When I started the Mad Fientist, I didn’t do anything special to start my “business”.

As I mentioned in my last post, I was sick of being paralyzed by stuff that didn’t really matter so I just started writing and didn’t stress about the business end of things.

I kept track of my business expenses in a spreadsheet and when tax time rolled around, I just filed a Schedule C for my Sole Proprietorship and used those business expenses to reduce my W-2 taxable income.

It wasn’t until 5+ years after starting this site that I actually formed an LLC and started filing my taxes as an S Corporation.

Why did I make the change after so many years? What are the benefits that prompted me to do it?

That’s what this post is about.

My last article described why I think everyone should start a business and this post explains the benefits of forming an S Corp once your business becomes more profitable.

To assist me with this article, I brought back the tax mastermind who helped me switch my own business over to an S Corporation – my personal accountant, Steve Nelson!

Steve knocked it out of the park with his last guest post (Section 199a – The Tax Break of the Century) so I figured he’d be the perfect person to come back to talk about this complicated business tax stuff.

Welcome, Steve!

Okay, a warning. The S corporation tax strategy requires a bit of fiddling. For many small businesses, the strategy won’t make sense.

But for some self-employed folks, the S corporation option easily adds a six-figure chunk to your net worth.

Accordingly, the Mad Fientist thought it made sense to cover this tax-avoidance topic before the year ends.

The paragraphs that follow go over the accounting, discuss the costs, and then point out the steps to take if you want to do this.

Understanding S Corporation Tax Savings

To understand how an S corporation saves tax, you need to look first at the way a sole proprietor’s self-employment earnings get taxed.

Take the case where a sole proprietor earns exactly $100,000.

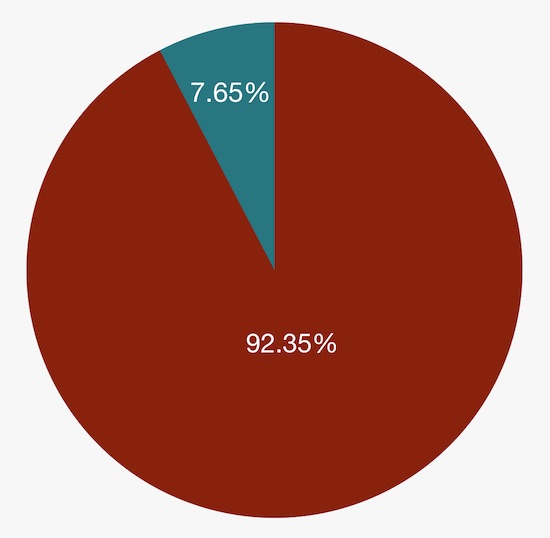

Assuming this person doesn’t have another job, the self-employment taxes equal 15.3% of 92.35% of the $100,000 of profits.

That means this person pays about $14,130 in self-employment taxes.

Note: Self-employment taxes replace the Social Security and Medicare taxes that employees pay and basically work the same way.

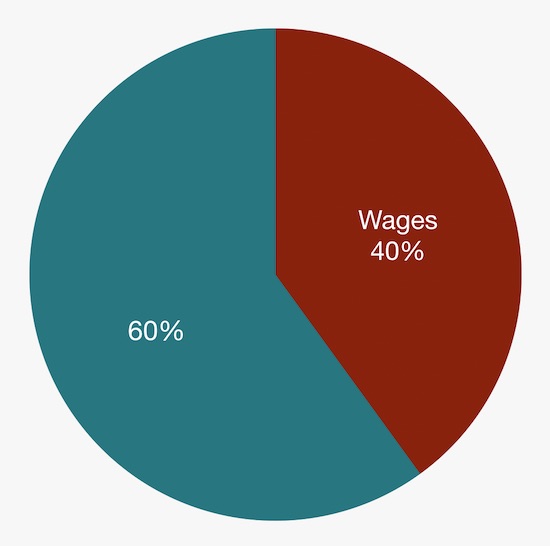

However, suppose this person incorporates their sole proprietorship and makes an S election. In this case, the business needs to call out a chunk of the profit as wages. And in this case, that 15.3% tax (now Social Security and Medicare taxes) only applies to the wages.

If the wages number equals $40,000, for example, the employment taxes equal 15.3% of the $40,000.

And this means the person pays about $6,120 in employment taxes.

You see the roughly $8,000 of savings: $14,130 vs $6,120…that’s the S corporation strategy in a nutshell.

The Flip Side of the S Corporation Coin

Obviously, the S corporation tax strategy delivers substantial tax savings. Annually.

But the savings come with extra costs and risks.

For one thing, both the federal and state governments levy additional payroll taxes on the $40,000 of wages that they don’t levy on sole proprietorship profits. That’s often about $500 a year.

Further, an S corporation burdens you with additional tax accounting. You might decide to just learn the law and do this yourself. Or you might outsource the work to some accountant.

In either case, that extra accounting costs time or money or probably both (as a guess, maybe another grand for a small S corporation if you outsource the work?).

Nevertheless, an S corporation often saves substantial sums.

You’re talking low to mid six figures for many FIers but for folks who work longer, the future value “S corporation” benefit probably grows into seven figures.

The Reasonable Compensation Riddle

Lots of people use the S corporation gambit (maybe around six million folks but recent IRS data is sketchy).

But you have a big riddle to solve if you want to do this. That riddle…what wages do you pay yourself as the business owner?

To maximize your savings, you want to pay yourself as little as possible. Peanuts, ideally.

But the IRS says (and courts agree) that you need to pay something reasonable. Reasonable means what a similar employer would pay an employee for doing equivalent work.

