Traditional IRA or Roth IRA – Which one should you contribute to?

Everyone has an opinion but nobody has a definitive answer.

Until now.

This article shows that there is a clear winner for people who plan to retire early.

And if you choose the right option, you could accumulate an extra $100,000 over the course of your lifetime!

Types of Retirement Accounts

Before I get into the specifics, let me first recap the two major types of retirement accounts.

Tax-Free-Contribution Accounts

Tax-Free-Contribution accounts are the most-common type and have the following characteristics:

- Funded with pre-tax (i.e. untaxed) dollars

- Grow tax free

- Taxed at withdrawal

Here’s a simple illustration showing when your money gets taxed:

Traditional IRAs, 401(k)s, and 403(b)s are all examples of this type of retirement account.

Tax-Free-Withdrawal Accounts

Tax-Free-Withdrawal accounts, on the other hand, are:

- Funded with after-tax dollars

- Grow tax free

- Allow tax-free withdrawals

Roth IRAs and Roth 401(k)s are examples of this type of retirement account.

Taxable Accounts

Both options are good because they provide some tax benefits that allow your investments to grow faster than they would if simply invested in a normal taxable account.

Here’s what a taxable account looks like:

Not only is your money taxed before it enters the taxable account, your investment growth is also taxed along the way.

Choosing Between a Roth IRA and a Traditional IRA

When choosing between a Traditional IRA and a Roth IRA, you are effectively choosing when you want to pay tax on your money.

If you decide to go with a Traditional IRA, you pay tax when you withdraw the money and if you go with a Roth IRA, you pay the tax up front.

Roth IRA Conversion Ladder

Today, I’m going to show you how to get the best of both worlds – tax-free contributions, tax-free growth, AND tax-free withdrawals!

Here’s the strategy:

Step 1: Contribute to a Traditional IRA During Your Working Years

While you are working, your tax rate will likely be higher than it will be after FI so shield as much of your income from the taxman as possible by contributing to a Traditional IRA.

Step 2: Slowly Convert Traditional IRA to Roth IRA

Once you begin your early retirement, you’ll have less taxable income than you did when you were working so use this period to convert your Traditional IRA to a Roth IRA.

You didn’t pay tax on the money when you contributed to your Traditional IRA so you have to pay tax when you convert to a Roth. Your income will be lower after you retire though so you’ll likely pay very little tax on the conversion. In fact, if you convert an amount equal to your deductions, exemptions, and credits every year (and assuming you have no other ordinary income), you could execute these conversions without paying any tax at all!

Step 3: Enjoy Your Completely Tax Free Retirement Money

After converting your entire Traditional IRA to a Roth IRA during your early retirement, you can withdraw that money from the Roth tax free!

Note: To avoid paying a 10% early-withdrawal penalty, you have to wait five years after the conversion (or until you turn 59.5, if that’s sooner) to withdraw the converted funds from the Roth.

How is This Possible?

This strategy is referred to as a Roth IRA Conversion Ladder and you may be wondering why everyone doesn’t do this.

Well, there are a few reasons this strategy only makes sense for early retirees…

Low Income and Living Costs

Most early retirees live on a modest amount of income from tax-efficient sources like long-term capital gains and dividends (which are taxed at 0% when you’re in the 15% tax bracket or below). This means they can use their tax-free space (i.e. deductions and exemptions) for things like Roth conversions.

Long Conversion Timeframe

Conversions from a Traditional IRA to a Roth IRA are taxed as ordinary income so it’s beneficial to spread the conversion over a large timeframe. That way, you don’t increase your taxable income too much in any given year.

Since most people work full time until they reach retirement age, they never have periods of lower income to do these conversions cheaply. Any amount converted while working would increase the amount of tax they have to pay at their marginal tax rate and wouldn’t be worthwhile.

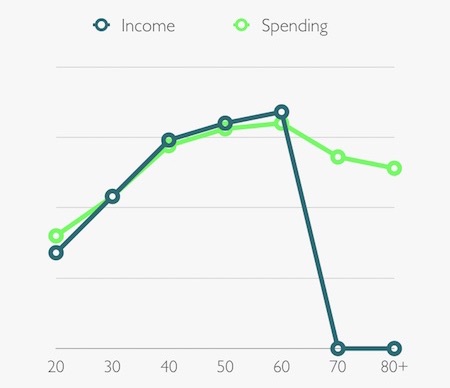

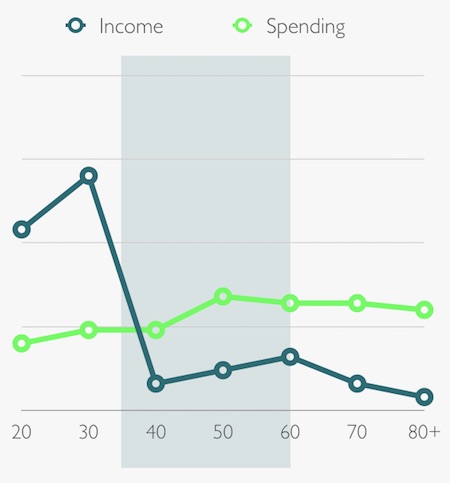

Here’s a typical income/spending graph for someone on the standard retirement track:

As you can see, income is high (and growing) from age 20 to age 60 so there aren’t any good opportunities to do the conversion.

Early retirees, however, can use their low-income years during early retirement to gradually perform the conversion, tax free.

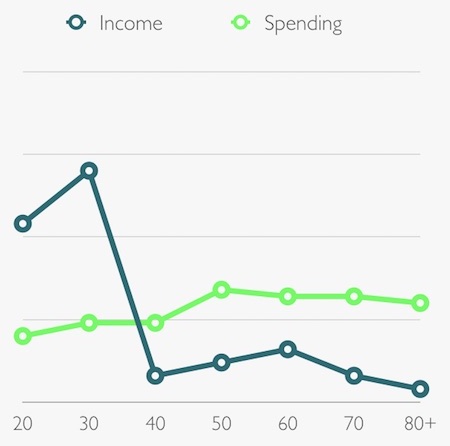

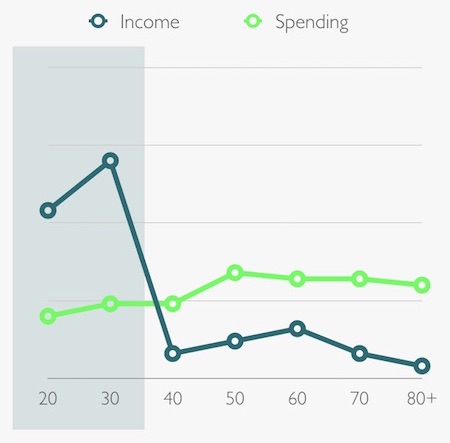

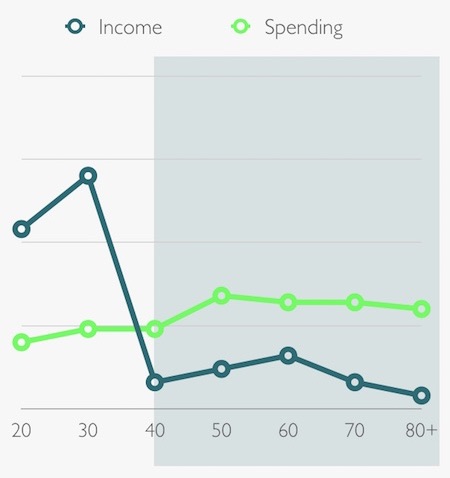

Here’s a typical income/spending graph for an early retiree:

Let’s see how this entire strategy could play out…

To save on taxes during your working career (i.e. when your income is high), you contribute to a Traditional IRA:

When your income drops during early retirement, you start rolling over that money to a Roth IRA:

Five years after you begin the conversions, you begin withdrawing money from your Roth, penalty free:

The Power of this Strategy

A simple example will highlight how much money this strategy could save you over the long run.

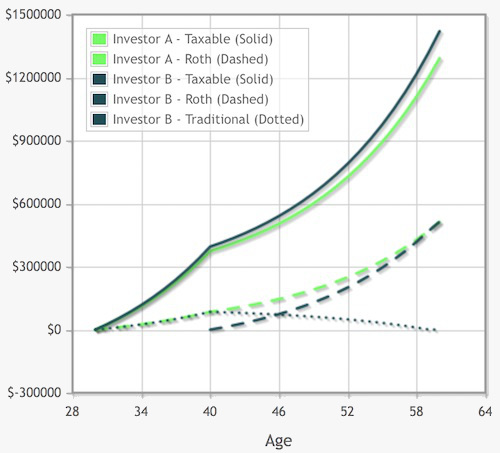

Imagine two 30-year-olds who hope to retire by the age of 40.

