I’ve written about many tax-avoidance strategies that future early retirees can take advantage of but I haven’t ran the numbers to see how much of a difference these strategies could make to someone’s journey to financial independence.

Until now…

Assumptions

The lab rat for this experiment is a 30-year old single person who:

- Has no children and expects to live until 90 years old

- Makes $60,000 per year

- Resides in a state with no state income tax

- Happily lives off of $1,400 per month ($16,800 per year)

- Expects a 5% inflation-adjusted real rate of return on investments

- Invests $30,000 per year into taxable investing account

- Plans to utilize a 4% withdrawal rate (adjusted annually for inflation) during retirement

- Invests in a 75% stocks/25% bonds portfolio of low-cost index funds (so transaction costs and management fees are negligible)

All of the calculations in this post are based on these assumptions so let’s see how much earlier our lab rat could reach financial independence…

Triple Value of Income

In the Triple Value of Income article, I showed how to dramatically increase the value of your earnings by utilizing various tax-advantaged accounts and retirement incentives.

Let’s assume after reading this article, the lab rat decides to take advantage of his employer’s 5% 401(k) match.

He knows he should contribute more than 5% though so he decides to fully max out his 401(k).

This results in an annual contribution of $20,500 ($3,000 from his 5% employer match and $17,500 from his own pre-tax contributions).

Traditional IRA vs. Roth IRA – The Final Battle

Let’s also assume he decides to max out his IRA during his working years.

Using what he learned in the Traditional IRA vs. Roth IRA article, he decides to fund a Traditional IRA rather than a Roth IRA because he knows he can convert the Traditional IRA to a Roth IRA after FI without paying any taxes. Smart guy.

Ultimate Retirement Account

After reading the Ultimate Retirement Account article, he realizes that a Health Savings Account (HSA) is the Clark Kent of retirement accounts (it’s actually a super IRA in disguise) so he decides to contribute the maximum of $3,250 to his HSA every year as well.

Graph

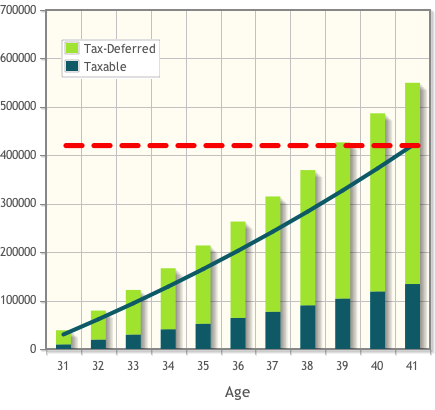

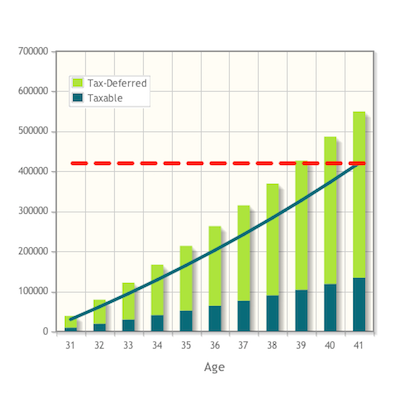

The following graph shows how these optimizations affect his path to financial independence.

The green line in the graph shows what happens when the lab rat simply invests everything into a taxable investment account like he was before and the bars on the graph are what happens when he implements the optimizations described in this article. Finally, the dashed red line represents the amount he needs to achieve FI.

Retire Earlier

As you can see, it’s possible to retire over two years earlier by taking advantage of these optimizations!

It’s pretty amazing that he can take years off of an already short working career without earning more, spending less, or taking on any additional risk!

Taxes

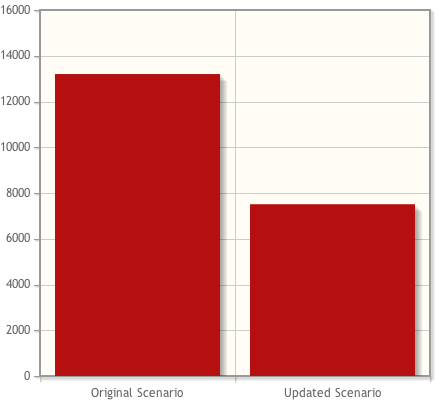

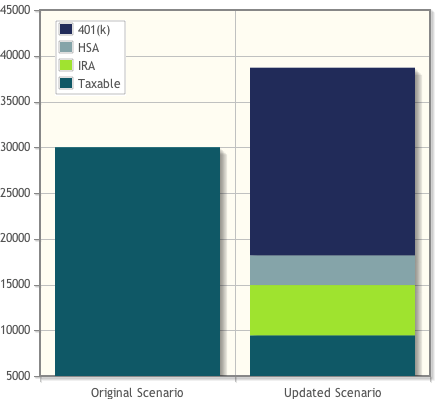

The reason these seemingly subtle changes have such a big impact is because they decrease the amount of money spent on taxes and therefore, increase the amount of money that gets invested.

When we look at the graph representing the amount of tax paid in each of his working years, we can see he is paying nearly $5,700 less per year in the updated scenario than he was in the original scenario.

Combining these tax savings with his employer’s 401(k) match, the lab rat is able to invest almost $8,700 more per year than he did in the unoptimized scenario.

Eventual Taxation?

I can hear you ask, “Since most of his money is in tax-deferred retirement accounts, won’t that money be taxed eventually?”

No, actually.

Thanks to his low living expenses and the fact that he won’t be earning any more money from employment after he reaches FI, he’ll be able to slowly convert his tax-deferred accounts (401(k) and Traditional IRA) into a Roth IRA, without paying any tax on the conversion (see the Traditional IRA vs. Roth IRA post for more information on this conversion).

Early Withdrawal Penalties?

Since most of his money in the updated scenario is in tax-advantaged retirement accounts, you may wonder if he will be forced to pay early-withdrawal penalties when he withdraws money from these accounts before standard retirement age.

No again!

Thankfully, there are many ways to access funds in retirement accounts before standard retirement age without paying any penalties!

Surprised?

I don’t know about you but I was actually a bit surprised to see how much of an impact these changes had on this hypothetical scenario.

I know tax-advantaged accounts can really help supercharge your retirement savings, which is why I’ve been maxing out mine for years, but I didn’t expect these tax-avoidance strategies to take over two years off of an already extremely short working career.

I’m looking forward to experimenting with more optimizations in future articles, in an effort to make the lab rat’s career even shorter (and hopefully yours and mine as well).

To see an experiment where these strategies are applied to actual market returns, check out the real-time Guinea Pig Experiment!

What do you think? Were you surprised by the impact of these optimizations? Will it make you think twice about taking full advantage of retirement accounts in the future?

Dynamite post.

I love the math behind early retirement, and this apples-to-apples comparison to see how individual variables affect time to retirement is brilliant.

Well played.

Thanks, arebelspy.

The whole reason I wrote the Lab Rat and Assumptions post was so that I could do more of this type of apples-to-apples comparison in the future so I’m really glad to hear you’re into it!

I agree, nicely done. Looking forward to shifting some of my strategies in this way so I can get out of the rat race earlier and be a younger, healthier, retired rat.

Great work! Couple of financial planning items to add to make this even better! The HSA contribution also escapes Social Security and Medicare tax (usually 7.65%) so that adds and extra $250/year (minor I know, but thought I’d point out). Much more importantly, now the rat has a taxable income of $23,750 ($60k – $17.5k 401k – $5.5k IRA – $3.25k HSA – $6.1k Standard Deduction – $3.9k Personal Exemption) so…this lucky rat doesn’t have to pay any taxes on qualified dividends or long term capital gains (as long as his taxable income stays below $36,250 with the qualified dividends and long term capital gains in 2013) in the taxable account each year! If put money in tax efficient investments (think total stock market index with only qualified dividends) then you basically turn this taxable account into a Roth IRA and have access to it day one after reaching FI. Based on my calculations, the taxable contributions in year one would be about $13,900, so with the return you are using this could make a difference over 10 years! Maybe get us down to 7 years?

Great catch, Nick! I was still taxing his investment gains during his working years so I updated the graphs to account for the tax-free growth in his taxable accounts.

Making this change sadly didn’t get his working career down to 7 years but it did make 8 years look a lot more doable.

