I’ve written a lot about the benefits of tax-advantaged accounts and why they are especially beneficial for people planning on retiring early.

I’ve even created a real-time experiment to prove that utilizing tax-advantaged accounts is the best way speed up your journey to financial independence.

What I haven’t done yet though is write a comprehensive post about all the ways you can access the money in retirement accounts prior to standard retirement age.

Today, I plan to fill in that missing piece of the puzzle and also determine which early-withdrawal method is best for early retirees.

Early-Withdrawal Penalty

The problem with tax-advantage accounts is that you could be forced to pay a 10% penalty when withdrawing your money before you turn 59 1/2 years old.

Since these accounts are for retirement (in the normal sense of the word), the penalty is the government’s way of discouraging you from spending the money early.

Luckily, there are loopholes you can exploit to get around the penalties so you can access this money during early retirement.

Standard Retirement is Part of Early Retirement

Before we dive into the various withdrawal methods though, it’s worth stating something obvious that people seem to miss.

Normal retirement is part of early retirement.

Here’s a highly-detailed diagram to help explain this even further:

People have said to me that they aren’t contributing to their 401(k)s because they plan on retiring early. That’s insane! Even if you plan to retire early, you still need money to live on in your 60s, 70s, and beyond so why not pay for those years with tax-deferred (or potentially tax-free) money?

Everyone should utilize retirement accounts for standard-retirement-age spending but for people who think they’ll have more in their retirement accounts than they’d ever be able to use after they turn 60 and want to start accessing that money during early retirement, here are your options…

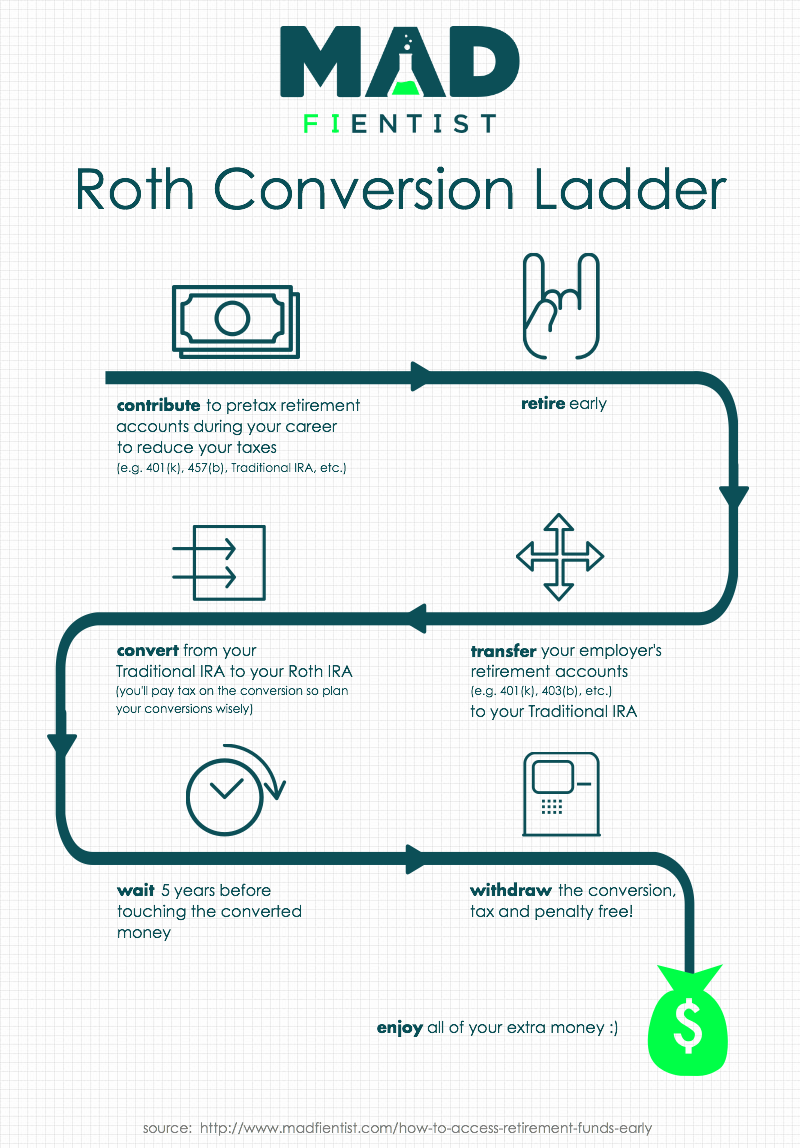

Roth Conversion Ladder

The first method for accessing tax-advantaged money early is the Roth IRA Conversion Ladder.

Here’s how it works…

- When you leave your job, immediately roll your 401(k)/403(b) into a Traditional IRA. Since all of these accounts are very similar, tax-wise, this conversion can be done immediately and there are no penalties or tax consequences to worry about.

- If you think you’ll need to access some of your retirement account money in five years, convert the amount you think you’ll need from your Traditional IRA to a Roth IRA. You will pay tax on the amount you convert so make sure you’re in a low tax bracket when performing the conversion and only convert as much as you need.

- Wait five years. While you’re waiting, you can do additional conversions so that you have money to access in years 6, 7, etc.

- After five years, you can take out the amount you converted without paying any additional penalties or taxes (you were taxed in Step #2 when you executed the Traditional-to-Roth conversion).

Here’s a sexy graphic I created that lays out the process:

I know people often try to explain these concepts on forums and elsewhere on the internet so here’s a direct link to this image, in case you want to share it: www.madfientist.com/roth-conversion-ladder-graphic

Pros

The pros of this method are:

- You can minimize your taxes because you can choose which years you do the conversion based on your income in those years. If your income is low enough, you could potentially execute tax-free conversions, which would mean you will never have to pay any tax on that money!

- If you don’t need to use the money, you can leave the conversions in your Roth to grow tax free until you do need to use them.

Cons

- You have to wait five years after executing the conversion to withdraw the money without penalty.

- You pay tax on the conversion five years before you can use the money so you lose out on the tax-free growth that money could have provided.

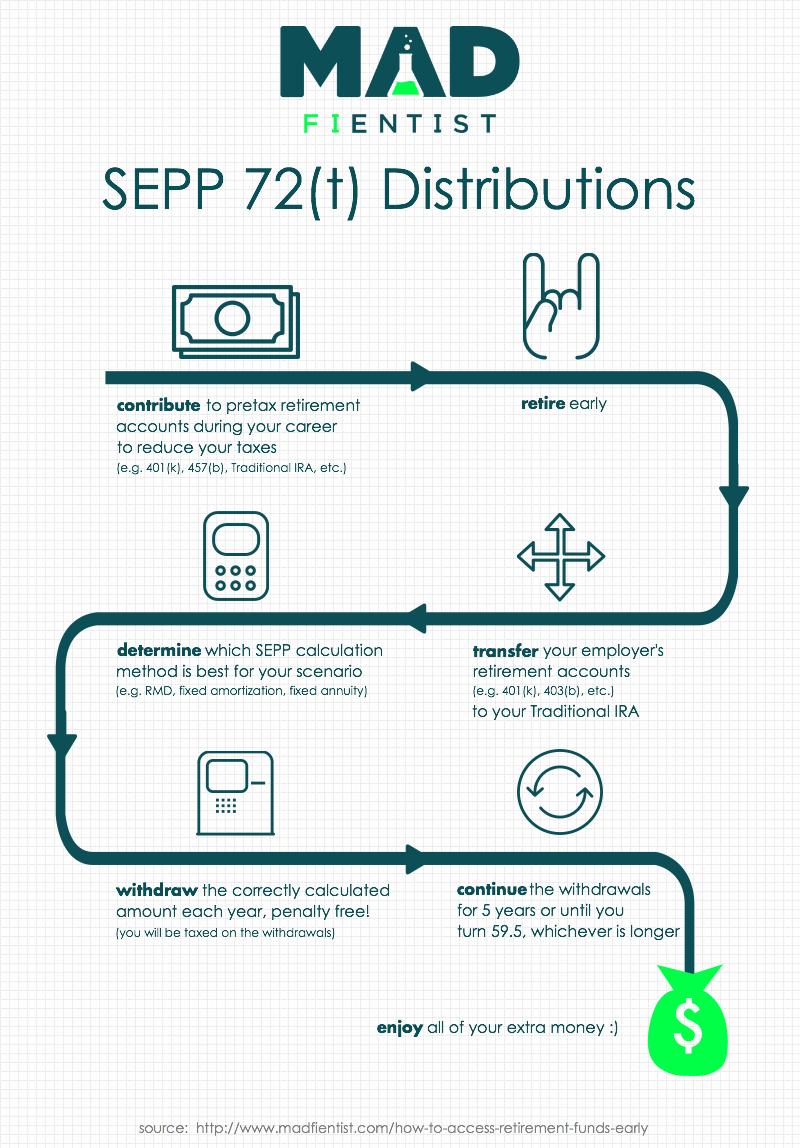

72(t) Substantially Equal Periodic Payments (SEPP)

Another popular early-withdrawal method is 72(t) Substantially Equal Periodic Payments (SEPP).