To make things simple, assume they each start with nothing, make $60,000 a year, and can happily live off of $18,000 per year.

Investor A decides to max out his Roth IRA between now and when he retires at 40.

Investor B instead decides to max out his Traditional IRA and then slowly convert it to a Roth IRA after he turns 40.

Both invest all leftover money into taxable accounts.

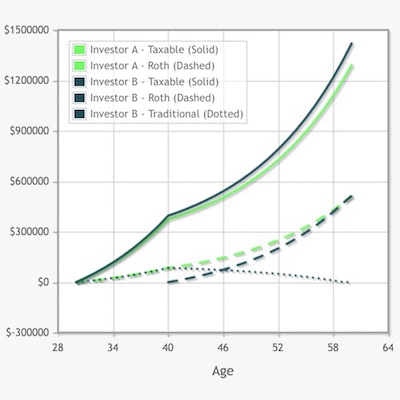

The following graph shows the value of the accounts of these two investors:

Investor A is represented by the light green lines and Investor B is represented by the dark green lines.

The solid lines are the investors’ normal taxable accounts, the dashed lines are the investors’ Roth IRA accounts, and the dotted line is Investor B’s Traditional IRA account.

At age 40, both investors stop contributing to their accounts and begin withdrawing $18,000 per year from the taxable accounts. Investor B also begins converting his Traditional IRA into a Roth IRA at this time.

Since Investor B converts less than his standard deductions and exemptions each year, he avoids paying taxes on the conversion and ends up having exactly the same amount of money in his Roth IRA as Investor A does when they reach standard retirement age.

What you’ll notice though is that Investor B actually has quite a bit more in his taxable account. Contributing to a Traditional IRA reduced his taxes when he was working so he had more money to invest in the taxable account during his 30s. As a result, he ends up with over $100,000 more than Investor A when he reaches retirement age!

It’s pretty incredible that a simple choice between two good options can result in a six-figure difference in retirement savings!

Why Stop There?

In this article, I’ve shown how a Traditional IRA can become a completely tax-free retirement vehicle when combined with a Roth IRA.

In the Ultimate Retirement Account article, I described how an HSA can also be used as a completely tax-free retirement account.

What about the other major retirement accounts like the 401(k) and 403(b)?

Yes, they too can potentially become completely tax free!

Tax-Free 401(k)

Since you can easily convert your 401(k)/403(b) to a Traditional IRA after you separate from your employer, it is just one extra step to get your 401(k)/403(b) money into a Roth IRA using the tax-free method described above.

What if You Earn Too Little or Too Much?

The upfront tax deductions provided by traditional retirement accounts are the reason this strategy is so beneficial.

If your income is low enough that you don’t have to pay taxes anyway, additional tax deductions aren’t going to help you so you should just put your money into a Roth. That way, you can withdraw it later, tax free (when you could be in a higher tax bracket).

Conversely, if you earn too much to get the Traditional IRA tax deductions, you’d also be better off contributing to a Roth, a Mega Backdoor Roth, or simply a taxable account.

Here are the 2018 income limits for obtaining Traditional IRA tax deductions:

- IRA deductions for people covered by a retirement plan at work (e.g. 401(k), 403(b), etc.)

- IRA deductions for people NOT covered by a workplace retirement plan

Accessing Retirement Accounts Early

Many future early retirees worry about putting too much money into retirement accounts because they don’t want their money locked up until standard retirement age.

As this article has shown, the Roth IRA Conversion Ladder is a great way to access that money early but here are even more ways to access retirement account funds before standard retirement age.

Traditional vs Roth IRA

So there you have it.

Finally a definitive answer to the Roth IRA vs Traditional IRA debate.

For future early retirees, the clear winner is the Traditional IRA.

What do you think? Will this strategy work for you? Do you expect your income after FI to be low enough to allow for completely tax free conversions?

This post was originally published on February 12, 2013 but was updated on March 21, 2017

Great article, MF…

Clear, concise and a cool strategy. I liked it so well, I linked to it on my own post on the subject.

OH, and neat picture of the fighting foxes.

Thanks, Jim! The post that you referenced (http://jlcollinsnh.wordpress.com/2012/05/30/stocks-part-viii-the-401k-403b-ira-roth-buckets/) is actually one of my favorites of yours because it not only describes the various types of retirement accounts but it also discusses which investments should go into each type (or “bucket”, as you say) to maximize tax efficiency.

Ha, I’m glad you like the foxes image. It’s hard to find an image to represent a battle between two types of retirement accounts!

Hi MF, I have a 401(k) at a previous employer. I am now at a new employer that also offers a 401(k). Is it better to move the old 401(k) into the new one, or as you mentioned above, to convert it into a Traditional IRA? And if the latter is the better choice, how would I go about doing that? Thank you !

I’m not MF but the most prudent thing to do in this situation is to simply just rollover your old 401k into a Traditional IRA with either Vanguard or Fidelity. The reason is that most likely your new employer 401k will not offer options as great as the Vanguard or Fidelity Traditional IRA. Employer 401ks usually have higher expense ratios (ER) that really eat into your investments over the years that you’re employed. To rollover your money, simply google “401k rollover.” The first result is from Vanguard. You really can’t go wrong with Vanguard. Follow the instructions and profit.

This can prevent you from doing a backdoor Roth IRA, depending on how much you make.

Just be sure to do your homework and talk to a professional or two… Before you take action!!

Great Analysis FI!

I would also add:

1) Keep in mind that there is a 5-year holding period (lockout) when you convert a Traditional IRA to a Roth IRA. That is, the investor must wait 5 years before withrawing the originally converted amount.

2) In some cases it may make sense to make the original contributions to a Traditional IRA/401k, then withdraw desired amounts from the IRA/401k before age 59 1/2 (yes, PAYING THE EARLY WITHDRAWAL PENALTIES) if the IRA/401k contributions during working years are in a high tax bracket, and the withdrawals in retirement/early retirement are in a low tax bracket.

Thanks, GubMints! You make two great points. Your second point highlights why I take a “get all the tax breaks I can now, worry about getting my money out later” approach. I’ve already exceeded the amount of post-standard-retirement-age savings I need to accumulate but I still keep maxing out my tax-advantaged accounts because to me, the tax breaks are worth the added hassle of getting my money later (if I decide I need some of it before I turn 59 1/2). As you said, the worst-case scenario is I’d have to pay early withdrawal penalties but since my tax bracket will most likely be much lower after I reach FI, I could still end up being better off even after the penalty.

Hello,

I’m trying to implement this strategy for myself. I am starting to contribute more to my 401k and less to my taxable accounts. One thing alway makes me curious! To cover that five year waiting period for the first batch converted to be available, should you invest into a Roth IRA 5 years early so that you withdraw the principal and live on that? Or should you simply save 5 years of expenses into a taxable account?

I hope I stated my concern clearly.

Thank you!

Damien

Hi Damien,

You should have a non-retirement account with sufficient funds available to cover you for at least those first five years until you are able to access your rolled funds.

Also, you’re only able to rollover $10,000 tax-free each year (as of 2015 laws) as long as you don’t have any other ordinary income, so if you plan to need more than $10,000 per year to pay for expenses you will need to account for those funds in a non-taxable account, transfer more than $10,000 and pay taxes (albeit at a presumably much lower rate), or be willing to take early withdrawal fees on your Roth.

Regards,

Drew

Thanks Drew for the answer. We need to set up a few step by step rules such as how much/percentage you should have in an emergency fund, how much/percentage in taxable accounts and how much/percentage to throw in tax advantaged accounts.

Another strategy that would result in tax, but still be much less than what you would pay if you were working in a job. You can retire early and take money out of your Trad IRA up to your standard deduction and all other deductions $23,000-ish. You would only need to pay the 10% penalty. If you live overseas or live in a state w/o income tax then that should be all you need to pay. Am I missing something? I think this would work if you were retiring in your 50’s or needed the money sooner than 5 years out…

Jason could you do a SEPP instead of paying the 10% penalty?

This is the post I’ve been scouring the internet for!!! I always wondered to myself if this could work and now with your confirmation, it just makes me feel so much more reassured! But I still have a doubt/ question… I’m planning on retiring early with rental properties (which I believe you own as well). So my question is, do you think it will still be possible to offset profits from the rentals with other rental expenses (depreciation, etc) enough so, so that I will be below the 15% tax bracket? I’m assuming it will be as long as I possibly purchase more properties during those years and do a cost-depreciation study..? Penny for your thoughts pleaseeee.

