A pandemic is affecting the entire world. Economies have shut down. Over 36 million people in the United States are newly unemployed. The price of oil went negative for a bit. We experienced the fastest 30% drop in stocks ever and then got to enjoy a 30%+ rebound immediately after.

And all this craziness happened within the last couple of months.

Although this is an uncomfortable time for everyone, it could also be an incredible learning opportunity.

You know what a crash feels like (i.e. peak “fear”), what record highs feel like (i.e. peak “greed”), and you can appreciate how difficult it is to predict anything about the world or the markets.

Since being in the middle of market turmoil is a lot different than thinking about a future crash, it’s worth reflecting on your investment plan.

As Mike Tyson famously said, “Everyone has a plan until they get punched in the mouth.” Now that you know how it feels to get punched in the mouth, where has your plan fallen over? Have your emotions caused you to override the rules you had set for yourself? Are there systems or automations you can put in place so next time that doesn’t happen?

While your memories are fresh, think about these extremes and develop a better plan for your portfolio so that the next crash isn’t as costly or traumatic.

What’s In My Portfolio

To help you develop your investing plan, I’m going to explain all the mechanics of my portfolio.

I’ll dive into the investments I chose, the systems I have in place, and the rules I’ve set. I’ll explain how they trick me into doing the right things at the right times (and keep me from doing the wrong things).

I’ll also share a new spreadsheet I created to help you implement similar strategies.

None of what I do is special, fancy, or complicated but maybe it’s the simplicity that allows me to stay the course during uncertain times.

I’ll also describe what I’ve learned from the current crisis and explain how I’ve enhanced my rules based on what I’ve learned. Even though I experienced a big crash before as an investor, back in 2007, I still found myself struggling with a certain aspect of my investing plan this time.

Before diving into my portfolio, let’s start with the lesson I thought I had learned from my first crash yet still struggled with this time…

Learning from My First Crash

It was 2007.

We had just sold our house in Scotland for over 50% more than we bought it for 2.5 years earlier and I was going to start investing that money into the markets.

Stocks went down a bit and I was happy that shares were on sale so I bought some. I can’t remember the exact percentages but I let’s say I invested 30% of the money I planned to invest.

It felt great getting a deal!

Then the next day was even worse. I invested a bit more but I didn’t have as much left so I decreased the amount I put into the markets.

A few days later, it got much MUCH worse.

Catching a Falling Knife

As the financial world collapsed, I kept putting more money in but I invested less and less each time because every time I put money in, I’d lose more money.

This continued until the market bottomed in March 2009.

By then though, I was just trickling in $150 every so often. Not because I was out of money to invest but because I assumed stocks would keep going down and I didn’t want to make the mistake I made at the beginning by investing such a big percentage of the cash while things were dropping.

I remember the market bottom vividly because I was at my grandparent’s house in Florida and I was going to do my normal small investment but the market had gone up that day. “No big deal”, I thought. “I’ll just invest tomorrow when it goes down again.”

Well, it didn’t get any lower the next day. Or the next. It kept going up and I kept waiting for the markets to make new lows. The new lows didn’t happen so I didn’t invest.

Stocks were the cheapest they’ll likely ever be in my lifetime and yet I sat on a chunk of uninvested cash because I was trying to time the bottom.

It’s easy to see now that I made a mistake but when you’re in the middle of a big drawdown, it’s hard to know what to do.

When the markets started to recover in 2009, it didn’t feel like things were any better. It felt like everything was going to keep getting worse so the upward moves didn’t make sense.

The thing is, you never know what’s going to happen or what bad things are already priced into the market. The world could get worse but if investors already expect it to get worse, stocks could go up. Or, if investors think things aren’t improving as fast a expected, stocks could take a big dive even when things in the economy are getting better.

As I learned, putting money into a falling market is a lot more difficult than it seems.

Ben Carlson from AWealthOfCommonSense.com summed it up perfectly in a recent article:

Every investor is told to buy low and sell high. But most don’t realize that buy low typically works out to buy low, then buy lower, then buy even lower, and once you really hate yourself, buy lower than you thought was possible.

I thought I learned from my 2008/2009 mistake so I assumed I’d be better prepared this time around.

I was wrong.

Although I’m used to the feeling of buying low, then buying lower, then hating yourself and buying even lower, I started falling into the same trap I fell into in 2007 – I stopped buying enough because I thought I knew that the markets were going to go lower.

I had the cash, stocks were on sale, and yet I was timidly trickling money in again because I thought things were going to get worse before they got better (my brain and emotions were again trying to sabotage my plan).

That’s where systems and rules can save you (and me).

So let’s dive into my portfolio and explore the systems and rules I have in place (including the new rules I’ve developed to solve this particular problem)…

Two Baskets

At the very top level, I’ve split my money into two baskets:

- FI Portfolio

- Cash Buffer/Real-Estate Fund

My FI portfolio is what we’d live on if all our other income went away.

As explained in the Safe Withdrawal Rate post, a 3.5% withdrawal rate is very conservative so I keep enough money in this basket so that 3.5% of the value of the portfolio could sustain our annual spending.

In my other basket, I’ve started accumulating cash that I may one day use to buy some real estate. We currently rent and I enjoy renting but I imagine we’ll want to put down roots somewhere eventually, and buying somewhere will help us do that, so I’ve been building up a small real-estate fund over the years.

When new money comes in, I either top up the FI portfolio (to maintain a 3.5% withdraw rate) or I add it to the real-estate fund.

Never Sell

One rule I have is that I can never sell anything in my FI Portfolio (unless it’s for rebalancing purposes).

Getting back in after selling is one of the hardest things to do as an investor so I don’t ever put myself in the position to have to do that.

It’s very tempting though. In fact, I thought about it in February before all this stuff kicked off.

On February 7th, I had dinner with my brother-in-law. He’s a microbiologist and I asked him what he thought about the new virus that had forced China to shut down. He said it was extremely concerning and he thought it was already way too big of a problem to contain.

At that time, stocks were hitting record highs and hadn’t seen a significant pullback in a long time. If there was any time to move some money to cash, it was that one.

I knew better though and even considering what’s happened since, I’m so glad I held my nerve and followed my own rule of never selling.

Had I sold my stocks on February 10th (the first weekday after that dinner with my brother-in-law), here’s what would have happened…

Stocks would have continued their rise for the next nine days. Each day would have been more excruciating than the last because I would have been second-guessing my decision and beating myself up for going to cash.

In all honesty, I’m not sure I would have had the patience to wait and may have bought back in at a higher price before the crash.

Assuming I did stay in cash, I would have felt like a genius a few weeks later when everything dropped 30%+ but then I would have had to figure out when to get back in, which is even more difficult.

The markets inexplicably rebounded 30%+ after the March 23rd lows. There’s no way I would have bought back into stocks on March 23rd because, at the time, it felt like stocks could easily drop another 20%+ since people were still freaking out and the virus was looking really bad.

So after a rebound of 10%, would I have gotten back in then? Hell no! I would have assumed it was a dead-cat bounce and stocks would go even lower soon.

How about today, when we’re 25%+ above those lows? Nope. I’d be really pissed off I missed out on all those gains but I’d also worry an even bigger pullback is possible. Unemployment is soaring, the virus is still killing thousands of people, and the full ramifications of the economic shutdowns aren’t fully apparent yet.

How could I buy stocks in this environment when things are looking worse than they were in early February?

But what if a new COVID-19 treatment gets approved tomorrow or something else happens that causes markets to keep going up from here? Could I stand to be in cash and miss out on even more gains and new highs?

How would I ever get back in?

As you can see, it’s an extremely difficult situation to be in, even if you get out at the right time. That’s why I don’t do it.

Instead, I alter my asset allocation when my risk tolerance changes.

Let’s dive into that asset allocation…

Portfolio Asset Allocation

My FI portfolio is very simple and only consists of three funds:

- Total Stock Market Index Fund

- Total International Stock Market Index Fund

- Total Bond Market Index Fund

For these three funds, I’ve settled on the following allocation:

- 65%-75% Total Stock Market Index Fund

- 25% Total International Stock Market Index Fund

- 0-10% Total Bond Market Index Fund

Note: Although my FI portfolio can sustain our spending, my credit-card search tool for travel hackers is still bringing in more income than we spend so my asset choices are more aggressive than they would be if I wasn’t earning any income.

I’ll explain more later about why my allocations are ranges (and why this has been beneficial recently).

Buying Low

I like having three funds because it provides a bit of diversification and it also helps me buy low.

Since I’m still earning money, I don’t sell anything and I just rebalance with new money.