I will tell you this..the average S corporation generates about $90,000 of profit for an owner and calls about $40,000 of this profit “wages” (this breakdown lines up pretty neatly with the earlier example).

But what you need to do is identify a reasonable compensation amount—and then document your logic.

Dirty Laundry

We’ve got a longer write-up on the setting reasonable S corporation salaries here at my blog: S Corporation Reasonable Compensation.

But we should have the “awkward talk” at this point. Regularly S corporation owners go ape when setting their salaries.

They don’t, for example, set the salary to some reasonable level. They set a salary artificially, often absurdly low.

The Treasury Inspector General in past has reported that tens of thousands of S corporation shareholders pay themselves zero salary. And in that case, they avoid paying any self-employment taxes.

Presumably, hundreds of thousands of S corporation shareholders pay more than zero but still unreasonably low salaries.

But you don’t want to do that. You really don’t.

If you set your salary too low, the IRS can reclassify distributions paid to shareholders as wages and then slap you with penalties.

And here’s the other thing to keep in mind. You don’t have to go crazy or break the rules.

How Optics Matter to Reasonable Compensation

Consider again the earlier example where someone makes $100,000 but pays $40,000, or 40%, in wages.

Okay, maybe that works for some taxpayers. And it meshes with the averages pretty well. But that breakdown may be unreasonable.

Yes, many taxpayers get away with this. The IRS audits about 12,000 S corporations a year, and nearly 6,000,000 S corporations exist.

If you’re paying the average, you are pretty boring to the IRS’s computers.

However, what you really ought to do in a situation like this?

Dress up the optics of the tax return. And people use two tricks here…

Trick One: Nontaxable Fringe Benefits

Trick one? Add nontaxable fringe benefits like health insurance and employer pension contributions.

For example, say you were running a small S corporation that makes $100,000 and that you want to set $40,000 as your S corporation reasonable wage. That leaves $60,000 you pay out as a distribution to your owner—and on which you pay no employment taxes.

That might be risky…

But say the S corporation provides $20,000 of health insurance and a companion health savings account.

In this case, that $20,000 counts as wages (and so bumps the shareholder wages from $40,000 to $60,000) but the extra $20,000 of wages doesn’t increase the employment taxes.

Say you also run either a SEP-IRA or a solo 401(k) plan that provides a 25% employer match. The 25% employer match applies to the $60,000 of wages, which means another $15,000 of nontaxable fringe benefits.

With these fringe benefits, the $40,000 “base” grows to $75,000 of total compensation—though note again only the $40,000 of base wages get subjected to payroll taxes.

If a business makes $100,000 and pays out $75,000 as compensation and benefits, that still leaves another $25,000. And maybe a little risk exists there…

But here’s where a second trick comes into play.

Trick Two: Dial Down the Distributions

That second trick? If you can, you dial down the distributions to the shareholder. Why does this work?

As noted earlier, an IRS agent can only reclassify as wages those distributions the S corporation pays out (remember in our example that’s the last $25,000 a year).

So, if you leave some of that money (say $2,000 or $5,000) inside the S corporation (as your rainy-day fund or as part of your taxable portfolio), bingo…that money can’t be reclassified as wages.

Another example? If you’re someone who gives to charity (say $1,000 or $2,000 or whatever), you can use some of that $25,000 for your charitable giving. And then that money can’t be reclassified as wages.

Note: When you make charitable contributions from an S corporation, the charitable contribution still ends up on the 1040 return.

To put all this together, a sole proprietorship making $100,000 a year might be able to pay a $40,000 wage, save nearly $8,000 a year in payroll costs, and then remove the risk of an audit by legitimately sculpting the tax return to bump compensation and fringe benefits and dial down the distributions.

Further, this sculpting might be especially compatible with working toward FIRE through aggressive saving and investing.

How Would You Even Do Something Like This?

Okay if you operate an unincorporated small business, this all sounds pretty interesting, right?

Sure, some extra work but not that hard to deal with.

So, what’s the next step? Well, if you did want to do something like this, what you would probably do is immediately form a limited liability company.

A limited liability company (LLC) is one of the legal entities that can make an election to use the S corporation tax accounting rules.

The Mad Fientist, on your behalf, arranged for our offices to supply complimentary copies of our DIY S Corporation formation e-book. It provides step-by-step and state-specific instructions for setting up an LLC, getting the LLC an EIN, and then making an S corporation election for the LLC. The DIY kit also includes sample LLC operating agreements. And by the way? Normally, we sell these for about $40. Mad Fientist did you a solid on this! Grab a complimentary kit from this page, Downloadable S Corporation kits… All you need to do to “buy” a kit for some state for free is enter the promo code MADFIENTIST.

Mad Fientist Note: I used one of these kits to set up my Florida LLC and S Corp and it made the whole process super simple. I just followed the guide, line by line, and got everything set up really easily. Thanks to Steve for making these free for Mad Fientist readers and be sure to get your state’s kit before the end of the year because the code will expire on 12/31/2018!

An important point: You need to form the LLC before the new year starts and then file the S corporation election paperwork after setting up your LLC but before March 15th of the year for which you want to use the S corporation gambit.

Example: You might form an LLC today—this very morning or afternoon, for example. But you would file the S election paperwork so it sets 1/1/2019 as the effective date (for 2018, the LLC gets ignored and so your business is treated as a sole proprietorship).

The one other rule to consider: Once you operate your business as an S corporation, you must pay yourself a reasonable salary. And you need to have paid that reasonable salary before the calendar year ends.

Example: If you form an LLC in late 2018 and elect Subchapter S status for 2019, you need to have paid yourself reasonable wages by December 31, 2019. That means paychecks, quarterly federal and state payroll tax returns, tax deposits, etc.