Here’s how it works:

- When you leave your job, immediately roll your 401(k)/403(b) into a Traditional IRA.

- Determine how much you think you’ll want to withdraw from your retirement accounts every year until you turn 59.5

- Calculate the three possible withdrawal amounts (see this IRS document for more info) and pick the one that is closest to the number you decided in Step #2.

- Speak with a tax professional to ensure that your Step #3 calculation were correct.

- Withdraw (and pay tax on) that amount every year. Depending on the method you used to calculate the withdrawal amount, you may need to adjust the amount you withdraw every year.

- (Optional) If you find that you need to withdraw more money or you don’t need to withdraw as much, you can change the IRS method you use to calculate your withdrawals only once so make sure you’re happy with your change.

- Continue making the withdrawals for five year or until you turn 59.5 (whichever is longer). If you stop the withdrawals or if you withdraw the incorrect amount, you could face steep penalties so definitely don’t do that!

Here is another sweet graphic, depicting the SEPP 72(t) process:

And here’s another handy link specifically for this image: www.madfientist.com/sepp-72t-graphic

Pros

- You pay tax on the withdrawal in the same year you spend the money so your money can grow tax-free for as long as possible.

- You can start withdrawals immediately after early retirement so if you don’t have a lot of money in taxable accounts to hold you over, you can start tapping into your retirement accounts right away.

Cons

- 72(t) distributions usually require help from a tax professional to set up correctly.

- You must continue withdrawals until standard retirement age, whether you need the money or not.

- You must continue withdrawals, whether it makes sense to or not (which means you could be forced to sell when the markets are down).

- If you stop withdrawals or withdraw the incorrect amount, you could be forced to pay a penalty on all 72(t) distributions you’ve received, even in previous years.

Pay the Penalty

Another method I didn’t even consider until recently is to just pay the 10% early-withdrawal penalty and take money out of your retirement accounts whenever you need it.

Since I try to avoid penalties whenever possible, I never considered this as an option but Joshua Sheats from the Radical Personal Finance podcast brought this strategy to my attention recently.

One of his podcast listeners suggested that even if you plan to pay the 10% early-withdrawal penalty, it still makes sense to contribute to tax-advantaged accounts over ordinary taxable accounts.

This is quite a surprising conclusion so to see if the listener’s theory was correct, he ran some numbers (listen to this Radical Personal Finance podcast episode to hear him describe this in more detail).

He then asked me to run some of my own numbers to see if I reached the same conclusion and I did. My analysis is described below and was a big part of the reason I decided to write this post.

So simply taking money out of your retirement accounts early and paying the penalty is a viable option and has the following pros and cons:

Pros

- No advanced planning is necessary

- You can access the money immediately, whenever you need it, and you don’t have to pay tax in advance.

Cons

- You have to pay a 10% early-withdrawal penalty, in addition to the taxes owed.

Other

There are a few other ways you can avoid paying the 10% early-withdrawal penalty that are worth mentioning briefly.

For example, you can withdraw retirement account money early if you become disabled or if you use the money to pay for education expenses or for a first-time home purchase. None of those strategies are particularly useful for early-retirement planning though so I won’t elaborate on them here.

You are also able to use IRA funds to pay for medical expenses that exceed 10% of your gross income so if you aren’t lucky enough to have access to the Ultimate Retirement Account, you could potentially use your IRA to pay for medical expenses during early retirement (although you’ll still have to pay tax on the withdrawals whereas you wouldn’t with an HSA).

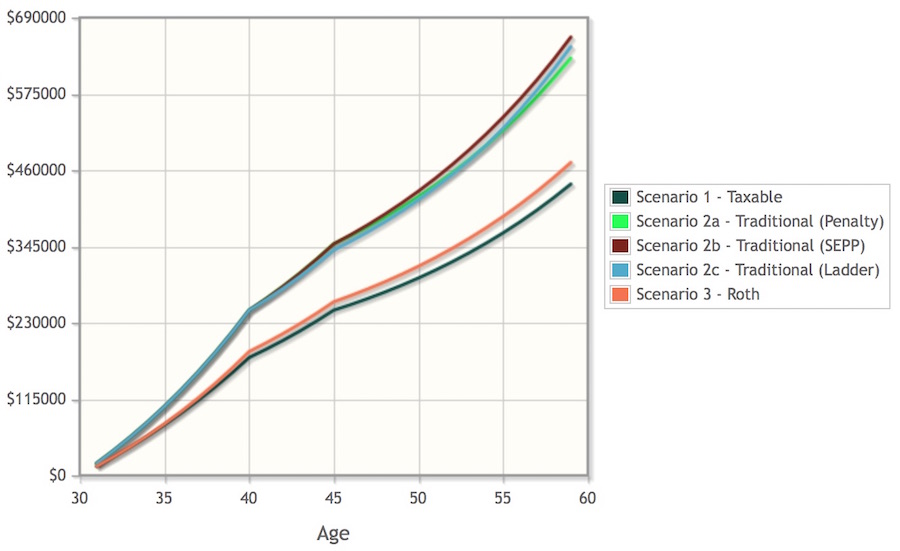

Comparison

Now that we’ve described the various options, let’s see how they stack up against each other by running some numbers on a hypothetical early-retirement scenario.

Assumptions

Imagine a 30-year-old woman who plans to retire when she turns 40.

Once she retires, she won’t need to access the money in her retirement accounts from age 40 to 45 but she’s going to need to withdraw $9,000 of her money per year from the age of 45 through to when she turns 60.

She’s in the 25% tax bracket during her remaining 10 working years and will drop down to the 15% marginal tax bracket when she retires.

She has $18,000 of pre-tax money to contribute to an account every year during her career so lets see what her options are:

Scenario 1 – Taxable

The first scenario is she just contributes money to a taxable account. This is the easiest option and what most people would do if they knew they needed to access that money before standard retirement age.

Since she’ll be taxed on the money before she puts it into the taxable account, she’ll only be able to add $13,500 ($18,000 – 25% tax) to her investments every year. She will also be taxed on the growth of those funds at 15%, since the funds are in a taxable account.

When she reaches 45 years old, she just starts withdrawing $9,000 per year and she doesn’t have to pay any tax or penalties because she already paid tax on that money before she contributed to the taxable account.

Scenario 2 – Traditional

In scenario 2, she contributes $18,000 to her Traditional 401(k) every year. Since 401(k) contributions aren’t taxed up front, her full $18,000 can be invested.

When she turns 45 and needs to access $9,000 of that money every year, she has a few options:

Scenario 2(a) – Penalty

Her first option is to just start withdrawing $9,000 every year starting at age 45 and simply pay the 10% early-withdrawal penalty.

Scenario 2(b) – SEPP 72(t)

Her second option is to set up SEPP 72(t) distributions to withdraw $9,000 every year, starting on her 45th birthday, that continue until she turns 60.

Scenario 2(c) – Roth Conversion Ladder

Her final option is to build a Roth Conversion Ladder.

In this scenario, she immediately converts her 401(k) into a Traditional IRA when she leaves her job at 40 and converts $9,000 every year from her Traditional IRA to her Roth IRA. That will allow her to withdraw $9,000 every year from age 45 onwards.

She will stop the conversions at age 55, because she’ll be able to withdraw her money after she turns 60 penalty free anyway so no need to pay tax on that money five years earlier than necessary.

Scenario 3 – Roth

In Scenario 3, she decides to contribute to a Roth 401(k) instead. With a Roth, her money is taxed before it goes in so she’ll only be able to invest $13,500 every year but that money will grow tax free and she’ll be able to take those contributions out whenever she wants (since she already paid tax on that money).

Graph

Here’s a graph to show how the various scenarios play out:

If you’d like to download the spreadsheet that was used to compute these results, click here!

Let’s break things down into the various stages of her career and retirement…

After Working Period

It’s not surprising what each scenario looks like after the end of her working career.

| Scenario 1 – Taxable | $177,523 |

| Scenario 2 – Traditional | $248,696 |

| Scenario 3 – Roth | $186,522 |

Scenario 2 (Traditional) is the winner, based on total dollar amount, because no taxes were paid upfront so all of the money was invested and was able to grow tax free.

Scenario 3 (Roth) is slightly better off than Scenario 1 (Taxable) because although both were funded with after-tax money, the Roth was able to grow tax free.

After 5-Year Conversion/Waiting Period

After the five-year waiting period, where she doesn’t need to touch any of her retirement account money but is no longer working, the winners are Scenarios 2a and 2b. This is not surprising because the money in those accounts has been allowed to grow tax free without being touched.

| Scenario 1 – Taxable | $248,986 |

| Scenario 2a – Traditional (Penalty) | $348,809 |

| Scenario 2b – Traditional (SEPP) | $348,809 |

| Scenario 2c – Traditional (Ladder) | $339,676 |

| Scenario 3 – Roth | $261,607 |

You can see that the Roth Conversion Ladder scenario (Scenario 2c) is slightly less than the other Traditional scenarios. This is because when converting money from the Traditional IRA to the Roth IRA, taxes are paid on the conversion so some money and earnings potential is being lost to the government every year.