Each month, I plug my numbers into a spreadsheet and it tells me how out of whack my allocation is and what I need to buy to fix it.

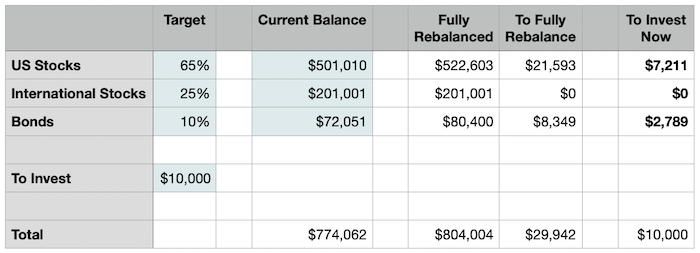

Here is a simplified version of that spreadsheet (with dummy numbers) that I created to share with you:

To download a copy of this spreadsheet, click here!

Once you’ve downloaded the spreadsheet, simply update the numbers shaded in green and it will let you know where you should deploy your cash.

For example, when the international stock fund wasn’t doing as well as my total stock market fund (as has been the case for the past few years), I knew that any new money I earned should go into the international fund to bring it back in line with my target allocation.

How This Tricks Me Into Doing the Right Thing

It’s been hard to invest over the last few years because markets have gone straight up for so long and everything felt expensive.

When I switched to this system, it became easier because there was always something that looked cheap (even though the cheapness was only relative).

So even when all three asset classes were booming (i.e. stocks, international stocks, and bonds), one of them would have lagged behind the rest so it’d look cheap relative to the other options and I’d have no trouble buying it. The desire to bring my portfolio back in line with my target allocation made putting money into an overheated market easier.

And doing that was the right choice because markets kept going up far longer than I imagined they would.

Check out this Mad Fientist reader email from April of 2014 (6 years ago!):

…given that the dow and the s&P are due for a correction, would you recommend keeping some money on the sidelines until that happens?

And here is my response:

…market timing is a loser’s game so I always try to get my money into the market as soon as I can. If you look back to April of last year, I bet you would have thought that a pullback was imminent and as we know, it wasn’t. The market has marched upwards since then so if you had waited for a pullback, you’d still be waiting. Also, how will you know it’s an actual pullback and not just a down day/week? How long would you wait until you put your money in? What if the market surges upwards before you do? There’s no way to know what’s going to happen so any sort of timing is a suboptimal strategy in the long run.

It was difficult sending that reply because I too felt like the bull market had gone on for a long time so I was expecting a pullback. But I knew that trying to time the market was a bad idea so I kept putting money in anyway and I kept recommending that readers do the same.

I’m glad I did because the market kept going up until it hit its February 19th high this year, gaining another 80%+!

The point is, your emotions are trying to force you to change your actions but systems and rules help you fight against that.

Why Those Percentages?

I didn’t put a lot of thought into the percentages I picked because I’m more concerned with sticking to the percentages than picking the perfect percentages.

I simply looked at the efficient frontier graphs for the various allocations and picked a blend that had high expected returns and acceptable volatility.

For more information on the efficient frontier, check out this post I wrote back in 2013 – Minimum Variance Portfolio

US vs. International Stocks

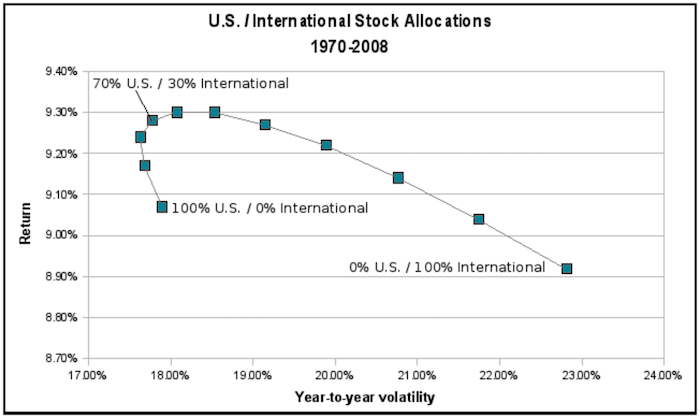

As you can see on the efficient frontier for US and International stocks, somewhere around 70%/30% seems to be a sweet spot for high expected returns and low volatility.

I settled on 72%/28% US/International for myself because 2s and 8s are nicer-colored numbers in my mind than the other options (I’m actually serious…this is why I try to take my ridiculous brain out of my investing decision-making as much as possible).

Stocks vs. Bonds

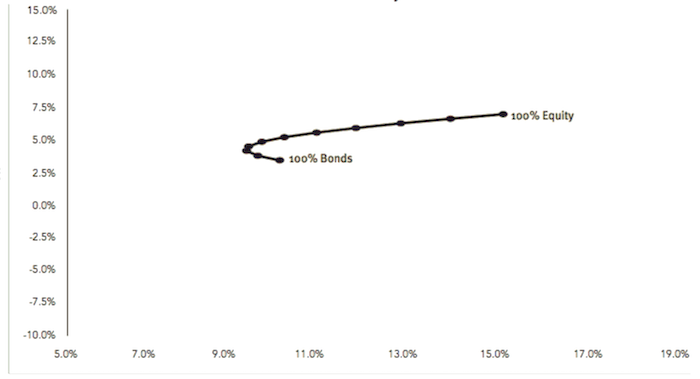

Here is the efficient frontier for stocks and bonds (for 1960-2004):

I settled on 90%/10% for my allocation because I want to mainly be in stocks but I wanted to at least have some bonds for a bit of diversification and to have another asset class to rebalance with.

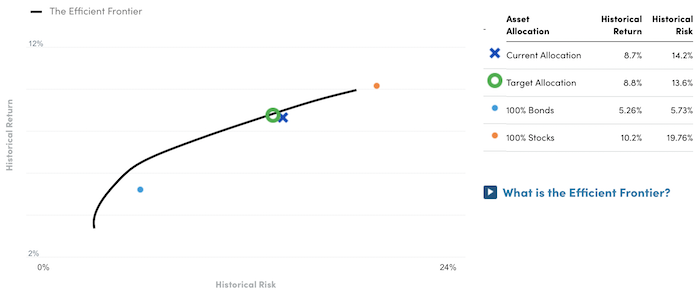

Personal Efficiency Graph

These decisions provide me with an aggressive but efficient allocation, as indicated by my own portfolio’s efficiency graph:

To automatically generate an efficiency graph for your own portfolio, click here to sign up for a free Personal Capital account and then click on Planning > Investment Checkup!

Asset Location

In addition to deciding what to invest in (and how much), it’s also important to think about where each of those funds is going to live.

Income from bonds usually gets taxed as ordinary income, so bonds are better off in a tax-deferred account like an IRA or 401(k).

With international stock funds, you can sometimes get a tax credit for foreign taxes paid but only if those funds are in a taxable account.

Here’s a great Boglehead post all about asset location, if you want to dive deeper into this important aspect of investing.

This is where I decided to put my different assets:

- Bonds – Tax-Deferred Accounts (e.g. Traditional IRA, 403b, etc.)

- International Stocks – Taxable Account

- US Stocks – Everywhere and Anywhere

How This Tricked Me into Buying Bonds

These asset location decisions helped me buy into bonds over the last few years and I’m glad that I did.

I had been sitting on too much cash over the last few years and I wanted to add to my portfolio but stocks were hitting record highs and I was getting uneasy.

My cash wasn’t being productive so I wanted to diversify into bonds but they seemed like they were terrible investments at the time too. Interest rates were at record lows and it seemed they could only go up from there (which would cause the value of the bonds to drop).

I knew that buying bonds was the right decision for my long-term plans but I couldn’t force myself to use my cash to buy bonds.

Thankfully, my portfolio structure helped trick me into doing it. Here’s what I did:

- I sold $x of stocks in my IRA and bought $x of bonds in the same account

- I bought $x of stocks in my taxable account using my cash

So in effect, I just bought $x bonds with my cash but it felt way better than that.

Here’s how it felt in my mind…

- Hell yeah!! I locked in all those juicy stock gains and didn’t have to pay any tax on them because they’re in my IRA!

- I bought the bonds that my portfolio needed and I put them in my tax-deferred IRA, which is where they need to be!

- I maintained my appropriate stock allocation but now I have some stocks in my taxable account with a high cost basis, which I can use for tax-loss harvesting next time the markets go down!

