers are Average Cost, FIFO (First In, First Out), and Specific Identification.

To illustrate the differences between these various methods, let’s create an example scenario to play around with.

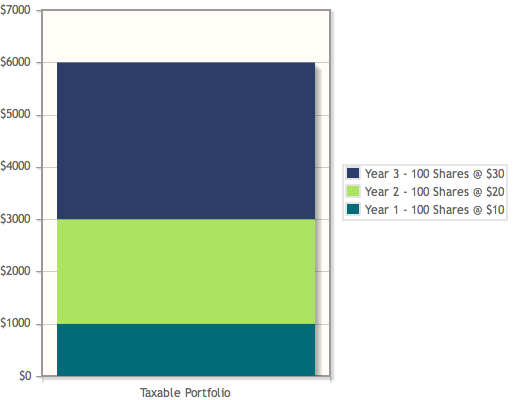

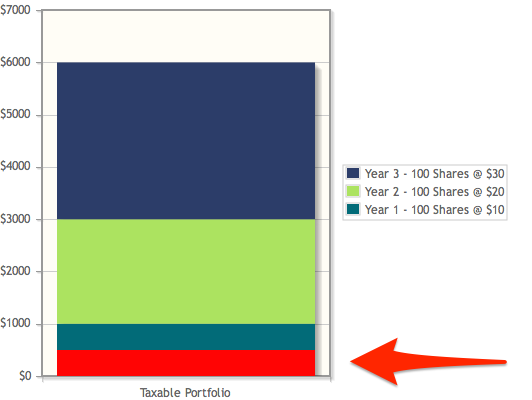

Assume you purchase 100 shares of investment x in your taxable portfolio every year for three years. In year one, you purchase 100 shares of the investment for $10 per share. When you buy the investment again the following year, the price has risen to $20 per share so you buy 100 shares at $20 per share. Finally, in year three, the price has risen again and you purchase 100 shares of the investment for $30 per share.

Let’s take a look at what would happen if you decided to sell 50 shares using the three different accounting methods.

Average Cost

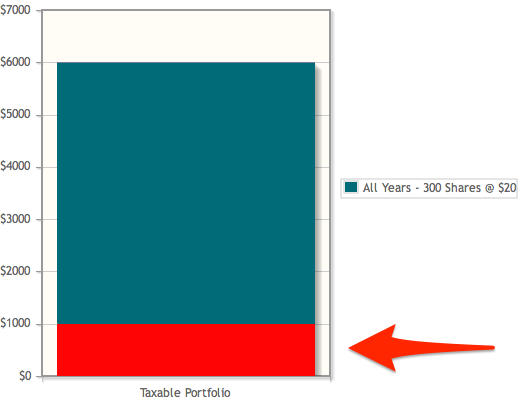

The Average Cost method simply takes all of your cost basis values and averages them to produce a single cost basis for all of your shares.

In the example provided, the cost basis using the Average Cost method would be $20 per share.

This is a reasonable way of doing things but what if the price of the investment falls to $20 in year five and you’d like to harvest those losses on the shares you bought in year three? With Average Cost accounting, you wouldn’t be able to because your average cost basis would be $20 so selling 50 shares of the investment for $20 wouldn’t result in any gains or losses.

First In, First Out (FIFO)

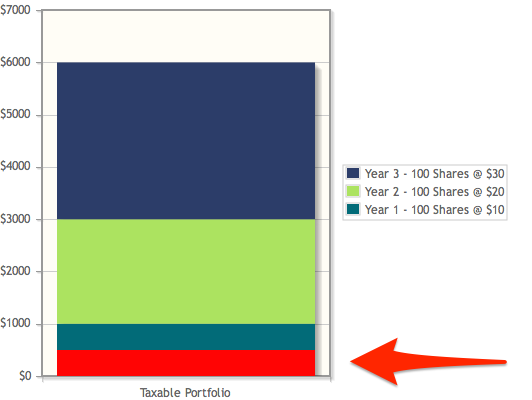

The second method uses the cost basis of the oldest shares in your portfolio first (i.e. the shares that go in first are the first to come back out).