Whenever I stumble upon such discussions of roth vs. traditional IRA, the considerations always seem to be whether one’s income would be lower or not at retirement (hence a lower or not tax bracket) or whether the tax rates will increase in the future (a very popular belief in Canada).

I think that these are minor factors and for most people hard to predict. For most people without (or with small) pension plans traditional IRA’s are better for the simple reason that the tax savings during contributions are at marginal rates, while the withdrawals are at average rates. This is of course why the conversion strategy proposed in this post works.

There’s an added advantage for people living in high tax states – they can change their residency after retirement.

So my conclusion is that for people without significant defined benefit pension plans or with huge savings, saving in a traditional IRA’s is the faster way to secure comfortable retirement income.

For me, my first priority is to make sure that I’ll not be on the street or a burden to my children. After that, if I’ve managed to save a ton of money, who cares if I pay a bit more in taxes. Security first, then getting rich!

That’s a great point, Pat. Trading a marginal tax rate for an average tax rate makes sense no matter what you think tax rates or your personal income will be in the future.

That’s also a good point about being able to move to a state with lower taxes after retirement. This is actually something I plan on writing about in the future. Because I’ll be living abroad for a good part of my life after FI, I’ll need to investigate which state would be best to establish residency in prior to leaving America. The last thing I’ll want to do is pay a bunch of state taxes when I’m not even living in a state.

Good idea about living abroad! I’m doing that right now to reach FI next year, full retirement 2 years after (got to get a boat :-). I get a whooping 92K deduction for living full time overseas. It helps because of the company perks pushes my salary above 95% percentile (US average income).

If I live overseas after retirement, than I can convert the full amount, IRA to Roth IRA every year, and withdrawal more than 30K/yr (dividends) and still pay $0 tax.

I used to pay California state tax (9%+), working in Silicon Valley. I relocated to Texas prior to working overseas. I changed my physical address, get a TX license, and filed Texas as my “home domicile” (IRS term). Now I do not pay that CA tax anymore! There are 7 states with no state income tax: NV, FL, TX, SD, WA, WY, AK. Alaska is special because it has no sales tax (double tax protection). If AK is too cold, live in southern WA, and drive across to Oregon (no sales tax) for shopping. Or live west South Dakota (no income tax) and shop at Montana (no sales tax). The no sales tax states are AK, MT, OR, NH, DE.

I love your website! Maybe because I’m an engineer :-)

Nice! Where are you living now?

Great call on ditching the California state tax. My parents are actually planning on moving to Florida soon so I’ll definitely be spending a bit of time down there to establish my legal residency before heading abroad!

Glad you’re enjoying the site! It’s amazing how many engineers and software developers are on the path to early financial independence. I think it’s our obsession with efficiency and our tendency to try to optimize everything that leads so many of us to this way of life. What kind of engineering do you do exactly, if you don’t mind me asking?

What do you need to do to establish legal residency for taxes? Can you just rent a place for say 6 months, change your drivers license, utilities, etc.? What do you do when you leave the US? Do you have your mail forwarded overseas? The last state you lived in stays as your tax address?

I imagine it’s different for each state so you’d probably want to do some research after you decide on a state.

I sadly wasn’t able to establish residency in Florida before moving abroad. I get my mail forwarded to my parent’s house in Florida but I’ll likely still need to file a Vermont tax return. I’ll probably write a post about it after I look into it more next year.

That’s some hardcore geographical arbitrage! I just printed out a map, color coded the states (no income tax and no sales tax) and pinned it to my wall. Yes, I’m an engineer too!

Haha, nice! Let me know where you end up deciding to go.

Don’t forget about TN! We do have a relatively high sales tax to make up for it, though the cost of living is substantially cheaper than some of the other non-income tax states.

Tennessee also has a Hall tax on dividends and interest of 6%.

I know this is an old article, but wanted to also point out that state sales taxes are also bracketed and tiered, just like federal taxes, and you get exemptions, too. If you have an income of just $18,000 in ER, as described above, then you’ll only pay $205 in state income taxes, which is only about 1.1%. If you’re married, filing jointly, you won’t pay any with exemptions. If you have one kid together, then you can make up to $36k without paying state income taxes. Depending on where in California you live, you can call that your weather tax, since I can’t imagine living in most of those states without breaking the bank in AC or Heating costs!

Hi, I’m confused on why withdrawals from a traditional IRA are not taxed at your marginal tax rate at time of withdrawal but instead at “average” instead:

“the tax savings during contributions are at marginal rates, while the withdrawals are at average rates.”

To ease the discussion, below are some of the tax brackets for 2014 for someone who is single.

0 to 9,075 10%

9,075 to 36,900 15%

If I have 10k of other income (to simplify, assume I have zero deductions and exemptions), and I withdraw 5k from my traditional IRA, I believe my marginal tax rate would be 15% on that withdrawal as my taxes on my full income of 15k would be calculated as:

10% * 9,075 + 15% * (15,000 – 9,075) = 1,796

The entire 5k I withdraw is taxed at the 15% rate (plus $925 of my other income). The average rate however is

1,796 / 15,000 = 12%

Which is of course lower than my marginal rate of 15%.(My average rate had I not taken the withdrawal would of been even lower.)

Now there is the corner case that your other income plus your traditional IRA withdrawal combined is below $9,075, in which case your average and marginal taxes rates would be equal at 10% since you are in a single bracket for all income. However, I don’t think that is the point this comment was trying make.

Also, I can change the parameters a little to get my rate paid on the withdrawal closer to my average rate. Suppose for example, I only have 6k of other income and still withdraw of 5k. In that case, the first $3,075 (9,075 – 6,000) of my withdrawal would be taxed at the lower (non-marginal) tax rate of 10% while the rest, $1,925 (5,000 – 3,075), would be taxed at the marginal rate of 15%. If it is this possible spitting of tax brackets that is the point of the comment, I think it is unfair to call the tax savings on contribution “marginal taxes” while the taxes paid on the withdrawal are called “average” since the symmetric case occurs on the contribution side: if your income is 10k and contribute 2k, you get the marginal 15% tax break on the first $925 ($10,000-$9,075) but only a 10% tax break on the remain $1,075. Hence the tax rates you are avoiding would be equally an “average” tax identical to the withdrawal case.

Am I missing something? (Sorry, for any grammar or arithmetic errors.)

Hey Matt, I definitely see what you’re saying but I think Pat’s point was that if you choose to contribute to a Roth instead of a Traditional, you are choosing to be taxed on that money at the marginal rate.

When it comes time to withdraw money from your retirement accounts, you withdraw how much you need to live on so you can think of all of the withdrawal being taxed at an average rate.

For example, If someone makes $20,000 and decides to contribute $5,000 to a Traditional IRA in 2014, they are saving at the marginal rate because that entire $5,000 would have been taxed at 15% if they had contributed to a Roth instead (using your example tax brackets).

Assume when they retire, they withdraw $20,000 every year from their IRA to live on. That $5,000 contribution they made in 2014 is just part of the amount they withdraw that year so it is being taxed at their average rate. Yes, you could argue that the $5,000 in question is the last $5,000 of the $20,000 total, so it is the part that is taxed at 15%, but I’d probably see it as just part of the average, since I’m withdrawing $20,000 per year no matter what.

I think it’s just a different way of looking at things.

FI, thank you for your reply.

I think the 5k from the traditional IRA fund really should be treated as the “last” 5k in the context of traditional vs Roth because if you had used a Roth you would only have 15k of taxable income rather than 20k with the other 5k coming from your Roth. It is the use of the traditional IRA that causes you to have that extra 5k of taxable income, all of which will be taxed at your marginal rate. (Unless that 5k crosses a tax bracket as discussed before, in which case only some part will be at your marginal.)

When I first read this comment, I thought I misunderstood the tax-ability of the traditional and one would literally calculate their average tax rate (without the traditional withdrawal) and apply that tax rate to the traditional withdrawal. I’m a bit sad to hear that’s not the case, but if it sounds too good to be true…

Please note that I am not arguing against traditional IRA over Roth, only that the “average” vs “marginal” argument here is a red herring.

Thank you again.

Good point Matt. The $5,000 should be considered the last $5,000 because of the choice to go Traditional instead of Roth. I guess it can’t really be thought of as trading a marginal rate for an average one so sorry for getting your hopes up!

Don’t worry about arguing or disagreeing with something, by the way. I am always up for a spirited debate here so if you don’t agree with something, I definitely want to hear why and chat more about it.

Thanks again for the comments and have a good weekend!

I realize this is an old post. But whether you are paying taxes now on a Roth, or later with a traditional, aren’t you paying the average / effective tax rate either way depending on your income level, tax bracket, deductions, etc? Is this really an advantage, marginal vs average tax rates as a differentiator between choosing Roth or Traditional? Asking because I don’t know. Thanks!