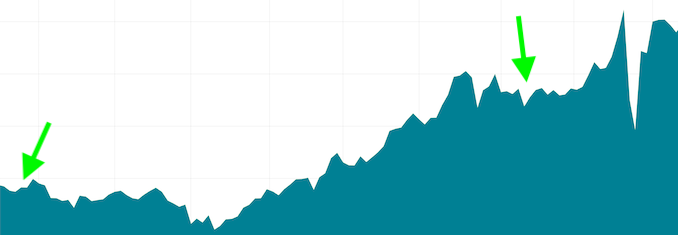

This simple change in thinking helped me do something I had been putting off for months and it worked out great because here’s what happened to the value of those bonds since then (let me remind you, I was convinced when I bought them that they only had one way to go…down):

Side Note: It is surprising how easy it is to delude yourself into thinking you know where the markets are going, no matter how many times you failed to make accurate predictions in the past!

Ranges

Let’s return to the ranges I talked about before.

I mentioned that I try to have 0%-10% bonds and 90-100% stocks.

This is great because it allows me to feel like I’m timing the market (which my brain loves to do) without damaging my long-term investing success.

When stocks felt overvalued last year, I put more money into bonds and it felt better than investing in expensive stocks. I kept adding to bonds until I got up to 10%.

Now that stocks have gone down and bonds have gone up, I can move back into a heavier stock allocation and feel like I’m taking advantage of the lower stock prices (by selling bonds to buy stocks).

Picking a Range

If you don’t know what allocation range you’d be comfortable with, now is a great time to figure it out.

Think about how you felt when markets were at all-time highs in February and compare it to how you felt in March when they were over 30% down.

In March, did you wish you weren’t taking as many risks in February? Did you freak out more than you expected when stocks crashed? Did you wish you had constructed your portfolio differently to better handle a big drop like that?

Now, assume these recent market gains are the start of a new multi-year bull market. What would you like to have your portfolio look like at this stage?

If you can figure out a happy allocation for each of these scenarios, set those numbers as your range.

Adjust as You Go

What you come up with doesn’t have to be perfect and it will likely change as your situation changes.

Before this latest downturn, I was very comfortable being 100% in stocks. I knew that I had a long time horizon and I still had income coming in so I was happy taking more risks to get higher expected returns.

But when the markets started tanking in March, I was relieved to have 10% in bonds. I already hit my FI number so why try to get an outsized return with 100% stocks and deal with the increased risks associated with that allocation when I already have enough?

I also like having three different types of assets to rebalance between so I now realize that 10% bonds should be my minimum. My new bond range is 10%-20% and I imagine that will continue increasing as the years go by.

If stocks hit new lows before this virus is finished, I can sell bonds until I hit 10% and then, when stocks start increasing again, I can slowly build up my bond balance until I hit 20% (hopefully right when the stock market tops out again next time).

Catching a Falling Knife (More Intelligently)

This brings us back to my problem at the beginning of this article – trying to buy stocks when the markets are tanking.

I thought I’d be prepared this time but my brain and emotions still got in the way so I needed more rules/systems.

Here’s what I came up with…

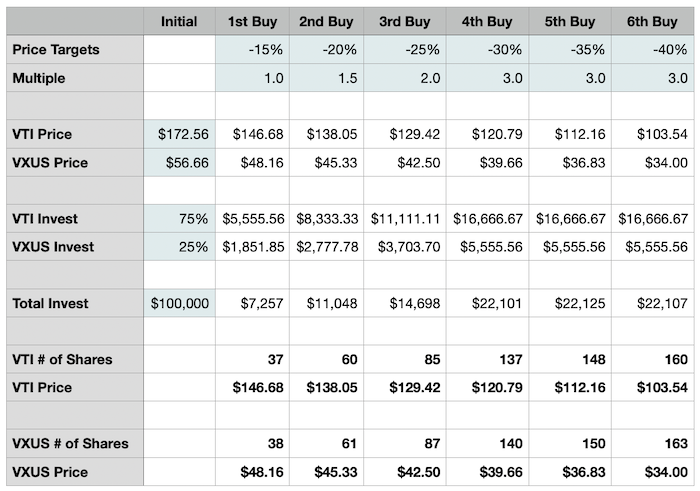

After the markets had already fallen ~12% from their highs and I felt like much more falling was possible, I created a spreadsheet for my cash-deploying strategy.

I knew that I had $x in cash that I’d be willing to deploy and I had $y in bonds that I could sell (to buy more stocks) so I determined the max I could add to my stock portfolio as stock prices decreased and I split up my contributions.

I set up buying opportunities at -15%, -20%, -25%, -30%, -35%, and -40%. And instead of buying fewer shares as the market dropped, as I did in 2007/2008, I planned on increasing my purchases at each stage.

So I determined a value $x where I could invest $x at -15%, $1.5x at -20%, $2x at -25%, $3x at -30%, $3x at -35%, and $3x at -40%.

If the market ends up going below 40% the February highs, that’s when I start selling even more bonds to buy stocks.

The good thing about this plan is that I’m happy anywhere in my range so if markets don’t revisit the March lows, I at least deployed a big chunk of my cash and will benefit from the recovery.

If stocks do make new lows and I end up deploying all my cash and selling more bonds, I’ll still have an appropriate allocation for my risk tolerance and I’ll be an even better position to take advantage of any recovery that takes place.

Limit Orders

Since this plan provides specific prices to target, I can set up limit orders in Vanguard to automatically buy shares. This removes the possibility of my brain sabotaging anything.

Note: Limit orders are stock buy/sell orders that specify a price target (e.g. buy x shares of VTI but only if the price is lower than $y).

Limit orders are great because often, especially in extremely volatile times like these, your orders can get filled at prices even lower than the limit price you set. For example, I had set an order to buy VTI at $143.06 and I ended up getting it for $140.00 because markets opened much lower than expected.

Side note: I accidentally got a ridiculous deal on some shares during the Flash Crash because I had a limit order set up that got filled at an insanely low price. That’s why I now set up limit orders whenever I expect a volatile open.

Spreadsheet

If you already downloaded the spreadsheet I mentioned at the beginning of this post, you’ll notice there’s a tab call “Bear-Market Buying”.

If you haven’t yet downloaded the spreadsheet, click here to download now!

This spreadsheet allows you to easily come up with your own price targets for future market drops.

All you need to do is fill in the green boxes with your settings and the spreadsheet will automatically calculate the price targets and number of shares to buy at each target.

Then, you can create limit orders for these prices and completely ignore what the market is doing!

Why Are These Systems/Rules/Plans Valuable?

Are these plans and rules perfect?

Absolutely not.

They don’t have to be though. As long as they keep me from sabotaging myself, they’re worthwhile.

It doesn’t matter what’s going on in the outside world because I know if I follow my rules, I’ll be doing the right thing for my long-term investing goals.

It allows me to feel good about my actions (or inaction), even in times when my brain is screaming that I’m doing it wrong.

I’ve accepted that I’m a fallible human. I understand that my emotions are influencing me far more often than I like.

Rather than fight who I am, I instead try to minimize the influence those emotions have on my investing with rules, systems, and automations.

And in highly uncertain times like these, those things can make all the difference.

What About You?

Do you have any portfolio rules you follow? Do you have a better strategy for catching a falling knife? How has your thinking changed during this latest market turmoil?

Let me know in the comments below!

Another excellent post. Thanks for sharing, Brandon! I’m interested to go to my PC and do some tinkering. I haven’t been the best at balancing my portfolio over the years so maybe this is what forces me to start! I hope things are going well for you two in Scotland!

Good to hear from you, Gwen! Glad you enjoyed the post and hope you’re doing well!

Genius stuff here. Right now, we’re 100% in U.S. Stock. While we’re definitely going to add bonds 10% in semi-retirement and 30% if we’re no longer making an income. I’m not too sure about international stocks yet even though I know it adds diversity, but also some small extra layer of complexity. I’ve been on the Boglehead forums, but didn’t find anything to convince me otherwise. If you know of anything that I should read to help me reconsider further diversification, please share. As far as tricking yourself into satisfying your urge to time the market, it’s quite genius. I’ve never thought of rebalancing can satisfy that desire. Thank you for sharing Brandon!

Glad you enjoyed it, Art! As far as the case for international is concerned, check out that efficiency graph in the post that shows that investing in international stocks can increase your expected returns while decreasing your portfolio’s volatility. Higher returns with less risk seems like a pretty convincing case to me!

