One of the internet’s most-respected retirement researchers and financial planners, Michael Kitces, joins me for an episode of the Financial Independence Podcast!

You may remember that my Safe Withdrawal Rate post drew heavily from the incredible research Kitces has done on the topic so it was great to talk to him directly to dive even deeper into important topics related to early retirement.

During the interview, we discuss…

- Safe Withdrawal Rates and whether the 4% rule is still safe in the current market environment

- The unique challenges early retirees face that normal retirees don’t (and also some of the unique advantages early retirees have)

- How Michael tackles early retirement from a financial planning perspective

If you’re worried about figuring out how much you can withdraw from your portfolio after you retire, this episode is for you!

Listen Now

- Listen on Spotify or Apple Podcasts

- Download MP3 by right-clicking here

Highlights

- Why Michael began researching safe withdrawal rates

- What the Shiller CAPE is and how it can be used to determine a better safe withdrawal rate

- Why the initial criticism of the 4% rule was that it was too low

- What would be a safe withdrawal rate to use today, considering current market valuations

- Human capital vs. financial capital and the advantages of having both

- How to find a financial advisor and what Michael would do if a client came to him with early retirement plans

- The biggest wild card that early retirees need to be concerned with that standard retirees don’t

Show Links

- Kitces Blog | Podcast | Twitter

- Pinnacle Advisory Group

- XY Planning Network

- Understanding Sequence of Return Risk

- White Paper – Is the Safe Withdrawal Rate Sometimes Too Safe?

- Safe Withdrawal Rate for Early Retirees

- Mad Fientist’s Travel Credit Card Search Tool

Full Transcript

Today’s guests, I’m super excited about. It is Michael Kitces from Kitces.com. And if you’re not familiar with his work, he is one of the Internet’s most respected retirement researchers and financial planners. And if you read my Safe Withdrawal Rate post, his research was the core driver for that post. I referenced many of his articles and white papers. He’s just created some great stuff.

And he’s an incredible guy. I’ll list some of his qualifications. He’s got a Master of Science in Financial Services. He’s got a master’s in taxation. He’s a certified financial planner, a chartered life underwriter, a chartered financial consultant. And he speaks probably at I think like 50 to 70 events every year talking about all this stuff. And he’s got over 17 years of experience in the business.

So, loads of knowledge. He puts out some great content. And I’m excited to dive in deeper and really talk to him about unique challenges that early retirees in particular face and to dive into some of the early retirement research that he’s done and the research into safe withdrawal rates.

So, before I get him on the program, I wanted to run a quick experiment. This story just proves how bad I am at like internet business stuff.

As I mentioned in my First Year of Freedom post that I released earlier in the month, the credit card search tool I created has been bringing in some unexpected income. So rather than just keep that income and be taxed on it, I’ve been trying to think of ways to reinvest it.

So, I was listening to a podcast at the gym, and I was like, “Oh, maybe that would be a good way to reinvest the money. I could pay for advertising on somebody else’s podcast, and then tell more people about the credit card search tool. And that may be a good investment. That would be a way to spend some of these profits productively.”

It wasn’t until later that I thought to myself, “Hey, you idiot, you have your own podcast, and you haven’t even tested it out there.

So why would you pay money to put an ad on somebody else’s podcast when you don’t even know if podcast advertising works.”

Really stupid not think of that. But I’m going to test it out here.

So, this episode is brought to you by the Mad Fientist Travel Credit Card Tool. So if you go to MadFientist.com/cards, you’ll be shown a list of all the best sign-up bonuses currently on the market today.

The real power of the app though is in the filter. If you know you want to earn BA miles, for instance, you can just select BA, and it’ll automatically display all the best sign-up bonuses that will earn you BA miles, which is really useful in today’s complicated travel environment because there are all these different kinds of flexible points that transfer to various airlines and hotels. It’s really complicated to figure out which cards actually would earn you the most points for a particular program.

The filter also lets you filter out cards with annual fees or first year fees. So you can find the exact card that’s going to be the best for your travel needs. So again, head over to MadFientist.com/cards. You can check it out there and let me know what you think.

And I’ll be able to see if podcast advertising actually does work. And then, I could decide whether I want to actually invests in podcast advertising elsewhere.

So, thanks for letting me run this experiment. And without any further delay, welcome, Michael Kitces. Thank you so much for being here. I appreciate it.

Michael Kitces: Thank you! Good to be here in the Mad Fientist laboratory.

Mad Fientist: Yeah, I’m excited to have you here. I’m really thankful you’re able to do this especially considering how busy you are. You’re one of the busiest guys I know. So, maybe just give people out there an idea of what Michael Kitces’ life is like.

Michael Kitces: Oh, man! So, I work a couple of different hats. I am a partner and the Director of Wealth Management for the Pinnacle Advisory Group, an independent management wealth firm in the Baltimore, Washington area, overseeing about $1.8 billion dollars for more than the thousand clients that we work with.

I’m also the co-founder of a group called the XY Planning Network which is a community of about 450 financial advisors specifically focused on working with younger folks, with Gen X and Gen Y people. That’s the XY in the name. And our focus there is doing financial planning for people for just an ongoing monthly subscription fee. So many advisors in our world require big asset accounts or sell products. And our focus is just straight, independent fee per service advice, pay on an ongoing subscription to work with an advisor in an ongoing relationship. And we’ve got a couple hundred advisors that have joined that.

And then, I publish a blog myself called the Nerds Eye View. So of course, I have a an affinity for laboratories and all things science and research. And I’ve been running that for, gosh, almost 10 years now with kind of a range of topics we cover there. About half of it is actually for the advisory industry. So, we talk about practice management trends and business strategy for advisors. But the other half, much of my work in my career has been around retirement research and kind of the intersections of retirements and investment theory as well as retirements and tax strategies.

And so, I publish a lot of research both in some of the journal publications for financial advisors as well as a lot of research that we just publish directly on my own site of all the stuff that we’re studying and analyzing about how to do retirement and make it work better.

Mad Fientist: And that’s fantastic stuff that I stumbled across. I’m not sure when or how, but yeah, I’ve been a reader of your blog for many years. It’s just fantastic stuff.

If anyone out there had read my Safe Withdrawal Rate post, they’ll know that I linked to probably about five different posts that you had written on Kitces.com that were just like incredible. That post could have been a book report of all of these—and it pretty much was.

Michael Kitces: Much appreciated! I know it’s the cool just about blogging and publishing research from—you live it as well. As a blogger, there’s nothing more exciting like, “Oh, my God! Someone linked back to me, reference something that I wrote. It’s so exciting!” And so I’m just thrilled to see that it’s getting out there and getting read, and hopefully having some helpful, positive impact for people who are trying to plan their retirement path.

Mad Fientist: Absolutely! It was incredibly helpful for me. And yeah, everyone that’s read that post hopefully has got a lot out of it as well.

So, I’d actually like to talk to you about that research you did into safe withdrawal rates, if you don’t mind.

Michael Kitces: Sure!

Mad Fientist: That seems to be one of your biggest areas of research. So, how did you start looking into that? And what caused you to really dive deep into that research?

Michael Kitces: The safe withdrawal rate research has been kind of an interesting path for me. I really came and into spending a lot of time studying it in the early, mid-2000’s.

So, as you know, the original version of a study that put that on the radar screen for the advisor community was an article by Bill Bengen in the October 1994 issue of the Journal of Financial Planning. And the research has kind of lingered out there in the advisory community. Not only did it not get a lot of adoption in the early years. Bengen, at the time, was actually pretty harshly criticized by the advisor community who said that 4% number, that’s just ridiculously crazy low.

Mad Fientist: Right!

Michael Kitces: Why would you spend that little? In 1994, I’m like, “I know how to solve retirement. You just pull out a spreadsheet. You put in that the long-term return of stocks is 10% to 12%. You buy a diversified portfolio. You calculate how to amortize your portfolio over a multi-decade time period. And it’ll tell you that you can spend like 6.5% or 7% because that’s what you get when you plug in 12% returns on stocks which back then would have been like a conservative estimate by some people’s views.” So, he got lambasted for being too low.