Three Cautions to Wrap this Up

Let me issue three cautions before I wrap this up.

First, carefully think through the reasonable compensation math. The S corporation gambit only works well if you can pay yourself a wage that allows you to really save on your self-employment tax bill. Possibly if you’re a one-person independent contractor, you will need to finesse the optics with fringe benefits to get the S corporation to really work safely.

Tip: Usually S corporations don’t work well for side hustles if you have another W-2 job. And usually they don’t work well for businesses unless you’re making high five-figure profits or more.

Second, you should know that two states—Tennessee and California—make the economics of an S corporation option tricky. California levies a 1.5% franchise tax on the S corporation’s profit (the franchise tax also is always at least $800). And Tennessee doesn’t let you use the S corporation accounting for state tax purposes. For these states, you need to double-check your math. The state tax laws may mean the S corporation isn’t viable.

Third, an S corporation’s reduced wages reduce your future Social Security benefits. Now, that effect is usually modest if you pay yourself a reasonable wage. But to really come out ahead on this, you want to save your payroll tax savings.

It’s the Mad Fientist again. Thanks for the post, Steve!

There’s another benefit of having an S Corp that’s worth mentioning…

If your business makes a lot of money (i.e. more than $157,500 for a single person or $315,000 for a married couple filing jointly), having an S Corp could help you qualify for the tax break of the century when you may not have otherwise.

Imagine you’re a single person and your business earns a $250,000 profit next year.

If your business is structured as a sole proprietorship, you wouldn’t receive any Section 199a deduction because you earn too much to qualify.

If you instead have an S-Corp, you’d be eligible to receive a Section 199a deduction on 50% of the W-2 wages paid by your business.

So if you paid yourself 28.5714% of your business profits (which is the percentage that would maximize the Section 199a deductions in this case), you’d be able to get a 20% deduction on $71,428.50 of your income.

This benefit alone could save you thousands of dollars! Throw in the savings on employment taxes described in the post and you can see why this is a great move for many profitable businesses.

If you already have a business, hopefully this post helps you save a big chunk of money on your 2019 taxes (remember, set up an LLC now if you want to make an S-Corporation election for the entire 2019 tax year).

And if you’re just starting your business, hopefully this article gives you an idea of some of the other tax benefits you can look forward to when your business grows!

You said S Corps are not good for side hustles, but I thought if you work less than 500 hours a year on your S Corp business then you can classify the entirety of the income as profits, not have to call any of it wages, and then pay 0% self-employment tax. To the best of your knowledge, am I correct on this, or am I missing something?

Hi Dave,

So no “500 hour” rule exists for S corporations. The rule is, an S corporation must pay its shareholder-employee reasonable wages.

BTW, if someone only worked part-time, that matters in the reasonable compensation calculus. Someone working part-time would logically earn less than someone working full-time.

So in setting wages, optics is more important than actual hours spent working on the business?

I have blog income and book royalties. The work on the book having been done years ago, the royalties are completely passive.

As for the blog, I work less than 10 hours a week on it. Based on a 40 hour week, that is ~25%.

Since the royalties are ~2/3rds of the revenue, using 100k as an example:

67k = Royalties

33k = Blog x 25% = $8250 wages

That would be the “real” number. But it is only 8.25% of total income, far below even the 40% you suggest is borderline.

The rule for S corporations says “reasonable compensation,” and really that just means what a similar employer would pay an employee for doing the job. Factors like the hours required and worker skill matter play into this.

Regarding optics, I think they *do* matter. But they aren’t more important. Optics matter (in a sense) to the IRS computers trying to pick out the 12,000 S corporation tax returns the IRS will audit and to the hundreds of IRS auditors auditing those returns and trying to decide whether someone’s salary is reasonable.

Jim, I clicked Reply too soon…

But to clear up this confusion, I am not suggesting 40%. That was only for illustration.

Also, the optics of 8.25% might look pretty bad. E.g., if the total profit equals $100K, $8250 is *probably* too low optics-wise.

But if the total is $1,000,000, $82,500 may be workable.

And if the total is $10,000,000, $825,000 probably works.

BTW, former Democratic VP candidate John Edwards paid himself about 1% in his S corporation. That 1% equaled about $250K and his profit equaled roughly $25,000,000.

What I suggest is this: Develop a good argument for why a particular number is reasonable. And then make that number even lower-risk by making the optics look good.

Regarding book royalties in specific, I think the fact that an author wrote a book X years ago doesn’t mean an S corporation can pay the shareholder-employee “zero.” I get your argument there. (I received royalties for “Quicken for Dummies” for two decades… and I continue to receive royalties for “QuickBooks for Dummies” even after two decades.) But the optics of zero salary for a successful author may look too sketchy on both the 1120S tax return and to the IRS auditor.

Final comment: It’s possible my royalties on Quicken for Dummies equaled $10K a year at the very end. (I don’t know for sure. But say they did.) In that case, if that were the only book in my S corporation, I think the right salary number could just be zero.

Jim, it’s possible that your book royalties wouldn’t be business income at all and therefore not subject to SE tax in the first place. However, you are clearly in the business of writing.

“The IRS has ruled that an individual who writes only one book as a sideline and never revises it is not regularly engaged in an occupation or profession, and the book royalties are not considered earnings from self-employment.”

https://www.thetaxadviser.com/issues/2013/dec/kelley-dec2013.html

If you are able to separate the royalty income from the blog income, then you can re-figure your math and the optics look a lot better.

very interesting.

If that is the case, where/how on the return would royalty income be reported?

If I could peal that off self employment income, I might not need an S-Corp at all.

Thanks!

I don’t think it works to say you’re not a writer and so not in the business of writing and so can report book royalty income on Schedule E (which would be where it goes… but of course I know the specifics of your situation.