Awesome! Yeah, I crunched the numbers and arrived at the same conclusion. The benefits of the 0% dividends and capital gains will continue to increase over time (fingers crossed they keep it around). Awesome job with the article. Look forward future posts.

Holy smokes, MF, this is just too bloody brilliant!

I l-o-v-e your concepts and analisis here, especially the Roth conversion ladder.

The only “flaw” I see is that strategies this good tend to snowball your net worth. Next thing you know your investment income pushes you to levels that are taxable in the end.

As flaws go, a very nice one to have!

Well done!

Thanks a lot, Jim!

I agree…that is definitely an excellent flaw to have! I’m sure that after a few decades of retirement, he won’t mind sending a few bucks Uncle Sam’s way if needs to.

This is, undoubtedly, one of my most favorite posts ! I like the way you make it simple for most people to understand. Often, personal finance bloggers forget that most people don’t like reading about personal finance as it is a daunting subject to comprehend. Way to go, my friend. I tweeted and added to my G+

Shilpan, I’m really glad you enjoyed the post and thank you very much for tweeting about it! It looks like the Share Bar plugin you recommended to Jim, which I then installed on my site, worked nicely :)

Can you really max out a 401k and contribute to an IRA in the same tax year? I have been told by CPA people that if you put money into a 401k in a tax year you cant put into an IRA.

Please look into it and let me know.

Cameron

Hey Cameron, yes, you can definitely fund both a 401(k) and an IRA in the same year. You just need to make sure you meet the income requirements for the IRA (see this article by PT Money for more information on IRA income limits).

Loved this article. I checked out the PT Money article you posted. We are married and filing jointly. Our combined income is $150,000. We both max out our employers plan. This quote by PT money caught my eye:

“If you file your taxes as Married Filing Jointly or as a Qualifying Widower in 2013, your income needs to be below $95,000 for you to be able to fully deduct your contributions to a Traditional IRA. If your MAGI is between $95,000 – $115,000 then you are in the “phase-out” range and the amount you can deduct starts “phasing out”. At $115,000 you are unable to deduct the contributions you make to a Traditional IRA.”

So… How do I go about figuring out if a Roth or a traditional IRA will earn more in this situation?

Sorry for the delayed reply, Kristin; I’ve been out of commission for the past few days and haven’t been on my computer much.

If you make too much to deduct contributions to a Traditional IRA, your best bet would be to contribute directly to a Roth IRA. That’s actually the situation I’m in so I just max out my Roth every year.

Is the phase out considered on the gross income or the income after reducing 401k? Say for ex: if a person makes $120k/yr and contributes $17.5K/yr into 401K, would his be counted as $120K or $102.5K?

The phase out is based on you modified adjusted gross income (MAGI) so in your example, the 401(k) contributions would lower it to $102.5k.

Sorry for “necroing” this comment.

In a third situation, if I make too much to contribute to a Roth (not sure if I will go over the 117k limit this year — but assuming), would you recommend going with a Traditional, then converting it to Roth? If so, is there a best time to convert? You mentioned the 5-year rule and am not sure if that plays a role in when to convert. Thank you!

@Brian the Necromancer,

Deducting to a non-deductible traditional IRA and then converting to Roth is often called a backdoor Roth IRA. Also note that there is a significant drawback if you have other, deductible traditional IRAs.

There are two schools of thought on the best time to convert. The predominant school is to convert as soon as you can. Whatever amount the traditional IRA gains between when you contribute and when you convert, is taxable at conversion.

The second school of thought is worried that the IRS is going to someday retroactively invalidate backdoor Roths under what is known as the step transaction doctrine. In that case, you would want to leave the money in the traditional for a while. Noone knows how long “a while” is. It’s low probability that the IRS will ever make this ruling, but the stakes are high if they do.

Definitely do not trust that CPA for anything. He does not understand one of the fundamentals of his job!

Yes 401k and IRA are 2 different retirement options and both can be utilized in the same year to their Maximum.

The US tax laws are pretty friendly to those that want to retire early (and live well with relatively modest spending.)

The zero tax burden after retirement is fantastic too!

Great post!

You are absolutely right about US tax laws being friendly to early retirees. I am really looking forward to taking advantage of the friendliness next year :)

Nice post! This is a good one for anyone trying to understand the basics of retirement accounts. I especially like the graphs, specifically the taxable/tax-deferred graph.

Thanks, Jon. I’ve always been a big fan of graphs so you can expect to see more of them around here in the future. Thanks for stopping by!

I’m so thrilled to have found this post. I’ve been thinking something like this should be possible (waiting till FI to make 401K conversions to Roth piecemeal in order to minimize total taxes), but haven’t been able to find anything online that went along with it. I suppose it’s not a concept that works for most people — most people aren’t planning on having little to no income most of their adult life.

It’s great to see someone actually doing the legwork on researching this stuff.

Welcome, Roger. I’m glad you found the post too!

You are absolutely right that what I described is not a concept that would work for most people. That touches on one of my main motivations for starting this site actually…I wanted to investigate and write about common financial topics but through an “early financial independence” lens. The majority of financial discussion is geared toward the majority and, in my opinion, the majority are doing it all wrong!

I really like this post, and this site. I’ve learned so much going through these articles.

I currently work for a Small Business that offers a SIMPLE IRA in lieu of a 401K plan. They contribute 2% and i’ve been maxing it out to the tune of $12,500 a year. Also, after reading your analysis about HSAs i’ve started maxing that out as well. The rest of my savings i’ve been putting into a taxable account through Vanguard.

I guess my question is, do you know is the same type of conversion guidelines apply to a SIMPLE IRA? Can i roll that into a traditional IRA, then turn around and roll it into a Roth IRA?

My second question with the strategy of rolling over your traditional IRA funds into a Roth IRA, and then withdrawing the 9K per year before “standard retirement” are you worried at all about those funds running out before standard retirement?

Thanks!!

Hi Chris, big apologies for the delayed reply; I have been out of the country for the past couple of weeks and I haven’t been able to spend much time on the internet. I’m back home now though so you should expect prompt replies from now on!

I’m glad to hear you are enjoying the site. It’s great when people chime in and ask questions so thanks a lot for the comment.

To answer your first question, a SIMPLE IRA can be rolled over into a Roth IRA just as a Traditional IRA can. To quote the IRS directly, “A SIMPLE IRA plan account is an IRA and follows the same investment, distribution and rollover rules as traditional IRAs” (see here). With SIMPLE IRAs, however, you could be penalized if you attempt a rollover within the first two years of having the account (see this IRS page for more info) so I would just make sure you don’t do any rollovers until two years after your first employer contributions. Once the two years are up, the SIMPLE IRA should act just like a traditional IRA.

To answer your second question, no, I’m not worried at all. I keep a close eye on my finances so I’ll be able to monitor my accounts and predict how long my pre-standard-retirement funds should last. Since I won’t be tied down to a particular location, I’ll also have the flexibility to move to cheaper locations and lower my expenses if I think my pre-retirement accounts risk being depleted. Since I’ll hopefully be healthy and employable during my pre-standard-retirement years, I could also pick up some part-time work to supplement my withdrawals, if absolutely necessary.

Chris, you said “The rest of my savings i’ve been putting into a taxable account through Vanguard.” Max out a Roth IRA if you’re able to from your taxable funds. This will start your tax-free compounding of interest NOW while preserving your basis (invested amount) for withdrawals at any time. This turbo-charges your taxable investments.

First off..thank you so much for the inspiring posts!

I have a stupid question. How can he save over $17000 pre tax? I thought the limit for an IRA was $5500 this year as per PT Money stated? I must be missing something important here?

Chris

Ok…so I found out I too can put up to $17k into my 403b but that’s not accessible till 60. So that not a great option for early retirement. It seems if you are trying to build up the funds to access before trad retirement age the best methods pre tax is to max out the IRA (and then transfer to Roth) and the HSA? Otherwise it’s post tax for the rest?

Am I understanding this right?

Chris

One more question…in your example your guy will have enough funds to retire at 41. It looks like the majority of those funds are in his 401k?

Is it normal to have access to those funds before 59 1/2? My 403b limits us to after that age. Maybe there is an angle I am not understanding?

Your thoughts?