The Vanguard website has all you need to know, but there are plenty of other convincing sources as well. Similar to MadFientist, I’m also at 30% international, although I overweight emerging markets because they have so much room to run. Here’s a link that might prove helpful. https://investor.vanguard.com/investing/investment/international-investing

Thanks for the link, Jess! I am 25, and I am heavily invested in Target Date Fund, and vanguard has a 36.20% Vanguard Total International Stock Index Fund Investor Shares to 54.20% Vanguard Total Stock Market Index Fund Investor Shares breakdown.

The historical return on emerging markets doesn’t look very good compare to the US total stock index; however, developing economics typically grows faster than developed economies. I have a feeling that the shift of global power will boost the total international stock returns in the next few decades.

Only time could tell.

– Atticus

I go with Vanguard Total World in the IRA and Total Stock Market and Total International in taxable. The stock allocation is set to world market cap. I let the taxable account float with world market cap. Whenever I add more money to it, I check it’s current allocation and add the money at that allocation. The seperate funds in taxable allow me to capture the foreign tax credit. I could put total world in taxable but there is a tricky IRS rule I want to avoid.

I’ll add bonds when we hit our goal.

A very interesting post. I live in the UK and my question is about home bias. Living in the States with the largest GDP in the World, this bias seems ok but, with the UK being a long way down the league table, I am much more sceptical about holding too much in UK stocks. I am also concerned about a sector bias implicit in leaning towards one market or another ie. the US is heavily tech stocks, the UK banking and finance, Germany automotive etc.

I look forwards to your view on these points.

Yeah, I’d be skeptical about holding too many UK stocks too. A market-weight allocation would probably be the best solution but I can see how that’d be more difficult when your home country isn’t the US.

I think your point regarding sector weighting in indexes is very important and being overlooked by the “buy total market only” crowd. Just buying 25% of your allocation into “foreign developed” does not cover this diversification issue either. If “stocks” is just looked at as an asset class, rather than a market of businesses and industries, then maybe it blinds one to the constituents of the index. Many people even buy a total bond index, not realizing that the average maturity is less than 10 years, and only 43% are treasuries. Over 22% of the vanguard total bond index is in mortgage backed securities. The rest is in corporate bonds. This gives the holder equity risk from the commercial paper and bonds. It also levers the real estate industry. Someone packing a total bond index and thinking it offers the risk-reducing benefit pictured in the efficient frontier, they are mistaken. That frontier is using intermediate treasuries, which have a strong negative correlation to stocks. Corporate bonds and mortgage bonds have correlation.

The lesson here is that even picking total market index funds means you are applying factors to investing. You are picking large size, growth, technology/finance, and momentum factors by buying a total stock fund. You are picking equity risk premium, intermediate duration, almost all US, by picking total bond market fund.

Today’s total stock fund is 25% technology, 17% financials, and 15% health care. You only get 3% in utilities, and 3% energy. Only maybe 3% is real estate, and I think only a handful of reits are in the index. You are not adequately exposed to those industries because many of the businesses are smaller sized.

Now what about other country indexes? Foreign developed is mostly Japan, Canada, UK, and smattering of Europe. The EFA fund holds 26% of its holdings from Japan. This is the place where fake money has mired their economy in zero growth for 30 years. The sector breakdown is another 16% financials, 14% healthcare, and once again very low utilities, real estate, or energy.

You should be looking to have more equal exposure to the various industries and sizes of companies. I think that around 95% of VTSAX is in companies that are in the S&P500. 5% in mid and small companies is not enough to have any real diversification effect. 2.4% in utilities is also not enough to make any difference.

Dear Josh,

I absolutely agree! But your point of view makes inveting also a lot more complicated and also more expensive to invest. So I do think that starting with an All World Index is a very good way to start.

To be honest, that was also my thought/problem when I started investing. Nevertheless, I started with 70% MSCI World and 30% MSCI Emerging Markets.

I reworked my asset allocation this year, because I think that my portfolio size now also allowes for some more granularity. I came out with the following:

~30% MSCI World

~10% MSCI Europe

~20% MSCI Emerging Markets

~20% Russel 2000 (Small Cap USA)

~20% MSCI Europe Small Cap

~10% MSCI Emerging Markets Small Cap

Since I like to invest GDP based, I had to find a way to reduce the US market in the MSCI World index, which is why I added the MSCI Europe.

I also have Small Caps in my portfolio now because of the same arguments that you are bringing.

But there is a second argument why it is so important for me to invest in Small Caps and to reduce the US: in Europe we tend to have smaller companies. Especially here in Germany we have many smaller companies (the US would call them micro companies ;) ), and probably the majority of them are not listed on the stockmarket. And I wanted to accomodate that.

How do you deal with that Josh?

Greetings from Germany

Ms. Maxi

Hi Josh

I had a look at the mad fientist portfolio using 70/30 split between VTI & VXUS over ten years. I used the sharesight.com trial plan, where you can plug in up to 10 holdings for a portfolio for time periods going back 20 years. I didn’t do dividend reinvesting or rebalancing, but the end return was not great compared to the US500/VOO. I don’t like VXUS very much, too much emerging markets holding ie 20% which I think is going to take a hit for several years with covid. So I wonder if this is the right fund to use for efficient frontier purposes. I do want to move towards a system like this eventually but I think I’d use VTI only for my stocks, as JL Collins advocates. I think BND is ok to use for bonds.

Hi,

Sorry to contradict, but it sounds like you’re not fully understanding equities and equity risk vs bonds and fixed income risk. Corporate bonds are not equity, they are fixed income debt – a different part of the balance sheet. There is not equity risk in a bond portfolio.

It also sound like you are knowingly misleading yourself and others if you’re showing an efficient frontier based on one type of bond to asset an optimal allocation and then showing investing and returns from a different bond class. Why not compare apples to apples?

Your use of tax shelters is backwards. Highest risk/return should go in Roth IRA/401k/403b or HSA, next highest in Traditional IRA/401k/403b, lowest risk/return in taxable account where you want to hold for at least a year to get long-term capital gains benefits.

A small tweak to your portfolio to include 10-20% small cap stocks will also improve your alpha. Small caps outperform and the broad indices have only 1-2%.

Corporate bonds are usually taken to be part of the equity allocation or split 50:50 between equity and bond allocations because they behave more like equities than bonds in times of market distress (during good times they act like bonds). In short they are a poor choice for ballast and that is why many go for government bonds only for their bond allocation.

:

Yep, struggled with this concept for years. We live in an emerging market (South Africa), and we’ve been hit both by equities dropping as well as the currency. Ironically 50% of our market cap aren’t even shares that are based in South Africa, but just because of so much selling have taken a huge hit, plus currency devaluation.

I’ve gone with the view that the USD is the reserve currency, and as such VT will be fine, just go global and stop trying to pick shares, countries, indices.

Excellent post. Thank you for sharing. I like the concept of setting up systems that trick you into making good systematic investment choices while at the same time freeing you from the emotional drain of agonizing over trying to time the markets.

Hi MadFI,

Can you comment about how cash fits into this portfolio? In your example ss you have $100k dry powder ready to go before you need to start selling bonds. I don’t know what your FI number is, but say someone’s FI number was $1M to $1.5M. That would mean your real allocation has something like 6% – 10% cash. I assume this is from your “cash buffer” basket. If the purpose of your cash buffer is cost of living and avoiding withdrawal in periods of significant decline (like in our current crash), are you ok with utilizing this money for investing? If its purpose is for investing, why not include it in your asset allocation as a percentage. I am currently (before the crash even) working through this on my own portfolio – whether to hold cash or bonds or both and at what percentages. Great article! I agree entirely with laying down rules and sticking to them and the ones you have outlined seem effective.

Thanks,

Mike

I’m also very interested in this. I read/hear everywhere “buy the dips!” but also “don’t try to time the market, dollar cost average”. You can’t do both. Dollar cost averaging means little to no cash, buying the dips means timing the market. I’ve always dollar cost averaged so I never have cash on hand (other than emergency funds), but sure wish I did back in March!

Hey Mike, the numbers in the spreadsheet and screenshots are all just dummy numbers so they’re not mine.

The cash question is still something I’m personally grappling with though. My cash % has been too high ever since I left my job in 2016. Before I left my job, I increased my cash buffer because I expected to start living off of that money. Ironically, that’s when my card tool started earning more money so rather than use the cash to live on, like I had expected, I started accumulating more cash.

Eventually, I got close to 20% cash and that’s when I knew I needed to do something so that’s when I started forcing myself to buy bonds.

My cash allocation is now less than 10% of my net worth and I’m comfortable with that level but if stocks start making new lows, I’d be fine deploying a big chunk of that to buy more stocks (since we still have some income coming in that we could live off of). I’d keep at least a year’s worth of expenses in cash, in case our income goes away, but I’d be fine using the rest of it to buy stocks.