And in the mid-2000’s, I was working at the Pinnacle Advisory Group as the Director of Financial Planning at the time. And my job was to build out and develop our financial planning process. And we had a strong focus on working with retirees—we still do. And so it was my job to kind of take in the research and figure out how we’re going to analyze and evaluate retirement situations.

And so, that for me was at least the starting point of starting to gobble up some of the safe withdrawal rate research as well as spending a lot of time looking at the Monte Carlo Analysis Tool. There are a lot of different modeling techniques that have evolved in the preceding 10 or 15 years around retirement.

Up until basically the 1980s, your retirement was basically just “buy bonds, invest, and spend the interest” or “buy stocks and spend the dividends.” Unless you wanted to literally pull out an abacus, it was kind of hard to do all the number crunching to figure out what sort of retirement would work.

It wasn’t until the ‘80s, late ‘80s, showed up when we started getting personal computers that we could actually begin modeling this stuff (no coincidence that Bengen’s study came out a couple of years later).

And so, the 1990s and the early 2000s was kind of an explosion of all these different tools and techniques to analyze retirement. And I was trying to take them all in to figure out how we were going to do it and build an approach for our clients.

And at the same time, I was also deeply involved with our investment team. And our investment team at Pinnacle, we’re not fans of trying to time markets and buy individual stocks. We just find markets are way too efficient to really be able to add a lot of value there.

But it still gets pretty clear to basic level that bonds that yield two are probably going to produce less of a return than bonds that yield eight, and stocks with an earnings yield of two are probably going to produce less than stocks with an earnings yield of eight.

And earnings yields is really just P/E ratios and valuation flipped upside-down. And so we kind of came at investing with this view and philosophy that valuation matters. When you want to set everything from a reasonable allocation for a retirement portfolio to just figuring out what you can spend, knowing that stuff has really lousy yields matters, and knowing that stuff is really good yields matters. And that needs to be weighed in the consideration.

And so, I was kind of at this point of spending a whole lot of time looking at safe withdrawal rate research as well as Monte Carlo tools and all these different ways to model retirement while I was also immersed in an investment team that had a very long-term valuation-driven investment process. And it kind of led me to bringing the two together to say, “Well, what happens if you actually start looking at all of this retirement withdrawal research through the lens of market valuation.”

And that was what led to the study I’d put forth in 2008 that basically said, “What happens if we take something like long-term valuation measures (so Shiller P/E ratios, the CAPE 10 ratio), and then screen what’s actually happened with withdrawal rates using Shiller CAPE,” which now, CAPE has become very popular as a mechanism to look at. The fact that Shiller got a Nobel Prize didn’t really hurt so much.

Back then, no one was talking about it. No one knew what it was. The first thing I had to do when I talked about the research was just explain what a cyclically adjusted P/E ratio was and all the work that Schiller had done in creating that measure.

But what I found was that when you look historically in all the time periods where you had to use the safe withdrawal rates number where you can only take out like 4% to 4.5% of your initial account balance adjusting subsequently for inflation, that initial withdrawal rate was really only set by like three or four different starting points for retirement in history, all of which were time periods where you retired when valuations were really, really high.

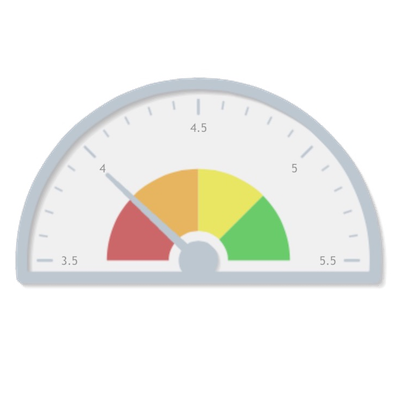

And it turned out all of the historical scenarios that necessitated these really low withdrawal rates were specifically environments that were high valuation. If you got into merely average valuations, it really wasn’t a 4% rule, it was a 5% rule. And if you got into cheaper valuations, it was more like a 5.5% to 6% rule.

And so, we published this study that said, “If you want to figure out how to set an appropriate initial withdrawal rate, and what’s a sustainable portfolio, you’ve really got to look at what’s going on with overall valuation levels of the market at the time because 4%, frankly”—and we wrote it at the time. It was a good idea at the time. I published this in the early 2008. I said valuations are really high, you really should be spending conservatively because there’s a risk of a material market decline (not actually knowing that was going to play out within six months when I published the study). And so it kind of worked in that context.

But then, likewise, after we went through a market decline, and we had people coming in in 2009 and 2010 and saying, “Well, what can I spend?” well, the answer was it’s really not a 4% rule for you anymore, it’s a 5% rule.

Five percent is a slightly smaller account balance (which is kind of a bummer from the bear market), but the withdrawal rate is different after you see that kind of market volatility and stocks get cheaper.

And that’s a really important thing to consider when you’re trying to set policy around “how much of this can I spend” or conversely, “do I have enough in my retirement assets to make this retirement goal work? Am I actually financially independent?”

Mad Fientist: I’m looking at the graph that you created with the safe withdrawal rates versus the Shiller inverse of the P/E 10, and it’s just amazing, lots of correlation there. And I will link to that in the show notes. I think it’s in your Understanding Sequence of Return Risk post…

Michael Kitces: Yes.

Mad Fientist: But yeah, it’s just incredible that you could predict these safe withdrawal rates based on something that you can look at today. It’s that predictive. That must’ve been an incredible realization.

Michael Kitces: Yeah, it was pretty striking when I really finished that first study, that first take on it, and just started this modeling of P/E ratios and subsequent safe withdrawal rates.

We’ll make sure you get a link to the original report that we actually did which was all the way back in May 2008. We called it the Kitces Report. It was the research, white papers, that I was publishing at the time—and still do.

We had this chart in there. I still remember working on it where like, “Alright! Well, let’s plug in P/E 10 ratios at the beginning of retirement, and then the safe withdrawal rate for retirement, and see how well these things line up. It was just the perfect mirror image to each other that the predictive value was phenomenally high. I think it was like a 0. 74 correlation.

Actually, my background, I was a psychology major. And in psych research, the brain and human psychology is so complex that, if you’re doing a psych study, and you get results that have like a correlation of 0.1, you get excited. If you get a correlation of 0.2, it’s basically guaranteed to publish as long as you don’t screw up the article or you didn’t have broken methods.

So, to find this correlation of 0.74 between valuation levels and 30-year safe withdrawal rates that no one had ever written about before, I got pretty excited at the time.

Mad Fientist: That’s crazy. Yeah, I’m actually looking, and it’s 0.79 actually too. So it’s even better than 0.74, it looks like. When you look at the graph, it’s just such a clear trend.

So, for people who maybe are in their car right now and aren’t able to google Schiller CAPE 10, can you just give a little description about it, and talk about why it is so predictive in this case?

Michael Kitces: Yeah! So, the idea of Shiller CAPE and this P/E 10—so, the basic idea of a P/E ratio is, as the name imply, P and E. The P is the price and the E is the earnings of the company. And I find for most people, it’s easiest to actually think about it as the flipside, which is an E/P ratio—earnings on top.

So, when you think of any investment like a bond, a bond pays 5%—or a bond pays 3%.So, if a bond pays 3%, that simply means, for every dollar that you put in, you’re going to get ¢3 back as a yield.

And stocks really mechanically function the same way. If I’m running a business, and my businesses are worth say $100, for every hundred dollars of business value, if my E/P ratio is 3, that means for every hundred dollars of business value I have, I make earnings of 3%.

