The ultimate retirement account isn’t technically a retirement account…

It’s a Health Savings Account (HSA).

An HSA is a tax-advantaged savings account available for people who are enrolled in a high-deductible health insurance plan (HDHP).

Since people with HDHPs could face more out-of-pocket costs (due to the higher deductibles), the government provides tax incentives to motivate people to save for those expenses.

HSA account holders can contribute pre-tax dollars to the account and can then withdraw money from the account, tax free, when paying for qualified medical expenses.

And if used wisely (as described below), it could be one of the best places to put your money when saving for early retirement!

Warning: Do not confuse HSAs with other health-related accounts like FSAs and HRAs because they are very different and definitely aren’t as good. This article is about HSAs only.

HSAs are Super IRAs

The HSA is billed as a savings account for health expenses but it’s really the Clark Kent of retirement accounts because it’s actually a super IRA in disguise.

Why is it a super IRA?

Before answering that, let’s first briefly touch on some of the benefits of the various types of retirement accounts.

Tax-Free-Contribution Accounts

These are the most common retirement accounts (e.g. 401k, 403b, Traditional IRA) and are great for two reasons:

- Your contributions to these accounts are pre-tax contributions. This means that you don’t pay any income tax on the money you contribute. For example, if you make $100,000 a year but contribute $15,000 to your 401(k), the IRS treats you as if you only made $85,000.

- The money in these accounts is able to grow tax free.

You eventually have to pay tax when you withdraw money but since you receive a tax break when you put money in and the money is able to grow tax free, it is usually worth maxing out these accounts to take advantage of these benefits (see why I think these accounts are best for early retirees).

Tax-Free-Withdrawal Accounts

Tax-free-withdrawal accounts (e.g. Roth 401k, Roth IRA) are different because they require you to pay tax on your income up front but the money grows tax free and you do not have to pay any tax when you withdraw the money after you reach the age of 59.5.

So using the salary in the above example, if you contribute $5,000 to a Roth IRA, you will still initially pay tax on your full $100,000 salary but you won’t have to pay any tax when you withdraw the money from the Roth.

HSA Accounts

For most of the population, an HSA is simply a savings account for medical expenses that provides some tax benefits.

Since you’re a smart Mad Fientist reader though, I suggest you disregard the medical aspect of the account and simply think of it as a special retirement account that you are able to contribute to when you are enrolled in a high-deductible health plan.

When used intelligently, the HSA can potentially provide the best benefits of both a Traditional IRA and a Roth IRA because you are not only able to contribute pre-tax dollars, like you can with a 401(k)/403(b)/Traditional IRA, but you can still enjoy the tax-free growth and tax-free distributions that a Roth provides!

That means you could potentially have tax-free contributions in, tax-free growth, and tax-free distributions out. Or in other words, completely tax-free money!

The best part is, you can take the distributions whenever you want (assuming you’ve had a qualifying medical expense after setting up the account) so this can be used to fund your early retirement!

Automatically calculate your net worth, asset allocation, and investment fees with this free portfolio manager!

Get StartedDelaying HSA Distributions

Since there is no rule stating that you must use your HSA to directly pay for medical expenses or that you must withdraw money from your HSA within a certain amount of time after paying for a medical expense, you can just take out the money whenever you want.

As long as the qualified medical expense occurred after the HSA was opened, you can withdraw money from the HSA at any time after incurring the expense to reimburse yourself.

Example

Let’s assume that I only spend $200 a year on medical expenses. It doesn’t make sense to pay a lot of money for an expensive full-service health insurance plan, since I rarely go to the doctor, so I instead decide to get a cheaper high-deductible health plan with a lower monthly premium.

Since I have an HDHP, I am able to open a health savings account so I elect to max it out with $3,650 every year and I invest the account’s money in a total stock market index fund.

Because contributions to the HSA are pre-tax, depositing $3,650 into my HSA decreases my taxable income by $3,650 and therefore reduces my taxes.

When I go to the doctor, I can pay for my $200 yearly visit with my tax-free HSA funds directly but if I instead pay with cash or my normal credit card, I am able to withdraw that $200 from my HSA at a later time (to pay myself back for the qualified medical expense).

The great benefit of having an HSA is that I can decide when to pay myself back. Since I am already maxing out my other tax-advantaged accounts and have ample savings, a $200 payment isn’t going to break the bank so there’s no rush to get paid back from my HSA. Instead, I am able to leave that $200 in my HSA to grow tax-free until I decide to withdraw it!

As long as I keep my receipts (and make digital copies, in case the physical copies wear out), I can withdraw the money for qualified medical expenses from my HSA at any time, in a similar way a retired person over age 59.5 can withdraw money from a Roth IRA – tax free!

So to summarize, I have saved myself from paying income tax on the $3,650 of income I used to fund the HSA, I now have $3,450 that is growing in the account tax free, and I have another $200 that is in the HSA growing tax free that I can withdraw whenever I want to!

Worst Case (or Best Case?) Scenario

I can hear you saying, “What if I put all this money into my HSA but I don’t have any health issues…how will I ever get my money out?”

In this case, the account will simply act like a Traditional IRA but with an increased distribution age (65 instead of 59.5 for a Traditional IRA).

Like a Traditional IRA, your contributions to the HSA are pre-tax contributions and your contributions are allowed to grow tax free. If you don’t use your HSA funds for medical expenses, you can begin withdrawing money from your HSA account for any expenses after you turn 65, without penalty. You’ll have to pay income tax on any distributions that aren’t for qualified medical expenses, just like you would with a Traditional IRA, but you won’t incur any additional penalties or fees.

Therefore, after the age of 65, an HSA is nearly identical to a Traditional IRA but it’s still better because your withdrawals for medical expenses are still completely tax free!