The big question is what to do with any new cash that comes if stocks keep going up. I don’t have a good answer for that at the moment. I don’t want to be sitting on a lot of cash but it doesn’t really make sense to keep adding to the FI portfolio either (since a <2.5% withdrawal rate could currently sustain our spending, which is extremely conservative).

Obviously, a very good problem to have but I haven't come up with an answer yet. Should we put our money at risk to build a bigger FI portfolio than we need or accept minuscule returns on a big chunk of cash? I'm leaning toward the latter but ideally I'd find something more productive than cash to put that money in (which is why I relabeled my cash buffer as my real-estate fund, haha)!

Thanks for the reply. I figured they were just example numbers. Your current allocation of <10% lines up with what I was thinking – something like 5%. I like your target ranges mentioned in this article, so maybe I will call it 0-5% cash. That way I can implement your bear market strategy mentioned above in down markets and build it back up to 5% during good times.

I had a similar problem to the one you outlined during '07 during this crash. Namely, I had some cash on the side and used about 50% of it after the 15% dip. I continued buying on the way down, but in smaller quantities like you. I did manage to put it all in, but most of my investing was in the -15% to -25% range and weighted toward the -15%. This isn't a very big deal as it wasn't a large sum of money, but I will implement some of the strategies you went over in this article.

Always love the articles and podcasts! Keep em coming.

How confident are you that your future spending won’t increase? I’m not necessarily talking about medical bills, but that one’s preferences might change in the future. While today’s FI number might make it possible to maintain a comfortable, somewhat minimalist lifestyle indefinitely, I’m worried that one day I wish there was more money available for X that I hadn’t planned for. Not a necessity, but something that improves once’s life.

For example, the discovery of an expensive hobby that one loves (diving, aviation, etc), or perhaps living close to family that decides decades from now to move to an HCOL area.

Just curious as to why anyone would have so much in cash. I’ve read other FIRE bloggers state up to 3-4 years worth of expenses in cash. I can understand the current year’s expenses in cash if you don’t have income.

The best savings accounts I’m seeing today are at 1.5%

Why wouldn’t you keep most of that cash in bonds instead which are earning ~5% (VBMFX 5% YTD) and can be sold to replenish cash for expenses when needed in a market crash like we’ve experience recently?

@George: My wife and I have enough in bonds and cash for five years‘ expenses. IF we reduced our expenses we could stretch this to seven or eight years. So, to answer your question, because we feel very good knowing that when the market drops we have nothing/very little to worry about. We have enough money to support our lifestyle for the rest of our lives, with enough in stocks to stay ahead of inflation. The decision we made was that we’d made enough at the roulette table, so why keep playing if we didn’t have.to.

The mix of the cash and bonds is simply to edge our bets as bonds can take a hit too – on the cash front, we are still getting 2%.

Hope that explains it.

Do you mind sharing where you are getting 2% in cash?

Other than a few bucks in CDs (that are about to expire) that pay ~3%, the best I’ve found is closer to 1.5% for cash.

Great article! … I do something very similar.

I use this allocation and like you I never sell:

Cash 5%

Bonds (VBTLX/BND) 5%

US Stocks (VTSAX/VTI) 50%

International Stocks (VTIAX/VXUS) 20%

Real Estate (Home Equity + VGSLX/VNQ) 20%

To cover “No-Sell Rebalancing”:

I use dollar cost averaging weekly to buy a fixed dollar amount in any category that is underweighted

To cover “Bear Market Buying”:

I use 3 ETF limit orders -5% =1 share ; -10% = 2 shares ; -15% or more = 3 shares

(Whenever any of these get executed, I wait till market closes and replace with new limit orders)

This approach removes all emotion and I don’t watch CNBC anymore ;-)

Nice, cool to see how you tackle these issues!

Where did you place the Real Estate and International? Taxable?

Great Post! In particular I loved the section “Never Sell”. Way too hard to decide if to get out of the market and then when to get back in. I have friends who switched to 50% cash a few years ago expecting a crash and are still having trouble pulling the trigger and getting back in.

I just let it ride. Few years from retirement. Twice a month I get paid and add money to my 401k, HSA, ROTH IRA and my wife’s ROTH.

Thanks for the article.

Rob (the guy with all the kids in Maryland)

Good to hear from you, Rob, and glad you enjoyed the post!

Yes, getting back in must be excruciatingly difficult so that’s why I buy low-cost, diversified funds that I know I’ll never want to sell and then I never sell them :)

If this is inappropriate, please delete.

Jason Zweig wrote a great book, “Your Money and Your Brain”. It addresses many of the issues you faced, the anxieties, the temptations, and so on. Jason addresses these issues and shows you the biology behind some of it and why the intensity of feelings are so strong. This book was recommended to me by Paul Merriman and I found it to be very helpful over the years in making the decision to stay the course and to follow my plan. I wish it was available before black Monday in 1987 when the market fell 22.6%. In one day!

Added it to my list so thanks for the recommendation!

Hey Brandon, another great post. Been a long time listener to your podcasts. I received a withdrawal from a 457b plan April 1st. I had to set up a withdrawal schedule a year ago and once selected no choice to change it! I knew that I had to take the scheduled withdrawals so I had long ago switched to about a 90% bond allocation. So the impact wasn’t as bad as it could have been. I used the money I received to max out Roth contributions for my wife and I. It felt super icky buying into the market in early April but I forced myself to do it in two chunks over two weeks. I kept thinking the market would drop again, and I should wait, but did it anyway. So glad I bit the bullet and did it as the market has not gone down another 30% as some “experts” were predicting. ** how often do you re-balance? ** I’ve typically only done it once a year, but perhaps I should be doing it more often?

Yeah, it was hard putting money in when the markets were falling so quickly but I’m glad I did too.

I don’t rebalance properly unless my portfolio gets really out of whack. Instead, I just correct my allocation with new money once a month, as I described in the post.

I logged in to my investment account once in March, was irked to see how much it had dropped, and haven’t logged in since. My rationale is that some of the most successful portfolios are those of people who have died, and that it wouldn’t do any harm to just ignore the whole thing for a bit since there wasn’t much I could do about it. That “strategy” seems to have preserved my portfolio and my mental health.

I am early retired and my husband works a part time job he enjoys. While we no longer actively contribute to our portfolios (except for maxing out Roth IRA contributions while our tax rate is low), we have enough other income that we don’t have to draw from our investments. If we were still contributing, I would plan to follow my same contribution plan whether or not the market was rising or falling.

I appreciate this post. Some of your deep dives, like this one, have been really helpful in navigating investments.

Hello, I have a small correction for the formulas in column F on the No-Sell Rebalance sheet:

=MAX(IFERROR($D$2/$B$2,0),IFERROR($D$3/$B$3,0),IFERROR($D$4/$B$4,0))*B2

This allows a 0% allocation of any of the three asset types, like for instance 0% Bond allocation when working full time during the accumulation phase.

Thanks, Drew. I just put those categories as an example and assumed people would add/remove/rename the rows based on their own investments. Didn’t think about people having a temporary 0% allocation though so thanks for the new formula!

I had a question about this part of the spreadsheet as well. I think I must be thinking about it differently. Shouldn’t the totals in the Current Balance and the Fully Rebalanced columns agree? I’m assuming you’re just looking to rebalance your portfolio without adding anything to it in columns F:G, I don’t understand the point of the MAX formula, so hoping someone can help me out here. When I was looking at it, my instinct was to just take B2*$D$8 in cell F2 and then drag that down. That would tell you what the current balances would be with your target %ages and no change to the total balance. Then you could either rebalance, or take the additional cash to try to get to those targets, which I think column I is already doing.

I was trying to figure this out as well…my “fully rebalanced” and “to fully rebalance” columns magicked up an extra almost $300,000 that I really wish I had. Why don’t the “current balance” and “fully rebalanced” totals add up to the same amount? Especially since columns D, F, and G aren’t affected at all by changing the “to invest” amount. I’m afraid I need some further explanation to understand what’s supposed to be happening here.

Excellent system. Fantastic Post. I really like the automated progression of increased share purchases as “the knife falls” so you can slowly catch it without cutting yourself! Thx for sharing!

Thanks for sharing! Always love the perspective! Out of curiosity, where are you putting your real estate nest egg?

Cheers!

Right now it’s just in a money market account but need to find somewhere better for it.