Final Totals

Once our fearless fientist turns 60 years old, she will have contributed exactly the same amount of pre-tax money and withdrawn the same amount every year in each of the scenarios. The only difference is the type of account she’s contributed to so that’s the only factor affecting the final balances in her accounts at age 60.

Here are the totals:

| Scenario 1 – Taxable | $469,799 |

| Scenario 2a – Traditional (Penalty) | $672,827 |

| Scenario 2b – Traditional (SEPP) | $706,892 |

| Scenario 2c – Traditional (Ladder) | $691,465 |

| Scenario 3 – Roth | $504,620 |

Wow, what a huge range of values!

It’s important to mention what types of accounts the money is in, since $1 in a Roth is more valuable than $1 in a Traditional IRA (because you won’t have to pay tax when you withdraw from the Roth).

| Scenario 1 – Taxable | $469,799 in a Taxable Account |

| Scenario 2a – Traditional (Penalty) | $672,827 in a Traditional IRA |

| Scenario 2b – Traditional (SEPP) | $706,892 in a Traditional IRA |

| Scenario 2c – Traditional (Ladder) | $604,046 in a Traditional IRA and $87,419 in a Roth IRA |

| Scenario 3 – Roth | $504,620 in a Roth IRA |

It’s hard to see a clear winner though, since the money is scattered across different types of accounts that are treated differently tax-wise.

To help make it all clearer, let’s add another assumption to our hypothetical scenario…

Let’s assume that our now standard-age retiree wants an additional $45,000 to use every year and she’s going to fund it by withdrawing from these accounts. She’s not worried about when the money runs out, because she has other money to fund her essential expenses, but she’d obviously like for the money to last as long as possible.

So how long would each of these accounts last?

Here are the ages at which her accounts will be completely depleted in each of the scenarios:

| Scenario 1 – Taxable | 76 |

| Scenario 2a – Traditional (Penalty) | 86 |

| Scenario 2b – Traditional (SEPP) | 90 |

| Scenario 2c – Traditional (Ladder) | 90 |

| Scenario 3 – Roth | 79 |

Incredible! By contributing to a Traditional 401(k)/IRA and then doing either a Roth Conversion Ladder or SEPP 72(t) distributions, she could have almost 15 extra years of elevated income (when compared to simply investing in a taxable account)!

Surprising Conclusions

There are a few surprising conclusions here.

The first is that even if you don’t want to mess with things like Roth Conversion Ladders or SEPP distributions, it still makes sense to max out your pre-tax retirement accounts and then just pay the early-withdrawal penalty! The Penalty scenario (Scenario 2a) has over $200,000 more than the Taxable scenario (Scenario 1) by age 60 and will provide an additional decade of elevated income during standard retirement!

The second thing that surprised me was that it’s better to do SEPP 72(t) distributions instead of a Roth Conversion Ladder.

Since you have to pay tax on the conversion five years in advance of accessing the money in the Roth Conversion scenario, you lose out on tax-free growth that you don’t in the SEPP scenario. That’s why the SEPP scenario has $706,892 by age 60 whereas the Conversion Ladder scenario only has $691,465. This makes sense but it’s just not something I’ve thought about before.

My Plan

Obviously this hypothetical example is not perfect, because it assumes consistent growth with no fluctuation year-to-year, but how do these conclusions affect my own personal plan?

Luckily, I’ve taken full advantage of all the pre-tax accounts I’ve had available to me during my career, even when I didn’t think I could get that money out early, so I’ll continue utilizing my pre-tax accounts whenever possible.

The way I’ve always thought about it is, the government only gives you one shot to deduct a big chunk of your current year’s income by contributing to retirement accounts (i.e. you can’t change your mind in 2021 and say, “Hey, I’d actually like to contribute to my 2016 401(k) now so I can lower my 2016 taxes.”).

If you don’t take advantage now, you’ll lose the opportunity forever. That’s why I take advantage of every single tax break I have available to me now and will worry about decreasing my taxes later when I start the withdrawal process.

One thing this exercise has made me reconsider is the SEPP vs. Roth Conversion Ladder choice. I had planned to forgo SEPP 72(t) distributions during early retirement, due to the strict rules and administrative headaches associated with them, but if I know I’ll need to withdraw a set amount from my tax-advantaged accounts every year, it makes sense to set up SEPP because this exercise has shown that it is the most tax-efficient way of accessing retirement-account money early.

My early-retirement withdrawal plan will definitely still include strategic Roth Conversions though. Whenever my income is low enough to execute completely tax free Roth IRA conversions, I will do it. And if I realize I’m going to need more money or if I’m starting to worry about RMDs (Required Minimum Distributions), I’ll increase the size of my conversions, even if it means paying a little bit of tax.

What About You?

How about you? Did these calculations surprise you? Will they cause you to change your strategy? What’s your plan for accessing your retirement account funds early?

Let me know in the comments below!

Thank you so much for writing this post Mad Fientist! Your work on taxes was very eye opening for me, when I first stumbled upon it in 2013. Thank you so much for generously sharing your research with us!

Mad FIentist provides one of the best analyses of tax-related topics in early retirement available as far as I’m concerned. :)

Amen! This is amazing. The FI community appreciates all your work so much. Bravo!

MF, I love your articles. I recently retired early (42 yrs old). I actually pulled the trigger a few years earlier than I probably should have, but I had reached a breaking point in my career.

Starting on the day I entered the taxable workforce (age 17) I had always planned to work “for the man” no more than 30 years. Built my first retirement spreadsheet that year, and updated it periodically as my life changed (college, career, major purchases, wife, kids).

I’ve taken a year off work to do more math, update/renovate our home, get back into creative writing, help out some financially challenged family memberd, and other non-job related activities. But, I will need to reenter the workforce part time in the near future, or it is likely that my savings will be depleted to quickly to sustain us thru old age. Thankfully, my wife works part time, and we are living this year off equity from the sale of our previous home. Also thankfully, I can now afford to pick up just about any part time job that I could enjoy, rather than choosing based mostly on financial need/benefits.

I will be paying the early withdrawal penalty to access about 40% of our living expenses from my traditional IRA. The remaining 60% will come from our part time jobs for about 10 more years. Should be able to fully retire at that point.

Since our annual income is low enough, and our expenses (kids) are high enough, we will be in the lowest tax bracket. With the new tax law updates, our standard deduction is high enough that we may not pay any taxes at all. So, I plan to convert from my trad to my Roth IRA as much as possible without significantly altering my tax burden. This will get my conversion ladder moving in the right direction.

I also looked into the SEPP quite a bit. While it wouldn’t have worked for us this year (I have no job income at all), it might be doable in subsequent years. The challenge is that the SEPP calculations use very conservative withdrawal rates mandated by the IRS. You can’t just pick any amount you want. If your best egg is not very large (say, $1M or more) the withdrawable amount is very limited…not sufficient for a family of 4 at all (not even a family of 2).

Basically, the IRS limits the SEPP to such an extent that it is nearly impossible to deplete your nest egg (i.e. allows a risk tolerance of 0). I ran the numbers using a $500K account, the maximum withdrawal rate (120% of Federal mod-term rate – currently this totals 3.4%) that has been historically blessed (i.e. not prosecuted) by the IRS, and a reasonable investment return rate (8%) also afforded by the IRS. It gave me about $12K per year (again, insufficient for a family of 4 on its own). The SEPP plan is so conservative that you end up with more than $1M leftover when you die (mortality tables put me in my mid-80s). If your goal is to leave behind a charitable trust or big pile of cash for your kids, then it makes sense. But, if your goal is to raise your kids to be financially intelligent and self-sufficient, and you plan to use your retirement years to donate sweat-equity to your charitable interests instead of cash upon your death, then SEPP is not your friend.

Yes, most early retirement forums say that 4% is the magic (safe) withdrawal rate, so 3.4% is not that much more conservative. But, Mustachians and Fientists are savvy enough to afford an easy 5%. And, that’s again assuming that you plan on your nest egg growing exponentially even after you start living off of it (i.e. leaving a huge pile of cash behind for someone after you depart this life). It’s important for people to understand the underlying assumptions that go into the math, and not just blindly accept advice or calculations from anyone. The SEPP is a great tax shield, but can you live off of its meager revenue?

Mark, note that SEPPs can be stopped at age 59.5 or after 5 years, whichever is longer. No need to continue using them after that point, and in fact you can withdraw more once the SEPP has concluded.

Thanks for this! I was aware of the first two methods, but, like you, had never even considered just paying the penalty. I don’t think that would work for me (that’s a lot of money to lose), but for some folks, that might make a lot of sense.

Although the 72(t) method gets you your money faster, I kind of feel like the control is taken out of your hands in a way – you’re being forced to take the money out even if you don’t need it (although I guess you could reinvest it again if desired).