How to Maximize Your HSA

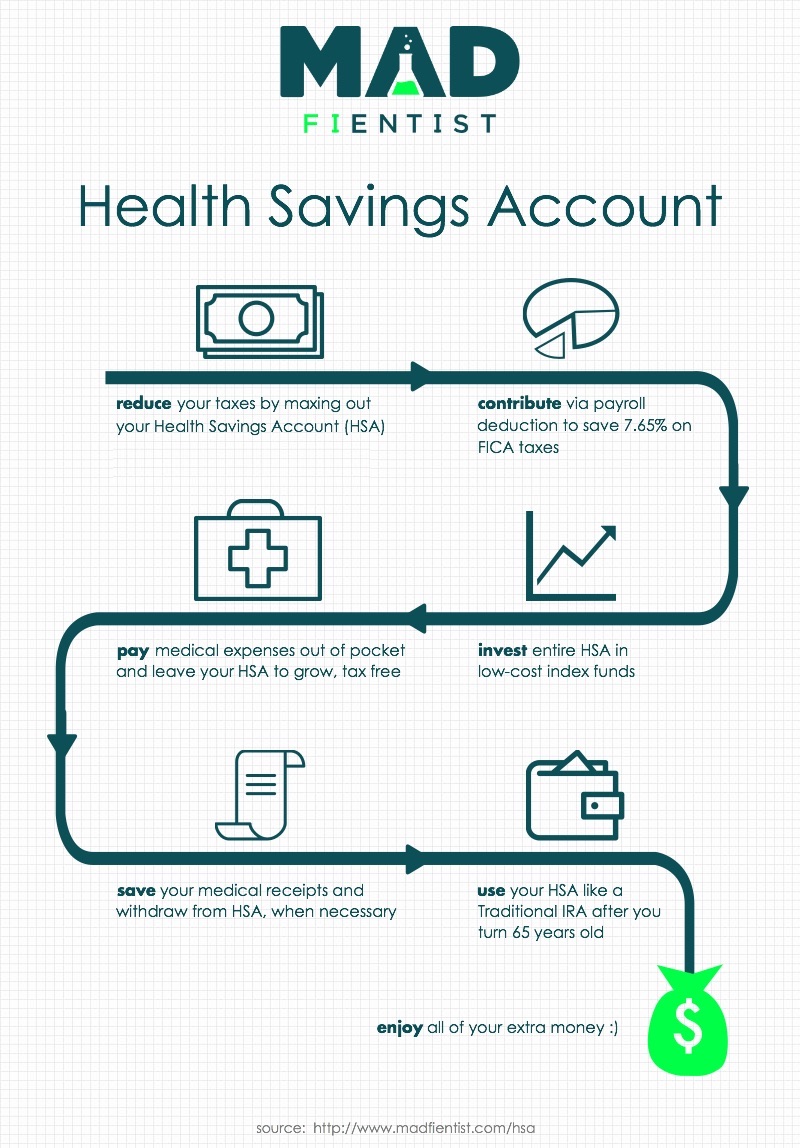

Here’s a graphic explaining how future early retirees can take full advantage of an HSA (descriptions about each step are below):

Max Out Your Contributions

Decrease your tax burden by contributing the maximum amount to your HSA each year and increase your savings rate by investing the tax savings.

The contribution limit for 2022 is $3,650 for individuals and $7,300 for families.

Assuming your family is in the 24% marginal tax bracket, maxing out your HSA could save you $1,752 in taxes each year!

Contribute via Payroll Deduction

When you contribute to your HSA via an automatic payroll deduction, you are able to avoid paying FICA taxes (i.e. Social Security and Medicare) on your contributions.

Assuming your family maxes out an HSA, this could result in an additional $558.45 of tax savings per year!

I am not aware of any other retirement account contributions that are exempt from the 7.65% FICA taxes so this is yet another reason the HSA is the ultimate retirement account!

Invest the HSA Funds

Rather than treat your HSA as a savings account, instead treat it as a retirement account and invest the entire HSA balance in low-cost index funds (note: not all HSA custodians offer low-cost index funds so make sure yours does before opening an account).

Don’t Use your HSA to Pay for Medical Costs

Rather than use your HSA to pay for medical expenses, instead use your after-tax money so that you can leave your HSA money to grow tax free.

Keep Track of Your Medical Receipts

Keep track of all your medical receipts so you know how much you are able to withdraw from your HSA.

As you incur qualified medical expenses, you increase the amount that you can withdraw during early retirement (you effectively convert your HSA into an early-retirement Roth IRA over time).

Treat Your HSA as a Traditional IRA After Age 65

Assuming you reach the age of 65 and have not accumulated enough medical receipts to fully liquidate your account, the HSA can be used for ordinary expenses in the same way that a Traditional IRA can be used for any expenses after standard retirement age (note: withdrawals for qualified medical expenses will continue to be tax free but withdrawals for all other expenses will be taxed as income).

Things to Consider

Obviously you shouldn’t switch to a high-deductible health plan just to take advantage of an HSA so do the math to see if an HDHP makes sense for your family before making the switch.

Employers are actually starting to make HSA contributions for their employees (which is great!) so factor those contributions into your calculation when deciding whether an HDHP is worth it.

Also, fees can sometimes be an issue with HSAs so make sure either your employer is covering the HSA fees or they are low enough to still make it worthwhile before setting up an account.

Conclusion

A health savings account is an incredibly valuable tool in an early retiree’s arsenal, especially if you are already maxing out all of your other tax-advantaged accounts.

By treating your HSA as an additional retirement account, you can use it to further reduce your tax burden during your working years, shelter more of your investment earnings from tax, and potentially provide a source of tax-free income during your early retirement years!

What do you think? Do you agree that an HSA is the ultimate retirement account? If not, what type of account gets your vote?

thanks for the article! I have one of these but never bothered to look at the details >_<

Glad it was helpful, Greg!