Now, with businesses, it’s a little bit more complex because I actually get a choice. As a business owner, I can take that 3% and keep it and re-invest in my company, I can take that 3% and pay it out to the shareholders as a dividend. Most companies do a blend of each. They pay a sum up to dividends, and they keep the rest. But if you hope that they’d re-invest the money productively into something that helps to grow the company, whether they re-invest it themselves or they give it to you, it’s kind of there for future growth.

And so, if we look at just the earnings of a company relative to the price, we can get an understanding of its yield or what kinds of earning power it’s generating.

And it really functions pretty similar to bonds. Things that have high earnings yields are producing a lot of dollars; things that have lower earnings yields produce very few dollars for each hundred dollars of value in the company.

So, in the stock world, we tend to flip that yield over. And instead of talking about it as earnings over profits, we talk about it as price over the earnings—and so P/E. So, if you think of something that has a 3% ratio, that means it’s generating $3 of earnings for every hundred dollars of profits. And I flip that over, I get 100/3 which means my P/E ratio is 33—or 33.333 (repeating).

And so, we can look at this to start understanding what kinds of perspective earnings power does this company have. High P/E ratios means low earnings yield; low P/E ratios mean higher earnings yield and so and so. In this case, low P/E’s are good, high P/E’s are bad.

Now, the problem with this in the short-term is that companies are volatile. Some have good years, some have bad years. 2008, the whole S&P and the aggregate lost money because the financials lost as much money as the rest of the economy put together or as the rest of the S&P stocks put together. And so, because earnings get really, really volatile, it gets challenging to use earnings from year to year as a measurement of valuation.

And 2008 is actually a really good example. 2008 was so horrible that companies hardly made any money, which means if you calculated a P/ E ratio, the price over the earnings, and the earnings went to zero. Because the market was so bad, the market had this implied P/E ratio of a thousand or basically of infinity if you try to literally divide by zero. Even though they actually just crashed and went down 40%-something, in theory, it should be a lot cheaper after they just went on sale by 40%. Yet if you calculate a traditional P/E ratio, the E is so volatile in a recession that it makes them look worse after the crash than it does before.

So, to fix this, the great revelation of Schiller was that, instead of just taking the current earnings of the company and dividing that to the stock’s price, you take a 10-year average of the last 10 years worth of earnings.

So, by the time you take a 10-year average of company earnings, you start to smooth this out a little bit. Yeah, there are some bad years in there, but there’s also some good years. They kind of offset each other. And you get to a balancing point that starts to work.

And that was basically what Shiller found. If we take a 10-year average of earnings, we get a pretty stable predictor of earnings yields valuation and a pretty strong relationship to subsequent returns, particularly long-term returns.

That Shiller P/E 10 ratio actually doesn’t do a very good job at all of telling you where the market’s going to be in the next three or six or twelve month. But it’s amazingly good at telling you what’s going to be going on in the markets over the next 10 years and whether the next 10 years are going to be good or bad which is really important when you’re talking about retirement distributions because, as we know, the biggest driver of the long-term outcomes is the sequence risk—basically, what happens in the first decade.

So, if you know a valuation and a measure like Shiller P/E 10 tells you what’s going on with valuation over the next 10 years or it tells you what returns are likely to be over the next 10 years and whether they’re going to be above average or below average, that becomes incredibly informative about whether you can take a higher or lower withdrawal rate than 4%. And that was basically what we found in the research.

Mad Fientist: That’s amazing! So right now, we’re sitting at CAPE of 30. We’re getting into really high territory. I think the only other time it’s been higher is leading up to the big crash in the 2000s.

Michael Kitces: Yup!

Mad Fientist: So, we’re sitting at high CAPE. But there’s a floor to the safe withdrawal rate that you found. Can you talk a little bit about that?

Michael Kitces: Yeah. You know, as bad as it can get when you get these bad sequences, what we still ultimately found is it still doesn’t seem to get any worse than about 4%.

Even when we look at horrible time periods like if you retired in 1929 on the eve of the Great Depression, the market went down about 85% in the first three years. Fortunately, if you had a diversified portfolio with some bonds in there, you mitigated that a little bit.

But that’s horrific, truly horrific. It makes the financial crisis look mild by comparison. But the market really did go down about 85% from top to bottom from 1929 to 1932. Yet the 4% rule worked through that time period—the combination, the diversification, and keeping our spending modest, and frankly, the fact that the Great Depression had a lot of deflation which is really bad economically, but is technically good if you’re a retiree. It means, bad news, the market went down; the good news, you don’t need as much for your portfolio anyways because everything got cheaper (because that’s what happens with deflation, the stock gets cheaper).

And so, this 4% initial withdrawal rate worked.

And likewise, when we look at other time periods, like retiring in the mid-1960s, the interesting historical footnote, 1966 was the first year that the dow hit a thousand. And unfortunately, it actually wasn’t a very good year in the markets. The markets had to pullback. It took them a couple years to recover. And by early 1973, the dow still was not any materially higher than a thousand.

Then ’73/’74 bear market crash happens, and the market declined about 45% from top to bottom. And it took another eight years for the market to recover.

So, in 1981, the dow was still at a thousand, trying to break through to a new high.

So, if you imagine being in retirement, and for the first 15 years, the market gives you no capital appreciation whatsoever, you begin to get a sense of what it was like to be a 1966 retiree.

Now, on top of that, it gets even worse because inflation went from about two to twelve, which also caused the worst bond bear market of the century at the same time that stocks generated no appreciation for 15 years.

Mad Fientist: Geez!

Michael Kitces: And despite that, or even through all of that, what we find is this 4% initial withdrawal rate adjusting for inflation works.

Now, the good news for both these time periods—retiring on the eve of the Great Depression and the 1966—is the second half of your retirement was great. In fact, the 30-year returns were not that bad. They were only down a little bit. But the first half of retirement was so horrific in these scenarios that you needed to spend a more conservative number so you had enough money left for when the good returns finally showed up because finally stocks are super cheap.

When you got to the bottom in 1981, the bad news is you made no appreciation on stocks for 15 years. The good news was stocks were giving cash dividend yields of like 7% to 9% by the end of that.

So, you weren’t making any appreciation, but the economy kept growing. And if your stock isn’t going up while your economy is growing, eventually, there’s just more and more earnings powering through, and you’re getting bigger dividends. And eventually, you start to make it up.

But what we find is this 4% number just seems to work. And I don’t think there’s anything really magical or sacred about it. It’s really just a recognition that if you actually look historically, we’re pretty consistent that about once every 20 or 30 years, we do something really, really bad and dumb to our economy. I mean, we kind of do it like clockwork.

We did it in the 1970s. 1966 was kind of a slow start, but the bad stuff didn’t really hit until the 1970s. We did it during the Great Depression in the ‘30s. If you actually go thirty years back before that, we did it in the first decade of the 1900s as well. A giant national financial crisis completely froze the economy, ultra low interest rates, massive real estate crisis (actually surprisingly similar to the one we had in 2008).

And so, we just seem to do these every 20 or 30 years. We did it in the first decade of the 1900s, we did it in the 1930s, we did it in the 1970s. And then, we did it to ourselves in the 2000s. And what we find is 4% just seems to be a number that’s low enough that, even if you start when valuations are high, and risk is elevated, or returns are likely low, and then you add a whole bunch of bad stuff on top, the withdrawal rate is moderate enough that you can still make it to the good returns.

Mad Fientist: Right!

Michael Kitces: You still have something left, some moderate amount left, so that when the good returns finally show up, you can work through to the end.

And when we actually look even in the international data, you see something pretty similar. Safe withdrawal rates in even places like Canada and Australia were right in this 3.5% to 4.5% range as well.

It stays pretty stable around the globe with kind of the small historical asterisk that, if you’re a retiree in a country that loses a global war, it doesn’t go well for you. So if you run the safe withdrawal rate of a 1939 retiree in Japan, your safe withdrawal rate is like 0.5% because you’re actually losing global war and getting hit with nuclear bombs. It really does bad things to your economy. Safe withdrawal rate in Germany was about 1% to 2%; in Italy, it was about 1.5%.