Jim I know this is an old comment. But to the best of my knowledge passive income such as book royalties is best to have in a regular (non s-corp) LLC, since passive income is usually not subject to FICA (payroll tax) anyway.

I only have a profit of about 55,000 and so I don’t think an S corporation would work for me.

Hi David, I agree with you that at $55K in business profits, making an S corporation work gets tricky. You would need to be able to extract a lot of the S corporation profit as fringe benefits in order to even sort of make this work.

E.g., if the S corp paid David the employee $30K in wages subject to FICA and Medicare… and then it provided $10K of health insurance and HSA to David and his family… and then it provided a 25% SEP benefit of $10K, that probably works.

Note: This accounting leaves $5K “leftover” for a shareholder distribution.

But that’s a lot of fiddling. And what the shareholder saves is $3300-ish in FICA and Medicare taxes. Which isn’t really enough to pay the full freight.

In the new 199a-QBI deduction world this makes a whole lot less sense and I think this article is doing a disservice to a lot of people that would be better off in their default sole proprietorship than as an S corp as prompted by this article. To ignore the effect of the potentially significant reduction of the QBI deduction when moving from a sole prop to an S corp is to miss the forest for the trees. I think most smart people are trying right now to figure out how to do the opposite of this article – to dissolve their S corps and get back to a sole prop, or form a partnership.

To add: the only mention of the 199a deduction in the article provides factually incorrect information.

You said: “If your business makes a lot of money (i.e. more than $157,500 for a single person or $315,000 for a married couple filing jointly), having an S Corp could help you qualify for the tax break of the century when you may not have otherwise….Imagine you’re a single person and your business earns a $250,000 profit next year…If your business is structured as a sole proprietorship, you wouldn’t receive any Section 199a deduction because you earn too much to qualify…If you instead have an S-Corp, you’d be eligible to receive a Section 199a deduction on 50% of the W-2 wages paid by your business…So if you paid yourself 28.5714% of your business profits (which is the percentage that would maximize the Section 199a deductions in this case), you’d be able to get a 20% deduction on $71,428.50 of your income.”

This is incorrect. The QBI deduction phaseout is based on Taxable Income (Line 10 form 1040). The allocation of a single shareholder S corp income to wages (Line 1 form 1040) vs distributions (Line 17 Schedule 1, gets added at Line 6 form 1040) doesn’t change the ultimate Taxable Income for the tax filer, and isn’t going to produce a QBI deduction where none existed in the case of a sole prop.

Jaco, Good issues to raise. And the interplay between Subchapter S and Section 199A gets complicated.

Probably the only truly useful “rule of thumb” is to run the numbers and look at both using an S corporation and not using an S corporation.

But because you’ve raised the subject, let me point out a handful of things:

First, some people need an S corporation in place to get the Section 199A deduction because they need W-2 wages in order to get the Section 199A to work. (We talk about this in the Section 199A blog post that the MadFIentist references above.)

Second, for the typical small business owner, the S corp savings actually dwarf the Section 199A savings. E.g, the typical S corp saves 15.3% on $50K of earnings or about $8K. This S corp also gets about a $10K Section 199A deduction which probably saves about $1200 in income taxes. If you dissolve that S corporation to bump its qualified business income by $40K, that will bump the Section 199A deduction and increase the Section 199A savings… but not by very much. Roughly $600-ish of savings? Why? Because the Section 199A deduction equals the lessor of the qualified business income or the taxable income. (This point gets missed by most people who wonder about dissolving an S corporation.) In this case, the typical S corporation by dissolving would pay $6K to $7K more in taxes.

A third final comment: We have a giant S corporation tax practice. Further, we also publish a bestselling technical monograph on Section 199A for tax practitioners learning the new law. And I would say the S corporation election and the Section 199A deduction are actually complementary.

Great article Steve! Can you talk about the interplay between the QBI, S-corp wages and specifically 401k contribution amounts?

Brandon talked about the ~28.57% of business profits to maximize the QBI, and you talked about keeping wages down to minimize employment taxes, but there is some consideration to 401k contributions as well, right?

As I understand it, you can only put in 25% of wages on the employer side of the 401k contributions.

Would love your thoughts…

In an S corp, the QBI deduction is 20% of profit (distributions). Wages are excluded from QBI. There is a limitation on the deduction as a percent of wages as well, which is where the 28.57% wage number comes in.

Employer qualified plan contributions are a deduction to the S corp on the 1120S and therefore reduce profit. You are correct that employer contributions are limited to 25% of employee compensation (wages).

The thing is, in a sole prop, the entirety of the income is QBI. So the 20% QBI deduction is much larger for a sole prop compared to an S corp. Which is why this article doesn’t make much sense right now. The payroll tax savings for most businesses won’t make up for the “tax cost” of the reduced QBI deduction.

Jaco said, “In an S corp, the QBI deduction is 20% of profit …”

Okay, I think I see where we’re disconnecting.The above statement is incomplete.

The Section 199A deduction equals the lesser of 20% of the qualified business income or 20% of the taxable income adjusted for capital gains.

Consider the two following small business owners: Both earn exactly $100K. Both save $16K into a pension. Both are married and take the new standard deduction, $24K.

Steve operates as a sole proprietorship. So his QBI equals $100K. But his Section 199A deduction doesn’t equal 20% of $100K. His taxable income, roughly $60K, limits the deduction. The actual Section 199A deduction equals $12K. (That’s 20% of the taxable income.)

Jaco operates as an S corporation and breaks the $100K of profit into $40K of wages and $60K of distributive share. His qualified business income equals $60K. Coincidentally, his taxable income also equals $60K. The actual Section 199A deduction therefore equals $12K.