That’s great you already have an HSA set up so that you can start taking advantage of it immediately.

Let me know if any questions arise as you dive into the details.

Thank you for your post. I have an HSA that is just set up as a savings account through my bank, where I do not pay any service/maintenance fees.

I’m interested in moving the $ to an investment account, but I don’t know which administrator is best. The main administrators seem to have fees of around $60/year plus a percentage of the total assests…. what is the break even point where the fees are worth it, and do you know of an administrator that doesn’t charge fees this high?

Yes, this is my absolute favorite investment vehicle. One thing I hadn’t realized until recently was that you don’t have to withdraw money to pay for medical expenses in the current year. Like you point out, the best strategy is to let that money grow tax free, and save those receipts! It looks like the HSA contribution limits may be significantly increasing under the new administration too–we’ll see if that pans out.

I’m having trouble getting detailed information from my HSA admin on what exactly qualifies as a “receipt” for future claims.

Examples:

If I purchase medication through my online pharmacy, is a digital snapshot of the purchase with the drug name / my name / price paid enough of a “receipt”?

If I pay a doctor with a check and don’t receive any receipt, can I use their paper bill (before it was paid) as my claim reference?

My HSA has said “it can’t be an Explanation of Benefits from your insurance company”, but that helps me exactly zero. I don’t want to end up 20 years later with a pile of “receipts” that don’t cut the mustard.

Thanks :)

~Meech

Here is one company’s take on it…

https://support.tangohealth.com/hc/en-us/articles/204316210-Health-Savings-Account-Record-Keeping-Receipts-and-HSAs

I Scan all my receipts, medical docs, any correspondence and load it to google drive. Then toss the receipts, etc. ( should probably keep them but receipts sucks and seem to erase after a few months anyway). I think the only time I would actually need them is if one were audited by the IRS. My HSA distributes money “on my honor” for reimbursement. Once they even allowed a Amazon Prime subscription to renew from my HSA Debit card. I got that change reversed via Amazon however.

Mad Fientist. I sold a $87K equity position in my HSA in Oct 2021 with proceeds put in my HSA bank. The platform used was Optum Financial.

I had auto invest for my payroll deduction enabled and 30 days after I sold the position the auto feature automatically bought it back. I lost 10K on that transaction and Optum Financial says it has no liability because I had checked the auto investment through my payroll check. Any advice on this matter. It seems to me that this is very poor consumer protection.

I agree, great article! I didn’t know there was a way around FICA and Social Security taxes either. I am going to max this account out every year until retirement.

Woa woa I don’t think this is a good idea! I just stumbled on this article so I’m three years late to the discussion. I appreciate that this is a clever idea and loophole, but I don’t believe it actually leads to any benefit. Please allow me to explain:

The amount of tax-free money you can withdraw from this is equal to the sum of your health expenses. Lets take the author’s example of $200 medical expense that occurs in the year 1980. You pay that with in 1980 with your own post-tax money, external to your HSA in 1980. Then in 2015 you can withdraw $200 tax free. But according to inflation that $200 is worth a lot less! In fact it’s 2015 equivalent is $579.26! Again you are limited to your healthcare costs, the entire remainder works like a traditional IRA.

The next problem is paying your initial medical expense in 1980. You have to pay that bill regardless. But lets say instead you paid it from your HSA with pre-tax money and then use the $200 of post-tax money (that you would have used in the author’s example) to invest in a Roth IRA. Come 2015, assuming the $200 investment only kept up with inflation, you’d have $579.26 tax free. That’s a lot better use of money!

Eric, you are correct in your reasoning. However I think the this particular idea is for people who have maxed out their other retirement vehicles, contributed max to 401K, and IRA’s and are looking for more ways to etch out a couple of extra pennies. For those who have not maxed out their other retirement vehicles this tactic is not useful.

Thanks for the reply Hin. I considered what you wrote and I agree that this is ONLY useful if you’ve maxed out all other retirement vehicles. However the article says:

“The ultimate retirement account is better known as a Health Savings Account, or HSA.”

Ultimate by definition is:

noun

1. the best achievable or imaginable of its kind.

Is this THE best retirement account? No way! You would actually be losing out on a lot of money to use this over a more traditional Roth. In fact I’d argue that given inflation you are better off paying your medical expenses out of the HSA as intended. At best the article is disingenuous and at worst its steering people to make costly financial decisions (which I assume is the opposite goal of this site?). In fact I was linked to this article from reddit where someone claims this is better than both a traditional and Roth 401k! For further evidence that this is misleading look at some of the other comments here.

Please re-name this article “An interesting loophole in HSAs that allow you to pay more money now to get less money in the future”

For reference here is the reddit discussion that shows how this misinformation has spread to other people that mistakenly think this article is true and a good idea. https://www.reddit.com/r/personalfinance/comments/2tkk65/are_roth_401k_contributions_worth_it/

I had a discussion with the site owner about this. Apparently this site is for those individuals that have exhausted all traditional means of savings for retirement and are looking for as you may put it “interesting loopholes” to increase their retirement savings. If you have not maxed out all your traditional savings vehicles then go to Suze Orman and the kindergarten class before coming here. While I wouldn’t consider the article misinformation per se, it is ,as you note, a bit exaggerated.

My main objection to this HSA savings strategy is that 20 years from now they may change the HSA rules, such as only allowing the deduction on medical expenses incurred in the same year. Then poof that 20 years of saving receipts was for nothing. Also what happens if you lose the receipts? Lost again. Too much work and risk for me.

My biggest concern with this strategy is also with potential law changes as Hin mentions. Most would argue there would be a grandfather clause, yet that’s not always the case. An example of this in recent history is that you were allowed to use 529 plans to pay for a student’s computer (i.e. law at the time of contribution). The law then changed at time of distribution that you can only use the plan to pay for a student’s computer that is explicitly a requirement to attend the university. While it seems as if this is a given, the taxpayer in this case did not have written proof to show the IRS that it was indeed a requirement and had to pay tax on that money. Since this was a small purchase further pursuing this with the IRS was not feasible, yet one would think if this was challenged in the court the taxpayer would win. To me this HSA strategy makes for an interesting court case in the future!