Those kinds of like truly external global war sorts of events still change this number because now you’re not just talking about “Hey, we made some bad decisions for our economy, and we’ve got to heal them,” now you’re talking about like we destroyed all of our factories and lost a third of our working populations to death and war. Unfortunately, things on that order of magnitude can still break even that 4% rule.

But literally, it’s about what it takes. Short of anything from that, we find this number in about 3.5% to 4.5% seems to work pretty much around the globe.

And most of those studies are actually just based on very simple [unintelligible 29:51] portfolios, large cap stocks, and government bonds. And of course, today, we tend to own more diversified portfolios which actually just brings even a little bit more stability to those results.

Mad Fientist: And it’s worth mentioning, we’ve been focusing on the worst case scenarios here. I’m just going to quote some of the things that you said in some of your other posts like “the safe withdrawal rate actually has a 96% probability of leaving more than all of your original starting principle.”

Michael Kitces: Yes!

Mad Fientist: So, it even survives all these terrible times. But in most cases, it’s doing even better than surviving. You’re going to have a lot more money than you even started with

So, like over two-thirds of the time, the retiree would finish with more than double their starting principle, 66%. You’ve doubled your money, and you’ve lived off of it for 30 years.

Michael Kitces: Yeah.

Mad Fientist: My audience is all early retirees or people that are hoping to retire early. So a lot of questions that I get are: “Well, yeah. All these studies are great, but they focus on a 30-year time horizon. I’m only 30, and I’m hopefully going to live another 60 years. So what does that do to my safe withdrawal rate?”

You’ve actually done research on that. So can you just share what you found there?

Michael Kitces: Yeah, yeah. We’ve published a couple of pieces over the years looking at the safe withdrawal rate framework over different time periods. And actually, the first person to publish on this was Benget himself. He did the original study in 1995.

And no great surprise, even then, people responded to him like, “Hey, neat study. But I’m a little younger, and I’m not planning for 30 years,” or some people said, “Hey, neat! But I’m already 73 years old. I’m not really planning for 30 years right now. Twenty would be awesome, thanks!”

So, he published a follow-up study. And we’ve since replicated the research and the results as well.

Basically, when you move the time period from 30 years out to 40 to 50 years, you end up going from a 4% rule to about 3.5% rule. So it’s a haircut, but it’s actually just a fairly small one.

And the reason, in large part, is markets on average go up way more than 4%. Even balanced portfolios, on average, go up way more than 4%. If we just plug in long-term market returns, you find that the safe withdrawal rates based on average returns should be about 6.5%. And actually, if you just calculate all of the historical withdrawal rates that would have worked on average, you find that’s about 6.5%.

So, in this world where, on average, 6.5% works, but we have to take out 4% just to defend against the bad luck that we could be on the eve of the next great economic catastrophe and we might happen to be like that 1929 retiree or that 1966 retiree or one of those horrible scenarios, the few that crop up, we take 6.5% all the way down to 4%. But we’re still only doing it because once every 30 years, we manage to do something that’s so horrible to our economy that we need 10 to 15 years to recover, and then the good returns finally show up. And once the good return show up, the bull market that eventually shows up is so good, it pretty easily carries you to the end.

Mad Fientist: Whether that’s 30 or 45 or 60…

Michael Kitces: Right! And that’s the thing. Once you make it through the first 10 to 15 years and you have what I call a decent chunk of money for the rest of the time thereafter, the difference between having money for another 15 or 20 years or another 30+ years (which on top of the first 15 is now 45+), it’s not actually that big of a difference.

And actually, because of that, I and a few others now have been starting to work on figuring out some kind of rules-based systems to make this a little bit more dynamic. The effect that really ends up happening, particularly if you’re looking at things like 40- or 50- or 60-year retirement time horizons, is if the first 10 years go well (or even just not horribly, you just get decent returns and things move up a little), and you’re only withdrawing something like 3.5% or 4%, your portfolio is going to climb 30%, 50% or 100% in the first 10 years.

And at that point, you’re going to sit down and say, “You know, I probably don’t need to still take this 3.5% withdrawal rate because, actually, my portfolio is up so much. What started out as 3.5% is now down to 2%. And 2% is way more conservative than we need to be even in bad sequences.

Mad Fientist: Sure!

Michael Kitces: And so, you end up with this path where, for the first 10 or 15 years, if things are good, frankly, you’re going to realize certainly 10 years and probably earlier that it’s okay to start ratcheting your spending a little bit higher because you’re already so far ahead of even that initial 3.5% rate that you might have started with.

But we start down at that lower number just in case it turns out we really are on the eve of the next horrible bear market or the next Great Depression and that things could be lousy for 10 or 15 years. And if that’s the case, you’ll be thankful that you were at a low number. You’ll spend very conservatively for the next 10 or 15 years. And then, eventually, by like the 2030s, eventually, when the good market returns show up in the 2030s, you’ll get to start lifting your spending up then at that point once the good returns finally set in and show up again.

And that really then becomes the dynamic. You won’t realistically stick with this one initial withdrawal rate and lifestyle for the next 50 or 60 years because 30 years in—in fact, frankly, probably 10 years in—you will either already be so far ahead that the number will seem trivial, and it will be clear that you need to re-anchor, or you’ll have gone through some difficult time period. But once the good returns show up, if the good returns show up (and they’re not just good, but they’re great), you’re still going to end up getting ahead at some point. a

That’s the nature of this threshold style approach of safe withdrawal rates. When everything anchors around literally the one worst case scenario of horrible below average market returns that we’ve ever, ever seen at any point in history, anything that’s better than that means that, at some point, you’re going to end up not getting a little ahead, a lot ahead, or really far ahead, and be able to adjust your spending.

And a lot of what we’re working on right now is just trying to figure out how far ahead do you realistically need to be in order to start dialing up your spending.

I don’t necessarily want to move it really far up the minute I get a good year in the market, so if there’s a market pullback, then I’m not going to have to sell that awesome, new thing that I just bought. So ideally, we want to ratchet this a little bit more slowly. But we’re trying to figure out what are the good trigger points for when are you far enough ahead that it’s okay to lift up your lifestyle a little bit because you’re far enough ahead that it’s safe.

Mad Fientist: And I think a lot of people who are thinking about early retirement, they want to be super conservative. A lot of people say like 3% or even less. Some people have said they’re trying to wait until they could only withdraw less than 3%. And I think they missed the point, the fact that if they have a really bad initial five years or ten years—

Early retirement is so different than standard retirement. When you’re planning for your standard retiree clients to retire, they’re probably not as marketable in the job market at that stage—maybe they’re not able to work as long hours or do a variety of different things potentially at an older age. Whereas somebody in their 30’s, they could get a job at the bar down the street if things got really bad, if you know what I mean.

Michael Kitces: And truly, the fact that when you retire young—

So, economically, the way I’d put it is when we work with older retirees who tap out when they’re 60 or 70-something, there’s not a lot of working options left for them. Either they literally don’t have any physical capability to work anymore, or they just don’t have good skill sets to get paid well. And so they don’t really have many working options left.

When you’re younger though, work is still an option. And work has an economic value attached to it. In fact, one of the ways that we like to look at it and talk about it with our younger clients is to literally say like, you know, when you’re in your 20’s and 30’s—and frankly, even still in your 40’s—your single greatest asset is your ability to work and generate income. We call it human capital.

So, you’ve got human capital which is your ability to work and generate some income, and you’ve got financial capital which is basically human capital that you had in the past that you converted into money and you saved. And now you’ve got financial capital.

So, our goal is to get to the point where our financial capital covers all of our needs, and we don’t need the human capital anymore. That’s what we call financial independence, “I don’t need to work to get paid anymore.” But it’s still your choice about whether or not to harvest your human capital and turn it into additional dollars—and you can.