Chris

Hi Chris, a 403(b) is similar to a 401(k) in that you can easily rollover a 403(b) into a Traditional IRA. Once the 403(b) money is in a Traditional IRA, you can then gradually convert the Traditional IRA into a Roth IRA, as described in the Traditional vs. Roth IRA article. This will allow you to access the 403(b) funds prior to standard retirement age.

Maybe it’s just my situation…but my 403b doesn’t allow rollovers unless you terminate employment? I guess if I could swing a full early retirement that would work. For us(family of five) the big challenge is buying affordable health care for a family. Maybe if Obama care coes thru?

You’re correct in that you’ll have to wait until you leave your job before you can roll over your 403(b).

Great post. Do you have any optimization strategies for higher income folks? My husband and I make $240k, which inhibits us from contributing to IRAs and I don’t have access to an HSA. While we have no complaints about our income, the tax hit is huge. We’d love options in addition to 401ks.

Hi Fallon, sorry for the delayed reply. As I mentioned to Chris above, I’ve been out of the country and have had limited internet access.

I’ve actually been thinking about additional tax-lowering strategies recently. I’m not sure if you and your husband could utilize the following strategy but here is what I am considering…

I’ve been thinking about investing heavily into my side business while I’m still employed full time, thus lowering my taxes (more money would be going into the business than coming out, creating a business loss that I could then deduct from my taxable income). The hope is that those investments would then provide additional income after I stop working (when I’m in a lower tax bracket).

I’m also looking into how I can use my plan of living abroad for the first few years after FI to my advantage as well so I’ll let you know if that avenue of investigation produces any interesting findings.

Hi MF!

I wanted to thank you for the reply above and your subsequent tax gain/loss harvesting articles. It’s given me a lot to think about. I also wanted to give you a mini update. Your amazing blog inspired me to continue researching other tax optimization strategies. I discovered that even though I make too much to deduct Traditional IRA contributions or make direct Roth IRA contributions, I can make indirect Roth contributions through the “Backdoor Roth.” I simple funded a Vanguard Traditional (non-deductible) IRA with $11,000 ($5,500 for 2013 & 2014), which I held in a money market fund. Once the deposit cleared (two business days later), I converted the contribution to a Roth IRA, ultimately investing the money in VTSAX. Per the Tax Code (see IRS Pub. 590), there are no income caps on converting traditional non-deductible IRAs to Roth IRAs. Since the contribution to the non-deductible IRA was with after-tax dollars, I would only incur tax on any gains realized when the funds were converted. Since my money was initially held in a money market fund for a couple days, I didn’t have any gains, so I won’t pay any more tax. Sure it takes an extra step, but using Backdoor Roths are great options for high income earners looking for tax free growth and withdrawals. Especially folks, like me, that max out their 401k contributions and would otherwise contribute all their extra money to taxable accounts. This approach will also give me a headstart on the Roth conversion ladder.

Hey Fallon, great to hear from you again!

Yes, the Backdoor Roth is a great way to get around the Roth income limits. Our income sadly doesn’t exceed the limits so I’ve never had to go the backdoor route but it doesn’t sound like it was too painful, which is good.

Thanks for getting back in touch and hopefully I’ll hear from you again soon!

Oh no, I hope my comment didn’t come off as bragging. Believe me, the income comes with long hours and big headaches. That’s why I’m so focused on FI. With the ideas and inspiration I’ve gotten from you, MMM, and Mr. Collins, its looking more like a reality every day =) Thanks again!!!

No, your comment definitely didn’t come off as bragging! I hope my reply didn’t imply that it had!

Look forward to hearing from you again soon

Be careful with that strategy.

The IRS likes you to make money 3 out of every 5 years. And if you do Home Office deduction, business expenses, etc at a decent clip (ie maximize your losses) it can be difficult to show a profit when you need to.

Better idea: make a profit for a year or two, then don’t. Though that may not fit your FI schedule.

Yeah, I’ll likely be making a profit for at least 3 out of 5 years so hopefully the IRS won’t come knocking. I read somewhere that that whole thing could be a myth though so as long as your numbers aren’t ridiculous and you actually do have a business, there’s probably nothing to worry about.

Not a myth (IRS link below), but possibly not rigorously enforced.

http://www.irs.gov/publications/p535/ch01.html

“Presumption of Profit” section.

Whoa, I didn’t realize they explicitly called that out. Thanks a lot for sending the link. Looks like I’ll have to focus more on being profitable :)

It’s pretty easy to be profitable in a side business.

The trick is to maximize all the deductions (business, home office, SEP IRA / solo 401k) and still be profitable. It’s a balancing act, because you often lock in your deductions early in the year and your income can be unpredictable — I often get to the end of the year and wish I had more/less deductions.

Fantastic! The lab rat is me! OK not quite but pretty close. Not sure about the 90 figure but you gotta think big :P I find this exciting as so many scenarios are often presented by couples raking in huge amounts of cash ect. Nice to see something I can relate to.

Roughly 57K take home after all federal and state taxes, 32 Single Male, 401K Max 17.5K + Employer match 3.5% + Roth IRA Max 5.5K. Annual expenses 17K. The rest goes to VTSAX in a taxable account.

Now the big difference between me and the lab rat is I already have 110K saved in these accounts with 3K on hand for short term challenges.

Not sure exactly how far away I am from FI but it is looking promising based on these numbers. Also I am almost completely equities.

To make matters even better, I am happy with my job currently and am in no rush to break free so to speak. I am very interested in hearing more about how to distribute this cash over time to reduce the tax impact. Though my status as single will not change, it is probable that I will make about 3% more each year average over the whole period to FI should the blessings I have been given continue over the entire period.

Thanks for the experiment.

I’m happy someone out there is in situation similar to the example scenario. Since you have over 110K saved up already, you are actually much further ahead than the Lab Rat so nice work! The fact that you love your job means that your journey to FI should also be a very pleasant one so that’s definitely icing on the cake.

I plan on using the Lab Rat example scenario when doing any sort of quantitative analysis in the future so you’ll be able to keep comparing yourself to the example as you go along. You’ll have to keep me posted on your journey as well so that I can see how accurate my theoretical models are, compared to your real-life situation.

Also, this has raised some additional questions in the peas sized brain of your lab rat ;) Should I stop contributing to the Roth IRA and open a traditional IRA as well? It seems having both might be the best of all avenues. How do you know how much to contribute to it vs the taxable account ect., to make sure money is accessible without penalty when you become FI? Is there a conversion table in existence? Sorry this is not real clear to me. Finally, how can you determine if you are eligible for an HSA. My health care provider and employer have no idea if my plan is is a HDHP despite it having a high deductible :/

Thanks. Love the site! Keep up the good work.

As I mentioned in the Traditional vs. Roth IRA post, I would personally choose to contribute to a Traditional IRA while employed, in order to take advantage of the tax breaks. I want as much of my money working for me as possible so I’d gladly pay less tax now in exchange for a more complicated withdrawal process later (see the Roth Conversion Ladder described in this post for one possible early-withdrawal strategy). Looking at your numbers though, your income may be too high to contribute to a Traditional IRA (check out this post for IRA income limits) so you’ll want to make sure you’re eligible before proceeding.

I just used a spreadsheet and a tax calculator to plan the Lab Rat’s conversion/withdrawal strategy so, sadly, I don’t know of any existing conversion tables or anything.

As far as the HSA goes, if neither your employer nor health care provider has any idea if the plan is HSA-eligible, it is probably not. Try to speak to your HR department, if you have one, so that you can get a definitive answer though. If your company offers an HSA, someone in HR has to know about it.

Brandon,

I saw your comment earlier about investing in a side business and harvesting the benefits there to lower taxes…Wanted to see if you can put the lab rat in a “self employed” situation and explore the SEP plan and solo 40k options??

Good idea, Danielle. I added those topics to my list of future article ideas so I’ll start doing some research into those self-employed options soon. Thanks for the suggestion!

Great post!

I think my main hang up right now is figuring out how to have cash from the point between retiring from a career and a Roth IRA Conversion Ladder. You state: “Since his taxable accounts will provide enough income to sustain his first five years of early retirement”

That’s essentially 5 years of income you would need, I’m assuming from a taxable account unless I would need to work side jobs. If you can only withdraw at most 4% to obtain a reasonable yearly salary of $25000, you would need $600k in a taxable account. Is that correct? I’m assuming you are not touching principle in this taxable account…

I think that’s the biggest question for me regarding early retirement. Do I need to have that large of an amount of money saved up in a taxable account in order to retire sooner than 59.5?