My plan is to go with the Roth IRA Conversion Ladder when I quit the 9-5. However, those first five years are probably going to be a little tight so I’m working on building up a handful of rental properties before then to have another means of cash flow to carry us.

— Jim

To address the issue about 72(t) potentially forcing you to take more than you want, this post got me thinking “Hey, why not do a 72(t) with a lower fixed distribution and supplement it with a ladder and money from my taxable account as needed. I think Mad Fientist also alluded to this in the last paragraph in “My Plan”.

So long as I am fairly certain I won’t have additional income generating activities later on this would work well. And I suppose if I do have income generating activities later, I have my one time to change the 72(t) distribution or just divert as much of my new income back into tax deferred accounts!

My thinking too. It seems like a good options is to set a “floor” value for 72(t) withdrawals, say 50% or 80% or so, of your expected spending. If expected expenses are relatively fixed and predictable (as far as these things go) there’s little disadvantage to have some income be 72(t). That way that is taken care of. Then supplement in other ways, preferably Roth conversion. But from this it seems even just paying the 10% penalty isn’t a horrible option either. I think that would be a nice, flexible way to do it. And if you take out too much you can always reinvest in taxable.

You can always set up multiple IRA accounts and only perform SEPP withdrawals on what you need.

A monster post indeed! Thank you for sharing all these knowledge :)

Super awesome post. We definitely plan on using the conversion ladder strategy, but had never considered just paying the penalty. Those numbers are interesting and definitely thought-provoking. Both my wife and I contribute 100% of our maximum allowance into our company-sponsored retirement accounts, so they will be ready and willing to help fund our lifestyle in the very near future.

Great analysis. I think the idea of paying the penalty is something that gets missed. Often times my friends are leery to put money in because they can not get it back out in an emergency. But if there is an actual emergency where you lose your job and drop a couple of tax brackets then you are still doing better with the 10% penalty than if you had paid a 30% tax in the first place – and you also have the loan option.

Scenario 1 is a little harsh assuming %15 tax on fund growth. That might be fair unless she primarily invested in stocks. The capital gains rate would be 0% when she retires into a lower tax bracket.

Good job detailing out all the numbers, Fientist! I love that we are able to give early retirees even more options to consider!

For those slightly older early retirees, you can also withdraw funds from a 401k without penalty beginning at age 55 if you retire from that company in or after the year you turn 55. If someone has been with a company for a while and reaches age 55 with a sufficient 401k balance, this is probably by far the easiest.

Thank you for that insight. I had 59½ stuck in my head for no penalty, but I see now that there is “a rule of 55” that would allow me to withdraw without penalty from a current 401K.

+1. This is our plan for using our 403bs in a few years at age 55+ and, secondarily, we can just pay the 10% penalty on any smaller IRA withdrawals, if needed. Mad Fientist, thanks for pointing out that sometimes it just makes sense to keep it simple and pay the penalty.

It just has to stay in your company’s 401k until you turn 59 1/2 at which point you could then roll it into a Traditional IRA which would give you more investment options.

This is a really interesting point! Mad F, can you comment? I’m 51 now in my 29th year with my Company, I expect to have $1M in my 401K when I hit 55. Thoughts on getting out at 55??

I’m almost in that situation, just off by a couple of years. Just got laid off after 17 years in the company, and I’m turning 53 this year.

I have substantial amount when considering 401k + Traditional IRA + Pension. I suppose I should take my 401k + Pension and roll it over into the existing Traditional IRA, correct?

Also, I plan on working part-time and continuing to contribute to the IRA (probably a SEP IRA?)

I’m wondering which method would be best to use to start withdrawing early? Will the spreadsheet help me make a decision?

Does the Rule of 55 apply to all 401k Plans?

It does, for 401K or 403B. If you retire from your job… this is from Forbes; The rule of 55 is an IRS guideline that allows you to avoid paying the 10% early withdrawal penalty on 401(k) and 403(b) retirement accounts if you leave your job during or after the calendar year you turn 55.

From smartasset.com “note that employers are not obliged to allow early withdrawals; and, if they do allow them, they may require that the entire amount be taken out in one lump-sum withdrawal. This could expose you to a higher income tax.”

For example, one of my former employers required that you have 10 years of service in order to retire and take withdrawls at 55.”

It is always worth checking your employers specific plan documentation.

Yes, the Rule of 55 applies to all 401k plans, including Roth 401k.

However, be mindful that this rule will only make you exempt from paying the early withdrawal fee. If you take a distribution from a Roth 401(k), before the age of 59 1/2, then the *earnings* will be taxed as ordinary income. There’s no way of getting around paying the income tax before the age of 59 1/2, and obviously this is not desirable when withdrawing from any Roth accounts.

Also, I should point out that when taking a distribution from your 401(k), you cannot choose how to source the distribution. In other words, your plan will distribute from all sources, pro-rata. So it will contain a mixture of your contributions and your earnings. So like I said, be mindful if you have a Roth 401(k), and take distributions between the ages of 55 and 60, you will be liable to pay ordinary income tax on the *earnings* portion of your distributions.

It gets even more complicated if, during your employment, you contributed a mix of pretax money and after tax money (i.e. Roth). I only mention this because if you’re like me and have contributed to your 401k with pre-tax dollars in some years, and in other years contributed with after-tax dollars (i.e. Roth). Then your distributions from the 401k account will contain a pro-rata mixture from 4 sources: pretax contributions, after-tax contributions (i.e. Roth), pretax earnings, and after-tax (i.e. Roth) earnings. If I did this, then I would be liable to pay ordinary income tax on the pre-tax contributions and earnings (obviously), but also on the after-tax earnings. So I will avoid the early 10% fee, but I sure don’t want to pay any income taxes on my Roth money.

The solution to this problem is to rollover the after-tax monies into a Roth IRA. At this point, your 401(k) account has only pretax dollars left, and then you can take distributions as you wish, without the 10% early withdrawal fee , and you just pay ordinary income tax ( as you normally would on a traditional 401(k) account).

Butttttttt, now that you have all your Roth 401(k) contributions (and earnings) in your Roth IRA account. And you can withdraw those contributions at any time, tax-free, and penalty free.

Ensure your company’s plan authorizes the Rule of 55. In my case it is a no.

If you have access to a 457, and the investment options aren’t horrible, why would you ever roll that into an IRA? You can access all that money immediately after separation from your employer no matter your age with no penalty.

That’s my plan. My 457 will carry me through until at least 60.

I was thinking the same thing when he mentioned rolling over 457 money.

Yea he needs to revise it, the no penalty for 457 means it needs to be a whole different discussion.

In fact, it is my understanding that if one rolls 457(b) funds into an IRA upon separation from employment one loses the penalty-free withdrawal benefit, so revision is indeed advised lest someone unaware of this does something that would negate this fantastic benefit of 457(b) plans.

457(b)s are often ignored and seldom discussed plans, but governmental 457(b) seem to me the absolute best tool for early retirement. One could envision loading both either a 401(k) or 403(b) and a 457(b) while working, retire early, and then establish a Roth conversion ladder with 401(k) or 403(b) funds while living of 457(b) funds – which can be withdrawn at any age penalty free – for the 5 years that it takes for the Roth funds to become available tax free. I’m still looking into the best way (tax-wise) of tapping the 457(b) during those five years and beyond (preferential tax treatment of long term capital gains and dividends may not be available for 457(b) plans) – and some wisdom from the MF would be great in this regard – but a 457(b) does seem to offer unique opportunities to folks considering early retirement lucky enough to have access to this deferred compensation plan.

It you’re only retiring a few years before the penalty free age, you could also use the age 55 rule:

https://www.irahelp.com/slottreport/age-55-rule-taking-money-out-company-retirement-plan

Hey, Mad Fientist.

You should also note, that when you separate from an employer who offers a 457 plan, you can access that money without a 10% penalty. This was mentioned in your interview with the Millionaire Educator, and I’ve confirmed it with my employer’s 457 plan. In other words, you don’t need to do a ROTH ladder with 457 funds. You can simply withdraw them as you would from ROTH principle, which makes it a great account for early retirees!

-Greg

While a bit unorthodox, consider this 457 scenario.

You retire, or at least end your 457 eligible employment, and don’t need the money for five or more years. You could:

1) Leave the money in the 457 growing tax deferred. You will pay taxes on all withdrawals in the future including gains earned during the 5+ years.

2) Withdraw money now, pay taxes withdrawn amount, invest the money until you need it, withdraw money again, pay taxes on gains.

3) Convert money now to a Roth IRA, pay taxes on the withdrawn amount, invest the money until you need it, withdraw money again but tax free including gains.

With a large number of tax rate scenarios, it’s hard to say for sure one option will or won’t work for you, including option 3 Roth conversion.

Interesting, I had always thought of SEPP and Roth Conversion Ladders as an “either/or” situation, it never occurred to me that you could utilize both. The main concern I had with SEPP was the fact that I plan to be semi-retired and still earning income, and so I didn’t want to end up withdrawing money if I didn’t need it. That said, this makes me wonder if it makes sense to set up SEPP with a relatively small amount and then use Roth Conversions to dynamically cover the difference year by year. Great post!