You can continue to “work in retirement.” That’s actually why I’m a huge fan of even just the label of “financial independence” and not “retirement” because we see this routinely with clients—and have for years and years now.

If you’ve got any physical and mental capability to keep working in retirement, most people we see continue to work in retirement for a period of time, or they take a little bit of time off, and then they realize they’re kind of bored. They go back and they end up working in retirement.

Now, work looks completely different for them. Sometimes, it’s free work. It’s volunteer. It’s non-paid. It’s non-profit. Sometimes, it’s drastically lower paid than anything they were doing before. But hey, you don’t need the money, so who cares? Anything is better than nothing. It’s fun spending money.

And more importantly, particularly in the context where people are doing extreme early retirement scenarios, the fact that you can turn the human capital back on means you ultimately always have another fallback if things are going really badly for your financial capital, which is you just find a little bit of work to supplement it.

And the good news is you don’t even necessarily have to find a ton of work and supplement it a lot because when I’m only trying to spend a few percent of my financial capital in the first place, even a moderate amount of work that just brings in a little bit of money dramatically reduces what your ongoing spending need is if you are living fairly frugally in the first place.

And I find for a lot of prospective retirees or early financial independence folks, they actually grossly underestimate the sheer impact of just doing a little part-time work for like $10,000 a year. Bear in mind, if you were assuming that this 3.5% withdrawal rate was your number, an extra $10,000 a year of side gig income in retirement is like having another $300,000 in your portfolio.

Mad Fientist: Exactly!

Michael Kitces: If you were only going to assume a 2% rate, that $10,000 of side earnings—that’s a couple of hundred bucks a month—is like having another half a million dollars sitting as part of your retirement portfolio.

And so, when you view it that way, a little bit of side gig, side hustle, part-time, fun work, but you get paid, whatever you want to call it, actually has a dramatic impact on making that early retirement even more easily sustainable, including, for a lot of people, we point out like, “Hey, I know you’re trying to work another seven more years to hit your number for extreme early retirement, but you realize if you just cut your work back to 50%, you have enough today.”

Mad Fientist: Right!

Michael Kitces: Just cut back 50%. And if you cut back your income 50%, you don’t even have to keep doing your current job.

In fact, it’s funny. I see a lot of people that are really buried into a current job and feel like they’re stuck and they have to do it. But what I say to them is like, “if all you needed to earn was $10,000 or $20,000 a year”—for some people, it’s a higher number. But $20,000 or $30,000 a year is more than enough to supplement that early retirement goal”—you could do anything on the planet you wanted that would pay you $20,000 or $30,000. Could you come up with something that might be fun that you might even enjoy a little bit more than your current job?

Mad Fientist: Yeah.

Michael Kitces: And a whole lot of people say yes once you put it that way. They’re like, “I don’t even need to be done. If all I’ve got to do is earn $20,000 or $30,000, yeah, I can find some stuff to do that would be a lot more fun and a lot more enjoyable, that I might actually enjoy my day, and I wouldn’t even have to work as many hours. I could clear $10,000 or $20,000.

Mad Fientist: And it’ll be a much easier transition from work life to early retirement as well. Just taking the leap is probably pretty scary for a lot of people. So yeah, just dialing it back or switching careers into something that you actually enjoy is an excellent idea, definitely.

Michael Kitces: It makes a huge impact on how much you need or not need to be able to make that transition the first place.

Now, if you truly want to say like, “No, no. I’m so financially independent that I can take a zero on that work income for the rest of my life,” then okay, you’ve got to hit your whole FI number.

Mad Fientist: But even then, you’re maybe in your 30’s or your 40’s, and you’re more adventurous maybe than somebody in their 70’s. If crazy inflation hits the states, then you could just go to Asia for a year and have an amazing experience.

So yeah, you have a lot more flexibility as an early retiree on the earnings side, but you also have a lot more flexibility on the spending side. So if the really bad 10 years hits, there’s so many things that you could do rather than work an extra 10 years so that you can only withdraw 3%.

Michael Kitces: Yup! It’s so true. And again, I know even just from the flipside, having been through this with lots of clients over the years, the number of people who insisted on getting to their pure, standalone financial independence number because they never ever, ever, ever wanted to have to work again, within three years were working again.

Mad Fientist: Yeah, definitely. That’s something I’ve realized just within a year of leaving my job. It’s like I get the most happiness and pleasure from making progress on projects. It’s great doing these projects with no worry for whether it’s going to have a monetary reward, but most of these things do.

Michael Kitces: Yeah! Except they end up actually still having a monetary reward, right? I mean, even in the financial independence community, you look at folks like Mr. Money Mustache. He tapped out for his financial independence because he saved up to hit his number, except then he was bored in retirement and made a blog. The blog turned out to be so successful that now he’s making I think more money than he was when he was working off of the hobby that he was going to do when he didn’t have to work and earn any more money.

And I think, really, just the challenge for so many people is we get so stuck in this way of thinking that “I’m in a job now, and I don’t really enjoy my job. So the only path forward I can see is getting to a number where I can say goodbye to my boss and never have to work again” because working is, for some folks, unfortunately so unpleasant. It feels like the only relief is not working and getting to financial independence, when in reality, we need things to wake up to in the morning, and we need to be able to have a sense of progress. We want to crave to have something that gives us a feeling like we’re having an impact.

And most of those things end up being activities that earn some money—even if you didn’t mean to or even if it’s like, “Hey, I’m bored. And I really want to get some social fulfillment.”

We had a client like that. Two years later, he’s a really successful bartender. He was a programmer. He was a really social programmer who wanted to be on the computer world I think in part because he wanted more social interaction. He didn’t feel like he got it as a programmer. And he ended up being a bartender. He gets to chit-chat with people and have fun. He pretty much enjoys it because he only takes the shifts that he wants. And he only works a couple of days a week. And he’s making money—and it’s not trivial money.

You never would have thought like, “Hey, have you ever thought about quitting your good computer engineering job and being a bartender?” I mean, if we’ve had that conversation at the time, he probably would have laughed it off. That’s exactly where he ended out because he just—

Having 50 years in front of you is so much time. You’re going to want to find things to do. And a lot of the things you’re going to end up wanting to do are going to end up producing some dollars.

And again, the irony for him and so many is if he just admitted that even doing a little bartending work might have been on the table in the first place, he probably could’ve been out two years earlier.

Mad Fientist: Yeah, definitely. And it’s funny you mentioned Mr. Money Mustache. Just within the last 24 hours, somebody asked him and I a question on Twitter. And his response was the secret of very early retirement is that almost everyone makes money after retiring. Too much happy energy to avoid.

And I definitely agree. You just have so much more energy and so much more passion for things. And you can devote all that passion and energy towards something. And when that happens, it usually creates something good, and people somehow pay money for it or somehow money gets generated from it. So no, that’s great.

So, I’d like to just take a step back and have you put on your advisor hat. Is there anything in particular that you focus on when someone comes to you with maybe like really early retirement dreams?

Obviously, the savings aspect, and maybe talk a little bit about what you focus on. Is asset allocation different? I’m assuming for a longer time horizon, more stock-heavy portfolios are probably better.

But yeah, just talk to me as an advisor. What are some of the things that you consider when someone comes to you and says, “Hey, I want to retire really early.”

Michael Kitces: So, there’s a few things. One is just there’s a little bit of blocking and tackling around just the portfolio and the dollars and the savings, how it’s invested, what are you doing to actually produce cash flows from this.

Are you going to invest in a total return portfolio and simply spend some combination of interest dividends and capital gains? Are you are you buying real estate to generate cash flows? Is a bunch of the money tied up in pre-tax retirement accounts where we have both tax consequences—the truth is, if you’ve got a big account, but it’s an IRA, basically a quarter of that is earmarked for Uncle Sam. So, your financial independence’ nest egg is maybe not quite as big as you thought it was when you consider that Uncle Sam is going to lay claim to a portion of that.