Assuming I could retire at 50, would I still then only be able to withdraw $9,750 per year with the conversion ladder? Would the remaining taxable account money be my ’employer’ to hold me over until 59.5?

Thanks, Kyle!

Yes, you are correct that you’d need to fund the first five years of your early retirement with either money from your taxable accounts/side job/passive income source/etc.

Assuming you have enough in your tax-deferred accounts to provide for your entire retirement after 5 years though, you wouldn’t need to stick to the 4% rule with your taxable accounts. You could simply keep 5 years worth of expenses in cash and then just deplete those accounts until your Roth IRA conversion ladder takes over. So you could simply save up $125,000 in your taxable account to provide 5 years of $25,000 income.

As far as the conversion ladder is concerned, you can create a conversion ladder for any amount that you want. I gave $9,750 as an example because that would be a completely tax-free ladder (in the Lab Rat’s scenario). You could just as easily create a $25,000 ladder but you would likely pay a bit of tax on the conversion every year (which is not a big deal, especially if you need $25k to live off of and you have enough in your retirement accounts to provide that every year).

Hope that helps!

That is a great question, and one that had me going around in circles for a little while.

One thing to keep in mind is that your nest egg is your entire net-worth, wherever it may be located (taxable and tax-advantaged). So, taking more than 4% from a taxable account in order to bridge the gap is not a bad thing at all. It is actually the best way to go about it.

If you do the math, depleting your taxable account first, allows your tax-advantaged accounts to continue to grow uninterrupted, reinvesting dividends, etc. So, understanding the big picture should allow you to have absolutely no hesitation in depleting the less tax efficient accounts first, in favor of maximizing the growth of the Roth accounts. That is where your real growth potential exists. With that in mind, I would not even think about taking anything out of a Roth account until I have depleted the taxable ones first. And you can add your home equity to that equation, if you decide to lift up the anchor, sell your house, and rent while you travel. Emotionally it feels “wrong” to go back to renting, and spending your home equity on living expenses, but remember the big picture… Your nest egg is growing mostly tax free if you keep your paws off of your Roth accounts for as long as you can. :-)

I’m glad I read this post. For so many years while I was maxing my traditional IRA (instead of a Roth) I secretly had this twinge of fear that I was doing the wrong thing.

Conventional financial advice said over and over “when you’re young, contribute to a Roth” as if that answered the question in full. I always knew my tax rate in retirement would be lower than my 15% marginal rate while working.

And between penalty free withdrawals of Roth conversions (after 5 years), 72t withdrawals from traditional IRA’s, taxable accounts, and 457 withdrawals, I wouldn’t have a hard time funding my 26 years of early retirement before I hit 59.5.

I always knew I was doing the right thing (saving tens of thousands on taxes each years), but always had that twinge of fear. Now I get it – conventional advice isn’t that great.

Hey Justin, I’m glad you read this post too :)

I’d say you were definitely doing the right thing. I always like to take advantage of all the tax breaks I can now because I figure I can always try to find ways to lower my taxes later.

I agree that conventional advice isn’t usually great in general but it is especially bad when applied to early retirement scenarios. That’s one of the main reasons I started this site; to look at common financial topics/scenarios/advice through a financial independence lens to determine the most optimal course of action for future early retirees. Unsurprisingly, my findings usually don’t match up with the common conclusions that you’re used to hearing about.

I think that is the key – 99.94% of the population aren’t seeking early retirement, so the advice caters toward the mainstream. I’ll take the tax savings today any time.

Then I can invest the taxes I would have paid (on behalf of the IRS, of course), and then pay those taxes later (or never). Delaying or not paying taxes seems like a smart bet, even if rates end up rising. Which I somehow doubt they will for us “near poverty according to the 1040” early retirees.

And thanks for the Roth Conversion ladder term. I’ll borrow that in an upcoming article on my withdrawal plans. I always planned on the trad to Roth conversions at a rate of $20k/yr or so for at least 10 years, and I knew I could pull those conversions out of Roth after 5 years, but to explicitly structure your conversions in order to time the 5 years – genius. I can push off 72t withdrawals even longer and keep my taxable income stream more flexible.

Exactly. Being able to invest the money that you would have otherwise used for taxes is the reason it almost always makes sense for future early retirees to take the tax break up front.

The Roth IRA conversion ladder is great, isn’t it? I had thought about going the 72(t) route as well but I’m not sure I want to deal with setting it up and I don’t like the fact that you have to keep it going until standard retirement age. The last thing I want to do is withdraw money from a tax-advantaged account when I don’t need the money so I’ll likely just stick with the Roth IRA conversion ladder instead.

It appears 72t and Roth IRA Conversion Ladder are essentially equal in terms of tax treatment when it is all said and done.

With a 72t, I might take $20k out of my traditional IRA and leave the Roth untouched. $20k income (which I wouldn’t pay tax on of course).

With Roth IRA Conversion Ladder, I could convert $20k from trad. IRA into Roth, withdraw $20k from Roth, and end up with the same tax situation. $20k income, $20k less in the trad. IRA, and the same balance in the Roth.

I’ll have to chew on this for a while.

I definitely don’t like the 72t withdrawals that lock you in for years or decades. My original plan was to deplete taxable accounts to about 20% their initial value over the first 10-12 years, then start 72t withdrawals.

But I’ll be converting $20k trad to Roth each of those 10-12 years, so I’ll likely have ample funds to simply withdraw from the Roth. The conversion contributions will be well seasoned much more than 5 years by that point.

Whichever way you decide to go, it’s a good situation to be in :)

I would say you are better off depleting your taxable accounts first, rather than starting a 72t. I also looked into that, and the tiny trickle you get from the calculated rates applicable to those plans, require a large investment to make them worth while. The other thing is that you are locking that traditional IRA money for many years, and the penalties for messing up a 72t plan once started, are steep.

I believe you are better off doing a traditional to Roth conversion ladder, as Mr. MF teaches, and use up your taxable assets to bridge the gap.

OK, a few days ago I promised you a more detailed reply to the Roth conversion-pipeline strategy, and here it is. Basically, I think that most people would be slightly better off either taking SEPPs from a traditional, or simply paying taxes and putting all their money in a regular brokerage account.

The thing that makes this tricky is the 5-year lag time for the Roth strategy, which makes it hard to do apples-to-apples comparisons. Here’s what I did to try and make a fair comparison:

I start by assuming that the “lab rat” is someone like me: young, single, and making a modest salary that won’t go above the 15% tax bracket. That also means that he shouldn’t ever have to pay taxes on dividends or long-term capital gains. I assumed that if he used a retirement account he’d be maxing out his contribution and then also putting the same amount into regular savings, and then also planning to work a little bit after FI. Also I didn’t calculate the HSA; I figured that one was such a no-brainer that everyone should be using it no matter what.

Calculating the SEPP strategy was easy: 3% (the max allowed) from the traditional IRA, plus whatever withdrawal rate you choose from regular savings, plus a constant amount from working. No taxes after FI unless you work a lot.

The Roth calculation is slightly more complicated. I assumed that he started with the same amount of savings and worked at the same route, but that during the first 5 years he would deplete his regular savings by an additional amount equal to what he WOULD have gotten from SEPPs (3% of the total). So his non-IRA savings deplete by 3% a year for 5 years, and during that 5 years his net income is exactly the same. After 5 years, his income does go up if you choose a withdrawal rate higher than 3%, although his taxable income does too.

What really surprised me though, was when I compared it to a strategy of not using a retirement account at all. If you take all the money that he *could* have put in a retirement account, and pay the 15% income tax on it in order to put it in a regular account, it exactly equals the money that he’d have by depleting his regular savings by 3% a year over 5 years! (because 3*5 = 15) And as a bonus, his taxable incomes is less after FI, and he doesn’t have to worry about doing paperwork, and he can access his money all at once if necessary.

Now, granted, I didn’t account for state taxes or company 401(k) matching. Those could skew the numbers more towards the Roth-conversion strategy. But without those, I think you’re actually better off *not* using a retirement account at all, unless you’re very conservative with your withdrawal rate in which case SEPPs from a traditional account are better.

Hi Charlie, I’m not following your numbers.

