Depending on your tax bracket, you may be able use tax-gain harvesting to increase your cost basis and reduce your future taxes!

Tax-Loss Harvesting

Tax-loss harvesting allows you to reduce your income taxes by temporarily selling your investments that have lost value!

Radical Personal Finance – Part Two

In part two of the podcast, the Mad Fientist explores some very powerful tax-avoidance strategies for early retirees.

Radical Personal Finance – Part One

Listen to part one of my Radical Personal Finance podcast interview where I discuss frugality, travel hacking, and financial independence!

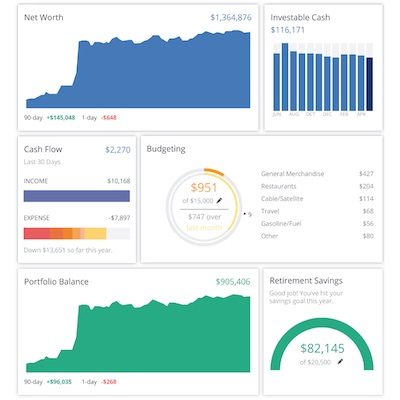

Personal Capital – The Best Investment Manager

Personal Capital is a free and powerful online investment manager that beautifully presents the most important information about your portfolio!