The awkward part is that the conversions can’t be withdrawn for 5 years though. You’d have to carefully plan conversion amounts in advance that could cover a difference and not have you paying too much in tax on any given conversion year….

I’m with JJ here. I’ve been mostly looking at 72t or just paying the penalty for the simple fact that the majority of my money will be in pre tax accounts. So my only option for funding those 5 conversion years would be to work part time, which means id most likely still have to pay taxes. Might as well take the 10% penalty.

Also a big key for us is to be able to live off of 40k or less during early retirement. That seems to be the number that has the most advantage for taxes, health ins, etc.

This is really interesting. Question though – if you’re not in the 25% tax bracket during your earning years, but in the 15%, how does that affect the long term numbers? Does it?

Maggie,

I’m in the 15% bracket. I haven’t run the long-term numbers, but it definitely affects one’s savings rate by several percentage points per year, about 76% w/out tax advantaged accounts (403b, 457, 401a, and IRA for me) and 79% with tax advantaged accounts. This savings differential will certainly affect the long-term growth of one’s investments because the additional savings will grow over time. Maybe the Mad Fientist can explain how this grows in greater detail.

-Greg

Thanks for the info, Greg!

I would also love for the Mad Fientist to answer this as well. We are in the 15% tax bracket and not even close to the 25% bracket. We are a single income family with 2 kids so we have the two child tax credits and extra deductions that help. We figured we would take advantage of being in this low of a bracket now. We are currently doing Roth 401K and Roth IRA for both of us. I’m definitely open to new ways of looking at this though.

That’s our exact situation too, Kristi. :)

Yes. +1 this scenario

Another excellent post. I am 3-5 years from early retirement with almost all retirement savings in tax-deferred accounts. Your post is helpful except I am still looking for help covering my first 5 years of expenses…it may be the SEPP is the best option for me.

I have two questions:

1. Is it allowable to file married separately, while still doing a Roth conversion? For example, could my wife keep working, while I file an individual return with low income other than my conversion?

2. Can you set up separate IRAs…one to provide the SEPP distribution for 5 years, and the other for Roth conversions during the same period? I don’t want to be locked into the SEPP later on because my conversion/withdrawal amounts will get hairy when my kids are in college.

Cancel that first question. It sounds like there are not many scenarios where it would be tax-favorable to be married filing separately.

Still curious on the second question…can you set the SEPP for a certain amount from one traditional IRA and run your Roth conversion on a separate traditional IRA? The SEPP distributions seem too small to be the only long term early retirement income for 20+ years, with no flexibility.

The IRS looks at all your IRA’s for the year and checks what conversions/withdrawals were done. So you can even do it from the same account. But like the fientist said, 72t are worth running through a tax pro

Regarding your second question, yes, you can.

What you can also do is just have one big IRA and then split it into two IRAs – one for the SEPP and one for the Roth conversions – whenever you’re ready to start the SEPP.

@Yaacov’s comment below is inaccurate. If you do the SEPP and the Roth conversions from the same account, the IRS will consider it as modifying the SEPP and you would be subject to penalties.

It is also possible to have multiple SEPPs, as long as each is coming from its own IRA and the method followed with each SEPP stream is consistent. I doubt many people bother with that level of complexity.

to question 1: It depends. Make sure you run the numbers, but to help you get a quick sense of it, here’s a great infographic that was made by 538 in 2015.

http://fivethirtyeight.com/interactives/marriage-penalty/

Great stuff, one comment: If you have a government 457(b), there is no early withdrawal penalty once you separate from your employer. Once you quit, you get full access to your money at any age!

Great post for those of us thinking…and re-thinking…and re-thinking of how best to approach the puzzle of early retirement.

My wife is eligible for a 403b and a 457. It seems to be the best of both worlds – invest pre-tax and withdraw penalty free at any age, just pay tax on the withdrawals. Are there any pitfalls to using a 457, especially to fund living expenses during the first 5 years of the Roth ladder? (And as long as it lasts after that.)

The 457 and 403b will likely have different investment options, so check those, but it’s unlikely that the 403b could have investment options that are better than not paying a withdrawal fee. My Oregon 457 actually offers lower-cost index funds than my 403b. Also, keep in mind that if you can manage it, your wife can max both a 457 AND a 403b every year, for a total of $36,000/yr of tax exempt investing. Max the 457 first, and if you can spare any more of her paycheck put it into the 403b. Hope that helps.

This is outstanding and the graphics rock (and yeah, they’re sexy too!) The timing of this is great. I just left full-time work and have funds in a 457 account (no penalty before 59.5) that I can now access when needed. My husband has funds in a 457 too. I also have funds in a traditional IRA and we were contemplating starting the SEPP or just paying the 10% penalty. We are working to fund the gap years until I can collect my pension in 5+ years (husband is retired). We are going to be in a higher tax bracket when I retire because of both of our pensions (and SS, rental income) – so it makes sense to get our money out now and use it to live and pay off rental properties for even more cash flow. Our situation is opposite of many so it has been hard to take action on. (We may make an interesting example for one of you to study!) This post helps to make sense of so many things. Thanks so much!

I’d like to see the comparison between those roth amounts compared to the traditional, with tax burden taken out of the traditional amount assuming your scenario of 45k disbursements per year. I’m betting the ROTH becomes a better choice once we factor in taxation on the other options.

He compares these final numbers like everyone is broke and not paying any tax in retirement. The retires that I know are in the 28% tax bracket.

If using 25% tax to the scenario 2C final numbers above, the purchasing power of 2C (Traditional ladder) only comes out ahead by $35,833 compared to scenario #3 (Roth).

Scenario 2C:

$604,046 – 25% tax = $453,034 + $87,419 (Roth portion of 2C) = $540,453 (purchasing power)

Scenario #3 (Roth):

$504,620 (purchasing power)

Very informative post. I expect and look forward to work until age 60 or so, which is slightly less than average for my profession, but this info is gold because I might have to stop work early for any number of reasons.

I wholeheartedly agree with maxing out any tax advantaged accounts you can get. The government doesn’t give do overs and having too much money in retirement is not a bad problem.

Thanks MF! I listened to that podcast as well, but was too lazy (too far from FIRE) to actually sit down and do the math. I think the 72(t) option might be a lot of headache up front but be a lot easier on an annual basis than worrying about fitting in Roth conversions under tax brackets over the long term. I have years to figure this out, but this was a great read!

I think you might of made one miscalculation in your excel. You’re taxing growth (the whole 7%) in the taxable account, when in reality only dividends would be taxed since you wouldn’t be selling until 45. The tax on growth should only come in to play when you start drawing down in early retirement. Or am I missing something? Thanks.

That’s what I thought too. But, in looking at the model, he uses a lower tax rate “Tax on Growth” of 15% (vice the 25% marginal tax rate) for growth in the taxable account during the working time period. I think this lower tax rate is trying to account for only being taxed on dividends.

It may be a little high, because 2% (dividend yield)/7% (growth assumption) * 25% (marginal tax rate) = ~7%. Changing that assumption kicks out the taxable account a few extra years (doesn’t materially change the conclusion based on the assumptions).

However, it’s interesting that at lower growth rates, the difference in the longevity of the accounts pretty much disappears. At 5%, all the accounts are busting withing a few years of each other.

If you’re in the 25% marginal tax bracket, LTCG are taxed at 15%. But if you are in the 10% or 15% marginal tax bracket, they are taxed at 0%.

Hi, I have also heard that LTCG is 0% in the 10% tax bracket but when I look at my 1040 it show it goes on line 9a and seems to be counted in with total income via my tax prep by my accountant. Is it credited back later somewhere else?

@Chris, yes. Where the total tax is calculated (it used to be on line 44 or so in 2017 when you asked this question), there is a worksheet either in the instructions or on Schedule D where the alternative tax calculation is done. Your accountant should be able to provide you with a copy of that worksheet filled in for your particular return.

Yes on the penalty, especially if your company matches a substantial portion.

My company matches 25% of contributions (e.g I put in $18k, they put in $4500), and I always tell co-workers who don’t like to contribute that you’d be better off contributing, getting the match, then just withdrawing it early if you really need it.

Well done for bringing up that option.

One thing I’ve been wondering since you advocate HSA, is there a way to access an HSA for non-medical expenses before age 65 without an early withdrawal penalty? This concern has been the primary reason I have not contributed to one as of yet.

I think the only way is if you pay medical bills out of pocket while you’re working, keep the receipts, and get delayed reimbursement later on. To me it is definitely still worth maxing out, especially if you’ve already maxed out your 401k because of the savings on fica taxes and HSA isn’t income restricted like a traditional ira is.