Assume someone in the 15% tax bracket worked and invested for 5 years, lived off of other taxable accounts for the next 5 years, and then began using the funds invested in the first 5 years after year 10, here’s how the different options compare…

In the retirement account scenario, investing $20,000 per year in a 401(k) and Traditional IRA for five years would result in a balance of ~$161K by year 10, assuming a 7% return.

In the taxable account scenario, only $17,000 would be invested per year for the first five years ($20,000 – 15% tax) so by the end of 10 years, the ending balance would only be ~$137K.

Obviously investing in tax-advantaged accounts is better because an extra $3,000 can be invested each year.

As far as the SEPP vs. Roth IRA Conversion Ladder is concerned, there’d be no benefit at year 10 going with SEPP over the conversion ladder, assuming the Traditional to Roth IRA conversions weren’t taxed (which they weren’t in the lab rat scenario I described).

In fact, going with SEPP would be worse because the withdrawals would be limited and would need to be continued until age 59 1/2.

Hmm. You did catch a big error on my part- I was using post-inflation returns of 5%, but I didn’t adjust the SEPP returns for inflation. If I use nominal returns of 7% for everything, the SEPP 3% does look pretty bad.

However, I think you’re making a mistake too. In the retirement account scenario, you don’t get 10 years of growth to calculate Roth withdrawals. You should be withdrawing from the Roth at the same rate you’re contributing to it, which would be the amount that you start taking out of your traditional IRA after FIVE years, not ten. So basically, the Roth-pipeline scenario gains 15% initially over the taxable account, but then loses out on 5 years of growth.

Doing the math with your numbers, I calculate that after 10 years, with a 15% marginal tax rate and 7% growth, the roth-pipeline scenario earns $12076.55 and the taxable-account scenario earns $13686.76.

Charlie, I think you are misunderstanding how the Roth IRA Conversion Ladder works.

As you build the conversion ladder (i.e. years 5-10 in our example scenario), all funds remain invested. Therefore, there is no difference in returns during the building years since the only difference is that you are moving the funds from one type of account (Traditional IRA) to another type of account (Roth IRA).

No, I got that. But since the amount you can withdraw from the roth is equal to what you contributed to it(not interest), and you have to contribute 5 years before, you miss that 5 years of interest.

Heres a simple example: suppose you have a traditional worth 200k, and nothing in Roth. You start by converting 10k to the Roth. Wait 5 years, now how much can you withdraw? Only 5k, regardless of how much interest either account might have earned in the meantime.

You don’t miss that five years of interest, you just can’t withdraw the interest early.

Using your example (Traditional IRA with 200k and a Roth with nothing, convert 10K from the Traditional to the Roth, wait 5 years), you can only withdraw 10k at the five-year point but that doesn’t mean the 10k hasn’t been growing for those five years. The full amount has grown but you can only withdraw 10k after the five years (the interest will need to remain in the Roth until standard retirement age).

Using a 7% rate of return, here is what the situation would look like after five years:

Traditional IRA (190k + five years of 7% growth) – ~$266k

Roth IRA (Withdrawable before retirement age) – $10k

Roth IRA (Withdrawable after retirement age) – ~$4k

Sure, but you don’t get that interest until normal retirement age. Which is fine if you’re trying to set up a nest egg for old age, but not so good if you want to retire as soon as possible.

Only a small portion would be locked up until standard retirement age and since you’ll still need money after you turn 59.5 anyway, I don’t see that as being a problem.

You can’t retire early without setting up a nest egg for old age so having some money growing tax free in a Roth IRA isn’t a bad thing.

“Only a small portion would be locked up until standard retirement age and since you’ll still need money after you turn 59.5 anyway, I don’t see that as being a problem.”

For traditional retirement planning, it’s not a problem. But it is a problem if what you’re trying to do is retire as soon as possible, or maximize your income in early retirement. Under that scenario (which I thought was the main goal of this article), most people with low taxes are better off paying taxes up front instead of locking away 5 years of interest. At any rate, you should at least mention that scenario, and encourage people to do the math themselves for their own situation to see what’s best. It’s especially important for people like me who still plan to work a little after “retirement”, because the Roth conversion adds taxable income.

Traditional retirement planning is part of early retirement planning! If you are unable to support yourself after age 59.5, you aren’t really retiring early…you’re just taking a long, unpaid vacation.

Most people won’t be better off paying taxes upfront, which is what this article describes, but if you still aren’t convinced (even though I have provided all of my numbers), email me your numbers and I’ll tell you what’s missing in your calculations.

One caveat I forgot to mention- the roth-pipeline scenario does come out ahead once you got to age 59.5, because it always has money that you can’t withdraw, unlike the taxable account where you can withdraw everything at any time. But I’m interested in early retirement, not maximizing the normal retirement.

This strategy is particularly useful for early retirees (see the Traditional vs. Roth IRA article).

Also, “it always has money that you can’t withdraw” is not a correct statement. You could potentially withdraw the entire balance well before age 59.5.

Thanks for your articles! This Roth conversion ladder looks to be a really promising tool to reaching my goals earlier!

– When doing the Roth conversion amounts each year, does the $5500 limit not apply? I think I remember you saying you planned to convert ~$19000 each year and pay little or no tax on those conversion amounts.

– How do you decide on the amount to convert to a Roth each year and how are the conversion amounts taxed?

Ok, just found the answer to the second question in the IRA article, “(IRA conversions count as ordinary income so adjust the amount you convert each year based on how much you withdraw from your taxable investments for living expenses).” Thanks :-)

Hey John, since you found the answer to your second question, I’ll just answer your first…

No, the $5,500 limit does not apply to conversions. Therefore, you can still contribute $5,500 in the same year that you convert $x from your Traditional IRA to your Roth.

Hi Mad Fientist,

I have read all of your posts, thank you very much for all the work, really helpful !!!

I have one quick question, probably due to my lack of understanding, but, thinking about the conversion ladder, and willing to open an IRA in Fidelity, I came across the following mention in the web site:

A distribution from a Roth IRA is tax-free and penalty-free provided that the five-year aging requirement has been satisfied and at least one of the following conditions has been met: you reach age 59½, die, become disabled, or make a qualified first-time home purchase.

link: https://www.fidelity.com/retirement-ira/ira/roth-conversion-checklists

shall we understand that when the IRS says “You do not include in your gross income qualified distributions or distributions that are a return of your regular contributions from your Roth IRA(s). ” that by “a return of your regular..” it does not mean the interest/dividends from your investment, which is generally named return in the financial industry, but rather distributions of your 5-year old (at least) contributions ?

because in the Qualified Distributions paragraph, it looks like the IRS embrace the same definition as seen in the Fidelity website:

A qualified distribution is any payment or distribution from your Roth IRA that meets the following requirements.

1. It is made after the 5-year period beginning with the first taxable year for which a contribution was made to a Roth IRA set up for your benefit, and

2. The payment or distribution is:

a. Made on or after the date you reach age 59½,

b. Made because you are disabled (defined earlier),

c. Made to a beneficiary or to your estate after your death, or

d. One that meets the requirements listed under First home under Exceptions in chapter 1 (up to a $10,000 lifetime limit).

I am confused about your assertion that the money contributed 5-years ago is available tax-free and penalty free. Is it that money, or the return generated by that money ? (see also your previous exchanges with Charlie).

Last, but not least: I am a non-resident alien, with a 401(k) from my former employer while I was working in the US. I would love to roll it over to a traditional IRA and then use the conversion ladder you are proposing to slowly roll it over Roth IRA. Does anyone know of a US-based financial firm allowing the opening of a traditional IRA / Roth IRA for NON-RESIDENT ALIEN ?

Thank you very much in advance.

Will also try to post in Jlcollinsnh and MMM website.

Hi Marc,

It looks like someone already answered your question over on Jim’s site but let me know if you still have any unanswered questions and I’d be happy to help.

Yes, I saw it, thanks very much.

This is clear, though I cannot find in the IRS publications the part saying that contributions to Roth can always be withdrawn tax free and penalty free (after 5 years).

Just wanted to repeat the last question, as I am not living in the US for now, though I used to live there, and I might come back next year:

If someboy knows of a US-based financial firm allowing the opening of a traditional IRA / Roth IRA for NON-RESIDENT ALIEN, I would be very grateful. I wish I could roll over some of my 401(k) into traditional IRA and then into Roth IRA before year-end, looks quite challenging in timing …

Cheers.