Bottomline? Yes, Steve enjoys a higher qualified business income because he doesn’t deduct wages. But that doesn’t result in a higher Section 199A deduction. Furthermore, Steve misses out on roughly $8K or $9K of payroll tax savings.

Brad, regarding interplay between QBI and S corp shareholder-employee wages, really what almost everyone wants to do is simply minimize the shareholder wages. Minimizing shareholder wages maximizes the “Qualified Business Income” (or QBI) that plugs into the Section 199A formula. Minimizing shareholder wages also minimizes the FICA and Medicare taxes paid directly or indirectly by the shareholder.

In a sense, to say this another way, you now have *two* good reasons to push down shareholder-employee wages. But that’s a little irrelevant because most S corps already do this…

How 401(k) contributions work is a little tricky. The employer match, which appears on the 1120S corporation tax return, reduces both QBI and the shareholder’s taxable income. The employee elective deferral (which is embedded in the shareholder-employee wages) reduces the taxable income so potentially reduces the Section 199A… but doesn’t reduce the QBI.

Note: In past, CPAs have said you ought to do the employer match first and the employee elective deferral second… but the Section 199A formula sort of flips this around. If you’re only going to one and not the other, you probably ought to do the elective deferral first. That sequencing may increase the Section 199A deduction.

Regarding the 28.5714% thing, if S corporation wages limit the Section 199A deduction, you optimize with that percentage. E.g., say you run a one person S corporation (maybe a super-successful realtor?) that makes $1,000,000. In this case, your Section 199A deduction can’t be more than 50% of your W-2 wages. So if you pay out $285,714 of $1,000,000 in profit as wages, your Section 199A deduction equals either 50% of $285,714 or 20% of ($1,000,000 – $285,714)… either way, the result equals $142,857.

Really late, but revisiting because it’s tax time…

Regarding the employer 401(k) match, if this match is put into a Roth 401(k) (as opposed to a pre-tax 401k), would this still reduce QBI?

Like Brad, I too would like to learn more about the interplay between S-corp wages and deferred compensation. Specifically, could an S corp or other LLC be set up for a business that barely turns a profit? I want the business to service the loan required to pay for the business. After expenses, at least initially, there will be little left over to compensate the two owners/employees (maybe $5k to 25k a year). The idea is the business would pay for itself initially and we would mostly work for the retirement benefits with one employee taking a taxable annual salary of no more than $12,000 and the other no more than $4,000 until the loan is paid off. Ideally, most of the compensation could be in the form of deferred compensation. Could a Sep IRA or Solo 401k get around the employer’s 25% limit on 401k wages Brad references above since our other income streams do not have any other retirement benefits?

Davin,

I don’t think you generate a financial benefit by setting up an S corporation to create wages so you can fund a pension. In that situation, you’re essentially paying a 15.3% payroll tax plus state payroll taxes plus FUTA plus cost of S corp return to put money into a tax-deferred account. That’s too expensive.

BTW, sort of related: People sometimes bump their S corporation compensation only to bump their pension contributions. That gambit also basically never makes financial sense. The taxpayer pays too much payroll tax for the relatively modest tax deferral benefit they enjoy.

Great article clearly explained for the tax-inept of us out there. I’m a couple years into my Sole Proprietorship, and while income is growing, *profits* after deductions are around 80-90. In your opinion, is that still borderline in terms of work-ability with this approach? Is 100k in profits a good ballpark to make this realistic?

Thanks for all your time.

Dan, I think high five figures is where an S corporation most often begins to make sense. E.g., say you make $80K. Further say you have $20K of health insurance and HSA and $10K of pension. Or say the reverse… that you have $20K of pension and $10K of health insurance.

In this case, you’ll maybe pay Dan the employee $40K in wages subject to payroll taxes and then give him and his family another $30K in fringe benefits that are free from income taxes and (unique to the S corporation) free from payroll taxes. In this scenario, you also sidestep payroll taxes on that remaining $10K.

The bottomline: Your payroll tax savings in this case equal about $5300.

BTW, your Section 199A deduction (a deduction mentioned in many other comments above) only equals $2,000 in this case and maybe only saves you $240 in income taxes.

So an obvious question is, should you stay a sole proprietor to increase the size of the Section 199A deduction? (By staying a sole proprietor you maximize your QBI to $80K… ) But the answer to this question is probably “no.” Assuming you are married and take the new standard $24K deduction, as a sole proprietor, you would get a Section 199A deduction equal to roughly $5200 which would save you only about $624 in taxes.

The point about the Section 199A deduction is the deduction equals 20% of the *lesser* of your taxable income adjusted for capital gains or your QBI.

Thanks so much for the informative post. My question is about the S Corp paying the health insurance for the single employee (and their family). The health insurance is in this case an S Corp expense, is free of FICA and FUTA taxes, but must be reported as (federal) taxable income, i.e. as part of your wages. My question is–do you still get to deduct it as an adjustment to income as self-employed health insurance? Thanks!

yes – S corp can pay for shareholder health insurance. The amount paid is added to W2 Box 1 compensation, but not box 3 and box 5, therefore FICA tax exempt. Shareholder then takes a deduction in the same amount on their personal tax return.

Same thing for HSA contributions if applicable.

Diana, you need to be careful about health insurance for s corps when you have non-shareholder-employees. But here’s the way this works now (and the way it’s worked for years).

Let’s say Diana owns and works in an S corporation. Say she pays herself $40K in base wages and then also provides $10K of health insurance for her entire family. In this case, the corp treats both the $40K and the $10K as wages and reports $50K in box 1 of Diana’s W-2.

Note: Boxes 3 and 5 of Diana’s W-2 report only $40K of wages because health insurance isn’t subject to FICA or Medicare.