So again, in our example scenario, you still wouldn’t be able to harvest your losses using the FIFO method either because if you sold 50 shares when the price dropped to $20, you’d actually create a taxable gain of $10 per share because you’d be selling the shares that you bought in year one for $10 per share!

Specific Identification

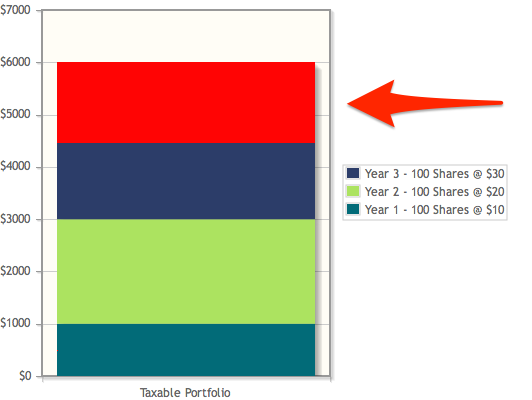

Luckily, the final accounting method, Specific Identification, allows us to specify which specific shares we would like to sell.

To harvest our losses in year five when the price falls back to $20, we would simply specify during the sale that we would like to sell the shares that we bought in year three for $30 per share.

What if we instead wanted to harvest our gains when the price was at $20? The Specific Identification method would allow us to do this as well because we could simply choose to sell the shares that we bought in year one for $10 per share instead.

Changing Methods

At Vanguard, the default accounting method for mutual funds is the Average Cost method and the default for brokerage shares is FIFO.

Although you can change your cost basis method during the execution of a trade, it makes sense to update your default cost basis method for all taxable investments to the Specific Identification method.

To do this in Vanguard, you simply need to select the Account Maintenance option under the My Accounts tab and then click the Cost Basis Method link.

Taxable Accounts

Please note, you only need to worry about cost basis in your taxable accounts. Cost basis is irrelevant in tax-advantaged accounts (e.g. 401(k)s, IRAs, etc.) because gains within those types of accounts are not taxed when shares are sold.

Conclusion

As you’ve seen, Specific Identification of Shares is the best cost-basis accounting method for those wanting to minimize taxes.

Although it adds an extra step when selling your investments, having contol over exactly which shares you sell is well worth the additional effort.

I’ll have to explore the specific identification of shares at Vanguard further. I’ve only sold things a handful of times at Vanguard, and I’ll usually call up the vanguard folks, tell them to sell, and that I want to identify specific shares. Then I secure message them with the specific lots I want to sell then print out that secure message and stick it in my tax files as the record of instructing my brokerage firm (as required by the IRS for recordkeeping).

One problem I have had at Vanguard (and a caution to others!) is that once you sell under the specific identification of shares, Vanguard doesn’t properly report your cost basis on their website. I remedied this by creating my own “cost basis tracking” spreadsheet and I update it once per year. In January. It’s on the to-do list right now.

Another excellent (and timely) post, Mr. FIentist!

Justin – does your comment on incorrect cost basis showing on the Vanguard website pertain to sales after the recent law change? My understanding is that since the law change, VG has changed their tracking to properly handle “covered shares” purchased after the switch. That’s unfortunate if there are still glitches.

No, I’m referring to the shares I acquired before the new cost basis tracking requirement started in 2012. On the “Cost Basis Summary” page, I can view detailed cost basis for each fund I own.

The Vanguard page says “For shares acquired before January 1, 2012, Vanguard has only average cost information.” And then all shares acquired prior to Jan 1 2012 are lumped into one line and the acquisition date is listed as “various”.

They never changed my cost basis on the pre-2012 shares in their system in spite of the fact that I provided them with a letter of instruction to identify specific lots. They told me the cost basis wouldn’t be correct, but it means I have to manually track and identify specific lots when it’s time to sell. Not a big deal, just clunky.

I’m only a mutual fund client, not a brokerage client FYI.