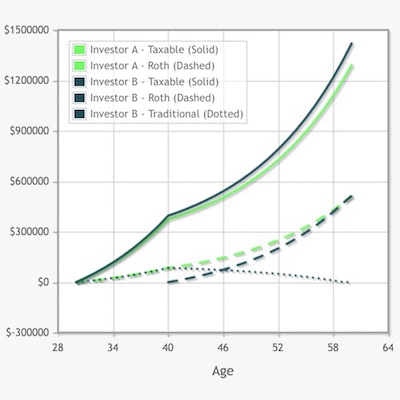

To keep it simple I won’t use numbers at all. Here is why the HSA is better than the other two:

Traditional IRA: Money going in (pay FICA tax), growth (no tax), money coming out (pay income tax)

Roth IRA: Money going in (pay income and FICA tax), growth (no tax), money coming out (no tax)

HSA: Money going in (no tax), growth (no tax), money coming out (no tax for medical expenses or income tax for non-medical expenses).

Even if you expect you’ll never have a medical bill to pay in your entire life (not likely), it’s still better than the other two since the HSA is better than a traditional IRA and I’ve already argued that a Traditional IRA is better than a Roth for early retirees.

As Hin mentioned, if you’re not maxing out your other retirement accounts, then it makes more sense to pay for medical expenses with the HSA and contribute more to your other tax-advantaged accounts.

Regardless of whether you use your HSA to pay for medical bills immediately or not, it’s still the best option because of the triple tax advantage.

Assuming that you have maxed out other retirement accounts, if you never have a medical bill to pay in your life then the HSA is almost exactly the same as an IRA, taxed advantaged going in, pay tax when withdrawn. I count the FICA as only a slight advantage to the HSA since paying less FICA could potentially reduce your SS benefits in the future. It is an interesting additional savings vehicle for those who have maxed out other accounts since at very worst it would be an extra $5k and change more you can save in a tax advantaged traditional ROTH like plan than otherwise, even if you never have a medical bill to pay.

Personally, I while I contribute quite a bit to my 401k I have not maxed it out while I have maxed out both my ROTH IRA and HSA contributions every year. Since you can only contribute a relatively small amount to a ROTH it is easy to max out and ROTH IRA accounts have several advantages such as the ability to take out the initial contributions tax/penalty free before retirement in case of emergencies. I use my HSA for current medical expenses to get the savings immediately and not worry about saving receipts or future tax law changes. Should I not have current medical expenses I would save enough in the HSA to cover a couple years worth of deductibles then switch to increasing my 401k savings.

A bit late to this discussion, but I have to generally disagree with Eric’s comment. At worst, like others have said on this article, the HSA is slightly better than (but about the same as) a Traditional IRA. I would argue even further that it is, in fact, better for most people to contribute to an HSA OVER maxing out one’s 401(k). This is because, while it may be true that your medical expenses now could loose out to inflation, most medical expenses don’t happen when people are young in life. In fact, most expenses will be, in all likelihood, incurred in retirement. Unless you are requiring this money for non-medical expenses, all of the money left in your HSA for these later medical expenses can be withdrawn tax free to pay for them as you need them. Thus, if your HSA allows you to invest your money, and you expect to incur medical fees over the amount you have in your HSA (estimates at over $200k throughout retirement), then it makes sense to let your money grow tax free and use the contributions plus interest to pay for medical expenses tax free. If for some reason you have way too much money in your HSA (which would be impressive, considering how low the max you can contribute in one year is), you can just stop contributing to it.

Finally, as some people have mentioned, there is a worry that the law will change and there will be a requirement to withdraw the money the year you have the medical expense. While this may or may not happen, I would still easily take such a risk because, at worst, the HSA becomes a Traditional IRA without minimum distributions, at best nothing happens, and more realistically, if such a bill to close the loophole was put before Congress, I would simply withdraw all the money I was eligible to before they passed the law (assuming it made financial sense). The interest on that money would still be in my account accruing tax free, and that money I withdrew (tax free) would go to whatever else I would want it to go to. Again, I could use the interest to pay off future medical expenses, and all of it would be tax free. Pretty much a no brainer.

I see a different condition that maximizes the effectiveness of this strategy. My family is currently spending more than what the HSA can cover in a year. (me, my wife, and a newborn baby boy!) But, we can’t deduct those expenses until they reach 10% of AGI. The first year I had my HSA, I used it for immediate reimbursement, but then found myself with several thousand dollars of medical expenses that I could not deduct. I am only starting my HSA in my 40’s, so I do expect that my medical expenses late in life will soak it up, anyway. But in the case as discussed here, where medical expenses in retirement do not take up the full HSA, then I am running a “medical expense surplus” each year, that will also eat into the investment growth of the money I leave in the account each year. (I am now leaving it untouched) I do take advantage of deductions in years when I top 10%, so I have to track that. But I am very comfortable that I will rack up lifetime total medical bill for my family that will allow me to apply this trick to its fullest potential. My HSA provider also has online storage for documentation, so I keep up with that for reference in the future.

The issue of inflation with regard to HSA accounts is the exact same as inflation in general: future dollars are worth less than today’s. The reason that HSA accounts are being used as retirement accounts are because you can invest the HSA money into index funds that generate above inflation returns (stock market returns are around 7% after inflation). You do not lose out to inflation in these accounts if you have the accounts invested in stock funds. In this scenario you would not put any money into the cash portion of the HSA. I found an HSA account with Health Savings Administrators that offers Vanguard funds, and is linked to from Vanguard’s website.