On Diana’s 1040 tax return, she reports $50K as her wages subject to income taxes… but she probably also takes a $10K self-employed health insurance deduction.

Looking for free advice (how frugal of me) :)

I’m an independent consultant (LLC), and will earn ~$135K next year working 1/2 time (about 1000 hours billed for the year). I’ll contribute the full $55K to my solo 401(k) along with about $4K to an HSA. I’ve looked into the ‘tax break of the century’ but I can’t use it for my particular situation/industry. Bummer… I also cannot in good conscience claim to be hiring my wife/kids (a strategy my former accountant was pushing).

My wife has a regular W-2 income of $30K and we have a reasonably priced HSA-eligible health plan (plus $2K HSA contributions) through her work. She’s planning on contributing $19K of salary to her 401(k).

So all-in, I’ll be taking a profit distribution of ~$75K to go along with ~$5K from my wife’s salary. Given this, do you think it’s worth the effort of going the S-Corp route? I may have a one-off increase of business income by 100% in a couple years (long term contract payout), so does that change the calculus?

.5 scale RE, you don’t provide enough info to answer questions… but note that if your total income equals $155K and you’re married, no matter what your trade or business, you qualify for Section 199A.

Actually, because you’re married, you would need at least $415K in total income to hit the start of the phase out range for specified service trade or business disqualification.

Regarding how to approach the question of incorporating your business, you’d need to determinate what your reasonable compensation amount is, look at any nontaxable fringe benefits you can provide, and then calculate your payroll tax savings. It would not surprise me if you can save substantial amounts with an S corporation.

Thanks for the quick response.

Regarding 199A, I actually asked you about this before, and due to the majority of my ‘consulting’ involving actual software design/programming, you suggested I probably wouldn’t qualify:

(from your comment)

The regulations describe “consulting” as situation where someone provides advice and counsel. If what a software consultant really does is programming or design, that’s probably not really per the Section 199A deductions a “consulting” activity.

(end comment)

I will definitely research fringe benefits and also take you up on your generous DIY S-Corp guide offer (thanks!). I see spreadsheets in my future…

Regarding ‘reasonable salary’, if I determine $100K/yr is reasonable for my industry but I am only working 1/2 time, does that help my case to only claim $50K/yr as my salary?

Since that ‘consulting’ answer I gave you, the IRS issued proposed regs… and software programming doesn’t count as consulting.

Regarding a part-time salary, that logically works.

I own an S-corp. In the article you make it sound like there would be no tax on the $60,000 profit, only on the $40k wages. But according to every accountant I have worked with, that $60k still flows to your 1040 and you end up paying taxes on it anyway. Am I missing something?

Hi Elton, the S corporation lets you avoid self-employment taxes (aka payroll taxes) on some of the pension fund contribution, your self-employed health insurance and on the amount of business profit not counted as wages.

E.g., a sole proprietorship who makes $100K pays self-employment taxes on 92.35% of the $100K

An S corp that also makes the same $100K but only pays out $40K in wages pay employment taxes on only the $40K.

If both of the example business owners above have a $10K self-employed health insurance deduction, a $15K pension deduction and another $25K of personal deductions–so $50K in total–that would mean $50K of income subject to income taxes.

Thanks for the reply. I’m still a little confused. I thought the 100k was profit after deductions. Why would the sole proprietorship pay taxes on 100k if they can make further deductions? Wouldn’t the deductions be on his tax return as well? I’m probably missing something.

Also, if your salary is above $117k you stop paying payroll tax on any additional amount correct? So does it matter how you pay yourself after your “responsible wages” exceed 120k a year? I am unclear on the new rules.

Elton, sorry, I misunderstood… so you’re right that you only pay taxes on your business profit.

E.g., if your business generates (say) $120K of revenues or billings and you incur (say) $20K of business expenses, your business profit equals $100K.

If you’re a sole proprietor, you pay the 15.3% self-employment on 92.35% of this $100K (as MadFIentist graphically shows earlier).

If you incorporate your business, elect Sub S status, and pay only $40,000 of the $100,000 as wages, you then only pay the 15.3% employment tax on the $40,000.

BTW, in both the sole proprietorship and the S corporation format, you pay income taxes too. But to determine how much income tax, you need to combine the business profits with all your other deductions: self-employed health insurance, pensions, itemized or standard deductions, etc.

Oops, forgot to answer the other easy question I should answer. For 2018, FICA limit equals $128,400. In 2019, that limit rises to $132,900.

As someone who actually paid for one of Steve’s S Corp kits a year ago I can confirm it is well done and helped me set up my S corp in Texas. I was so satisfied I will not even ask him to price match this deal.

I make about 100k of 1099 money through what is currently my LLC. I simply pay my estimated taxes. Including payroll and federal/state taxes. I can expense about 10 to 15k naturally via normal operating expenses so net 85 to 90k. I have a W2 job (60k separate from the 100k 1099)where I max out my 401k and also max out my wife and my Roth IRAs. So that takes about 30k of my income. I also have a 25k annual mortgage payment and about 50k in normal household expenses. So overall I need 75k in after tax wages just to pay the bills. (Not counting Roths) Would an S-Corp be a good fit? I just don’t see how I can pay myself some wage like 40k… because then I can’t pay my bills right. Am I missing something?

Brad, two comments about your situation and others like it…

First, making the S corporation thing work for a side-line or supplemental business is tougher. Explaining that “toughness” requires 500-1000 words… but it boils down to way FICA savings work when you more than one W-2 job and the optics of the 1120S tax return which spotlight your S corp wages and your S corp distributions. So, bottomline, the option isn’t as attractive in your situation.