But if you have to pay a 10% early withdrawal penalty, it seems like that would negate the fica tax benefit. I understand using it for medical bills, but if I maxed out for 10 years (35k for a single guy in my 20s), and used none of it or close to none of it until age 60, I could easily have 100k there that could have helped me in early retirement income. Sure, using it as ‘old man money’ might work but I don’t think it’s deserving of the ‘Super IRA’ title Mad Fientist gives HSA, and many commenters on this blog have recommended maxing it out as higher priority than IRA or even 401k. I think a more deserving title is ‘Super IRA – if you have extremely high medical bills before age 65’, otherwise it’s ‘401k, with delayed withdrawal age, no way around early withdrawal penalty, and a small tax benefit’.

I’ll have access to and HSA next month, and I’m also unsure how “super” it really is. It don’t have any medical expenses now, and don’t plan too until I’m 70+. Assuming I’m right, the only benefits then for the HSA is for late-retirement, tax-free money? I mean that’s nothing to scoff at and a good deal, and I’ll probably max it out, but I don’t think that amazing..

Not even tax-free after 65 unless it’s for qualified medical expenses that you could probably get government assistance for anyway. According to the ‘How to Hack Your HSA’ article on this site, “withdrawals for qualified medical expenses will continue to be tax free but withdrawals for all other expenses will be taxed as income, just as Traditional IRA distributions are taxed”.

Trust me, it’s super. Tax deferred growth is no joke. You would have to exhaust the account in fairly short order to outweigh the benefit. And it sounds like you grossly underestimate your likelihood of having medical bills in the next couple decades of your life. Although not typical, you could get to age 40 without ANY major medical or dental. Then consider the likelihood that any future spouse or dependents would also incur zero costs. Not saying you’ll be anywhere close to $100k, but it can add up to more than you think over time.

Great post. I had previously looked at the SEPP plan as more my emergency backup plan after I had exhausted all other options due to the potential complexity and rigidity vs. the Roth IRA ladder. Might have to reevaluate and rethink the order and size of withdrawals from my money buckets to keep my tax benefit/effort ratio high.

Interesting conclusions for sure! I didn’t realize simply paying the 10% early withdrawal penalty was superior to forgoing the deductions throughout one’s career or sticking with a Roth while working.

I’m planning on going with the Roth IRA conversion ladder. Ultimate flexibility in when I take withdrawals and how much I have in AGI each year (able to choose between living on cash, taxable investments w/ high basis, penalty free 457 withdrawals, or Roth withdrawals and I get to decide how much I convert each year).

72t SEPPs are too rigid for my tastes as a 30-something early retiree. In hindsight, I’m very glad I didn’t lock myself into SEPPs when I retired at 33 because I now have a decent little side hustle income from my blog, and I don’t really need a lot from my portfolio other than the dividends from my taxable account (which add to AGI whether I spend them or not!). As a result, my AGI is nice and low and I get fat ACA subsidies.

I like the flexibility of a Roth conversion ladder much better. This way, if I ever decide to do something that pays later in life, I won’t be paying tax on SEPP withdrawals AND jumping up to a higher tax bracket with my earned income (or book royalties or freelancing fees, etc).

Sorry if this has already been discussed elsewhere, but why not do the SEPP and Roth conversion together? Like take out your set amount and whatever you don’t use, contribute to your Roth?

Someone correct me if I’m wrong please. You can only contribute to a Roth if you have earned income. So if you use the SEPP and are not working in early retirement you can’t contribute the extra to a Roth. A conversion can be done regardless of earned income.

When Comparing the Roth ladder to the SEPP. Wouldn’t an individuals tax situation come into play? For example: If the amount I converted was less than my total Tax deductions then I would effectively have zero income (I’d be living of of cap. gains, dividends, and interest). Therefore ROTH would be superior (it is more flexible in withdrawals) to SEPP if an individual met certain tax requirements.

Yes that’s right. But I don’t know how SEPP income is taxed? Is that also taxes after deductions etc? Would some of it in the 0% bracket?

It’s taxed as regular income so yes, it could zero after deductions.

Excellent post as always, Brandon. I’ll have to reference this when I get closer to pulling the trigger!

Really great post. Thanks!

Isn’t it awesome how there isn’t a precedent for early retirement best practices and that a bunch of random internet strangers are getting together to hack out an optimal solution? It cracks me up.

I love the graphics you include with the post they make it much easier to content and understand the point you are making. How do you make them?

Great post Fientist! I’ve studied this before and then over time I seem to forget some of the details. Thanks for putting it all in one place!

Correct me if I’m wrong, but one other important consideration to make is that you can withdraw contributions to your IRA penalty free but not the gains/growth in the account? And when completing the conversions from employer sponsored accounts to an IRA, the initial contributions to the employer account can be withdrawn penalty free but not the gains either?

Thanks again!

No, you’re confusing Roth IRA rules with traditional IRA rules.

Very interesting – thanks! I was feeling some regret about possibly over-funding my traditional retirement accounts while working, but this analysis indicates it probably was better than putting more in taxable or Roth options.

I retired at 51 and had part-time income that meant Roth conversions didn’t quite make sense until now. But, I agree with Justin, and prefer the Roth Conversion ladder option, primarily because it allows the most flexibility to manage AGI each year, and therefore also manage ACA healthcare subsidies. My own upcoming decision is whether to convert some $ to Roth between 55-60 while still in a low tax bracket (even though it won’t provide earlier access to the money) mainly as a mechanism to reduce future RMDs and increase AGI flexibility by having a tax free account to access when helpful. I was leaning toward, for the next several years, converting just enough to stay below my tax thresholds, but your post has given me more to ponder before I decide. Thank you for sharing your work!

Not surprising. I did a ranking of all of the possible retirement accounts given a few different variables so that I could decide in what order to max out our accounts. Tax-deferred accounts make sense if you are in the 25% bracket now, but if you are in the 15% bracket now, it doesn’t make much of a difference if you assume you will still be in the 15% bracket in retirement. And notably, in a 15% bracket, a tax-deferred account with high fees does even worse than taking the tax now and putting it in a taxable account!

I have a 457 account and plan on using the Roth ladder as well.

Great post!

Another option for those of us still working is to use a mega backdoor Roth if our 401k permits after-tax contributions and in-service rollovers. This allows me to put in an additional 15-20k/year into a Roth, which will be available for withdrawal in five years. In essence, I am starting my 5-year Roth ladder early.

During FIRE, ideally I’ll have access to (1) taxable account money and (2) backdoor/mega backdoor Roth contributions. My plan is to utilize SEPPs once this money is depleted. SEPPs will be easier to calculate when I’m closer to 59.5 so my risk of being trapped into suboptimal withdrawals will be reduced.

This is a great article. I’ve been following your other posts about withdrawing funds before retirement age but this condenses everything very nicely. This year I’m putting money in a traditional instead of a Roth— Better late than never. Countdown to early retirement t- 10 years!!

If she’s in the 15% tax bracket during retirement, is she not eligible for the 0% capital gains rate?

This tax bracket is up 37,650 for singles and 75,300 for married couples.

Lets assume she’s married and decides to give her and her spouse the median household salary of 53000, she could *easily* wind up paying state taxes. Perhaps not even that if she lives in a no income tax state like Florida.

https://en.wikipedia.org/wiki/Capital_gains_tax_in_the_United_States#Summary_of_recent_history

My thoughts exactly.

A couple of years back, when I needed to cover this topic in Part XX of my Stock Series, I knew better than to write it myself. I turned to the Mad Fientist for a guest post.

And now this is linked there.

Awesome work, as always, MF!

Man, I love the numbers. My request for the spreadsheet used in this analysis is already in!

My husband and I were just talking about this idea last week, so this presentation of data, however simplified, is perfect. Conceptually, we couldn’t see the value in exploiting tax-advantaged accounts because of our age (early 40s), our estimated working time remaining (~14 years), and access to a pension. There didn’t seem to be enough time to employ a Roth Conversion Ladder, and so we wondered if simply having taxable accounts as a cash cow would be better? I’d just begun to research how to run simulations in Excel to see how the numbers would perform, and then you give us this. Fantastic timing.

The Mad Fientist giveth, and keeps on giving! (not unlike compounding interest…)

Hey good detailed post, and I heard the podcast with Joshua, it was a game changer as well as this post. Accessing my retirement money early has been on my mind for a few years now, and this post makes it easy to look at the options. Keep it up, as I’m sure the IRS will make changes later.

Unless I am mistaken (and I hope others will correct me), the SEPP/72t method will not quite work as described above. The required annual withdrawal amount via SEPP is strictly defined by math – with age, account balance, withdrawal method (relatively minor impact), and assumed interest rate as the variables. Online 72t withdrawal calculators can help you model your situation.

You cannot simply choose to arbitrarily withdraw $9,000/year from your account regardless of your age and balance. The amount is calculated for you (by a professional). The problem I have had with considering the 72t is that in order to come anywhere close to meeting annual living expenses, you would have to have a huge balance in the 401k and you would have to be old enough so that the numbers work out. If you have a huge balance and you’re TOO old, then the withdrawal amounts may be much larger than desirable [w.r.t. tax bracket] (and you’ll be close to retiring anyway). If you’re too young, the annual distributions will be calculated to be very small – probably too small to support you. For example, a 50-year old with $500,000 SEPP will be able to withdraw ~$15k to ~$20k. If you’re younger or have smaller balance, the annual withdrawal will obviously be smaller than this.