Hey Justin, good point about the separate recordkeeping. I didn’t want to complicate the article by talking about covered vs. uncovered shares but I probably should have mentioned that it’s a good idea to keep track of the lots yourself so that you have another record of the cost basis values. As Jameel indicated, it seems their cost-basis tracking for covered shares (i.e. shares purchased after Jan 1, 2012) is accurate but since it’s so easy to record the cost basis whenever you purchase shares, it makes sense to keep your own records as well.

What would be the columns to track in a DIY cost basis tracking spreadsheet? please

Every time Mad Fientist! You always have insight that I hadn’t even DREAMED of thinking of. Thank you!

Thanks very much, Dave! Glad you found the post useful.

Great information. I bought a mutual fund in my taxable Vanguard account in 2013. In looking at the Cost Basis method for that account, it says ‘Not established’. It’s unclear to me if I can change it now for that already placed trade. Any idea? I may give VG a call today.

The default for mutual funds is average cost, so I believe they treat it as average cost unless you specify otherwise. If you have sold any portion of the shares since 2013, then you are locked into average cost for those pre-existing shares, but I believe if you have not sold any, then you can elect specific ID, and it will use the proper cost basis for all shares you bought in 2013.

I have not sold any shares so I think I’ll try to do my due diligence and pick the Cost Basis method that best suits us. Thanks for the info, Jameel.

Hey Buck, I agree with Jameel that you should be able to switch to SpecID so give Vanguard a call if you aren’t able to do it on the website and they should be able to help you. Please let me know if you aren’t able to for some reason.

One other topic is how to set up your automatic investments to play nicely with specific ID. I have traditionally done an automatic investment after every paycheck and used automatic reinvestment of dividends and capital gains. However, this results in many different lots of shares. I don’t know if this is a problem (I’m sure the VG hard drives are huge). Since changing to specific ID, I have changed my dividends and capital gains to be sent to the sweep account. I have also changed my biweekly automatic investments to go to Prime instead of directly into total stock market. Then, I have an automatic exchange of 100% of prime into VTSAX once a month. This results in only having 12 lots of shares per year. It has the downsides of only being able to invest in one taxable fund at a time, and funds sit in Prime longer.

Does anyone know if Vanguard tracking of “covered shares” is good enough that I can quit worrying about minimizing the number of lots?

Everything I’ve read says that the tracking is good enough to handle it, but I don’t have personal experience with it.

Your alternative is to let those dividends pay out into your checking (or whatever) account, and just add them to your regularly-scheduled transfer.

Hey Jameel, as Garrett mentioned, I imagine Vanguard’s tracking would be good enough but I don’t automatically reinvest my dividends in my taxable account so I don’t know for sure (I don’t want automatic reinvestments conflicting with my tax loss/gain harvesting so I manually reinvest instead).

Can anyone out there provide a definitive answer for Jameel?

Nice one! Just updated my Vanguard cost basis to Specific Identification. I’ve been meaning to do it but this was a good reminder even though I don’t plan to sell any shares anytime soon.

Yeah, I don’t plan on selling anything anytime soon either (unless we see a big drop, in which case I’ll harvest some losses) but it’s good to get your default cost-basis method set up anyway.

Another great piece of information to fit into the investing puzzle! A generous tip of my hat to you sir!

Thanks, FIREstarter (and good to see you around here after chatting over at 1500days.com)!

I had no idea those options even existed. Thanks for the info. I now have some work to do for the small portion I have sitting in my Vanguard brokerage account.

Nice seeing you over here as well, Micro. Glad the post was useful!

Unfortunately for Canadians, the “average cost” is the only method allowed by the CRA for calculating ACB: http://www.cra-arc.gc.ca/E/pub/tg/t4037/t4037-e.html#P1185_82580

I was pretty sure that was the case, but decided to check to make sure I’m not missing out on a possible tax-saving strategy.

Hey jd, thanks a lot for chiming in with that information! It looks like you read Ottawa’s mind (see comment below). Even though I live 1.5 hours from the Canadian border, I have no idea what’s going on up there as far as retirement accounts are concerned.