Great post, and interested to hear thoughts from your financially intelligent readers. I am a big fan of your allocation set-up, as I follow a very similar % in my portfolio. I love the don’t sell rule for your FI portfolio, as I follow that as well – except to grab a free TLH opportunity, which I did at the market dump. Only thing I do differently is buy strategy – I don’t change it at all based on the direction of the market. I add the same amount at the same periodicity at all times – and follow my allocation strategy. Perhaps I will rebalance if the portfolio becomes too “out of whack,” but in general, I won’t invest more if the market goes up, down, or all around. Other thoughts from your readers on this?

That’s a great way to go about it and is what I did when saving for FI!

Those spreadsheets are clever. I made something similar but I have to manually calculate a few areas. I’ll probably steal some of the equations! I’m not sure if I missed something and your situation is quite different than mine but do you reallocate a few times a year (besides having those limit orders)? I don’t have anything besides passive income coming in – and I typically rebalance once a year after I do my taxes.

I think that having a strategy to keep yourself from doing anything inadvisable is brilliant. I’ve done the same thing. I think that it’s also important to remember that anything you decide is ultimately arbitrary – the only control we have is over our own behavior. And somehow letting go of the illusion of any other control makes me much more relaxed about not having income from a job or an entrepreneurial pursuit. If my plan fails, it won’t have been for self-sabotage reasons!

Hey Liz, nice to hear from you! Hope you’ve been doing well!

Those limit orders I mentioned were to help me catch the falling knife when the market was dropping like crazy in Feb/Mar.

During normal months, I usually just enter my numbers into my spreadsheet, see where things are out of balance, and then deploy any cash I have to try to fix that imbalance.

I considered doing a proper rebalance in March when stocks tanked but since I still had cash on hand, I just used that to top up my stock funds. If we see another big pullback and I deplete most of my cash though, I’ll definitely be selling bonds to buy more cheap stocks.

Thanks for the reply. It makes sense since you have income coming in, you just buy to rebalance (mostly). The mechanics of how early retirement income ACTUALLY works for folks has always been an endless source of curiosity for me (that seems like a thing only nerdy FI ppl must say). I set all my stuff up so that the income from my after tax investments would cover all my cash flow needs without having to sell any assets but I have turned off and on dividend reinvestment as I need or don’t need some cash flow and then once I figure out my tax liability or refund, rebalance by making my Roth IRA contribution and then making adjustments in the retirement accounts.

My taxes have been a bit unpredictable, I retired in 2017 but I deferred income into 2018 and made another private equity investment in 2019 and (I think) I can finally better predict what I’ll pay in 2020. The markets have been so volatile, I have been holding off on rebalancing, not that I’m trying to time anything, just that I would like my percentages to fall in the ranges I have set for at least a hot minute. Like if I had done it on Thursday last week, today they would already be out of whack.

Other quick question – No international bond index funds for you? Why/why not?

Liz,

I have a system very similar to the one presented here, but I’ve added “portfolio drift” as an indicator of when rebalancing is called for. Drift is basically how far off from my target percentages my investments have moved. As you mentioned, your portfolio will never be perfectly targeted for long. This is especially true once you’re no longer rebalancing by investing new money (i.e. when you’re actually retired). Once my drift exceeds 3% for a few days, I manually rebalance. Note that you can also rebalance by selling relatively over-valued assets in your portfolio when you are in the “draw down” phase of your financial life. By way of reference, I manually rebalance once, maybe twice, per year excluding the minor monthly rebalances I perform when I sell assets to fund my living expenses.

I follow Betterment’s calculation of drift in my own spreadsheet.

https://www.betterment.com/resources/portfolio-drift-rebalancing/

Thanks for the recommendation. I think that’s good advice. I wouldn’t want to touch it more than once or twice a year anyway – after being borderline obsessed with how things were looking those last 18 months before retirement, I’ve enjoyed not thinking about it at all for 3 years. Then when I had to think about it, I deferred, lol. Imma recreate my portfolio spreadsheet with Brandon’s stuff as well as this drift calculation and see if I can sort out a slightly tighter management process. Thanks again Grant!

Thanks for the info!

My wife and I reached FI a few years ago, at 40. She retired at 41, and I retired at 43.

We haven’t changed our strategy at all. My pension pays for our monthly expenses. And bc of the virus we have been spending less each month. So, all our excess money goes into 90% index, 10% gambling on individual stocks.

Whatever money we got our hands on went into the market ASAP. We try not to time the market, but sometimes we can’t help it either. We may wait a or so, but it all eventually goes into stocks.

We used to keep a large emergency fund bc we owned rental properties. But we got rid of all of them, the last one a few months before the outbreak. Very lucky.

So, now we keep a relatively small emergency fund. Less than 3 months. But, it’s only bc my pension is currently larger than our expenses.

So, basically, no changes with our strategy. But whenever we have money. And never sell.

We are no longer in the accumulation phase. We retired 13 yrs ago. But we do use rules. The rules I set down for us revolves around rebalancing. We don’t use annual rebalancing based upon some arbitrary anniversary date. We use guard rails. Our current desired AA is 65/35. This past Apr 10 I found our AA to be 57/43. So we sold $100k worth of bonds and moved it into VTSAX. All done within our Trad IRA and our ROTH, so no tax implications. The AA has risen since then to ~68/32. When it hits 70/30 I will rebalance again, but in the other direction. I use 5 point changes either direction as our guard rails.

Why are you using only stocks and bonds? What about REITs and gold as asset classes?

Long time reader, but have never commented before. Another excellent post. Thank you! We have nearly identical asset allocations and my reasoning around rebalancing and adding cash is strikingly similar to yours. I’m happy to go to 100% stocks when they are (relatively) cheap, but will tack back to 10% bonds where I am most comfortable (right now I’m at 3.4% bonds). I plan to slowly dial that up to 20% over the next 10 years. Naive and probably silly question for you. Do you keep your spare cash at Vanguard to fill the limit orders? One thing I’ve struggled with is the time it takes to get my money from Ally bank (pretty good interest rates) over to Vanguard/Fidelity to place the orders. How do you deal with this? Thanks again for such wonderful content. I’m (finally) going to try your spreadsheets now that the craziest semester in academic history is over (I’m a neuroscience prof).

I set myself up at 70% world wide equities and 30% world wide bonds years ago. The last year or so I wished I was 90/10 and told myself I’d transition to that the next time the market crashed. Then it crashed and I momentarily forgot that was my plan.

When I remembered, I decided to assume this mess could go on a solid year, so I should DCA from 70/30 to 90/10 over a year. So every day I’ve moved bond funds to equities, and so far I’m glad. We will see if I’m glad in 10 years!

I just wish I could automate it to do it daily within vanguard. oh well.

Thanks for sharing this Brandon! Great post!

I am guilty of trying to time the market this time round.

I have been waiting for about 2 years for the market drop, and when it did, i froze.

I thought it must drop further…

“Day ain’t over yet”

I will say I am glad I got to experience a large downswing, b/c the last time it happened I didn’t really have much money invested. But…. I wonder how I would have handled it had we not got a quick recovery.

I think over all, I did well, and I actually sold some bonds to buy stocks (rebalance/market time) and I also upped my 401k contributions and maxed out, rather than waiting on end of year.

I do think I may hold a little more bonds in the future, but we shall see. Great post btw.

I feel like I could have written this post.

I behaved exactly like you, except maybe that I caught your 2008 version of the falling knife :)

I’ve also set limit orders for VT (I mostly invest in a world stocks ETF, being myself a non-US resident), and constant monetary amounts for each purchase (like DCA). I also applied the mental trick of playing with a small – almost insignificant – portion of my Asset Allocation to give myself a false sense of control and to silent my monkey brain!

VT topped at $83 in Feb 19th, I purchased it down to $54. I had fuel to go down to $45 or so before having to sell bonds, and down to $40 cleaning all my bonds. At inception, in 2008, VT share price was $50, to give you some perspective. In 2008!

I think I still have pending limit order at 53, 52, and 51. Which means I have too much cash at hands, sitting in my brokerage account.

I’m not sorry for that. I actually felt quite a bit uncomfortable with such a flash crash. I’m happy it’s recovering fast and my portfolio is almost at Feb 19th levels – even though we’re far from Feb 19th market top. power of having purchased low. Sometimes I feel guilty for having stolen cheap stocks from panicking investors… And at the same time I bite my fingers for not having gone all-in on March 23rd. It’s a continuous game of regrets, guilt, greed and fear. Much better to sit on autopilot and forget :)

Really, if I map my behavior during last 3 months to yours, the differences are negligible :)

Thanks for writing this up Brandon!