The 72t was designed to permit people to make withdrawals over a long period of time – not to deplete an account on your timetable. The larger the annual withdrawal via SEPP, the more of your money is being tied up; i.e., you can’t use that money for a Roth Ladder too.

In summary, the 72t is an option, but it is a complicated and inflexible option. As noted by Mad Fientist, mess up the withdrawal amount in one year, and it may be the worst financial mistake you ever make.

My recommendation? Max out your 401k as Mad Fientist suggests. Plan to convert using Roth Ladder. Plan for income during 1st 5 years of Roth Ladder through one of following: Roth IRA/401k contributions, after-tax account contributions, after-tax contributions to 401k (if plan allows; some do) rolled over to Roth IRA, part-time work, or real-estate income.

You probably won’t be able to ER by just maxing out 401k contributions ($18k/yr this year). ER generally requires saving a SUBSTANTIAL portion of your annual income (30% – 80%). So you should be able to use your earnings above the maximum amount you can save in tax-deferred accounts to prep for the 1st 5 years of Roth ladder.

If you are allowed to (I cannot find whether it is allowed or not on the IRS site), having multiple 72(t) plans going from separate IRA accounts may work. You could put $100,000 in one account to start this year and start getting the payments, and add separate 72(ts) with other IRAs as you get older. This would allow you to ramp up the payments and/or, or even if you do 4 $100,000 72(t) accounts at the same time, if you screw up one, you only pay the penalties on that one.

Through my own research and a phone call to Vanguard, you can break up your IRA into several smaller IRA’s if as one way to artificially adjust the size of your 72t distributions.

The other benefit of doing this is that you won’t lock up your whole IRA. Remember that when you start taking 72t distributions, your IRA becomes “locked”. So an additional strategy like a backdoor Roth conversion won’t be possible unless you had several smaller IRA’s.

Another way to adjust the size of your 72t distribution is to choose a lower interest rate for either the Amortized Over Life Expectancy method or Annuitized Over Life Expectancy method. Remember that the interest rate you choose can be ANY rate less than or equal to 120% of the Federal Mid-Term rate for either of the two months immediately preceding the month in which the distribution begins.

Thank you My Money Design. This has been one of the most useful things I’ve read on the internet so far this year. Very simple idea with massive benefits. Go have yourself an ice cream, you made the world better for someone else just because you could.

I really appreciate you sharing this.

What we need now is for someone to build a tool that we put all the variables into with our target amount and it spits out the size IRA/options to pick for SEPP. The penalties if I get it wrong are very intimidating.

There is actually a good 72(t) tool at: http://www.dinkytown.net/java/Retire72T.html and this one allows you to see the results of your distributions. http://www.dinkytown.net/java/Retire72Alt.html . You can see the 120% interest rates here: https://apps.irs.gov/app/picklist/list/federalRates.html .

Thanks for the research My Money Design! Glad to know that could work.

With $500k balance you can take out $22k/yr using the amortization 72t method. Combine that with $27k/yr FERS annuity for VERA retirement (assuming the min of 25 yrs service and a tapped out GS13 salary, more or less depending on locality pay differences), and you’re looking at almost $50k/yr. Selling the home and investing the equity could provide the balance to carry some folks through age 59 1/2 by renting/leasing. Or use the equity to buy a small home outright. If you have $50k left over, invested at 7 percent hat will pay property taxes and home maintenance until age 59 1/2.

This is my first post, but I’ve been reading your blog for a long time. Along with MMM, jlcollinsnh, and a few others, my financial life has really improved. I’m 37 and hoping to reach FI in my early 50s. I’ve wondered whether you advice needs to be modified for those that will only be retiring a little bit early, or for those who won’t retire until “traditional” retirement age? With less time before mandatory minimum withdrawals in traditional IRAs, for the backdoor ROTH to work its magic, are there other things these folks need to consider? Thank you.

Thanks for such great detail Mad Fientest. I did frown on these traditional IRA’s for penalizing you for taking out your own money for early retirement. Now I’ve got a reason to appreciate them now thanks to this information. I now know that we can still utilize them for early retirement, still grow your money and minimize taxes. Thanks for the research you provided in this post.

I’m glad to see the “just pay the damn penalty” option getting the attention it deserves.

When you move into a lower tax bracket in retirement due to a combination of no longer paying payroll taxes, no longer paying a mortgage, and only withdrawing what you need rather than what you can earn, the 10% extra tax can be easily offset.

Pay the penalty is also by far the most flexible plan as there is no need to plan ahead at all. It’s nice knowing that even if you get in a pinch and need to take some money from your IRA, you will still be saving on taxes compared to your marginal rate when you were working!

I made a post about this very subject on the MMM forums last June: http://forum.mrmoneymustache.com/investor-alley/breaking-the-taboo-of-the-10-early-withdrawal-penalty/msg700255/#msg700255

Madfientist, thanks for consolidating this all together here! Awesome article and research!

Hi Doug,

Thanks for linking to your post! Would you be able to help me understand what the 10% penalty actually is? I have been wondering if the 10% penalty is a non-refundable fee that is “donated” to the IRS or if the 10% penalty is simply an additional tax that I may be able to get back at the end of the year through tax deductions or credits. If it is simply an additional tax then assuming I will have no tax liability I will time my early withdrawals for the end of the year and get the penalties back as refunds within a few months!

Celo,

The 10% is an “extra tax” according to the IRS. Unfortunately this is a flat tax and has nothing to do with income and cannot be offset in any way that I know of.

However, if you are in a very low tax bracket, an additional 10% is not that bad considering you are paying zero on a lot of the money you are taking out, and 10% on another big chunk.

Doug,

Thanks for taking the time to respond to my comment!

I agree, 10% can be a small cost for the huge benefit of retiring early.

Thank you! So great to have this all in one place.

I think one other thing to consider is health insurance subsidies. If you are doing a Roth Ladder, you could make your income too high to qualify, significantly driving up your living expenses. I think this is where contributing to a Roth very early on (despite the fact it is taxed at your presumably higher income tax rate) could come in handy. The idea being you can access the contributions later on when needed to keep your income low, as when you pull your contributions out of the Roth, it doesn’t count as income, but when you rollover it does.

I have this complicated spreadsheet that models this out over time with varying strategies to keep taxable income below around $60K (cutoff for a couple to get insurance subsidies in my state and also to keep capital gains taxed at 0)

– SEPP for baseline income (which is actually kind of poor right now… mid term interest rates are at record lows…. hopefully they start rising before I start the SEPP in a couple years).

– Drawing from taxable accounts or Roth Contributions

– Income for a rental property (which is nice, because of depreciation you can get more cash than income)

– Convert as much as possible from traditional to Roth, keeping below the income limit, so I have more contributions to pull out later once the taxable & original roth accounts dry up. You can also play around with doing this only once in awhile… sacrificing subsidies 1 year in order to build up roth contribution reserves, and then getting the advantages of lower income for the next few years.

But now I have to re-do the math. Maybe just taking the 10% penalty later. The tax on the roth contributions I’m making right now is pretty brutal since I’m still working!

A great topic to cover and it’s great to cover in such a thorough way. However there is something that I don’t understand in this article. MadFientist writes about Roth IRA Conversion Ladder in the “Con” section:

– “You pay tax on the conversion five years before you can use the money so you lose out on the tax-free growth that money could have provided.”

This is actually not a problem, because the money will keep growing tax-free in the Roth in those five years. If your tax rate after those five years is identical you will still have the same after-tax value.

1. Roth IRA Conversion Ladder:

Portfolio Value: pv

Convert to Roth and pay taxes at rate of t1%: Multiply by (1-t1%)

Growth over n years at g% per year: Multiply with (1+g%)^n

Portfolio Value at end: pv * (1-t1%) * (1+g%)^n

2. Keep in IRA and take out after five years:

Portfolio Value: pv

Growth over n years at g% per year: Multiply with (1+g%)^n

Withdraw money and pay taxes at rate of t2%: Multiply by (1-t2%)

Portfolio Value at end: pv * (1+g%)^n * (1-t2%)

If t1% = t2%, then the terms are identical. So as long as your tax rate is the same, you are NOT losing out on anything and it doesn’t matter, if you pay the tax five years earlier or not. In fact it might be advantageous, because if you pay the tax five years later, the taxed amount will be higher (by factor (1+g%)^n ) and that alone might bounce you into a higher tax bracket (if your returns are higher than the inflation adjustment of the tax brackets).

With that in mind, I don’t follow the author’s conclusion that SEPP is more tax-efficient than Roth Conversion Ladder.

In fact the “Final Totals” number don’t support the author’s conclusion either. When I compare scenarios 2b) and 2c) and discount the tIRA amounts with a tax rate of 25%, I reach the following equivalent after-tax amounts:

Scenario 2b – Traditional (SEPP) $706,892 in a Traditional IRA

After tax equivalent: $706,892 * (1-0.25) = $530,169

Scenario 2c – Traditional (Ladder) $604,046 in a Traditional IRA and $87,419 in a Roth IRA

After tax equivalent: $604,046 * (1-0.25) + $87,419= $540,453

In this calculation the Ladder scenario actually looks even a little better than the SEPP scenario. I’m not sure, why and I don’t think it should be better, but I didn’t verify the account amounts.