The second reason to put money in these beside inflation protection is that you get a tax deduction in the year contributed (if not pre-tax through employer – many employers don’t offer them). This is now well over $3,000 per year, that amounts to $750+ in tax savings. I see the $750 as additional money to invest each year, by front-loading my tax return into yet another tax-shelterded account the following year, compounding the tax savings. You could also look at the tax savings as an inflation hedge, down payment on your annual premiums, etc. Whatever way you look at it, you are $750 ahead every year than otherwise, and you have more money earning dividends tax-free.

I’m quite grateful for this article. This was the first article I read which opened my eyes to being able to use HSAs as extra retirement accounts. Very cool.

But, I’d like to add something to think about. I think it works out better to claim your HSA expenses as soon as they’re incurred, rather than saving them to withdraw sometime in the future. Now, I may have totally made a mistake in my calculations here and reached a wrong conclusion, definitely you should do your own calculations and not listen to some random guy who could very easily be dead wrong. However, so far things seem to be checking out; consider this food for thought. :-)

Let’s say you have the choice of either claiming $5000 of medical expenses from an HSA today and invest into a taxable account, versus leaving the $5000 in an HSA to grow for 30 years and (hopefully!) withdraw the $5000 tax free then.

The tax-free growth of the HSA seems like it would make the HSA the no-brainer investment. However, pulling the money out results in $5k of no-tax principal you can invest in a taxable account. Basically, this is $5k of no-tax principal in one account vs $5k of pre-tax principal in the other – with an eventual $5k tax-free withdrawal, yes.

What I see in my personal calculations is: while the HSA money does grow better due to not having to pay dividend taxes every year, the benefit of having that $5000 tax-free sooner outweighs leaving it in the HSA to grow completely tax deferred and then pull out the same $5000. The money in the taxable account grows slower, yes, but only the interest and dividends are subject to further tax, and at lower rates than taxable withdrawals from the HSA. The HSA money is all subject to likely higher income tax rates, and leaving the money in the HSA results in more taxes that eventually have to be paid, as well – except for what you can claim as medical expenses, of course. From that single $5000 amount, maybe your HSA would grow $7,500 more in 30 years than the same amount in a taxable account. But, even after accounting for the $5000 tax-free future withdrawal from the HSA, the post-tax value of the taxable account ends up, in my calculations, to still be higher than the post-tax value of the HSA.

That doesn’t mean it’s always better to withdraw early – and I could be wrong, and I’m no expert here – you may very well want to not withdraw if you need that money to cover medical expenses in the future. But if you’re investing in an HSA expecting to use a large portion of it as retirement income rather than covering medical expenses, do some calculations – you may find it’s better to *not* stockpile your receipts and instead claim things sooner. …That’s what I’m planning to do.

@Paul you make an interesting point. I didn’t consider the difference between earnings being taxed more efficiently as investment gains as opposed to income tax rates in the case of distributions for non-medical expenses after age 65. I suppose this difference can vary wildly depending on if your retirement income is lower or higher than your average tax rate over the years you slowly siphon money from the HSA. Personally I am still leaning on the side of keeping all the money invested in the HSA for the long run. Mainly because I think over my life I will rack up more random medical expenses than I think, and I have a very long time period to keep racking them up if I ever want to make progress on making tax free distributions. The more medical expenses I can reimburse myself for, the more I can distribute tax free, and the closer the gap becomes when compared to the advantage in tax rates for investments vs income taxes. Not only that, but as time goes on, the tax free growth begins to compound more than the other strategy allows. In your example it grew 7500 more. Well that 7500 more is now earning more money as well, further closing the gap even if the tax treatment is not ideal. I think if you play the waiting game and let your medical expenses stack up over time to maximize tax free distributions, and only make those taxable distributions when you are satisfied with your investment gains in lieu of harsher tax treatment, you may very well come out quite a bit ahead in the long run.

You’re missing an important detail. just like your IRA the HSA dollars can be invested and they grow tax free – so that negates any positive positioning to IRAs that you mentioned. Investing the HSA funds to grow while you wait to need them is possibly the greatest advantage. In your example you also didn’t account for the taxes paid upfront on the IRA contribution in the difference.

What everyone seems to be missing (and I admit I haven’t scrolled down more than a few dozen posts, but don’t have the time to check the entire comment section) is that many employers will contribute to your HSA, just as they do to your 401k. So… free money! In my case, my employer will contribute $500 per year, in 2 payments of $250 each, one early in the year and the other late in the year. The total allowed for 2018 is $3,450, which makes my max contribution for the year $2,950 (adding employer’s $500 brings us to the max). Maybe back in 2016 this was not true, and that’s why no one mentioned it.

You may need to check this–the total allowance for 2018 of $3,450 includes employer contributions unlike a 401k. If you go over you are in trouble. So since my employer contributed $300 I can only contribute $3,150.

Ooops sorry for some reason I read your total contribution would be $3950 instead of $2950 you are correct!

Deductions, personal exemptions put us in the 15% marginal bracket

The HSA alone saves us around 2% / year in effective taxes (including fica )

Brillant post here, Mr. MF.

In fact, I liked it so much I added an addendum to my own Stocks Part VII post discussing IRA, 401K and the like with a link to it.

As I said there, RE HSAs, I couldn’t have said it better myself and so I didn’t!

You’re too kind, Jim!

As I said in our Mad Fientist FI Podcast interview, I honestly think your stock series is the only thing a person needs to read to become a successful investor so I am truly honored that you included a link to my article in that series!

Kudos to this article making it to the stock series. I love that you great FI guys read and contribute to each others content. I never had any knowledge on this subject and got an excellent crash course. It made me look into what we had w/ my company which unfortunately is an HRA use it or lose it. It did get me to contact HR about what could be done about it or if our insurance policy would allow an outside HSA account such as the vanguard links you have posted. Would you recomment only doing this if 401k and IRA contributions were maxed out?