Second, just to clarify this important but often confusing point. If you have an S corporation making (before shareholder-employee wages) about $90K (this number distilled from your comment), you extract this profit in two ways: A chunk goes to Brad the employee… maybe that’s $45K. And another chunk goes to Brad the shareholder… maybe that’s the other $45K. The S corp, in other words, doesn’t reduce the cash flows to the business owner.

Great article, as I was just recently researching this topic – thank you! I am an independent consultant organized as an LLC. My first reaction was that the S-Corp gets trickier when income is high but not high enough to phase out of the QBI. For example, it seems hard to justify $100K of salary on $300K of business income but I think your comments on the “optics” and fringe benefits help paint the picture of how one might justify that. I am also in a situation dealing with the AMT this year for the first time so have had to look into strategies to avoid this. I haven’t run the numbers but this might help. Unfortunately, given the S Corp declaration needs to occur by March 15 (and I already have an LLC – any workaround for this?!), the ship has sailed for this year but might be something I consider for 2019. Thanks again!

Dan, the IRS allows very late subchapter S elections. So while the statute says you needed to elect by March 15 to have an S corporation for 2018, you can actually elect way, way, way later.

The big complicating issue you have with a late election is you’d need to pay Dan the employee reasonable wages between now and the end of the year.

Note: When you make a late election, you need to invoke the correct revenue procedure and follow its rules.

MadFIentist? I hope it’s okay to provide this link but if not, apologies and please delete:

https://evergreensmallbusiness.com/subchapter-s-election-timing-tips-tricks/

Can you make the credit apply for you LLC resource (instead of just the S-corp) for those of us who need to start with that step? Thank you for considering this request!

Thank you for the great information!

Hi Lynn, MadFIentist actually had you covered on this from the very start. What you want to download is the S corporation kit for your state per instructions above. The S corporation kit uses an LLC. E.g., say you’re in Texas and you grab the Texas S corporation and follow its instructions.

The kit has you set up a Texas LLC ASAP… and then you would make the S election effective for 1/1/2019.

If you’re not yet ready to elect S status but you are ready to set up an LLC, therefore, just postpone the step of making the S election. (This means you postpone preparing and filing the 2553 form.)

This is a great post. Very informative!

I’m semi retired, I spend time evaluating real estate deals to see if I want to lend. All of my borrowers report income to me on 1099-int. That is, non earned income. I pay no FICA on it. Currently, I don’t use an Scorp. If I claim reasonable income, I’d pay FICA on that. In this case is it worth it? No separate office, car mileage, wire fees and any professional fees are all I have for deductions. Toss more into an IRA. Taxable income in the 3xx,xxx range.

Thoughts?

Two thoughts come to mind about your situation HardMoney.

First, if you’re in business of hard money lending, maybe activity should be reported as a business and not as portfolio income. I.e., maybe you should consider yourself a bank. In that case, maybe you should be paying SE taxes. But that would let you have earned income and do pension contributions.

Second thought: If activity isn’t a business, it probably doesn’t make sense to use accounting you describe. The payroll taxes eat up the benefits from any tax deferral.

As someone who lives in CA and set up a S Corp a year and a half ago, I wanted to mention a couple things.

1. Even with the CA franchise tax, moving to a S corp saves us about $8k/year. And other than SEP-IRA/HSA, we don’t have any fringe benefits. I will definitely be looking into that more!

2. As someone who had never done payroll before or dealt with employer/employee payroll taxes, etc, the reasonable wage part was a bit confusing and scary. Long story short, I recommend to just outsource it. We did look at ADP and Paychex as they are the largest of the payroll outsourcing companies. Ended up using Intuit Payroll. It cost half as much per month ($30ish) and they handle all of the tax paperwork, worker’s comp (for all non-owner employees), monthly and quarterly filings, direct deposit, etc (they have 4 levels of service, we went with the 2nd cheapest). I was confused when trying to set it up and just called their help number. They patiently walked me through everything and now payroll (one owner and one part-time employee) is very easy. I can’t recommend them enough.

Thanks for the great post!

I read a comment from David Ann Arbor about his business making 55k a year and Steve mentioned that it probably wouldn’t be worth it. What about the example below…

My side business profits about 50k per year, but I only spend about 5 hours per week working in it and the work that is performed is not “high level” work. Therefore, could I pay myself $15 an hour, 5 hours a week, ~$4k per year?

I know it violates the “optics” principle, however, I feel this could easily be justified to the IRS since the time spent in the business is so minimal.

I really appreciate ALL of your time replying to these comments and for writing this article! Thanks!

Stephen, could you please walk me through how the employer match to a solo 401(k) can be added to wages as nontaxable fringe benefits? Most of the literature I’ve read says you can do it for health insurance, but I haven’t seen anything about the employer match.

You may have answered this in the comments with the following, but it is still unclear to me how it works:

“How 401(k) contributions work is a little tricky. The employer match, which appears on the 1120S corporation tax return, reduces both QBI and the shareholder’s taxable income.”

I make around $70k a year from various sources. My work is all in the same industry, but I work for multiple vendors/clients that pay a variety of 1099 or W2 depending on the payroll setup. I’m currently a sole prop and the only employee. I have an ACA health insurance plan and a Solo 401(k). My deductions are well under the new standard deduction as I have virtually no business costs since I’m being hired for my skills. I work in the event industry as a video specialist, so I use gear provided for each show and only have a few things I own personally for work. Would converting myself to an S-Corp be a reasonable move given that skeleton outline? And do you have any recommendations for a CPA in the Nashville, TN area or is your company able to work with people in any state?

If I’m making ~$30K a year with my LLC, does filing as a S Corp seem worth the hassle? I think Social Security maxes out around around $108K, right? If I make more than that with my main job, does the drop off in savings still make S Corp good idea?