Yes, but you can have both. That is the point of the article.

With the same income, same tax rate, say 10 percent, one dollar from Roth is worth one dollar divided by .9 from deferred or $1.11.

So, when you retire early and have a lower income, especially until social security kicks in, you are in a lower tax bracket. Time to start converting to Roth for the explicit reason of saving on taxes.

I retired three years ago and am doing this before SS and RMDs both start at 70. At that point you have no chance, you have lost the opportunity.

FI – Thanks for this post; it leaves me with lots to think about. My strategy throughout my 20’s was to plow as much money into my Roth 401k and Roth IRA as possible due to the obvious benefits of no taxation in retirement; however, since the early retirement bug bit me in the past year when I found ERE and MMM (and now your blog today), I’m not so sure . . . .

Right now, my current investments are about evenly split between Roth and Traditional retirement accounts (Roth: IRA rollover from prior employer Roth 401k, current contributions to employer Roth 401k, and current contributions to Roth IRA; Traditional: 401k matching from current employer, 401k rollover from prior employer, plus the ever popular Ultimate Retirement Account (aka HSA)). The big drag on getting to FI are my wife’s student loans, so if I switch my current 401k contribution from Roth to Traditional, then I can plow the extra money from my paycheck into reducing her loans. Then, once we retire early, I can gradually convert my Traditional to Roth in a tax free manner as described above.

What are your thoughts on Roth 401k plans? (forgive me if you’ve covered this in prior posts – I searched but I couldn’t find any mention of them)

Looking forward to reading more great posts; you’re in my RSS reader! :)

Welcome, Tom! Your path through ERE and MMM to get here puts some serious pressure on me to deliver so I’ll try my best.

That’s a great idea to switch over your contributions from a Roth 401(k) to a Traditional 401(k) in order to help pay off your wife’s student loans faster. Paying off debt would be a great way to use the extra money you save from investing in a pre-tax retirement account, especially if the interest rate on the loan is high.

As far as Roth 401(k)s are concerned, I don’t think I’d ever utilize one personally but not because they’re bad. I just think the benefits of tax-free contributions far exceed the benefits of tax-free withdrawals so I’d always choose a Traditional 401(k), when given the choice. I want as much of my money working for me as long as possible so the less taxes I pay up front, the better. I have confidence that I will be able to optimize my withdrawal strategy to limit my tax burden later in life so that’s why I’m comfortable only funding tax-free contribution accounts during my working years.

Thanks a lot for stopping by and I look forward to hearing more about your journey to FI!

Hi Tom,

2c from me, if you don’t mind. As I wrote previously, I believe that traditional accounts provide a better opportunity for tax avoidance. Roth IRA’s have two main advantages (from my personal perspective); (1) their treatment when inherited, and (2) more investment choices compared to 401(k)’s (e.g. I do some futures trading).

Point (2) obviously does not apply to roth 401’s. As for (1), if I remember correctly rolled over roths are not treated the same way as “original” roths when inherited.

Having said that, I’m on the revenue increase side of the US fiscal debate and encourage people to pay more taxes. So, please, do go ahead with the Roth 401 contributions. My children need your taxes :)

Hi,

I love your website. I found you through J and MM. Question…. Can you roll over the IRA when you are still working to avoid taxes later or does this only work when in a lower tax bracket and not working as much?

Thanks

Hi Andria, good to hear from you again. I’m glad you’re enjoying the site!

You can roll over your traditional IRA into a Roth IRA while you are still working but you would have to pay tax on the amount that you roll over. Say you are in the 25% tax bracket, you’d pay at least 25% tax on the amount you convert because the conversion would be in addition to your ordinary income.

newcomer to your site. love it. I have two questions, that may be obvious to others but aren’t really to me as I’m still educating myself on all this.

1) Aren’t your contributions to a Traditional IRA limited to $5500/yr for individuals? I know employer sponsored 401ks are like $17K or so, so that’s not nearly as low, but my understanding is that as an individual you can’t increase your contribution to individual IRAs beyond %5500. I gotta be missing something right? Next question is part of the reason I’m asking.

2) My wife is an independent contractor. Initially, I had thought about using our Roth IRA to double as an tax-savings investment account should we owe taxes on her income next year (you can pull some or all of your principle contributions on the roth and, from what I read, replace it penalty free within 60 days w/o adding to your contribution limit). Your article here has me wondering if my wife contributing a major chunk of her IC earnings to our traditional IRA would mitigate her tax liability next year? Am I right about this, or missing something?

Again, fantastic article. I came to you through MMM and J as well, and for me you really hit a great balance between those two guys. You all compliment one another well in your approaches and styles. Esp loved your ‘get a university job’ article

Welcome, Ryan! I’m really glad to hear you’re enjoying the site.

To answer your questions:

1) You are absolutely correct. The IRA contribution limits are $5,500 for individuals in 2013 (subject to income). On the graph in the article, you’ll notice that the IRA balances only increase by $5,500 (plus investment earnings) per year for the first 10 years, at which point the two individuals stop contributing and leave the investments to grow until standard retirement age.

The max you can contribute to a 401(k) in 2013 is $17,500 so it allows you to shelter even more of your income from tax. I am still maxing out my 401(k), even though I have more than enough saved for post standard retirement age, because I plan on using the method described in this article to convert most of that 401(k) money into a Roth IRA, tax free.

2) Interesting idea using your wife’s Roth as a tax-savings investment account. I like that idea, as long as you have a backup plan if your investments tank! You also have to figure out if it is worth the added hassle of keeping track of everything for the IRS for a few months of tax-free growth. I personally don’t keep a lot of cash around (for an emergency fund, for example) because I know I could tap into my Roth IRA if I needed cash for something unexpectedly but I’m not sure I would put money into a Roth if I knew I was going to withdraw it again in three months for a quarterly tax payment. I just hate dealing with the IRS so anything that could potentially involve more paperwork, I tend to shy away from (unless the benefits outweigh the additional hassle).

Contributing to a Traditional IRA would lower your wife’s taxable income but I’m not sure how much she makes so I couldn’t say whether it would mitigate her tax liability completely. A lower tax burden is always a good thing though so if she is able to contribute to a Traditional IRA, that’s probably what I’d do!

Thanks for the thorough response! That all makes sense. I should have paid closer attn to your graph :)

Technically my wife’s income is considered self-employment so we don’t pay estimated taxes, just the self-employment tax come tax time. Also, she doesn’t bring in much, ~$12K for the year. I have a salaried job and contribute to our 401K tho I’m a ways from maxing it out. Our Roth IRA is all Vanguard stock/bond index mix, so I’m not too worried about it’s volatility. We also view it as an emergency fund (absolute last ditch, life-threatening, don’t ever plan on tapping it fund), and initially I had thought it might double as a better place than a savings acct to stash potential tax bill $. However, the traditional IRA seems better, and we already have one (also Vanguard target retirement index mix).

Thanks again!

Great article–it’s made me consider this as a strategy, and I’m doing the math and schedule for myself. I did the same detailed research about mortgage pay-off. The wisdom is that we should pay our mortgage off early to free up money, but after spending days running the numbers, I changed my strategy and am NOT paying off my mortgage early.

Thanks, GP FI. I too reached the same conclusion with my mortgage.

Let me know how the Traditional vs. Roth IRA numbers work out for your situation.

So I see, I am not the only one to have found your blog through MMM :-)

Nice post and I like the math. This is a subject I have wondered about for a while?

Do the conclusions change if one’s family income is above say $200k/yr and not $60k/yr as in the example above, since one can no longer get the benefits of tax deductions? Isn’t Traditional vs Roth IRA account irrelevant as you are investing post-tax money, or can one still take advantage of Traditional IRA account?

Thanks for the nice analysis and I will be adding your blog to my RSS feed.

No, you’re definitely not the first to get here via MMM. The standard path is usually from MMM to JLCollinsNH to here, which is why I feel Mad Fientist readers are some of the best around. Only the most intelligent and hardcore people make it all the way to this site :)

Yes, the conclusions definitely change at that income level because as you said, you would no longer benefit from any tax deductions. Depending on your Adjusted Gross Income, you may not even be able to contribute to an IRA at all (check out this article for IRA income limits).

Thanks for the response. I am glad that my assumptions were not incorrect as I do expect to have a lower tax bracket if I reach FI.

Our family AGI is above the limit set by IRS for deductions, but one can still contribute towards one’s Roth IRA as discussed in this Forbes article

http://www.forbes.com/sites/ashleaebeling/2012/01/20/the-serial-backdoor-roth-a-tax-free-retirement-kitty/

So for the last 2 years, I have been transferring $5000 or $5500 (starting 2013) from my post-tax income to the Traditional IRA account and then immediately converting it to Roth IRA. This is legal and allowed as the article above explains helps in growing your investments tax free.