Marc, direct contributions to a Roth can be withdrawn, tax and penalty free, at any time (since you already paid tax on Roth IRA contributions, you don’t have to pay any tax when you withdraw the contributions and you don’t have to wait 5 years before withdrawing those contributions either).

You know, I’ve always maxed out my retirement accounts but never did the math for it to figure out what you just showed above.

I just assumed with common sense that it was a better deal, just from seeing that I don’t have to pay any taxes now as a dollar today is worth more than one tomorrow (inflation).

Also, you can withdraw the amount that you want when you retire. If you decide to withdraw more, you’ll get taxed more, as it is considered income.. so just plan on withdrawing the minimum of what you need to minimize any taxes.

A dollar today is definitely worth more than a dollar tomorrow, especially if you invest it!

I wish I knew what the Australian equivalent of all of these accounts was!

Sorry Kelly, I don’t think I’ll be able to help with that! Maybe another Australian reader out there could chime in?

Great post, I have always favored pre-tax investing first and foremost. I have been blogging for 2 years now and when I started I saw a trend where bloggers were promoting after tax investing to retire early, but recently there’s been a big switch in the media to do Traditional and Roth before anything else, because of the converstion tricks in FI.

Great post. . .does the ladder withdrawal process work the same if I leverage a strategy of converting a non-deductible IRA into a ROTH? The idea is that I make too much to be able to contribute to a traditional IRA, but if I contribute to a traditional IRA and don’t take the tax deduction and convert to a ROTH, I’m assuming I can withdraw per the scenario outlined in your post?

Thanks!

Hi Jeff, you can actually withdraw a non-deductible Traditional IRA to Roth conversion before five years and not pay any tax or penalty on the withdrawal. Keep in mind though that you would have to pay a 10% penalty if you withdraw any of the earnings on the non-deductible Traditional IRA money (for example, if you contributed $1000 to a non-deductible Traditional IRA and it grew to $1200 before you converted it to a Roth, you’d pay a 10% penalty on the $200 if you took the full $1200 out of your Roth within the first five years).

I think the article and the research are great. I even tried to talk myself and my wife into a some of the very tactics you are using. Based on the direction our plan. We are looking to be debt free in 3 years, so any outstanding loans and our rental property. After this our focus will be our current home, which also generates rental income. Rough estimate is we will be debt free and have rental income the level of the average American household. So assuming I’m 38 upon this version of FI, year 38-59.5 will be dependent on this income, everything in the IRS version of retirement is a “Retirement Bonus”(we contribute to our 401K and Roth 401K enough to receive the company match). I am also making the assumptions that we will have a year’s worth of expenses in our Emergency Fund and about a year’s worth of a deductible in our HSA(10K-12K). Any suggestions or comments to improve our strategy? I respect your opinion and appreciate any commentary.

Hey Steven, that looks pretty good to me. Personally, I would probably focus less on paying off the mortgages and would instead invest more in the stock market but I understand the appeal of being completely debt free so if that will make you sleep better at night, by all means go that route.

Take a look at my HSA post for my thoughts on how you can get the most out of your HSA.

You look like you’re on a good path though so good luck and definitely keep me posted on your progress!

The plan is in place and is about 8 months in so 6 years 4 months to go. It’s great to hear and read different ways to think about things. Retiring at 65 is so last year!

I am late to learning financial information and have debt. I assume to make some/all of this work is to eliminate my debt first?

Absolutely, Will. If you have any consumer debt at all, that should be your first priority.

If you have a mortgage with a reasonable rate, you don’t necessarily have to pay that off right away but if you have any credit card debt, car loans, etc., you definitely need to take care of that first.

Good luck

Hi Mad Fientist,

I am 40 and my husband is 44. We’ve reached financial independence…yet we continue to work. Mainly because we still have 2 kids at home (14 and 6) and we want to ensure we have their college funds fully funded before leaving the workforce.

But in 8 years, our house will be paid off, the 14-year old will be done college and I project we’ll have $200k saved in 529s for the last child to go to college….retirement here we come!

I have similar strategies:

– we max out on our HSA through my husband and don’t touch it. We are allowed to invest our HSA in index funds as long as we keep $2,000 as cash.

– I have a flexible spend account through my work and use $2,500 pre-tax dollars to pay for our medical expenses (prescriptions, braces, glasses, etc).

– I put 2% into my 403(b) to get the 10% match from my employer; and then contribute to my Roth 403(b) to max to the $17,500.

– My husband maxes his 401(k) and gets a 10% match from his employer.

The past few years, our AGI has been too high to contribute to a Roth IRA. So we’ve been contributing to non-deductible IRAs, and will eventually convert those to Roths.

I’ve been ‘worried’ that we have too much or our retirement funds in deferred accounts. I like the Roth conversion ladder you describe above and will apply that to our situation. That will take care of my worries.

Thanks for the info!

Hey, a fellow Vermonter! Where in this great state are you located?

Congratulations on being financially independent! I imagine working is not so bad anymore since you don’t really have to do it.

I’m glad to hear the Roth conversion ladder strategy relieves some of your worries.

Thanks a lot for getting in touch and enjoy all this snow we have. My wife and I are just about to go out for a nice skate around a big lake near us. With all the fresh snow we got Thursday night, it should be really pretty out there today!

Reaching FI is exciting and rewarding. Although it’s not something that I can easily share with co-workers or friends, as I don’t want to seem like I’m bragging. I’m glad that I can reach out to people like you who share the same goals.

We live in Chittenden County – near the ‘metropolis’ Burlington. Enjoy the skate on the lake. All the snow is really beautiful.

Ahh, a big-city girl :)

The skate was absolutely beautiful. It was snowing the whole time and it was a nice temperature so it was a lot of fun. We didn’t realize it when we were out there but it is actually the longest skating loop in the country, apparently (4.5 miles!)

Ok Mad Fientist, love this post, opened my eyes to new possibilities.

I’ve been playing with the taxcaster, what do you make of this:

Married, 2 kids under 16, taxable wages of $20k – (category that is used for IRA to ROTH conversions) Fed Refund = $7372, all from tax credits.

Contribute this $7372 of “earned income” into a traditional IRA and get the “savers credit” of $3686. (taxcaster maybe doesn’t know about this?)

Summarized, $20k converted, $7372 from the fed I put back into the IRA, and another $3686 from the fed into my pocket.

Any other income seems to start knocking down the credits. Please poke holes in this scenario.

Slight update after looking a little closer at this scenario. (savers credit max is $2k, and contribute to Roth since no tax liability)

$20k Trad IRA to Roth conversion

$4k contribution to Roth

$9372 refund from Fed in credits

Summarized: An extra $24k into Roth, $5372 to go toward living expenses and $20k freed from IRA traditional IRA.

Wow AJ, that looks like a great situation to be in.

The one problem I see is that the Savers Credit is a non-refundable credit so it can only be used to decrease the tax you owe. Sadly, it won’t provide a refund if you don’t owe anything.

Awesome analysis!!! This Roth IRA conversion ladder is one of the most useful ideas I’ve read.

If I’m understanding correctly…

You can convert as much TIRA to Roth every year **TAX FREE** as you have deduction + exemption space.

Example:

28,000 Mortgage Interest

8100 Property Tax

3900 Personal Exemption

——-

40,000 per yr of TIRA -> Roth Conversion TAX FREE

…plus…

36,250 of Qual Div / Long Term Cap Gains TAX FREE

So, you can actually control the size of the TIRA -> Roth space by controlling (engineering/targeting) your total deductions + exemptions.

Did I get that correct?

Exactly! Just adjust the amount you convert every year to take advantage of the “free space” you have available and assuming you have many years to convert, you could convert the entire amount without paying any tax!

Wow…this is causing me to recalculate my plans. I live in an expensive area and was sure that selling my house and moving was key to going FI.

But now I realize that my high mortgage and property taxes (which I always cursed) could actually be an advantage to me as they create 4x (40k vs 10k) the TIRA-to-Roth tax free conversion space. [Note: I have a locked-in super low 30yr fixed rate, so I’m actually break-even/making money on the loan.]

Now I’m thinking it might be worth it to keep my house for 5 years after going FI, convert 40k x 5 = 200k to Roth and that will give me some nice tax diversity going forward.

Plus that gives me time to more carefully scout my retirement state/city and I hold onto my house as a nice inflation hedge in case inflation explodes.