That’s a shame you have an HRA instead of an HSA. Hopefully you can convince your company to offer a High Deductible Health Plan so that you can open up an HSA somewhere.

I personally would invest in an HSA over the IRA, due to the benefits described in the article, so if I couldn’t max out everything, here’s where my money would go:

1) 401(k), up to the employer match %

2) HSA

3) IRA

4) Rest of 401(k)

How would you revise this for those of us with a TSP?

1. TSP up to employer match

2. HSA

3. TSP

4. IRA

or would you switch 3 and 4?

I’m not too familiar with TSPs but from what I know, they have very low costs so if you’re happy with the investment options, 3) TSP and 4) IRA makes sense but I’m not sure it makes too much difference so you could switch them and be fine as well.

Would 5) be taxable investment like VSTAX?

Two years later.. I just received your email referencing this blog post and I’m investing in my HSA for the first time. I was planning to nearly max it out and based on your article I will now DEFINITELY be maxing it out each year. Thank you.

Question: Why would you contribute to your IRA before you maxed out your 401k?

I have the same question as Alison–why would you contribute to an IRA before maxing out your 401(k)?

I’m guessing you’ve addressed this somewhere on your site–if so, could you point us in that direction?

It comes down to choice and control. Since a 401k and traditional IRA are taxed exactly the same, we have to look at the investments that are available in each. Since a 401k is with a broker that is chosen by your employer, and an IRA is with a broker chosen by you, you get more control in an IRA. Most 401k’s only offer 7-15 investments (and half or more are the utterly worthless target date funds), but you can invest in literally anything on the market with your IRA (since you can shop around).

Dang, I just spent 45 minutes compiling all the links to the ‘Stock’ series, to send to my daughter.

Then after the last one, I run across the page that links to a list of all posts in the series.

http://jlcollinsnh.com/2013/10/05/the-stock-series-gets-its-own-page/

It has a link to a Mr. Money Mustache page, with a link to all in the Stock Series.

http://www.mrmoneymustache.com/2013/03/07/how-about-that-stock-market/

Might save someone some time.

Hi Lamont…

I’m honored you are passing my Stock Series along.

With MF’s kind permission, here is the easiest link to use: http://jlcollinsnh.com/stock-series/

Permission always granted, Jim!

You say that you can invest the money in your HSA in index funds that you chose. Is that possible in all HSAs? I may be wrong but in my company provided HSA it only pays a small amount of interest, similar to a savings account.

George,

Just like with a 401(k) plan, it depends on your provider. I have not explored the availability of rollovers to a different provider (like rolling a 401(k) to an IRA) but you could present this issue to your HR department–HSA’s are new to them, too!

Your company deposits your HSA money into a bank or credit union HSA account of your choice so really your company has nothing to do with it. If your institution that holds your HSA account does not allow investment you can change it to someplace else that does. Generally they will not allow you to invest all your HSA funds. My credit union only requires me to keep the first $1,000 in cash and above that can be invested. I would recommend that you always at least keep your deductible (typically $3-6K) in cash and invest amounts more than that.

Hin,

My company has a designated HSA custodian, just like for our 401(k). I did not know that the company could have the option to open deposits at the employees discretion! The benefit of our arrangement is that this custodian is affiliated with the insurance company, so my expenses flow into it, reducing the paperwork (data entry) somewhat.

Since I am spending more than my deductible, (in fact, we have maxed out the last 3 years) I am choosing to invest all I can immediately. I do also have a minimum I have to maintain in cash–$2,000.

Hi Matt,

Every company I have been with just asks me to fill out the form with a voided check to the HSA account at my credit union. I get checks and a debit card from the credit union account so all my expenses flow into that as well so minimal paperwork. I think this is better since I can move banks to one that gives me the lowest fees and/or best investment options should I want to. Since you are locked into your HSA custodian you might be locked into their investment options and fees.

However remember before trying to take advantage of the HSA savings strategy you should be maxing out your 401K and Roth.

Larger employers will typically offer only one custodian. You can roll your money into another at any time, but your payroll deductions (and any employer contributions, if offered) will go into the company’s chosen one.

My employer also uses a terrible HSA provider, but they do provide some free money into the account each year, so here’s what I did:

1 – Open up an HSA account with the provider of your choice, preferably one that lets you invest immediately or with only a small balance that’s reserved for cash. There’s nothing stopping you from having more than 1 HSA account – you just can’t contribute more than your total max amount into the sum of the accounts.

2 – Directly contribute in your preferred HSA account the full max amount at the start of each year, so that it has the longest period of time to grow.

3 – After my employer’s contributions have been completed, I file the form to do a distribution of excess HSA contribution from the HSA provider that my employer chose. This way I don’t exceed the max HSA contribution amount. They will typically charge a fee to process that form, so I enclose a separate check to pay for the fee to ensure that I fully distribute the excess contribution.

Looking at some other comments, I didn’t previously realize that you could save on FICA taxes by having your employer deduct from your paycheck, so if you wanted to maximize that, you could do that as well and then do the distribution of excess HSA contribution after you’ve maxed out the HSA contribution amount. Since that would be at the end of the calendar year, that can easily become your next year’s HSA contribution into the provider that you chose, starting the next year’s cycle of contribution and distribution.

I have a different take on this. I think they’re great for individuals who can take advantage of them, but we don’t meet the “low medical expenses” criteria so for me an HSA is useless. Worse, I suspect that if you analyzed the impact of many healthy people taking HSA’s on the cost of medical goods and services, there may be some nasty side effects from healthy people removing themselves from the insurance pool and instead diving into these HDHP / HSA arrangements. Perhaps choosing an HDHP / HSA should come with a higher bar of entry if your medical situation changes later and you need traditional health insurance. When you get down to it, this article basically describes a way to game the health insurance system to avoid taxes; no criticism of individuals who choose this is intended; I’d do it as well if I could. But using these plans as a back door to higher retirement asset levels seems like a distortion of the health insurance market that only benefits a few. If I could vote to eliminate them, I would.