Great article, Ron. Thanks a lot for the link.

I had heard about backdoor Roth contributions before but I never looked into the strategy because I’ve always been within the Roth income limits. That’s great you are able to do that though and it is definitely worth the extra effort to get the tax-free growth that Roth IRAs provide.

Ron,

I am in your same predicament. Since my income is high, I just max out my 401K, 17K/yr (pre-tax contribution) and get the full company match. Then went I retire, I convert the whole amount to IRA. I still get the deduction from the 401K every year. And its better than the 5K limit.

I don’t how this works if your 200K/yr income is from self-employment.

I had the exact same question as Ron, curious if my annual “backdoor” Roth Conversion was the right move given my joint income is above the deductible IRA threshold….

I had a hunch it would have been covered here in the comments, and voila’!!!

Big thanks Mad Fientist and the community here. Incredible how many people (myself included) have footed the intangible FI trail of MMM -> JCollinsNH -> Mad Fientist. The breadcrumbs left along the way were delicious.

Incomes over $200K are still be eligible for non-deductible traditional IRA thanks to a recent change in rules. You can do what is known as “back door IRA”. If you have no other deductible traditional IRA’s, then you convert the non-deductible traditional IRA to a Roth IRA with no additional tax since you never got the tax deduction in the first place on those funds due to your income. It does not help your tax bill go down like a 401k, but it helps nonetheless, as those funds can grow tax free.

Quick question on this. If you earn more than what’s allowable for a deduction on a traditional IRA, MAGI is higher than $62K in 2017, is there an advantage to funding a traditional IRA and then convert to a Roth or just contribute to a Roth?

I’m with AleN on needing a little more explanation.

If my wife and I are over the MAGI and decide to go this route of funding a non-deductible traditional IRA with the intention of immediately converting it over to a Roth IRA. If I’m understanding these previous comments that money would not be taxed at all when converting from traditional to Roth?

That seems like a really obvious way for someone who makes more than the Roth IRA “limit” to essentially make the same contribution they would have if they fell under the limit. Am I missing something?

There is no difference, you might as well contribute directly to a Roth. Rolling over from a traditional is just extra administrative work (and will require extra tax form filling I imagine). The only time it makes sense to do the roll-over is if you make over $200k so that you aren’t allowed a direct Roth contribution.

Thanks for the article, great stuff!

I have the wonderful problem of making “too much” money for the tIRA deductions, and I was just wondering if there was any way for me to get back down to where that would work, or if I should just stick to the Roth IRA for now.

I make $88,000 a year (filing single), and will shortly be maxing out contributions to my 401k.

Is there a convenient formula (or maybe you could build another calculator for your lab, wink-wink) that would show me all the possible ways I could lower my AGI for purposes of getting the deduction on the Traditional IRA?

I’ve looked at it briefly and concluded that I’ll be stuck paying taxes either way, so I may as well use Roth, but I’d love to be proven wrong!

Hey Justin, that is definitely a good problem to have!

Just going off of the numbers you gave me, if you max out your 401(k), that should take your Modified Adjusted Gross Income (MAGI) down to $70,500. If you are also able to contribute the max of $3,250 to a Health Savings Account, that should bring down your MAGI to $67,250.

A MAGI of $67,250 would allow you to make a tax-deductible contribution of around $880 to you traditional IRA and then you could contribute the other $4,620 to a Roth IRA.

If you have any stock or business losses that you could deduct, that could bring your MAGI down even further.

A Roth IRA is a great place to put your money though so don’t feel too bad if you exceed the Traditional IRA income limits. I’m no longer able to make tax-deductible Traditional IRA contributions so I happily just fully fund my Roth IRA every year instead.

Thanks for the rundown!

I don’t qualify for HSA (and my work doesn’t charge me anything for my current insurance, nor offer any stipend if I decline it), so I’ll just keep going with the Roth IRA.

The Roth IRA is an interesting vehicle, “traditional” retirees should find it appealing at the low end of the income scale (because they’ll be in a lower tax bracket there then they’re hoping to be in retirement) then there is a brief income window where a Traditional IRA might make sense, but then they can’t deduct it any more, so they might as well stick it in Roth again.

Hi Mad FI – LOVE your site. Just stumbled upon it yesterday from a reddit post and I’ve already read 10+ of your blog posts (and signed up for your newsletter).

I’m in a similar boat as Justin – I make “too much” for tIRA deduction, but also income level with married-filing jointly makes us ineligible for a Roth IRA. So plan is to max out 401k (no company match) and then put rest of money in taxable account – is my thinking correct?

I just read your HSA post and still need to review whether my employer supports HSA, but my thinking is:

1. HSA (if available)

2. 401k up to $17.5k ($18k for 2015)

3. Taxable account (currently contributing $4k/month).

Just want to make sure I’m not making a mistake by NOT funding a tIRA or rIRA in my current situation.

Thanks,

Ian

You can also contribute more than $17,500 to your 401k and anything over the max can go into a Roth 401k (if you have that option available to you). Similar to doing post tax investment except all dividends and cap gains are tax free.

Glad you’ve been enjoying the site, Ian!

As Dividend Harvester mentioned, you may be able to make after-tax contributions to your 401(k) and then rollover those contributions into a Roth IRA (see my latest post for more info on this strategy).

There is also a way for high earners to get around the income limits for Roth IRAs so take a look at this Bogleheads page for more on the Backdoor Roth IRA strategy.

Hope that helps!

Thanks for the comment, Justin–I’m in a very similar situation (income in the high 80s, don’t qualify for HSA)and have been trying to figure out if I was missing something obvious with respect to minimizing my tax exposure. I’m convinced that I’m doing all I can: max out my 403(b), max out my Roth IRA, and put the rest in taxable (haven’t gotten to this last step yet but am hoping to start this year).

I have a question. I have tried researching to find an answer but have had no results. When you are converting a IRA to a Roth IRA it is counted as additional income, and assuming you are retired and withraling say 30k per year, doesnt this increase your tax bill?

Thanks!

This is the specific section I am confused about

“Since normal people work full time until they reach retirement age, any amount converted will increase the amount of tax they have to pay. However, an early retiree can comfortably live off of $30,000 per year, for example, and gradually convert $9,000 to their Roth IRA per year without having to pay any tax on their income or conversion.”

Hey Brendan, using the example I gave, here’s how the tax would break down:

$9K Traditional to Roth IRA conversion (ordinary income)

$30K investment income (long-term capital gains and dividends)

So the total income would be 39K and after the standard deductions and exemptions, the taxable income would be 29K. This would put the lab rat in the 15% tax bracket. The great thing about being in the 15% tax bracket is that dividends and long-term capital gains get taxed at 0%. So the investment income would be taxed at 0% and the other 9K would be wiped out by the deductions and exemptions.

Let me know if it’s still not clear and I’ll point you to some documentation that may help clear things up.

This clears alot up for me regarding capital gains tax, thank you very much. However, if you didn’t withdrawal from the IRA the deductions would still lower your taxable income to 20k vs 29k, thus the IRA withdrawal increases your tax bill? I would appreciate the documentation to further my learning.

It doesn’t increase your tax bill because in the situation I described, the tax bill would be $0 whether you convert the $9K to a Roth IRA or not.

This TurboTax calculator is good for playing around with some numbers (Note: it uses 2012 IRS rules).

Check out this link to read more about qualified dividends and long-term capital gains. You will see that if you are in a lower tax bracket than the 25% bracket, your qualified dividends and long-term capital gains should be taxed at 0%.

Thank you again for the information. I begin full time work next summer and want to be thoroughly prepared before starting!

My pleasure, Brendan!

Sorry, digging this one back up!

Why do you not have to still pay tax on the $9k that was converted? Is it more accurate to say that the deductions and exemptions just OFFSET the tax that is paid? The tax bill for capital gains and dividends is 0, but the $9k is not capital gains or dividends. Why do you get off without paying taxes on that amount? Assuming you’re married and filing jointly, currently that federal tax rate is 10%. Wouldn’t you have to end up paying $900?

I was explaining this idea to a friend and decided to share your article as the chart and article explains it very well. Would you happen to still have the spreadsheet you used for the chart? No problem either way, just trying not to reinvent the wheel if possible. Thanks as always!

Nevermind, I put together a spreadsheet for him. He also saved over $100,000! Look forward to reading your new post. Keep up the great work!

Haha, I sent you an email containing the spreadsheet at the same time you left this second comment. Sorry I didn’t get the spreadsheet out to you before you created your own.