When I started on my plan to “get free” 15 years ago, I felt like I was the only one doing this. Now all these websites have popped up showing others who are/have done it. Gives me confidence my numbers are right and it is possible.

Thanks for your super-clear analysis. I like how worthwhile each and every post you’ve made has been.

I wouldn’t keep an investment just for the tax deductions but if it’s a good investment even without the tax benefits then that sounds like a pretty good plan to me!

Thank you very much for such a nice compliment. I sometimes feel bad I don’t post more frequently but I want to make each post as good as possible so it’s great to hear you appreciate the quality over quantity.

Keep me posted on what you end up doing and I look forward to hearing from you again soon!

Yes, a strong vote from me for quality over quantity.

House: definitely a good investment. House actually more than pays for itself in gains (after all costs). Only reason I can’t keep it long term, is that it is no longer easy to extract those gains (via no-cost, cash out re-fi’s) once I’m no longer working…so I’ll probably live in it for 4-5 years then either rent or sell it.

Here’s another way to avoid some tax that plays into all this: your spouse’s IRA.

If your spouse does not work or does not get a 401(k) through work, you are allowed to contribute to his/her IRA. That Is long as you don’t make too much money (I believe the phase out is around $188,000) . This is called the Kay Bailey Hutchison Spousal IRA rule.

Put this in a Traditional IRA, and Boom! you have some more tax deducted funds growing tax deferred. Add in your Roth conversion ladder and things look even better!

Great tip, Michael! I actually wasn’t aware of that rule so thanks a lot for the comment!

I just saw this trying to figure out how to deduct more while being in the phase-out! Obviously 5 years later, but still!

Here’s a suggestion. I haven’t seen you figure in the Savers Credit when computing the Roth IRA Conversion Ladder when applied to Semi-Retirement. (Forgive me if I missed it in your Archives.)

As background, I retired from my day job as a Mad Scientist 10 years ago at age 51 so that I could pursue my passion as a volunteer for my favorite charity. They liked my work, so actually hired me part time, so I have a small amount of earned income in “semi-retirement.”

I discovered that the amount that can be converted from Traditional IRA to Roth IRA tax-free each year is maximized if I contribute to retirement accounts for my wife and I and apply the Savers Credit. For example, 2K each contributed to Roth IRAs for my wife and I gives a 2K tax credit, as long as our AGI is kept below 35.5K (for 2013). In the 10% tax bracket, this tax credit is worth up to 20K in additional TIRA money that can be converted tax free to a Roth IRA. Its not quite as simple as that, but the net effect is that if you or your spouse have a small amount of earned income in retirement, it leverages the amount that can be converted each year in your Roth IRA Conversion Ladder. Hope this helps; it has certainly worked for me.

Thanks very much for the comment!

We discussed the Savers Credit a bit in the comments of my Semiretirement post but I agree that it is so useful that it may warrant a post all of its own. I’ve added it to my list of future topics to cover so stay tuned!

Technical details are discussed in this thread:

http://www.bogleheads.org/forum/viewtopic.php?f=2&t=86207

Love this quote: “These credits function in similar fashion to a 401k match, but the IRS is the matching entity.”

Great site! I am learning so much. I do have a question for all you early FI folks who ditch the working life. Will you not really qualify for Social Security if you working life is so limited? You have to have 40 quarters to qualify (10 Years),right? But the payout is based on the highest 35 years and missing years get counted as zeros. Is there something here that I have misunderstood?

Glad you’re enjoying the site, Lauri!

I don’t know about everyone else but I personally don’t factor Social Security into my planning so anything that comes my way will be a nice surprise. If I get something, great, and if not, my own savings should cover me for everything I want to do.

Hey Mad Fientist,

Just want to make sure I’m understanding this correctly. In the first 5 years after he reaches FI, while he is in the process of the Roth IRA conversion ladder, will he be withdrawing 4% of the total value of his portfolio but just taking the entire amount from his taxable account?

For ex. If the value of his entire portfolio in all accounts is $600,000, and he’s using a withdrawal rate of 4%, will he be taking $24,000 out of his taxable account solely for the first 5 years?

Thanks and love your blog, hoping to implement this myself!

-Mike

I wonder if you could help me clear something up. Suppose I contribute $10,000 to a solo 401k, it grows to $50,000, I rollover the account to an IRA, and then I convert chunks of $12,000 each year to a Roth IRA to build the conversion ladder. Is the $12,000 considered the contribution amount that is fully accessible after five years? I ask this because if I had put $10,000 into a Roth, let it grow to $50,000, then expected to retire extremely early, I would only ever be able to withdraw the original $10,000, inflation be damned.

I exaggerated the growth rates but I think you can see where I’m going with this. I want to make sure that in the conversion ladder, the amount that is considered a contribution — what I can actually use to live on each year — is the amount I convert from IRA to Roth IRA, which would include all earnings in the IRA, and that I am not restricted to the original IRA contribution amounts excluding IRA earnings.

If that’s the case, I am probably not the first to recommend projecting inflation five years ahead and adding that to your conversion amount today.

Hi Tod,

Yes, the converted amount is considered the contribution so you’d be able to take out $12,000 after the five-year waiting period. You couldn’t take out any gains that occurred in the Roth after the traditional-to-Roth conversion but any amount that you convert from the traditional IRA can be taken out after five years.

Thank you. That is incredibly helpful.

I was wondering if you could do a post about tax advantages for married couples? My problem is that I want to quit but my spouse does not (weirdo, really loves his job). We’re both engineers, and even on one salary make WAYYYYY too much to take advantage of some of the tax strategies you list (as long as one of us is working, anyway). It’s a nice problem to have, for sure. But I’d really like to quit, rollover my 401k and start converting to a Roth. I don’t want to do that while he’s bringing in a salary, because a significant chunk would be lost to taxes. At this rate, if I leave it in there until my spouse quits (we’re 30, he wants to work until 60), it’s going to grow so big I won’t be able to convert it tax free fast enough before RMD’s start kicking in. Like I said, not complaining, just wondered if there were other strategies out there.

Have you ever thought about filing separately? In most situations, that’s a worse way to file but it could be better for you and your husband.

I’ll likely be facing the same problem within the next few years so you can probably expect to read something about it soon!

I did run the numbers for filing separately, but with two kids and a couple of other things it appeared to increase my total tax liability from previous years. That said, I’ll have to run the numbers for paying nominally more in taxes, but then having one person be below the income level in order to take advantage of the above tax strategies.

Looking forward to any new articles!

Hopefully your tax software makes is easy for you to see the differences between filing jointly or separately so you can easily run the numbers when the time comes.

Mad Fientist,

I’m late to the party. This is the first posting I’ve read as I have spent the last month getting caught up over at MMM. I read guest postings by you and Mr. Collins which I enjoyed very much and are both next on my list to read. Great first post that I’ve read and look forward to catching up on all of yours as well.

Welcome! If you’ve been hanging around with MMM and JLCollinsNH already, I know I have a lot to live up to but hopefully you enjoy what you find here.

I look forward to hearing from you more as you explore some of my other posts.

Have you ever looked into the 401K “After-tax” contributions?? These are not the “pre-tax” or the “Roth contributions” They are defined as “after-tax” Treated as such that you do pay tax on any Gains… However, they are not held to the Pre tax and roth contribution limits.

After-tax contributions allow up to $52K minus your Pre tax and roth contributions.. so if that being maxed at 17,500… 52,000 – 17,500 = 34,500 in additional contributions…. Where this comes in handy because you do pay tax on the gains… is that you can do a roll over to your Roth IRA and only pay tax on the gains. Or you can roll over the basis to your Roth IRA and the gains can be rolled into your Traditional IRA.

My former employer’s 401k provider even allowed in-service distributions of the after-tax 401k on a yearly basis.. so I could just roll the money out every year and there were minimal gains to deal with anyway.

Hi Tim, I’ve actually been doing a lot of research into this over the last few weeks. The IRS recently released some additional guidance on the type of rollover you mentioned and it looks very promising! Stay tuned for an article on this topic very soon :)

I have been doing this for 3 years and it’s awesome!!! I’ve been able to put more money in my Roth IRA than the traitional method would have allowed me to do in 10 years. And that’s all going to be tax free growth 30 years from now. It is vague terms with section 415. I would love to heard more about your research. However my current 401k does not offer after tax contributions.