Great article clearly explained for the tax-inept of us out there. I’m a couple years into my Sole Proprietorship, and while income is growing, *profits* after deductions are around 80-90. In your opinion, is that still borderline in terms of work-ability with this approach? Is 100k in profits a good ballpark to make this realistic?

Thanks for all your time.

Hi Stephen,

I really appreciate all of your insight. I wanted to ask a few questions:

1) Is there a point where you can make too much money for an S Corp to not be worth the lost QBI deduction? SS stops at about $132K, however, medicare costs are ongoing. Additionally, the QBI deduction does not fully phase out for a single flier until about $207K. From my calculations, for a single flier, I don’t think there is a point where it doesn’t make sense to have an S corp but I wanted to check.

2) The same question as #1 but how does this change if you are married and your wife’s income is about $70K? If you make over $200K, would it make more sense to not have an S corp and benefit from the QBI on the entirety of your income with SS stopping at $132K?

Thank you!

Ok but why the Roman Pantheon?

Hi, I opened my S-Corp Jan 2019. In my situation, approximately how much will I end up paying for taxable income on my business, and for my own self-employment tax, by my figures below? I have two part-time 1099 contractors who occasionally help me.

Also my CPA told me I only have to file every 6 months, but I read somewhere it should be every quarter.

115,500 K – gross income

30k – I pay myself

24k – standard deduction

4000 – 1099 worker

6000 – 1099 worker

51,500 profit

Hi – I’m revisiting this article as I reflect on my decision to convert to a S-Corp and comparing rough pro-forma taxes as both a S-Corp and LLC in the State of Ohio. Based on my analysis I believe the QBI deduction does not make it obvious to convert to a S-Corp. The salary you pay yourself reduces your qualified business income. This ultimately reduces the QBI deduction. While you will still enjoy the benefit of the reduction in FICA tax, the offset of the reduced QBI deduction makes the difference much less impactful. In fact, when you add on the expense you’ll likely incur for professional tax preparation given the more complex structure, the time associated with additional filings/administration and the use of a payroll service I just don’t think this is a slam dunk decision any longer. In my analysis, the S-Corp still had the lower overall tax burden but it was not significant. I just wanted to provide this perspective to those evaluating their own decision – I would evalute the pros/cons of each. The simplicity of a LLC may outweigh the smaller tax benefit you receive from converting to a S-Corp (of course everyone’s tax situation will be different!). Look forward to any comments if this analysis is off base. Thanks!

Have a question, which might be another reason to form an s-corp/business:

I was gaming out some stuff and ran into a couple of interesting scenarios based on the rules for Roth 401(k)s and Roth IRAs. It’s generally accepted that the following strategy has some popularity, otherwise known as the Roth ladder:

Contribute money to t401k during periods of high income (asset accumulation phase).

1. Retire early.

2. Rollover to tIRA (no tax event)

3. Convert portion of tIRA during period of no/low income (taxed at reduced rate) to Roth IRA.

4. Wait four to five years calendar years, depending on date of conversion (because years are counted instead of actual date, so a conversion on 1/1 is treated the same as 12/31)

5. Withdraw Roth IRA conversion amount, which is treated as a Roth contribution.

Pretty cool! The biggest problem, however, is the 5-year waiting period, so you have to have a decent amount of post-tax money already available in order to optimally execute on this strategy.

However, what if the conversion occurs in the 401(k) itself? The process would maybe go like this:

1. Contribute money to t401k during periods of of high income.

2. Convert t401k to Roth 401k within a 401k plan during periods of low income.

3. Trigger or have ability to rollover Roth 401k to Roth IRA that was created five-years ago. (maybe the plan allows at any time, maybe employment terminated, etc.)

4. Rollover Roth 401k money to Roth IRA

5. ????

6. Withdraw converted amount from Roth IRA, which is treated as a Roth contribution.

Notice step 5. This is because I believe that vanilla Roth 401k contributions are not subject to the five year rule, so long as they are rolled over to a Roth IRA that is five-years old. In other words, the Roth 401(k) rollover money inherits the age of the Roth IRA, either for good or bad. However, I cannot find any confirmation that Roth 401(k) converted funds are treated the same as vanilla Roth 401(k) contributions.

So, that leads me to a few questions:

Does anyone know about any holding period for t401(k) to Roth 401(k) conversions, similar to the tIRA to Roth IRA?

Has anyone done a t401(k) to Roth 401(k) conversion to beat the 5-year rule and make their ladder shorter? If so, did the IRS give any pushback or try to impose the 10% penalty?

How common are plans allowing t401(k) to Roth 401(k) conversions? My personal experience is that they are rare.

But what if you form an S Corp or sole proprietorship, generate income, and create a friendly Solo 401(k) that allows you to convert? Any limitations there?

Beating the 5-year rule through in-plan 401(k) conversions seems too good to be true. So, please tell me what I’m missing.

Hello Steve,

I make annually about 170-200K in W2 wages. My wife brings in 50K in W2 wages. My wife and I both max out 401k at our day jobs. On the side, I provide IT consulting to a startup that pays 100-150K in 1099. I am looking for ways to reduce my tax bill. I have been filing taxes with Schedule C. Does it make sense to form S Corp in my situation?

Thank you.

I know this is an old post, but I started freelancing last year and have had people tell me that I should form an LLC and file as an S corp to reduce my SE taxes, but I just feel icky about it.

I make about $160k/year. All of that money is hourly wages, trading my time for money. I don’t see how a “reasonable salary” is anything less than my total income. That’s what my clients have agreed to pay me, so that’s “reasonable”. How is it ethical to try to claim a lower salary?