Was your friend surprised and excited by the $100K savings?

Definitely, he understood the idea, but didn’t realize the significance until running the numbers! Appreciate your help!

Hi,

I just found your blog, and it’s very interesting. But I’m not sure I agree with this article. It’s definitely a great trick if you want to maximize your savings at age 59.5, but it doesn’t really seem to help those of us who want to retire as early as possible, since you can’t touch the Roth IRA until then without paying a huge penalty.

Wouldn’t it be better (and also simpler) to just keep your money in a traditional IRA, and then withdraw from it with Substantially Equal Periodic Payments when you’re ready for early retirement?

Admittedly that does limit how much you can withdraw, but it lets you get your money out much earlier. And if your income is low enough for the tax-free Roth conversion strategy to work, it would also be low enough for SEPPs from a traditional to be tax-free.

Well, to start with, you can always withdraw your *contributions* to the Roth IRA at any time without penalty. You can’t touch your earnings until later without a fee, but you can always take out the money you put in.

Additionally, any money you roll into this account from another retirement account is available for penalty-free withdrawal after a 5 year period. This means you just need to have contributed enough to your Roth to last you those first 5 years of retirement, and then make sure you rollover enough from your other retirement accounts each year so that 5 years down the line when it becomes available, you live on the now-free-to-withdraw funds.

Hi Charlie, thanks for the comment.

As Justin described, you can access your Roth IRA contributions at any time and any retirement-account rollovers five years after the conversion, penalty free.

Therefore, you can potentially fund your early retirement with a Roth IRA conversion ladder, assuming you have enough to live off of for the first five years of early retirement (take a look at this article for more information on the Roth IRA conversion ladder strategy that Justin alluded to).

SEPPs could work too but there are limits to how much you can actually withdraw, as you mentioned, and I don’t really like the idea of being forced to continue the withdrawals when I may not actually need the money.

OK, I misunderstood the Roth IRA rules then. Thanks for setting me straight. I still have some doubts about the Roth conversion strategy though… I need to check my math but I will post a longer comment about that later.

No problem, Charlie. I look forward to hearing your conclusions after you’ve had the chance to run your own numbers.

I enjoy your excellent blog. I am concerned or perhaps just confused that the “pro rata” rule would prevent me from minimizing taxes on the conversion of traditional IRA to Roth IRA. Any thoughts? Thanks for your help.

Whoops, posted my comment to the wrong blog. Sorry for the non-relevant question. Wow, excellent article and strategy if you have enough in non-retirement qualified dividends to live off while converting to Roth IRA. If someone has zero earned income, should they then be able to convert at least 19,000 a year (standard exemption and deduction) tax free? Thanks for your outstanding blog.

Hey Keith, sorry for the delayed reply; I’ve been traveling so I haven’t been on my computer much the past few days.

Haha, when I first saw the email come in, notifying me of your comment, I wondered, “When did I mention pro-rata?” I’m intrigued now…which blog did you mean to post that comment on? From the comment, it sounds like it’d be something I’d be interested in reading.

To answer your question, if you’re single with no other income, you’d be able to convert $10,000 completely tax free in 2013 ($6,100 standard deduction and $3,900 exemptions).

This probably is a dumb question, but how do you deposit $5,500 into a traditional IRA pre-tax? I’ve never really understood how that works. Also, do you need to have itemized deductions greater than the standard deduction to take advantage of the traditional IRA?

You keep track of how much you deposit into the Traditional IRA. At tax time, you place the total deductible amount you deposited on the appropriate line of your return. That amount is then deducted from your income, regardless of your itemization status. Check out IRS Publication 590 for more info. (Certainly not a dumb question; many others probably had as well.)

Couldn’t have said it better myself, T! Thanks a lot for the response.

Hi MadFientist!

First, I want to thank you so much for all of your advice! It’s been an AMAZING help for this FI newbie!

So I’ve run into a conundrum and would like your sage advice! In Feb. 2013, I contributed 10,500 to my Roth IRA for 2012 and 2013. However, I currently live in Japan and that money was excluded from U.S. Taxes (foreign earned income exclusion). I didn’t know it at the time, but this is a very bad move. Now, if I continue to keep that money in the Roth, I will have to pay a 6% penalty tax for every year I keep that money in the Roth. I would like to move the money out of the Roth and into a taxable account but don’t want to pay the 10% penalty fee (that 10% will practically wipe out my gains). Is there a way to get around this penalty? Any help and advice you can offer would be VERY MUCH appreciated! Thank you!!

Absolutely James! One of the benefits to a Roth IRA over a Traditional IRA is that you can withdraw your contributions at any time without paying a penalty. The 10% early distribution fee would only apply to any earnings you’ve made. So if you deposited $10,500, and now it’s worth (say) $12,500, you can withdraw the $10,500 penalty free! If you want to withdraw the $2000 gains you’ve made, you’ll have to pay the 10% fee on that, but getting $12,300 out of $12,500 is sure nicer than only getting $10,000!

Hey James, glad to hear you’ve been getting a lot out of the articles!

I’ve been out of commission for a few days, so sorry for the delayed reply, but I’m glad to see Justin stepped in with an excellent response (thanks a lot, Justin!).

I have to ask, where in Japan do you live? I’ve always wanted to spend some time over there but still haven’t been yet.

“you should convert an amount equal to your deductions and exemptions (assuming you have no other ordinary income).” Hello mad fientist. What do you mean by deductions and exemptions? If I wanted to retire by age 65 (I’m 24 now) would converting to a Roth IRA from traditional even matter? Im considering not working past this time. I’m a little confused about converting slowly and how to do this.

Spending some time going back and re-reading your articles, all are fantastic. I’m just trying to confirm how you determine what can be converted from Traditional IRA to Roth IRA tax free? I see in the comments where you indicate $10,000 based on the deduction and personal exemption (single filer) so I’m intepreting that as follows: if I get $20K from capital gains and dividends I’ll pay $0 tax on that (under the income limits) so basically my $10K conversion would be ordinary income that would be reduced to $0 once you consider the deduction and personal exemption. Obviously would then be higher for married filing jointly. Am I interpreting this correctly? Thanks for all your good work!

Hey Dan, I’m really glad to hear you are enjoying all of the posts!

You are exactly right with your interpretation.

If you want to see how much tax you’d have to pay if you decide to convert more, TurboTax’s tax calculator is useful for playing around with the numbers.

This is exactly what I have been doing since I stopped working in 2007 at age 54. My income has been very low, so every year I have converted $25k or more from traditional IRA to Roth IRA, increasing my income to the point where I owe >= $0 in federal income tax. I have paid a little in state (NC) income tax. But now, a new consideration. Under the ACA I will be elgible for subsidies if my MAGI is below approximately $90k, and the subsidy decreases as income increases, so I will have to decide if and how much of an IRA to Roth conversion to do without costing too much in healthcare tax credits.

That’s great to hear it’s been working out so well for you, Mark.

You’re right that the Affordable Care Act adds another variable to the equation but hopefully you’ll still be able to get a lot of your Traditional IRA converted.

Mad Fientist you misunderstood Mark J’s problem here. He has been doing trad to Roth conversions of $25K every year with no problems. But he won’t be able to do such large conversions in the future with ACA because to do so the conversions are counted as income and more income means LESS subsidy. The way to get the largest subsidy is to have your MAGI be as low as possible. So this means a dilemma — do you continue to do Roth conversions or do you instead limit or stop doing them, so as to keep your MAGI low enough to get ACA related Advance Premium Tax Credits. At low income levels the tax credits are substantial — hundreds of dollars a month, or thousands over a year. Getting them would mean delaying the process of converting so much of one’s tIRA to Roth IRA.

Thanks a lot for the comment, xyzzy. I must have had the Earned Income Tax Credit on my mind or something.

I’ve corrected my comment, so that others don’t get confused, so thanks a lot for chiming in.

I think this point needs to be addressed further, as I think it is very important. Early retirees are going to most likely have a lower income levels and thus a lot of us will rely on the ACA to help subsidize our health care costs. I think we need to run some numbers to see how this effects our amount we can convert vs how much is lowers our discounts on health care.

I agree. One of the things has kept us from declearing FI is health care costs. Since I retired early from one job, the employer wants 50% of my pension for health care. The ACA even in California is much more expensive that people want to admit. A high deductible ACA plan can cost easily over $500 a month. We can always go with a catastrophic coverage for risk mitigation and pay $200. Notice that on the spreadsheet for FI, he had listed $140 a,month for health care and we had not found anything that cheap.

On the high side similar coverage as employed can cost upwards of $1000 a month with out ACA subsides that are scheduled to phase out.