My current 401(k) doesn’t allow after-tax contributions either. I was so bummed out when I found out I couldn’t do it because it’s such an amazing way to boost your Roth savings!

It never hurts to ask your benefits people about it.. and express your interest in it.. If enough people ask about it … it just might get implemented.

I’ve been all over the benefits people since that latest IRS guidance came out, haha

Do you have any concern that politicians could close this loophole, or strategy before you implement it? I would hate to save most of my money in 401K/ IRA only to find out a year or two before early retirement that I can no longer move small amounts into a Roth IRA to fund early retirement and that I should have been saving a portion in a 401K for my 59.5 and later years and saving a different bucket of money in a taxable account for the early retirement years.

Ben, I agree that waiting a whole career (even a hopefully shortish one) trusting that a tax strategy will still be available is generally risky. A good approach is to do the back-door IRA (ie $5500 per person non-deductible Traditional IRA contribution and conversion to Roth) every year and the mega-backdoor Roth IRA (after-tax contributions to your 401k, converted to Roth), if your 401k allows in-service distributions, every year. That way by the end of every year (I actually do the conversions the same week I make the contributions), everything you’ve saved is safely in a Roth.

Regarding likelihood of these laws changing:

Definitely always a risk. Politicians are politicians. US is in massive debt and we will need to pay the piper eventually.

However:

1) Allowing Roth conversions is unlikely to change because it pulls tax revenue from the future (when people would have withdrawn from their 401ks/IRAs) to the present, making the current fiscal picture look better. Congress loves that.

2) The slow yearly conversion of 401k/IRA to Roth in FI is likely to always be allowed for reason #1, however….the 401k/IRA to Roth conversions against deductions and tax free capturing of qualified dividends and long-term capital gains in the 15% tax bracket and below, that is the part that could change. I certainly wouldn’t bet on some of that not changing sometime in the next 20 years.

Maintaining tax diversity (some taxable, some 401k/IRA, and as much Roth as you can create in a tax-smart way) should allow you to navigate your way through future tax law changes.

Final Thoughts:

Roth being taxed – that seems very unlikely, too obvious and clear to the masses.

More likely: VAT (national sales tax) or other types of taxes in the production chain that hit you when you *spend* your tax-free Roth funds (as direct taxes or increased cost of goods).

On the other hand….

Social Security was promised to be untaxed….and now up to 85% of it is taxed when you hit just 34k in income for the year. In 2012, Social Security beneficiaries paid a total of $46 billion in income taxes on their benefits, which will continue to rise with the baby boomer retirement wave.

Congress seems to have gotten away with that one…so, who knows, maybe they will go after the Roth directly 20 years from now….just seems unlikely because it would be such a clear violation of the entire principle of the Roth.

I tend not to worry too much about things I have no control over so I just try to do the optimal thing now and if things change later, I’ll do the research to figure out the best way to optimize things then.

Worst case scenario, I could just pay the 10% penalty and still take the money out early or I could keep working part time to cover my expenses until I hit standard retirement age.

This is often referred to as a “mega-backdoor IRA” because it leverages the same concept as a standard backdoor IRA (i.e. the fact that since 2010 there is no AGI limit on who can do Roth conversions) but allows you to put WAY MORE in per year. I do the normal and the mega backdoor. Anyone who’s 401k allows it, should do it. Limit just went up to 53k for 2015.

One gotcha: if you have pension contributions, they count as part of the 52k limit.

It’s also unlikely to be repealed, because the US gov is raking it in on people doing normal Roth conversions.

Of course, it’s a zero-sum game, so we’re just pulling tax revenue forward from future years. Short term thinking…but that’s our political leadership….kicking a yet even bigger can down the road.

Thanks a lot for all the intelligent responses, Brian.

I agree the mega backdoor is worth doing for anyone who is able to so look out for an article on that subject soon!

Excellent!

Your Roth IRA ladder post is the definitive one I point everyone too. It would be great if you had a similar definitive Mega-backdoor Roth post.

I thought I had the IRS Notice 2014-54 figured out, but then the Michael Kitces post on it confused me, and I haven’t had any time yet to dig futher (I’m not FI for another 14 months). Hopefully you can sort it all down in a clear way.

Keep up the great work.

Quality and Clarity over Quantity!

Is this the Kitces post you were referring to? It seems to me that he agrees that IRS Notice 2014-54 pretty much gives the green light for the strategy (the examples in IRS Notice 2014-54, specifically #4, make it pretty cut and dry, in my opinion). Great news for those who can make after-tax contributions!

Haha, I’m definitely not going for quantity so I try my best for quality and clarity at least!

Yes, that Kitces post.

It all sounded good, until I read part below. Which seemed to indicate you had to be converting your *entire* 401k and not just the after-tax (to Roth) and after-tax gains (to IRA/solo 401k) each year (the way you’d want to do it / everyone has been doing it). Then in the comments below he seemed to re-emphasize that point and say that IRS example 4 was in fact pro rata, but just didn’t seem to be based on how the IRS worded it.

That’s what concerned me. But I personally have a very difficult time reading Kitces, so maybe I’m misinterpreting. Everyone else writing on this is not mentioning any pro rata issues.

“To the extent a retiree takes out only part of the account, the pro-rata rules under IRC Section 72(e)(8) do still apply to determine how much is coming out in the first place. Thus, for instance, if the 401(k) balance is $100,000 including $20,000 of after-tax funds, and the individual only requests a $20,000 distribution, then the distribution is treated as $16,000 of pre-tax and $4,000 of after-tax; while this could still be split, with the $16,000 of pre-tax to a rollover IRA and $4,000 of after-tax to a Roth, if the account owner wants to get out all $20,000 of after-tax funds into a Roth, he/she will be required to take all $100,000 from the 401(k) plan – getting out the whole $20,000 of after-tax and $80,000 of pre-tax – and can then allocate the pre-tax funds to a rollover IRA and the after-tax to a Roth. “

Ahh, I see what you mean. Even if the pro rata rules apply, it’s still an amazing way to beef up your Roth balances with very little effort!

Brian: The pro-rata aspect of the ruling should not be an issue. The pro-rata treatment should apply to the entire subaccount containing your after-tax contributions and their earnings (if any), not to the entire 401(k). For example, you could instruct your employer to divide a single distribution from the subaccount into two simultaneous payments, with the pre-tax dollars (earnings on the after-tax contributions) going directly to a traditional IRA and the after-tax dollars going directly to a Roth IRA. Those using a mega backdoor strategy will regularly move the after-tax assets out before substantial earnings buildup. Just remember to always designate the distribution as coming from the appropriate subaccount. See:

http://fairmark.com/retirement/roth-accounts/roth-conversions/isolating-basis-for-roth-conversion/using-new-basis-isolation-rules/

http://fairmark.com/retirement/roth-accounts/roth-conversions/isolating-basis-for-roth-conversion/separate-subaccount-treatment/

yeah, I read all the fairmark articles (and many others on a wide variety of sites) all of which seem to agree. Kitces is the only dissenter I found.

But Kitces may also agree if we interpret him as discussing withdrawals from the after-tax sub-account only and not the entire 401k account (the point you made). But based on his discussion of example 4 (in answer to a question someone asked him) it seems he is referring to forcing pro rata on the entire account.

Who knows, maybe he’s confused. Because everyone else is in agreement that this IRS ruling solidifies and enhances what all of us mega-backdoor IRAers have been doing all along.

Kitces just put a bit of fear into me…because I would owe monster taxes if my 401k got pro rata force-converted to a Roth all in one year (would be especially bad if it was a year I was still working).

When I get some free time and mental focus (my capacity is currently getting sucked up by work) I will re-read the IRS ruling and Kitces carefully and see if I can square it up. But I agree with you, everyone else I’ve read (from Forbes to various tax and financial websites) is interpreting it exactly as you described.

Thanks for looking into it. I appreciate it.

I think Kitces and the Fidelity article are confused or at least confusing. They try to address the usual case of someone retiring and thinking about rolling over their entire 401(k) to IRAs. However, they are ignoring the subaccount treatment which is available through section 72(d)(2) of the Internal Revenue Code:

“For purposes of this section, employee contributions (and any income allocable thereto) under a defined contribution plan may be treated as a separate contract.”