And do we have a plan about how we’re going to get the dollars you need to spend given practical rules like IRA’s, have early withdrawal penalties before age 59 ½, which we can work around with what are called the substantial equal payment rules, but that limits how much money we can get out.

So, the first part of it is just kind of setting the cash flow plan and how the investments are going to be allocated to make sure that we can generate the cash flow dollars that we need.

The next thing –although, in truth, it’s really the first thing that I tend to talk about with folks—is just this whole early retirement/financial independence thing. What does it actually mean to you? And what’s your vision of how this is going to go for the next couple of years?

Just paint a picture for me. Where are you going to be living? Are you staying where you are or are you moving somewhere else? Are you going to travel? Are you going to sell your house and go nomad? Are you just going to hunker down where you are because you love where you live, you just hate it that you have to leave it to go to work every day? Paint picture for me of what this looks like.

That starts getting us into things like what is your cost of housing, what is your cost of living, what kind of cars are you going to have, or how many cars do you need, what’s your overall lifestyle expenses and spending.

For a lot of folks, that starts opening up the follow-up question we actually were just talking about earlier, which is: “So, there’s 168 hours in a week. You don’t have to spend any of them showing up for a job anymore. So what are you going to do to fill your time so you’re not just horrifically bored?”

Mad Fientist: Yes.

Michael Kitces: Everyone says, “I’m going to relax, be on vacation.” Like, “Okay, great! So you do that for three months. Then what? You’ve got 59.8 years left.”

Mad Fientist: Right, exactly.

Michael Kitces: After you take a couple of months off and take a breather, what are you thinking about doing with your time?

And sometimes, it gets in hobbies. Sometimes, it gets into volunteer work. But sometimes, that gets into side hustles, new jobs, new gigs, starting businesses.

Okay, if you’re going to start a business, how much of your money are you going to allocate starting your business, so that you don’t actually blow up your financial independence trying to start your new thing?

Just how are you going to fill all these time you’ve got for the rest of your life, particularly because most people tend to view what I find is a “I’m retired, and I’m not going to work anymore”? So, we try to kind of break that down a little bit into “Well, no, you don’t have to work anymore. But whether you’re really not going to work anymore, let’s talk about that because I’m slightly questioning it just having seen a lot of people go through this.”

The next big block in tackling issue usually is talking actually about health insurance and just making sure we’ve got a plan for how we’re handling health insurance.

So, this goes all over the map. The Affordable Care Act to me was an unbelievable blessing for early retirees because it gives you a path to guaranteed access to health insurance without being employed. And we had a lot of clients that pulled the trigger on early retirement basically as soon as the health insurance exchanges showed up because their only gap they couldn’t effectively solve was what to do with health insurance.

So, we can do health insurance exchanges now. The quality of the policies and even some of the pricing dynamics varies not trivially from one state to the next. So you’re just getting a handle on what are we doing for health insurance.

Sometimes, we see people split. One spouse is going to early retire, but the other one actually kind of likes his job, so he’s going to keep going. She’s going to retire, but he’s going to keep going—or maybe vice versa.

So, as long as one of them is working, they’re going to get health insurance through their employer. But if both of them is going to stop, are we buying it from an exchange? Are you going to start a business, and then buy your health insurance for yourself through your business (which you can do in some states, but not others)?

So, just figuring out what is the health insurance plan because, to me, that’s still one of the areas. You don’t mess around with your health insurance. That blows up not only early retirements, but entire family financial situations and individual financial situations. Medical expenses are still one of the leading causes of bankruptcy. Unexpected medical expenses are one of the leading causes of bankruptcy.

So, we’ll just usually spend some time just figuring out what’s the plan for health insurance and how are we making sure that’s covered.

And that’s really the primary focal points. I mean, there’s lots of little nuances for particular situations. But for most, the big three I find is just how are we going to generate cash flow from your retirement assets, what do you actually going to be doing with your time (you’re actually going to be earning some money because that will change some of the other decisions), and do we have a clear plan for health insurance.

If I can buckle those three down, there’s still a lot of other details that come after that, but most of the rest is not nearly as hard to sort out as making sure we’re good on those big three.

Mad Fientist: Great! And yeah, that seems pretty standard. It doesn’t seem like there’s any very unique challenges facing early retirees than someone retiring in their 50’s or 60’s.

Michael Kitces: Yeah. Again, figuring out the health insurance…

Mad Fientist: … is the big one.

Michael Kitces: It used to be a much bigger thing. My 57-year old retiree might have been able to get some employer continuation retiree medical plan to get us until age 65 to Medicare. Basically, for people in their 50’s and 60’s who retire, health insurance is a race to age 65 Medicare.

Mad Fientist: Gotcha!

Michael Kitces: When we’re retiring in our 30’s or even 40’s, we need another plan. Yes, at some point, in the 2040’s, I think Medicare will be available for you (unless we change it sometime the next 30 years), but we need a plan between now and then. That’s not going to include Medicare.

So, just figuring out what that is. Again, the health insurance exchanges made that much easier. Before that, it was lots of “Okay, can we find some kind of work that still attaches you to decent insurance? Can you start a business and buy insurance through it (which we could do in some states)? Do you need to move to a different state that has better insurance coverage that you can buy as an uninsured individual? Are we going to set a path where we go through COBRA Continuation Coverage from your former employer, and then exhaust that. You can get what’s called a guaranteed-issue HIPAA policy that they have to give you regardless of pre-existing conditions. But you can only get it if you expire your COBRA coverage first.

There’s all these maze of options that we’re sometimes messy, sometimes literally require people to move and relocate just to get to a state that had more accessible health insurance. And fortunately, a lot of that got easier with the health insurance exchanges—not perfect, but way, way easier than it was previously.

Mad Fientist: So, if somebody wanted to talk to somebody like you or another advisor, how would you recommend them go about it?

Obviously, the XY Planning Network sounds fantastic because it’s fee-only advisers, so you’re not forced about getting sold some crazy thing that’s just going to earn them a bunch of commission or things like that.

So, any sort of advice for somebody out there who is interested in just chatting to somebody about this?

Michael Kitces: Certainly, XY Planning Network is a great resource. I mean, we created it in part to help people through challenges like this. You can go XYPlanningNetwork.com. There’s about 450 advisors on there.

Again, we’re simply a support network for them. It’s not like, literally, our advisor firm. We just tried to create a community of advisors that tackle and solve these kinds of problems.

And frankly, there’s a wide range there. Not all of them work with people that are doing early retirement/financial independence. But many of them do. And you can kind of search by their specialties, and who they work with, and even where they are (although a lot of people actually engage our XY Planning Network advisors virtually). The Internet’s an amazing thing. You can hire expertise where they are and video chat your way to good discussions.

And then, we do work with some folks in this context as well at our advisory firm. Our Pinnacle Advisory offering is designed to be a combination of investment management and financial planning. And we do both for folks.

So, we’re a better fit for those that have accumulated a nest egg, and they just want to go do their retirement thing and not have to worry about the money and how it’s being managed and how to generate the retirement cash flows because we have a system and process about how we do that. And then, we give them all the other financial planning advice and guidance that they need along the way—but different solutions for different folks.

Pinnacle is really built to do that combination of “We’ll watch your retirement dollars, so you can enjoy your retirement and give you all the other advice you need along the way.”

XY Planning Network advisors are more varied. They are a few of them that will help with the retirement nest egg. But a lot of them are like, “Hey, you want to manage your own portfolio assets, but you just want some ongoing advice about things to navigate,” great! We’re here for you. However you prefer to engage advisers, to each their own.

Mad Fientist: Cool! Okay, I will link to all of that good stuff in the shownotes. So, if anybody is interested, you can go there.

We’re already over an hour, which I’m so sad about because I think I got through like maybe 40% of all the stuff I wanted to gel with you about today. But this is been fantastic. I really appreciate you taking the time to chat with me.