Hi Mike, thanks for the comment. High Deductible Health Plans (HDHPs) definitely aren’t for everyone so I agree HSAs are useless for people who are better off with another type of insurance plan.

While HDHPs are usually best for people with low medical expenses, sometimes they can actually be a good option for people with very high medical expenses as well. My health care provider, for example, offers a HDHP that has maximum annual out-of-pocket expenses of $2,500 for individuals and $5,000 for families. The other two “full-service” health plan options, which have higher monthly costs and don’t provide access to a Health Savings Account, have much higher out-of-pocket maximums ($4,500/$5,000 for individuals and $13,500/$15,000 for families). So for someone who could potentially need expensive procedures or require extended hospitalization, it may make sense to enroll in a HDHP, in order to minimize annual out-of-pocket costs and be able to utilize the HSA tax benefits described in the article.

As far as gaming the health insurance system, I don’t really see it that way. The government is providing an incentive to save for health expenses and I’m taking advantage of that incentive. Over the long run, I will be less reliant on an already stressed system, because I will be able to pay for more of my own medical expenses, so I can’t imagine the government would be too concerned with me maxing out my HSA and letting it grow for years/decades until I need to use it.

I’m not sure I understand what you mean by “HDHP/HSA should come with a higher bar of entry…”. Would you mind explaining that part a bit more?

Words: eaten.

We now have an HDHP through my wife’s employer. This only made sense once we decided to switch from my health insurance to hers, she had some options I didn’t. This move was primarily for cash flow advantages, after running the numbers we determined that we’d actually spend less out of pocket under her plan than mine, so we made the switch. Time will tell if this turns out to be the case in practice, and no read yet on it’s value as a retirement account.

Mike, good to hear from you again! I really appreciate you coming back after almost a year to post an update.

If you do decide to open an HSA to go along with your HDHP, make sure you contribute to it through payroll deductions so that you lower you FICA taxes (as Nick described in the comments below).

Keep me posted on what you think of the HDHP/HSA. Hopefully it will turn out to be a good switch for you and your wife.

I’d love to know how Mike and his wife faired!

“Gaming the health insurance system”. The incentive is available and honestly encourages saving for Health expenses later which will not be as it seems later (trust me…like when does the US have a solid track record in this department). The health insurance industry is gaming the reputable users/payers.

“describes a way to game the health insurance system to avoid taxes”

This is “gaming” the system about as much as taking your legally entitled deductions to reduce your taxes. I guess if you don’t want to “game” the system, you could just voluntarily not take tax deductions you are legally entitled to and pay more money to the government than you need to. Washington sets the rules to the game (and it is a game), as long as we follow their rules then our conscience should be clear. If you think the rules are wrong then contact your congressperson.

Hi Mad Fientist — I’m following you over from 20somethingfinance where I saw your comment there about HSA distributions using old medical receipts (the same as your article here discusses). I’m duplicating my comment on 20somethingfinance here to ensure you see it, plus it pertains to this article as well:

“No, you can’t do that.

Only “Qualified Medical Expenses” (QME) can be withdrawn from your HSA, and a QME is only valid in the YEAR the expense is PAID.

For example, if you go to the doctor in December 2012 — but pay the bill in January 2013, then that is a “Qualified Medical Expense” for tax-year 2013. You can’t, as you imply, pay that bill in 2013 out of pocket, and then get a distribution from your HSA in 2016 (or some future year).

This is mentioned in the language in IRS Pub 969 (talking about “Qualified Medical Expenses” for HSAs), and IRS Pub 502 defining when a “Qualified Medical Expenses” is good for:

“You can include only the medical and dental expenses you paid this year, regardless of when the services were provided.”

I erroneously thought the same as you a few years ago and a quick call to the IRS help line set me straight then: 1-800-829-1040”

Hi BG,

Thank you for getting in touch. I try very hard to ensure everything I post here is accurate so I’m really thankful that you took the time to speak up when you thought something I wrote was incorrect.

I had read the IRS Pub 969 when doing research for this article but I didn’t look at the IRS Pub 502 that you mentioned. I just looked through it now though and to me it still seems ambiguous. I can see how Pub 969 defines qualified medical expenses as “expenses that would generally qualify for the medical and dental expenses deduction”, as defined in Publication 502, and Pub 502 does say “You can include only the medical and dental expenses you paid this year” but to me, that doesn’t explicitly mean the HSA can only be used for current year expenses.

Publication 502 describes what medical and dental expenses you can deduct on your tax return so it makes sense that you can only deduct qualified medical expenses that were paid for in the tax year that you are hoping to receive the deduction. For HSA purposes, however, just because it doesn’t fall within the current tax year doesn’t mean it wasn’t a qualified medical expense. To take a deduction, Pub 502 states that the expense has to be a qualified medical expense AND has to have been paid for in the current tax year but an HSA distribution just states that it has to be a qualified medical expense, as defined in Pub 502. To me, the date the expense was paid for is additional information and does not determine if a medical expense is a qualified medical expense.

Saying all that though, if you actually spoke to the IRS about this, I definitely believe what you’re saying. I will give them a call to get clarification on everything and will update this article accordingly.

Thank you very much again for the comment and I will be in touch again soon.

When I called the IRS a few years back, it was for a real example I was facing. I had roughly $8k in QMEs, but only $6k (max contributions) in the HSA. My question to them was whether I could ‘roll’ the extra $2k in QMEs into the next year and take the distribution from the HSA then (when I could add an additional $6k to the HSA again).

The IRS agent pointed me to Pub 502 and said the best I could do in my current situation was try to delay the payments to the medical providers into the next year. Any payments I had already made in the current year would not count as a QME for HSA distributions in a future year.