This is almost exactly what I do. The allocation numbers are different (I’m more conservative in my FI portfolio), but other similarities:

– Rebalancing with new money

– Shifting allocation instead of getting in/out

– Setting allocation rules based on drawdown

Served me very well through the recent crash. I was never down more than 13%, which really helped me stay the course when S&P was down 30%.

Thanks for your post. I’m a longtime reader but I think this is my first comment

Hi, I liked your post. I’ve heard people like JL Collins say they don’t but international stocks because VTSAX basically has enough US stocks that operate internationally like Coca-Cola etc. What are your thoughts on this? Is it just preference? (Or did I misinterpret JL Collins?) Thanks.

After you catch the falling knife, how do you ease back into bonds/cash? Would an automated rebalancing portfolio achieve roughly the same effect (e.g. roboadvisor)?

I like the idea of preset limit orders. Unless I’m missing something, though, those are only cash->stocks. I’m not sure if the chance of catching a flash crash or sudden market downturn outweighs the benefit of a steady 3% in a rewards checking account.

Thought about leveraging eTrade’s API to do either auto-rebalancing or some sort of trailing limit exchange. Still wouldn’t be fast enough to catch a flash crash… but what other choices are there?

What are you thoughts on your portfolio compared to what robo advisors suggest re: diversification? Have you ever thought of simply following a robo advisor portfolio or one based on the underlying modern portfolio theory?

Sticking with “the plan” is a serious test of your nerves during times like these. All of our stock purchases are done on the first on payday. Sometimes I forget and it’s the 5th or 6th, but that’s the rule. We made a couple “great” buys recently because the market drops coincided with first week of the month. We also bought during one or two of these upturn periods as well. You look at the price change and want to kick yourself for missing the big score, but just remind yourself “you didn’t know it was coming. This is the plan. You’re doing what you’re supposed to do.” I made the biggest TLH of my investing life sometime in late Feb/early March, but could have done an even bigger one if I waited another week. There’s nothing wrong with doing “good enough.”

I don’t have fancy formulas for my rebalancing sheet like your example, but I have a simple setup that shows what my asset allocation ought to look like, what it’s at as of the 1st when I update my sheets, and the difference. I do some manual math to figure out where the next buy should go based on that.

Thank you for this new article Brandon, it’s great to see (and it’s reassuring), that global cap-weighted equity index like FTSE All-World has it’s place on the top of efficient frontier for US and International stocks (~57% US and ~43% ex-US right now). I follow this index via Vanguard FTSE All-World UCITS ETF (ETF listed on major european exchanges).

Apart from 1-year emergency fund (kept on high-yield saving account), this Vanguard ETF states for 100% of my investments. I’m 32 and don’t own any bonds.

It was fascinating to see these huge market swings lately (10% up, 10% down etc.). Now I know, that my portfolio can be 100% equities. I invest since ~2014 and it was my first experience like this.

Greeting from Poland.

Great post Brandon! I am not aiming for early retirement but am 8 years from earning a Federal pension. I define FI as being able to live comfortably on unearned income and that is my goal. Majority of assets are invested in the Federal TSP Lifecycle 2030 fund, along with Roths and Trad Iras from Vangaurd. We have no debt and live comfortably on my take home pay with a minimalist lifestyle. I continued to DCA into the TSP the maximum allowable by law during the Covidcrash and found myself hoping that prices stayed low for several more years so that I could accumulate more shares each payday. Guess I internalized all the FI blogs that I have read. I am about 30% Treasury bonds and 70% stocks, this will adjust towards 65% bonds as I get closer to retirement. We will be able to live well off of pension income and safely drawing from the TSP starting in 8 years, while putting off collecting SS until age 70 to maximize the benefit. Why swing for the fences when a double will win the game?

I love the structured rules based approach. Set it up when you’re thinking clearly, then follow the rules!

Do you rebalance monthly? I’ve read on Bogleheads that the optimal rebalancing strategy is less frequent than that, but I don’t have the math to prove it. Something about momentum.

The efficient frontier graphs were eye opening. The advice that which asset allocation you choose matters less than sticking to one is pure gold (and counterintuitive). Glad you put this post together. Timely.

Great post, thanks for sharing! I’d not considered automating things like buying and selling to this level with things like limit orders. I will definitely be revisiting this post as we determine our way ahead.

The latest market turmoil taught us we’d like a one-year emergency fund instead of six months. Otherwise, we are basically 100% stocks while employed. I see us going to 10-20% bonds once we are closer to FI.

I also finally caught up on your podcast (I only found it about 1.5 years ago), but wanted to thank you for all the great information. Looking forward to more!

How did you come up with the numbers that show some international exposure outperforming (60/40ish being optimal)? If I run a backtest using VTSMX and VGTSX. I show a 100% VTSMX outperforming going back to 1997. Some brief outperformance if you stop at 2008-2010, but not much. I’ve tried different combinations of contributions, rebalancing, etc, and VTSMX seems to outperform. So I’m just wondering what inputs and assumptions went into you making this determination.

With correlations being so high across the world right now, I don’t see international giving as much diversification as it once did. It may outperform due to being earlier in the long term economic cycle, but there are also other risks to take into account such as currency risk, less robust legal protections for investors, or cultural differences which do not prioritize investors as much as they do in the US. What are your thoughts?

Great post MADFI,

Two questions, sorry if already answered in your post, I am reading this while working and phone calls

– Do you consider real estate as part of your fixed income?

– How often do you rebalance when out of range?

Keep the good work

Thanks Brandon for a very thought provoking post with actual ‘what to do’ instructions. I’ve been following your blog for several years and love your podcasts. I send the link to your podcasts to anyone interested in FI. It’s one of my go-to resources, lots of other blogsites haven’t fallen by the wayside!

Very interesting discussion on FI investing strategies. I started off buying a lot of ETFs, bordering on stock picking, and then went to stock picking. Now it’s like a hobby that I enjoy. The FAANG/tech stocks have helped immensely in turbo charging my portfolio. I’m sure my approach is down the risky end of that efficient frontier chart!!

There are lots more options open now to New Zealanders to buy small amounts, regular investing, access to Vanguard funds etc than there were when I started out 8 years ago. I think I would use your strategy, once we are past the wealth building phase. The tail wind we have achieved from stock picking, mixed with some ETFs, has achieved a nearly 3% advantage over the S&P 500 benchmark, which leads to healthy compounded gains when we reach FI. Your article did stop and make me think I should get a small amount of bonds now though.

We are in our 50s, still like working for an income. However, I am aware of not leaving too much of a complex mess for our kids to take over, if they don’t happen to be interested in investing!! So thanks again for the post, we now have something to work towards to simplify things when we do retire. I know you won’t like this idea, but I’m actually looking at putting 1% of my portfoliio into bitcoin as a hedge against all the money printing going on

Hi Lesley I am also in NZ what are your thoughts on investing in VT or VTSAX from NZ, being that both funds are available in NZ.

I really like the idea of giving yourself a range so that you can trick your brain into thinking it’s doing something good, but yet you are also keeping it to a controlled safe zone.

I haven’t heard of this idea before, and I think it would work really for my brain as well! I may have to steal that idea, thanks =)

Great article! Do you, or would it have similar value, to use such a system for selling funds as they rise in value for the purpose of replenishing a spending account or for rebalancing a portfolio — selling $x or x% in x fund if its value rises by x%, then increasing the % amount sold whenever triggered by % value increases? I didn’t notice what system you use for triggering a sale in a fund for rebalancing or replenishing purposes.

Nice post. I have a very similar spreadsheet and system. I wanted to suggest adding a “portfolio drift” calculation to your spreadsheet. This will help you track the deviation of your actual asset allocation versus your target allocation. I wouldn’t be surprised if you’re drifting very little because you’re continually investing new money, but once you’re drawing down, drift happens a bit more quickly. I use 3% as my trigger for a manual rebalancing, though I’ve seen other percentages.

I use Betterment’s drift calculation: https://www.betterment.com/resources/portfolio-drift-rebalancing/ .

Another excellent article – appreciate all your legwork and creating the spreadsheet!

Still need to meet for that beer next time I’m back home in Scotland

So, with your limit orders, you have to have cash lying idle. Opportunity of earning from bond is lost.

Again, how is this not timing the market? The said 40% drop may never come and you end up waiting with cash.

I like your idea of moving allocation with new cash(income).

Since you are still generating income (blog, calculator, etc), directly investing your savings sounds better. As quoted by JLC (?) The best time to invest was yesterday.