I usually end all my interviews with just what one piece of advice you’d give to somebody who’s hoping to retire earlier or reach financial independence early in life.

Mad Fientist: Hmmm… so the biggest tip I’d give to people that are trying to reach financial independence early in life is watch out for that thing called lifestyle creep. The truth is when you look at even the research, most of us get our biggest raises through our 20’s and 30’s. That’s the biggest stage when our income grows.

And the trap that a lot of people get into is your income goes up, you feel like you can afford more stuff. You can go buy more stuff. Once you do that, you suddenly find that things that you never had in your life, you suddenly can’t live without. Once we add something to our lifestyle, it’s really, really unpleasant to subtract it even though we went for years and years without ever having it in the first place.

And because of that, once those expenses creep in, they’re so hard to subtract back out, and it ends up gobbling up a lot of the money that you could have ended up saving. And when we look at the people that are most successful in early retirement, every now and then, it’s just like, “Hey, I made a company, and I sold it for $10 million. Now, I don’t have to work anymore,” I’m like, “Cool, dude! Kudos to you,” but most people that go through successful early retirement, there’s a level of frugal living that tends to go with it.

But for most, I find that do it happily and successfully. It’s not because they took all the things that they enjoy and cut it out of their life, and suddenly, “Darn it! I’m going to live like a monk for 10 years if that’s what it takes for me to get to retire,” it’s that they just didn’t lift their lifestyle up as their income went up. They spend their 30’s living like they were still in their 20’s. And they live to spend their 40’s living like they’re still in their 30’s.

And if you do that, you’ll usually find you’re done by 50—sometimes, much, much earlier.

And so, particularly for those who are listening that are in their 20’s or maybe early 30’s where I find this tends to happen the most, just be careful about what new things you introduce in your life that quickly become a part of your lifestyle that are hard to go backwards on. Once you buy a new car, you almost never buy used again. Once you upgrade to a bigger house, you almost never downsize to a smaller one.

And so, if you spend time thinking about being cognizant of those permanent lifestyle additions that you make, even things down to like—boy, I’ll tell you. Once you hire someone to mow your lawn, you are never going to want to pull up that lawn mower again.

So, when you view it that way, it’s not—or whatever’s your area—it’s not $50 to get my lawn mowed this week. It’s if I do this, it’s $50 every other week every summer for the rest of my life, which is like $50,000—or whatever that adds up to—decision not to mow my lawn.

Mad Fientist: That’s a really good exercise, actually, yeah. Frame all of your spending as if you’re going to do it for the rest of your life. And then, add that up and see what that number is.

Michael Kitces: And particularly for the things that tend to be recurring. So when we hire housekeepers and landscapers and people to mow the lawn, and we buy new cars, and we buy new houses, those are the things that become lifestyle expenses that are hard to go back on.

And when you get good at those, what you find is—sort of the one-off stuff suddenly doesn’t get nearly so hard anymore.

I’ve spent most of my life living in houses that are, at worst, 20% of my income. Most of the time, I’ve lived in housing that’s less than 10% of my income. And when you spend less than 10% your income on housing, all that stuff about whether you should save money buying a $5 Starbucks coffee or not, I don’t give a crap. I just go buy the coffee. You know what? I feel like buying it, I just stop and buy it. I don’t care. When you get the big stuff right, and when you manage the recurring stuff, it’s actually amazing how not much the one-off stuff even adds up to at that point—unless you really go all out and splurge. If you’re going to buy $200 bottles of wine, you could probably add this up.

But there’s so much one-off stuff that just doesn’t matter when you make a good decisions about the big, recurring expenses that do.

And so, again, for the folks that are already there, unfortunately, you’ve got the challenging pain of figuring out some things that you may need to cut. But if you’re in your 20’s and early 30’s, you’ve still got a lot of raises likely ahead of you as you continue to grow your career and your income and your earning power. Just be cognizant about not introducing things into your life in the first place. Just be a little more restrained on that end, and you’ll be amazed at how quickly you actually reach that financial independence crossover.

Mad Fientist: That’s great advice. And I completely agree with what you said about just like the normal one-off’s. When I hit my FI number, and then I ended up working for an extra two years after the fact, one of those years, I was like, “Look, I’m getting this whole salary. I’m just going to go crazy because I didn’t expect to have this salary. I’m just going to, finally, for once in my life, just relax with money and just go nuts,” it felt like I went nuts.

We were going out to eat a lot. We were having drinks occasionally with friends. And it just felt like we were going crazy. But since all that big stuff was already taken care of from the years of me being really frugal, my wife and I didn’t increase our spending by more than a grand that year, and it felt like we were just going crazy!

Michael Kitces: Yeah. I mean, when you’re otherwise just kind of accustomed to a more moderate lifestyle, and you’ve gotten some of those big things right, again, it’s amazing how not much a lot of that little stuff adds up.

I find so many people inflict so much stress on themselves like, “I’ve got to save a couple of dollars a day by bagging my lunch instead of buying it in a Chipotle in the area.” You could just split an apartment with a friend for the next couple of years and save hundreds or a thousand dollars a month on rent and eat whatever the heck you want.

I spent the decade of my 20’s splitting an apartment with two buddies. It gave me enough savings to buy my house, pay for my marriage, and start my business just because I kept my housing dirt cheap. And you that I live in a standalone house, and I’m raising a family, there is no way I could go back to an apartment and split it with two buddies at this point.

But that’s the whole point. As long as I was doing that, it was fine. It was my lifestyle. I liked hanging out with them. It was all good. Once you move away from that to something else, it’s so hard to go backwards or to feel like going backwards. But if you just don’t introduce it in the first place, it’s amazing how quickly the saving start to accumulate.

Mad Fientist: Yeah, absolutely. Well, Michael, thank you so much. If people want to get in touch with you, obviously, Kitces.com—which I’m going to spell because it’s…

Michael Kitces: Yes, it’s K-I-T-C-E-S dot-com, Kitces.com.

Mad Fientist: And that’s the best place to reach you?

Michael Kitces: Yeah, yeah. You can reach me through the site or Twitter, @MichaelKitces. It works as well.

Mad Fientist: Yes, you’re very prolific on Twitter, which is…

Michael Kitces: I love me some Twitter. But yeah, Twitter or just through Kitces.com is the best way to reach me.

Mad Fientist: Awesome! Michael, thank you so much. I really appreciate it again. And I look forward to seeing you in Dallas in October.

Michael Kitces: Absolutely! Good to see you at FinCon. I’m looking forward to it.

Mad Fientist: Awesome, man! Well, thanks again. Take care.

Michael Kitces: Absolutely! Thank you. You too.

Mad Fientist: Bye.

Incredibly informative podcast. I’m in my second year of “early” retirement and found this very relevant to my situation. Learned so much, I always find fantastic content here. Thank you!

Nice interview, I really enjoyed it. Thank you.

HUGE THANKS to both of you for this. One of the best things I’ve ever listened to. I’ve read a lot about safe withdrawal rates previously, but having the basis of the calculations explained makes it much easier to feel comfortable relying on the concept. So much of financial planning is psychological and this does a great job of dealing with both the psychological and technical aspects. Can’t thank you enough for being so generous with your time and expertise.

Giving it a listen now! Thanks for doing both podcasts and a blog. :)

Awesome podcast. Would love to see a part 2 with Mr Kitces!!!

Good interview. Discussing what the rule is not is as important as discussing what it is. I agree with Jason. A follow up with Mr. Kitces, perhaps with some submitted questions, would be an interesting listen.

I can so relate to the discussion starting around 40 minutes about working until you hit your FI number vs reducing hours, doing something fun, etc. Unfortunately, sometimes you really are trapped – granted with golden handcuffs, but it kind of sucks. In some ways I really envy the younger generation that don’t have pensions and post-retirement medical holding them back.