Great stuff here. Just found your podcasts this week and they are very useful and interesting. I left my job almost 4 years ago when I was 33. I’ve been traveling and living cheap since then and my savings account hasn’t gone down much when you factor in the gains in the stock market. I didn’t have a specific plan for retiring permanently when I left, but don’t see going back into the career world either. I’m writing this from Buenos Aires and planning to stay here and teaching English this year. It will be my first time using my TEFL degree so should be interesting. Up to this point I haven’t worked, but traveled slowly and volunteered where I can which both saves money and provides interesting experiences. For instance in Oct/Nov I worked for 5 weeks in Bolivia walking, feeding and taking care of pumas (http://www.intiwarayassi.org/)

Anyway, I’m looking over your page here and GoCurryCrackers about never paying taxes again. I’m not worried about the capital gains exemptions as I need less than $12,000/year to keep going. I have 125k in my traditional IRA and have been converting that to a Roth since I left my job. Transferring at $9,500/year (10,150 exemption and standard deduction for 2014 minus some for non qualified dividends and bank interest) only requires a 7.5% return to hold steady from the 125,000. Have you run any numbers to see if would be advantageous to convert up to the top of the 10% tax rate? In my (single) case this is $9,075 (2014). Then I’d convert $18,500 and have to pay $908 in taxes, basically 5%. This would ensure that I get all my money into the Roth account. I’m only 37 so I have time to work with.

Hey Brian, glad to hear you’re enjoying it around here.

Congratulations on already being done with full-time employment. Your slow-travel lifestyle sounds excellent and I’m glad to hear you recommend volunteering as you travel. My wife and I have discussed doing some volunteer work when we move abroad so it’s nice to hear it has provided you with some interesting experiences.

As far as your conversion is concerned, I’d probably just convert the tax-free amount every year and see what happens. Even if you don’t get the entire balance converted, it’s not that big of a deal because you’ll be able to withdraw from the Traditional IRA after standard retirement age and if you only need to withdraw a little bit each year, you likely won’t have to pay much in taxes.

It’s up to you though so if you’d feel more comfortable getting everything converted to the Roth, the small amount of tax you’d have to pay likely won’t impact your long-term plans very much.

Thanks! I’d come to the same conclusion as well. It will also help for when I have to get health coverage next year. This year I should be exempt. As I understand it, if you spend 330 days of the year outside of the US you are exempt. Am planning to be stateside for maybe half of next year so minimizing this year’s income will help.

I just listened to the Lacking Ambition podcast and you mentioned potentially doing a Habitat for Humanity project down the road to pick up some building skills. Another organization to look at is All Hands Volunteer (hands.org). I haven’t done one yet, but they’ve been on my follow list for a while. Am thinking it will happen in the 2nd half of ’15. The one downside is you have a lot less say in where you go as they only respond where there have been emergencies. I’ve known a few people who have volunteered there and it’s been positive experiences for all of them. Cheers!

Thank you very much for the All Hands Volunteer recommendation. I hadn’t heard of that organization before so I appreciate you letting me know about it!

Brian Setzer, If you are out of the country most of the year you also get a substantial income tax exemption. I don’t know the current rules and whether it includes passive income, but definitely check into it. Used to be your first $80k or so was completely exempt from US income tax.

Probably a “never mind”. Looks like the exclusion applies to foreign earned income.

Sorry, if this is dense – I just don’t get it.

How can the 9k be tax free – you said earlier it would be counted as ordinary income and that you were in the 15% tax bracket so why isn’t it and the other $25k taxed at 15%.

Let me clarify, I now understand that the 25k is cap gains and dividends (and interest?), so I get that that is tax free since you are in the 15% bracket. I don’t see why the conversion would be tax free – wouldn’t you pay the 15% regular income tax on it?

Since the ~$9K would be the only earned income, the transfer amount would be less than the standard deduction and exemption so no tax would be owed on the conversion.

In 2013 you could convert $10K and still not pay any tax:

$10,000 earned income (i.e. the conversion) – $6,100 standard deduction – $3,900 exemption = $0 tax

As you mentioned, the long-term capital gains and dividends would be taxed at 0% so the total tax bill would be $0.

Make sense?

Yes it does. Thank you very much – I see I should have dug through the other questions… Maybe you could add a note about this in step 2 since it looks like there have been several of these questions.

Another followup – Am I right that you wrote this article as though you were single even though youre married?

As a married person does this mean you can transfer 20k per year – 2x personal deduction + 2x standard deduction? And if you had children, it would be an additional 4k (roughly) per child.

Also, you indicate in an interview that you can move all the money over to a roth in this way – assuming an ere of 29 and that you would need to finish by 59 – that works out to 9k * 30 years = 360k. I would imagine that you are going to get your 401k by maxing out and reinvesting to quite possibly exceed that amount by 59.

Good idea, Joe. I updated the post so let me know if you think it’s clearer now.

Yes, I just used a single person as an example to make it simpler.

You are correct that as a married person, I could potentially convert $20K per year, tax free.

It is definitely possible I won’t be able to convert all of my retirement accounts to a Roth tax free. Even if I have to pay a bit of tax on the conversion or if I don’t get the entire amount converted prior to standard retirement age, it should still work out better than investing directly in a Roth so I’m not too worried.

Hey, yeah – I think the note will help future readers. Thanks a lot for answering my questions. You might see some more from me regarding the more contentious asset allocation issues…

My pleasure, Joe. I look forward to hearing from you again soon

So, I was thinking earlier today about this – why couldn’t you move an additional 5k from the roth to the regular as for tax purposes, this move is considered regular income, then you would be buying your 5k worth of regular ira with roth money?

Hey Joe, I’m not sure I follow. When exactly are you suggesting you do this? Do you propose doing this while you’re still working or after you’ve already stopped?

The comment above was meant for after you quit working. My thinking was that since you need income to invest in a roth, the act of moving the money would constitute income and allow you to make this transaction. Thus allowing you to move 15k rather than 10k per year. Of course you would still have to stay under the 45k of income above – but does this make any sense?

Hey Joe, you need to have earned income to contribute to an IRA and sadly IRA conversions/distributions don’t count as earned income.

Thanks, that’s exactly what I was trying to ask about, but I didn’t know how to ask it.

Happy to help, Joe!

So I’m probably on my 4th or 5th time reading this, always thinking and adjusting things in my head.

So let me make sure I understand this. So you hit FI you have 100K in your 401K, you then roll the entire balance over to a traditional IRA, immediately after you then take whatever amount allowable without getting taxed(about 10k from what i’ve read so far) and put this in a Roth IRA, repeat for 5 years. On year 5, you are then able to take out 10K tax free(59.5 does not factor into this scenario, I can be any age under 59.5)?

You got it! Everything you wrote is exactly correct.

I guess I thought you still couldn’t withdraw until you were 59.5? I know Roth contributions could be taken before but can your conversion (assuming you wait 5 years and it contains earnings) be taken before 59.5?

Hi Dan,

Yes, the conversion can be taken without penalty after 5 years but not the earnings. So if you convert $10,000 from your Traditional IRA and it grows to $12,000 after 5 years, you can withdraw $10,000 without being penalized, no matter how old you are. If you attempt to withdraw the $2,000 in earnings though, you would be penalized.

Just wanted to stop by and let you know this article in general really changed the way I think about the Roth/Traditional debate. Right now I still want to make sure we have enough emergency funds while we build so I’m continuing our Roths, but in the future I believe I’ll open Traditional IRAs and fund those going forward.

Thanks a lot for taking the time to let me know, BGM.

Hey, have you come across 457 plans. It’s news to me, but my employer would allow me to double my contributions by using a 457. I was trying to dig around and I can’t see any drawback to the 457 and it seems better than a 401k or 403b as it doesn’t have the 10% early withdrawal penalty.

Yes, I actually just tried to enroll in one but I sadly don’t meet my employer’s income requirements.

You’re right that it is like a better version of a 401(k) so if you have access to one, I’d max it out!

Just reading this post now, hopefully you get notified – I was under the assumption that 457 plans were created for government or nonprofit employees only because they don’t get 401ks…how can it be fair for a person to double dip 401k/457?

Also, a question about this post in general. Couldn’t this strategy be applied to people that aren’t FI / don’t have dividends and interest? Say I decide to retire at 65, and have little earned income. I could be converting Trad to Roth with no income tax as well.

Hi Biceps…sorry I’m only seeing this now.

I don’t know whether it’s fair or not but if you can take advantage of both a 401(k) and a 457(b), you should!

And yes, this strategy can apply to anyone, whether you are pursuing early FI or not.