Of course, if you assume a lower marginal tax rate in retirement, then things would look very different and it would be advantageous to convert/withdraw the money at your lower tax rate. But that’s an altogether different consideration that the article doesn’t address.

What (if anything) am I missing here that I’m coming to so different conclusions than the author?

Bernhard

I had come up with the exact same thought and, therefore, the same question and searched in comments until I found if someone had already asked it. I agree they should be identical assuming the same marginal tax rate. I kept searching; Daren shows the math in a separate post down below.

Great Analysis! My spouse had always said that we’d do the 10% penalty fee (plan C) if our other sources ran out before 60; those being a 457b plus HSA (plan A), and then any Roth contributions (plan B). This is targeted for ages 45-60. The post age 60 accounts would be very padded (hence why he didn’t mind paying penalty). This is very worthwhile for us to look at the SEPP and the penalties again to see if we can knock a year or two off!

Always happy to see a post from the Mad Fientist and this one was well laid out!

I have about 1/3 of my NW in a traditional IRA (rolled over from my 401(k) when I quit working). I don’t need the funds before traditional retirement age but I’ll do strategic conversions to my ROTH when my marginal tax rate is 15% or less in order to lower my RMDs later on. Unfortunately the Affordable Care Act tax subsidy complicates the plan :(

These are surprising stats! I took a personal finance class last year during my senior year of college and was always told that we should contribute to a ROTH when we are younger so this contradicted everything I was taught. One thing that holds me back from a traditional contribution, at least in my first year of work, is that I am an international student so if I do not get a work Visa I will need to leave the country and it will not make sense to incur that 10% penalty. Got any thoughts on this?

One thing that gets left out of a lot of these discussions is the different investment choices available in these scenarios.

The investment choices in my 401K plan are HORRIBLE. The index funds have 1% expense ratios (my company recently changed providers…the old provider’s index funds “only” charged 0.75%.)

I didn’t request a copy of the spreadsheet, but I’m sure the assumption here is that all the different accounts grow at the same rates. If you can get a Vanguard index fund with a 0.05% expense ratio in a self-directed ROTH IRA for example but have to pay 1% for a SSgA index fund in your 401K…the growth rate won’t be the same…even if the two accounts are ostensibly invested in the same thing.

I don’t disagree with the conclusion, i.e. if you can defer the tax burden into the future, and then not have to pay it (or pay a substantially reduced amount) when it’s time to withdraw because of carefully planned sequencing…well then you will have a lot more money than you would otherwise.

But I’m willing to bet the tax-deferred scenarios are a bit overstated for crappy 401K plans, which I suspect there are a lot of.

Who knows…maybe I’m the only one?

Thoroughly enjoyed the post though.

The expense ratio on many funds in a 401k/403 rarely compete with the best you can get on your own, but for many retirees it still won’t be bad enough to outweigh the tax advantages, particularly if you are planning for a 7-12 year working/saving phase. Over 40 years it makes a huge difference, but the impact is negligible compared to the taxes you saved.

Also, every time you change jobs you have a chance to roll over, and last I checked the average time at a job is ~5 years so even over a longer career, there’s periodic opportunities to get your money out of those unfortunate high expense 401k

Such a detailed and well researched post. I suppose I shouldn’t be surprised: we Pittsburgh guys always create good work. :)

My wife has been chasing a PhD for the better part of a decade, and I no longer can utilize a Traditional IRA due to income limits, so, unfortunately, our 401k accounts (just mine) and Traditional IRA accounts (just hers) are not as large as we’d like. I suppose our little HSA counts, too. We’re socking away money like crazy, but the majority of it is in taxable accounts. Sad face emoji.

My initial assumption is that I might be better off simply accessing the taxable account money during early retirement, and seeing if the money in that ‘bucket’ can get us all the way to traditional retirement age. Assuming that’s possible, would that be the most efficient approach, tax-wise? (Along the way, if we can convert money to our Roths at $0 tax, of course, we’ll do that.)

Holy Cow! What an amazing post. Thank you for summing everything up so clearly. I had never heard of a SEPP but I might need to look into it. Am I right in thinking that there is no early withdraw penalty for taking funds from a Roth? If not, how do you access the money in your Roth (after you ladder it from your traditional IRA)?

Thanks again for such a great post!

There is no early withdrawal penalty when taking funds from the Roth as long as you are taking out contributions that you have made or conversions that are over 5 tax years old. If you take out more than that or sooner than that, then you will have the 10% penalty.

The idea behind the Roth ladder is that you always are either taking out contributions or conversions that are more than 5 tax years old.

The IRS considers withdrawals from a Roth to be taken from contributions first, then conversions on a FIFO basis, then earnings. In other words, they treat Roth withdrawals as nicely as they can.

“Whenever my income is low enough to execute completely tax free Roth IRA conversions…”

Can someone explain when will this ever be the case? Even if your income is as low as $16,600 a year your taxable income would still be $10,000 ($6,600 standard deduction) which means any withdrawals will fall into the 15% bracket. If you made less you would still fall into the 10% tax bracket. So when exactly can one fall into the 0% tax bracket?

So there are two sets of taxes: Federal Income Tax, and Capital Gains (in this case, long term). If you’re in the 10% or 15% marginal tax bracket for Federal Income Tax, then your tax on Capital Gains is 0%.

For a married couple, the 15% marginal tax bracket goes pretty damn high: $75,300 in 2016 (which would also include a $12,600 standard deduction AND $8,100 in personal exemptions).

Which means if your taxable income is anywhere in that 10% or 15% range, you owe $0 capital gains when you convert your funds to your Roth IRA.

Go Curry Cracker explains the process a lot better than I can:

http://www.gocurrycracker.com/go-curry-cracker-2015-taxes/

http://www.gocurrycracker.com/never-pay-taxes-again/

Ok so let me try to get this straight. (Apologies in advanced if I mess any of this up).

If I were contributing $5,000 a year to a non-tax advantaged account. Let’s say that I invest in some stock and have 100 shares ($50 per share) and I made a 10% return in my first year. Those $500 are not taxed because as long as I do not sell my shares I havent actually made or lost any money. Now if I were to sell 1 share after the first year at $55 then those $5 in gains are short term gains and taxable as regular income. If instead I wait until year 2+ to sell my shares then it would be considered capital gains. Is all of this correct or have I misunderstood something?

Also, assuming I now have money that is being generated and considered long term capital gains. Is the idea that as long as I stay within the 15% tax bracket then any money from long term capital gains is not considered regular income but is instead taxed at the long term capital gains tax of 0%?

You’ve basically got it: short term capital gains are taxed at your marginal tax bracket (so, basically treated like earned income). Long term capital gains are taxes at either 0% (if you’re either in the 10% or 15% tax bracket for your earned income) or at 15% if you’re in any higher tax bracket for marginal income. Of course, this is just what the tax laws of today state.

As you can see, there’s an obvious incentive to take capital gains when your earned income is low, like in early retirement, rather than while you’re earning income and presumably might be in higher tax brackets already. Avoiding capital gains is no big deal for frugal people retiring early. The trick is being able to make your earned income low enough to avoid federal income tax altogether.

Go Curry Cracker’s articles are really good at explaining strategies for the latter.

Just another observation.

So everyone here who is planning on taking advantage of the low or 0% tax on capital gains is not only maxing out their 401ks and IRAs but is also investing after tax dollars into investments that will later yield long term capital gains so that you can use those tax free?

With it taking 18k to max out your 401k and 5.5k to max out your IRA, it sounds like this is putting low wage earners out of the hunt for early retirement.

Done by Forty comments are inaccurate.

Roth conversions are taxed as ordinary income, not capital gains. The only time they would be effectively in the zero percent bracket is if all income were less than the standard deduction ($24K-ish in 2019 for a couple MFJ), or if it were offset by tax credits, such as the child tax credit, the earned income tax credit, the retirement savings tax credit, the American opportunity tax credit, or similar.

If you’re not working and have no earned income you can convert $10,300 per year tax-free (standard deduction plus personal exemption) using the 2015 figures. If one is retired or taking a break from working for a year it would be a good time to make a conversion (assuming no pension income).

As you say, if you have earned income of $16,600 in a year you could not do a tax-free conversion.

Thanks for the article. One thing I might add would be while you are waiting for the 5 years to pass you can start taking your contributions from the Roth tax and penalty free. Then in 5 years start withdrawing the conversions. This way you have ladder income starting immediately. This is my plan while at the same time as all of this I will have a 72t from a separate 401k.

In the calculations for taking the penalty, you discuss the penalty of 10% as a con; but you are leaving out the calculation for paying taxes on that money as well. Are you making sure to include the taxes owed & the penalty in your calculations?