This is a great intro, but what I’d really like to hear more about is how this all gets handled come tax time. The extra tracking work required for specific identification seems pretty cumbersome already, but what I’m more worried about is the tax implications (esp. what kind of records need to be kept in the event of an audit).

I think you just need to keep track of the cost basis and which lots you sell from and I imagine you’d be fine. This is easier if you only have covered shares (i.e. those purchased after Jan 1, 2012) because Vanguard should help keep track of everything for you but I’d still suggest keeping your own records so that you aren’t relying solely on Vanguard.

Hey Mad Fientist! I’m not sure that in Canada we are able to select the ACB accounting method. I believe we can only use the average method…can anyone confirm this?

Hey Ottawa, it looks like jd answered your exact question (see above) but I just didn’t approve his comment in time for you to see it!

Another good post. Your loss harvesting post gave me the kick in the pants I needed to actually benefit from some of the loses in my portfolio.

Readers should also note that taxable accounts will receive a step up in basis at death. This is a nice benefit to reduce the tax burden on the next generation.

Thanks, Prob8. I’m glad my post spurred you into action.

Thanks for pointing out the basis step-up at death as well. Might as well harvest those losses now and get that basis nice and low before kicking the bucket (which will hopefully be many many decades down the road)!

Do you see any advantage of investing in taxable stock investments if you have not yet maxed out your other tax advantaged accounts (401k/403b/etc)? I would think this strategy only makes sense if you have additional money to invest that you no longer can send to these accounts.

The short answer is that it depends on your situation, and especially your current income and your expected retirement income.

Personally, my 401(k) is only worth investing until I reach a point where I can receive employer matching and utilize the tax-free rollover described in this MadFIentist post.

I am currently in the 15% tax bracket, and will always be in this bracket unless my wife and I somehow suddenly starting bringing in 35% more income than we do (doubtful).

This means that my long-term capital gains rate is 0%. So, effectively, a taxable account (assuming all investments are long-term capital gains) is a Roth IRA for me, without the limitations on when I can withdraw it.

For me, the possibility of short-term capital gains is small compared to the added ease and comfort of having all my investments in liquid taxable accounts.

Therefore, I have no plans to max out either my 401(k) or Roth IRA this year or any year in the future.

The higher your marginal tax rate, the better the 401(k) or Traditional IRA options are. The lower your marginal tax rate, the less it really matters.

Another excellent article! Where were you during my intermediate accounting class? You have horrible timing, sir.

Haha, my apologies :)

You can harvest a loss from a taxable account, say sell 100 shares of VTSAX and then immediately purchase the same number of shares in a tax deferred IRA account and not trip the washsale wire, right?

No, that would actually trigger a wash sale. All of your accounts (and even your spouse’s accounts) are in play for the wash-sale rule.

Hi Mad Fientist,

This is an old post, but I’m finally going to harvest tax gains, but I don’t know which shares to select.

I aim to harvest around 40-50k (want to give myself a generous buffer as it’s my first year doing this), and I have the following in my Vanguard taxable account:

– $192,118.92 Unrealized gains from non-covered “various” shares bought before 2012

– $730.49 Unrealized gains from shares bought in 2012, and so on…

It looks like I was buying every quarter around the same amount, so lots of little gains adding up.

Should I sell the uncovered shares or start with the covered ones and try to find the actual prices for the shares I bought before 2012?

Thanks!

I found your site recently and have appreciated the content. I realize this post is old, but wanted to share some details that you may want to use to update the article that will help your community manage depletion more efficiently.

I work on wealthtech investment management platforms and while many advisors are still using FIFO or Avg Cost, there’s a growing population using a depletion method offered at most major custodians that automates the tax efficient depletion you described doing with lot specific methods.

At Vanguard for example, you can check out this option for more details:

https://investor.vanguard.com/investor-resources-education/taxes/cost-basis-minimum-tax

Other custodian resources:

Schwab – https://www.schwab.com/learn/story/save-on-taxes-know-your-cost-basis

Fidelity – https://www2.advisorchannel.com/wc/channel/jsp/sp3help/content/fwchlpcbdmdescriptions.htm (see STTS)