Hey Mr. Fientist. I love the blog (especially since I’m an actual scientist). This blog combined with jlcollins has taught me more about investing than any other source!

I have a few questions. My Wife and I have just started on our path to FI, currently saving 60+% of our income. I would like to semi-retire in about 5-7 yrs., and my wife wants to have a more traditional career. Currently I am enrolled in a roth 401k, and my wife and I both have Roth IRA’s.

1) My 401k is pretty awful. My employee match is a measly $500/year, and the best fund I can contribute to is Ivestco Equally Weighted S&P 500, VADRX. ER = 0.82% Is the tax benefit of the 401k worth the much larger fees (I have admiral shares with Vanguard, ER = .05), or should I just go straight for the taxable account? I plan to stay with this company for 5-7 yrs.

2) If the answer to 1 is yes, then I’m fairly certain I’m going to switch from the Roth 401k to the traditional 401k. Is that the right call?

3) Does the fact that my wife plans on working for some time, potentially to retirement age, defeat the effectiveness of the Roth conversion ladder? Would you still suggest a traditional over a Roth?

Nice, a real scientist! What kind of scientist are you?

It’s great to hear you’ve learned a lot from this site so far (and Jim’s too).

Even though the fees are bad for your 401(k), I’d say it is still worth maxing it out but only if you switch from a Roth to a Traditional (check out my addendum on this JLCollinsNH post for my reasoning behind this).

The Roth conversion strategy will still be useful to you even if your wife is working but you just may need to pay more tax on the conversion than you would if she wasn’t working. My wife plans to keep working so I’ll be in the same boat you will be in when it comes time to start the conversions. Even with her working, I’d still say Traditional is the way to go.

At one point I would have called myself an organic chemist, but with my new job I’ve kind of been shifted to more of a synthetic/polymer materials scientist.

It’s a shame that 401ks are dripping with fees. Mine isn’t as bad as some of the ones I’ve found in my research, but it’s still not ideal. I’ll definitely switch the Roth 401k to the traditional 401k (I’m not sure why HR recommended the Roth to begin with), and I’ll probably ask to see if they could add some low fee index funds.

Nice! That sounds really interesting.

Yeah, it’s awful that so many 401(k)s get weighed down by fees. At least you only have to deal with the high fees for 5-7 years. Once you leave your job, you should be able to roll the 401(k) over into a Vanguard IRA and can take advantage of the great index funds there.

Another thing you can try is discussing with your HR rep how you’d like to have an option in your 401k for a low fee index. I’m lucky enough to have 2 vanguard indices in my company’s 401k plan, so I haven’t had to deal with this, but they may be willing to work with you if you make your concern known. They can pass your request along to whatever management company they may be using for the 401k and they can add new fund options for you. Either way, Mad Fientist makes a good point that: “Once you leave your job, you should be able to roll the 401(k) over into a Vanguard IRA and can take advantage of the great index funds there.” The slightly higher expenses won’t hurt you too much if they’re only during your limited working years.

Is there any potential disadvantage to starting this conversion 5 years pre-ER, so that it is ready to go right away? My husband and I each have 2 401ks (4 total) because of previous jobs which we never rolled over- the fees were low so I didn’t see the need. Is there an income tax disadvantage to doing the conversion during our working years?

Hi Alison,

The disadvantage of doing it during your working years is that you’d likely get taxed quite a bit on the conversion. Since a Traditional IRA to Roth IRA conversion is taxed as normal income, it could be taxed at a high rate if you make a significant amount of earned income elsewhere.

If you instead wait to start the conversion when your income is significantly lower or when your income is coming from more tax-efficient sources like long-term capital gains and qualified dividends, you could pay very little tax (or none at all) on the conversions.

Is the conversion to be taxed at your current rate seen as income to influence your taxable rate?

For example, I could see saving up lots of cash and using that for the first year of retirement (early or otherwise) and do a 401k/IRA to Roth IRA conversion at that point when you have zero income (other than dividends and interest), which would in theory cause none of the conversion to be taxed at all.

Yes, the conversion is treated as income so conversions could bump you into another tax bracket. You’d want to make sure not to convert so much that you get bumped into the 25% bracket, which would cause your qualified dividends and long-term capital gains to be taxed.

So, a Rollover IRA is considered when a backdoor Roth conversion is taking place. For example, if you open a $5,000 nondeductible IRA and you also own a rollover IRA worth $95,000 from a previous 401(k) made with pretax contributions, then 95 percent of your contribution to the nondeductible IRA will be taxable when you do a Roth conversion.

Au contrare – one can withdraw from their Roth IRA PRIOR to age 65 is they take “a series of “substantially equal periodic payments” made over the life expectancy of the IRA owner.”

That’s my ticket and reason for using a Roth IRA. I don’t have to hit age 59 1/2 before starting withdrawals.

Of course, I’m 48 and have several other accounts to draw from if/when I can retire prior to age 59 1/2, thereby allowing this to be a moot point.

James, you can withdraw contributions to a Roth IRA at any time and you can withdraw Traditional-to-Roth conversions after waiting five years, all without penalty.

While 72(t) substantially equal periodic payments is one way to get money out of any IRA early, the rollover strategy described in this post (and in greater detail in this post) is a more optimal method, in opinion.

Could I get a copy of the spreadsheet you used to create the graph? Being the great software engineer that I am I strongly believe in re-use!

Sure! Just shoot me an email and I’ll send it over in my reply (fi @ mywebsitename dot com).

Mad Fientist – thanks for this, you have probably pulled my FI date a couple years closer!

Had a question about the 5 year rule – when would be the best time of year to perform the rollover? I was reading that the 5 year timer starts Jan 1 of year of rollover; I read this to mean that you should be doing a rollover in December, when you understand your tax year implications, and you still get credit back to Jan 1. Have you figured out your timing as you head into FI this year?

The reason I started this site was to help others (and myself) achieve FI sooner so it’s great to hear I helped pull your FI date a couple of years closer!

As you mentioned, if you want to access your money as soon as possible, it makes sense to do your conversions later in the year.

My taxable accounts should hold me over for more than five years so I’m not too concerned about accessing that money prior to five years but I’ll likely be doing my conversions at the end of the year anyway, since I’ll be waiting to see what my tax situation is before deciding how much to convert.

Awesome article, Mad Fientist!!

I’ve recently stumbled upon your blog, and I absolutely love it. I’m reading it at every available minute and burning through the podcast archive at a furious pace. As a 27 year-old who has only recently begun to realize that financial independence is possible, you are an inspiration. Thank you for making this information available and easily digestible.

Could you point me to a decent crash-course on retirement investing for us self-employed folk? Right now I have $17k in a Roth IRA and $50k in savings. My plan is to open a SEP, in to which I can still contribute ~$15k for 2013. Assuming I can make similar contributions each year, would the SEP likely be the primary retirement vehicle for a person like me? Per your advice on this site, I’ll likely be re-characterizing my Roth IRA to a Traditional IRA and looking in to an HSA as well.

Thanks again, Mad Fientist.

Glad to hear you’ve been enjoying everything, John!

Here’s a great article covering the different retirement account options available to self-employed people – http://www.obliviousinvestor.com/sep-vs-simple-vs-solo-401k/

I’m actually looking into opening one of these accounts myself since I have a bit of side income coming in.

Let me know which option you decide to go with!

John- Don’t know what type of self-employment work you do, but I did some contract work a few years ago and was able to squirrel away about $40k pre-tax by having my employer match 10x my contributions. And of course my employer was myself, but when you’re setup as your own business, it’s a valid business deduction. I had no one working for me, and if you do, then this won’t work since the retirement offerings for a company must be the same for everyone.

Mad FIentist,

I found this Forbes article about the IRA conversion you speak of: http://www.forbes.com/sites/josephsteinberg/2012/12/12/warning-about-roth-ira-conversions-often-misunderstood-irs-rule-can-cost-you-money-and-aggravation/ It warns against conversions because if you have more IRA money than the amount you want to convert to Roth, you pay tax on ratio of taxable to total. Do your calculations take this into account? I can see where you could do a lot of math and figure out the ideal amount of tax you want to pay and base your conversion amount per year on that … Please point me in the direction of such an article explaining this — or write one for us!

Hi Willow, thanks for the article.

The Forbes piece is actually talking about some of the pitfalls of the Backdoor Roth IRA strategy (which is mentioned in the comments above) but doesn’t actually apply to the Roth IRA Conversion Ladder strategy I described in the article.

For more information on Roth IRA Conversion Ladders, you can check out my guest post over at jlcollinsnh.com – http://jlcollinsnh.com/2013/12/05/stocks-part-xx-early-retirement-withdrawal-strategies-and-roth-conversion-ladders-from-a-mad-fientist/