Thanks,

Lokesh

to add:

you could also have looked at buying long dated PUT option (cheaper and no cash waiting for 30,40% drop) to hedge your portfolio value.

What a timely post — thanks!

Given that you only invest in three funds (the same as me), does that mean you haven’t tax-loss harvested anytime recently? I would have expected to see some other funds into which you’ve TLH’d, such as S&P 500 Index and some of the other Ex-US funds, but no?

Yessir. This is a very important and valuable article. I follow somewhat similar mental models and heuristics when it comes to (very) long-term wealth building. It’s kind of sad how many “smart and sophisticated” people fall in to the trap of market timing and predicting the future, and thus sabotage their long-term financial freedom. Interestingly, most of my friends who work in the financial sector fall in to this trap and never learn from their mistakes. In a sense, they’re living in an (ego-fueled) illusion.

‘As Mike Tyson famously said, “Everyone has a plan until they get punched in the mouth.”‘

100% This. This is a fantastic opportunity for people to really learn about themselves and their investing inclinations. COVID has just been the latest in series of “punches in the mouth” for me over the last year. The opportunity to learn about myself has been unparalleled. Thanks for the taking the time to share the growth you’ve seen from it Brandon!

How do you set up a limit order in Vanguard? I’ve tried looking on Vanguard support, Google, and YouTube. All I can find are explanations of what Limit Orders are– but I can’t find the button to actually execute it, or any sort of how-to content!

Thanks so much for the great idea. I’m holding too much cash too and wondering how to deploy it. Think I’ll do something similar. But I dont think I’ll be buying bonds.

I like vtsax and cash (in a high yield savings account). Nice and simple. I dont think the added 1% return in bonds over cash is worth the risk since the bond price could go down, in case I wanted to liquidate and use for real estate or another investment.

My portfolio is about 80% vtsax and 20% cash. I’m thinking I will deploy 1/4 of my cash if/when market drops 20% from the top on Feb 19th, another 1/4 if/when if goes down 30% from top, and a final 1/4 if/when it goes down 40%. Then I would be 95% vtsax, 5% cash and have bought at a big discount.

But like you, I’m thinking what if the market NEVER drops to those low numbers. Then I guess it’s not TOO bad to have that cash, i would probably use it for another house hack or some other investment. What do you think?

Another awesome post man. Great to see you writing again with some technical information and strategy. Those are my favorite posts of yours. I can’t thank you enough for all you have done to improve my financial life. I first saw your blog 4.5 years ago. You set me on the path to FI. And this year, I’ve pulled the trigger at 35. Cant wait to hear the album!

Hi Brandon,

Thanks for your post, very insightful!

I am still far from reaching FI, but was wondering how you can have 3.5% withdrawal rates if you not selling your portfolio at all. Are you just withdrawing cash from dividends/interests and that’s more than 3.5%?

Thanks!

I had a very similar approach to the Mad Fientist with the Covid-19 stock drop.

I added new money on drops of approximately 10%, 15%, 20%, 25% and 30%. VTI was my target. I also increased the size of my contributions as the market dropped.

I had just made a $50K buy of VTI at about 31% below the 52 week high ($119/share) when my target price ($109.5) was approaching for my 35% buy in.

I got cold feet. Actually greedy more than cold feet as I decided to add the new money at a 38% drop. Instead of buying $80K of VTI at $109.50, I set a new target price of $107. VTI got as low as $109.49 before it started the climb back towards all time highs.

Man do I wish I had stuck to the plan. I’ll use the Vanguard limit orders as Brandon suggested to avoid changing course due to greed, cold feet or whatever else would stop me next time.

Not the worst outcome (no panic selling and still bought > $100K at between a 10-30% discount from the highs), but could have done significantly better by not outsmarting myself.

Hello, Love the site and the math! I run similar portfolios and strategies and enjoy your insight. I am curious as to why you chose the reference ranges you chose for your efficient frontier analysis. Why not use from say 1950 to present? It looks like you selectively used 1970-2008 for equities and 1960-2004 for bonds. As someone who ponders the inner workings of life I can’t believe you did this without a reason….please share :)

Hi.

Thanks for sharing the spreadsheet. Very timely and interesting. Wish I had that – ooooohhhh – say around 2-3 months ago…?? ;-)

Out of curiosity, looking at the last “crash” with the pandemic around Feb/March, and in my case using Australia VAS, VTS and VGS, you would only have used at maximum half your reserve of $100k, and never invested the last half (well so far anyway).

Are you happy that’s OK, or would you now tweak the Bear part as you have potentially missed out on a once in a lifetime opportunity?

(Don’t ask me, I only got it half right)

Cheers,

It’s like the beginning of this article came out of my own brain. I am 100% stocks as I’m in the accumulation phase of FIRE. However, I decided to move my HSA from HSA Bank to Fidelity because they offer much lower maintenance fees. And wouldn’t you know my luck, I made the transfer right before the market collapsed. Well I logged into my account everyday wishing that the money would make it into Fidelity before the stocks recovered, it took over a month. But at this point I was listening to the news and everything was shutting down. So I decided to wait and see. But then wouldn’t you know it the market started going back up. I still sat waiting for the next drop but it didn’t come. I have always followed JL Collins that its time in the market not timing the market and I should have stuck with that creed. If I had traded the funds as soon as I got them into Fidelity I would have almost perfectly bought the low with pure unadulterated luck. Instead, I just put my money back in today because the market is back where it was when I originally sold. C’est la vie. Knowing Murphy, I expect everything to go to crap again but I’m going to leave everything where it is. I prefer letting the markets do their thing and I don’t have to take responsibility for jumping in and out. Maybe when I retire I will switch to a 90/10 so I can have a little wiggle room to take advantage of corrections. Thanks for another great article.

Excellent post!

My wife and I are in our mid to late 20’s, and as such, we are in 100% stocks between all our various accounts. My plan is to pay down our mortgage faster when stocks are setting new highs every week, and throw more money into VTI when the market is down (like at the moment). We will start bonds when our mortgage is paid off. It seems like this is a similar strategy to re-balancing with bonds. A lot of people will say to never pay down your mortgage and invest instead, but I want the peace of mind that comes with a paid for house.

This is my first time through a bear market as an informed investor, and I will say that implementing my strategy was much more difficult than I thought it would be. It’s easy to just throw a random number at a mortgage payment when markets are high. It’s another thing to use that extra cash in VTI when you’ve watched it go down so much so fast. The fact that I developed a strategy in good times though really made it easier to execute.

Cheers!

I appreciate your honesty on this one. Despite knowing better after 30 years of investing, I too fell for the market timing trap. First I was sitting on cash from a home sale last year becaue my limit order never filled as the market kept climbing and I waited for a pull-back that never came. Eventually, I gave in and invested it…in mid February. Awesome. I held on through the drop in March but when the markets “clearly” got ahead of themselves on the recovery, I sold a little. After the recovery continued, I sold a little more. Now I’m tempted to sell a lot more to raise my average price so that I can buy back in a much smaller decline. Ugh!…I know better than to do this but it’s so hard to resist. Maybe it’s a lesson I have to re-learn every decade. Glad to know that even you have to manage this urge. Thanks again for sharing.

I am 46 starting late, just began buying stocks and getting finances in order at the peak of 2018. Originally I used the standard 3 index portfolio, but I wanted to utilize tax losses harvesting to reduce my tax bill. I found this easier with a slightly more complex portfolio, one still based on a grounding of simplicity, but utilizing a couple more asset classes, like value and small cap, international and domestic. This provided more stock groupings that could be harvested for losses. Unlike most, I harvested any loss over 20$. Because I was buying 100-300 dollars at a time, I had lots with very few stocks. Loss harvesting not only game me tax advantage, over time it made my lots larger.

This current crash is my first. I’ve done well though utilizing my loss harvesting to get big tax savings, never leaving the market, just shifting my investing areas of focus . It lasted long enough I had multiple harvest opportunities.

One of my investing rules has been to never second guess a decision. I sell stock or buy stocks, the price is what it is. So far this has worked well. Also, I never try to time the market, but I have done well by converting some of my cash savings into stocks when they were on sale, breaking it into chunks I’m case process go lower in a week it two.

So far I’ve done well in the crash and recovery and have found my strategy and nerve have held well.

Hi,

I hope you can advise here. I want to follow using the 3 fund portfolio and have my allocation setup appropriately across my 401k, IRAs and taxable account. However, I also have a decent portfolio in India (am an Indian citizen) which is for long term as well. Do you suggest I count this as part of my international allocation? I wasn’t sure since all of it is in just one country, and that too an emerging market.