I finally hit my magic FI number a few months back at 51 1/2 years old. With only 3 1/2 years left to qualify for my company’s ‘early retirement’ option; literally doubling my pension payment and receiving essentially free post-retirement medical to age 65, it would be too irresponsible to NOT delay retirement. It’s worse on me mentally than it was before I hit my FI number. I didn’t really expect that as the original plan was to hit it enough years earlier that waiting for the additional benefits wouldn’t really be a consideration. That didn’t happen, so here I am. Unhappy (in one facet of my life) for 3.333333333333333 more years.

In the same boat, hit the number, yet working 2.5 years to get full pension benefit. Once the money is there, the motivation to push further in the same job is no longer there. Anxiously waiting to flip the page, and change the chapter. – Man, you nailed it.

I hate to gripe about it as “it’s a good problem to have”. Sometimes I hope someone will come out of nowhere with a well-have-you-thought-about-this comment that trumps the short wait for the huge benefit – but I’m sure that’s wishful thinking… :)

One day closer…

You will not regret if you stick to your plan. There is a saying from a movie: if you can take it, you will make it!

Thanks for this. Knowing when you have enough is a tricky question to answer, and going beyond the simple 4% rule is a good idea. I have huge respect for Michael Kitces. He’s put in the hard yards to develop deep expertise.

Fantastic Episode. Thanks for putting that together.

I do have a question in regards to ROTH Ladder conversions. It is a fortunate coincidence that I was just yesterday on Kitces’ website reseravicng for it, when I bumped into this: https://www.kitces.com/blog/understanding-the-two-5-year-rules-for-roth-ira-contributions-and-conversions/

Essentially, I would like to do something like you mention in your website here: https://www.madfientist.com/how-to-access-retirement-funds-early/, but using the ROTH 401k route, instead of the ROTH IRA.

I would contribute to AfterTax 401k and immediately roll into ROTH 401k. This conversion is significantly simpler. The 401k plan UI has even a “convert to Roth in-plan” button that is a single click action to do the conversion. Apparently, that would also start the 5yr clock there. Later, I could roll the Roth 401k over to a Roth IRA, and it would not be considered a conversion, but a in-kind rollover, and I would be able to use the money as it was converted to Roth IRA previously.

What are your thoughts about this?

I think you might be misunderstanding what the “covert to Roth in-plan” option does. It sounds like it would be doing a Traditional 401k->Roth 401k conversion, which means you’re paying income taxes right when doing that conversion. The point of the Roth conversion ladder is to NOT convert from traditional->roth until you’re in retirement, so that you’re paying taxes on that money only when you’re in the lower tax brackets.

So bottom line is if you wanna do rollovers keep the money in your Traditional 401k until you retire (not a Roth 401k), then start converting it slowly over to a Roth IRA. Just make sure you have enough years to do it before you hit RMDs.

Nope. The contributions are being made to AfterTax 401k, then immediately rolled over to Roth 401k. Traditional pre-tax 401k is already maxed-and-employer-matched out and waiting for retirement… no conversions there…

To clarify the question: is this a strategy as well? I would prefer to keep the money in 401k land for now. The fees are low, and my employer does allow access to institutional funds, where I can get expense ratios of .01%, which is even better than .04% :-)

Great interview. When Michael was talking about how health care is one of the biggest questions, it got me thinking that it’d be awesome if the MadFientist creates one of his ultra-thorough articles (or infographic) on the subject and how to handle health care costs for early retirees. Just an idea! :)

I second this! Medical costs and insurance coverage is pretty much the only area that I feel vulnerable with regard to FI. I’m very happy that the health exchanges exist, but premiums are rising fast (another 50% this coming year), the cheapest plans aren’t so cheap anymore, and I’m at a bit of a loss regarding back-up options or alternatives (aside from going back to work).

I third this! I’m surprised with how little this is discussed in the early retirement community. It’s so significant, it isn’t a simple wash with “not driving as much, not buying work clothes” type things.

Also, the ACA exists today in the US, but the government is trying to make significant changes that could affect early retirees.

I fourth this! – it is such an important factor. Hard to understand people support the movement to repeal it.

Appreciated his comment on focusing on the big things (careful of lifestyle creep) so that the “one-off stuff” won;t matter.

The largest discretionary expense for households is often housing…be careful not to overextend there, especially given the large entry & exit costs of owning a home.

Totally agree with Bill in NC. Too many people sweat the small stuff while the large expenses pin them against the wall. Also, MMF, your main audience might be the early FI community but I’m a single woman, 64, FI for 3 years now, not taking SS until I’m 70 & actually identify more with the early FI community than with traditional retirees. You & MMM have been my gurus in putting this all together & having the confidence to pull my own plug (now just picking up occasional shifts in medicine as it suits me). Thanks for a great podcast full of absolutely useful info.

Well, I agree kinda sorta except he kind of mixed things a bit.

A $5 coffee at Starbucks (clearly a sugar laden drink with other health related costs, as their coffee is much less) isn’t a “one-off” and does become one of those “recurring costs”. If $50 a week for lawn work is a problem (because you think of the yearly cost which may be 20-30 weeks in most areas of the US or $1000-$1500/yr) then perhaps that daily starbucks is just as large as having someone mow your lawn (220 typical workdays a year or $1100 on coffee assuming you only get one, most people I know who are coffee drinkers are likely to enjoy 2 or more cups of coffee).

So, some of the “one off costs” that he didn’t think as of a big deal in the big picture are actually recurring costs for many people ($200 bottle of wine probably is a one off, but said wine afficionado is likely buying 2-6 bottles of cheaper wine every month or maybe $700-$1600/yr which is on par with the lawn mowing service assuming a $20 bottle of wine is more typical for the weekly drinking). Even worse is that most average people (not professional wine tasters) find $200 bottles of wine taste bad and many times professional wine tasters are all over the place when rating the exact same bottle of wine (they only thing they can do consistently is identify a bottle as being expensive but can’t even agree with themselves on whether or not it is good).

Outside of House and transportation (two biggest costs), everything else may be small stuff. However, that small stuff here and there quickly adds up on a recurring basis and quickly devours any savings in modest housing vs more expensive housing.

Optimization would have a person address all of the spending and only spend extra where it matters to you (is that the starbucks coffee, the wine, the newer car, the slightly more expensive house?).

Did I hear correct? More than half way through Kitces talks about where the money is coming from for early Financial Independence. He talks about the ERee that has most of their income coming from tax deferred accts and mentions a “quarter going to Uncle Sam.”

I’m estimating 10-15% going to Uncle Sam. Not 25%. I’m wondering where 25% comes from.

Love the interview! Love the “little things don’t matter” at the end, but don’t let MMM hear!

Instead of spending on ads, why not partner the lab?

Awesome podcast and perfect timing for me! I had a hard time sleeping last night until I got up at 4am to go work a 12 hour shift today. My mind was racing around my current dilemma of whether or not to go FI. On one hand, I’ve been able to push my savings rate up incredibly high (literally 100%) during 2017 and should hit my “Lean-FI” number in the next couple of months. After working 11 years, I’ve been able to save 33% of my net worth this year alone. This makes it difficult to go FI at Lean-FI, since FI & Fat-FI aren’t far away. Buuuut, on the other hand, my wife is stuck in another country (we ran into immigration issues) with no end in sight. So, all that to say, thanks for helping me put my mind at ease with your discussion here on SWRs and being flexible with plans. I’m really looking forward to my unexpected geo-arbitrage opportunity! :P

Also, podcast marketing totally works – I’m off to check out your travel cards section so I can top-off my travel miles/points before I go FI. Thanks man!

A real gem of of an interview & fantastic insight into what to expect once you leave full time employment. I agree with Jason on wanting a part two!

Kitces is the man! Great show gentlemen. I also find myself linking to a Kitces blog post just about every other article I write on my site. It’s kinda easy to do since he has so much authoritative material to reference.