If you call the IRS and find that they have changed their position on this, that would be very good news.

OK, I stand corrected. I called the IRS again, and spoke with a representative who put me on hold a few times to research the question. She changed her mind from originally “you can’t do that” to ultimately coming to the conclusion that yes, you can ‘roll’ your QMEs into the future and take the HSA distribution at any arbitrary future time (be that years away).

She did say, however, “unless my specific plan precludes that” — though it isn’t clear if that is my employer’s ins. plan, or the bank (HSA) trustee that could preclude us from using HSAs this way.

Regardless, as far as the IRS is concerned, there is nothing in the rules preventing us from saving QME receipts, and deferring HSA distributions indefinitely — as long as you had an HDHP insurance plan when the expense was incurred.

Also, though this is common sense: no ‘double-dipping’ allowed: using the same QME for multiple HSA distributions and/or using a QME that was deducted on Sched A in any tax year.

BG, that’s great news! Thanks a lot for giving the IRS another call.

Tax documents are such a pain to interpret so that’s a great idea calling the hotline to ask questions. I’ve never thought to do that in the past, I’ve always just suffered through hours of frustrating reading instead, but I can definitely see myself using that service in the future.

Thanks again for bringing your concerns to my attention and for following up. It’s nice to know there are people out there keeping me honest!

Your HSA plan has nothing to do with this, since you do not have to substantiate withdrawals — you just have to keep your own records.

The IRS has issued a notice specifically on this topic — IRS notice 2004-50, see Q-39.

You’re absolutely right, Geoff. Jeremy from GoCurryCracker.com actually linked to that IRS notice in his comment on the How to Hack Your HSA article.

Here’s the link, for anyone else interested: http://www.irs.gov/irb/2004-33_IRB/ar08.html

“…as long as you had an HDHP insurance plan when the expense was incurred. ”

To be clear, does this mean an expense incurred previous to acquiring HDHP is not a QME even if it is paid after acquiring HDHP?

For example, one goes to hospital on (non-HD) insurance and incurs an out of pocket expense. One then changes insurance to HDHP and has not yet paid the bill. This bill is not a QME.

Calling the irs for tax advice is widely regarded as pointless. They don’t know what they are talking about. You need to talk to a tax adviser of some sort.

I realize I am late to this party, but I enjoyed the article and it has made me think more about fully funding my HSA account. I currently fund some but I do not max it out.

I wanted to point out another advantage of an HSA account with high deductible health plans. Many companies are encouraging HDHP and HSA’s by giving money HSA accounts. I’m assuming this is because it also saves them money. My company gives me $500 a year into my HSA.

So just another way to get “bonus” money from my company above and beyond my salary.

Welcome, Peter! It’s better to come late to a party than to not come at all so thanks for joining the discussion.

That’s amazing your company contributes $500 per year towards your HSA. I imagine that your free $500 combined with the amount you save on monthly premiums by having a HDHP adds up to almost cover the difference in deductibles between the HDHP and some of the other options. Your HSA is the super ultimate retirement account!

Not to one up Peter, but my company puts $2400 a year into my HSA, $200 a month, which equals my $2400 deductible.

Thanks for the great article. I never realized I could invest the money, its sitting in an account paying .15% interest. I found out I have 22 mutual funds I can choose from, including 2 vanguard index funds.

I also didn’t realize i could add in more than my company already puts in.

I have been looking for ways to sock away more money tax-free. I already have the 401k and IRA’s maxed.

Thanks for saving me money!!!

Wow, $2400 per year is very generous. That’s great you also have two Vanguard index fund options to choose from.

It’s always nice to hear when one of my articles helps someone so thanks a lot for letting me know!

Great article! As a financial planner, just wanted to add one extra feature that gives the HSA an extra vote as the “ultimate” retirement account. If you contribute through payroll deduction, you also save on Social Security and Medicare tax (7.65% this year)! You do not receive this extra tax break if you do not contribute through your paycheck at work.

Thanks, Nick! That is definitely another incredible benefit and one that I actually didn’t even recognize. This is why I love writing about this stuff here…other smart people like you come to my house and tell me more interesting information about topics that interest me. The HSA keeps getting better!

Hi Nick, MF….

Can you site a source for HSAs being free of FICA taxes? Sound intriguing, but I can find anyplace that confirms this feature. Thanks!

I don’t have an official document as a source, but I can say that looking at my W-2 from last year, Box 1 (wages minus 401k withholding and HSA withholding) and Boxes 3 and 5 (SS and medicare wages, respectively) differ only by the amount of my 401k withholding, so it appears the HSA contributions were not added back into the SS/Medicare wages.

Additionally, each paycheck I receive, I can calculate the amount that SS/Medicare withholding is based off of by dividing the withheld amount by .062 or .0145, respectively. Taking the difference between my wages and that amount tells me that my automatic payroll deductions for HSA contributions, as well as my portion of medical and dental insurance premiums that automatically come out of my paycheck, are not subject to FICA taxes.

Hey Jim, check out this IRS bulletin (see the answer to question #19).

Like Matt, I too can confirm that HSA contributions are not added back into SS/Medicare wages on my W2.

Question #19 in that bulletin is specifically referring to the money an employER contributes to an employEES HSA account. Has anyone confirmed “officially” whether the money an employEE contributes to their HSA is exempt from FICA taxes?

I don’t remember the source, but it was either official (us govt) or reputable (Forbes, Intuit, HR Block, etc). I came across this when I was reverse engineering what withholding method my employer used (turns out the withholding method was one of the obscure ones from Pub 15A).

Thanks guys!

That works.

Depending on your taxable income level, the FICA tax rate for the $3300 in potential HSA contribution will be:

– 7.65%: $0 – $117,000

– 1.45%: $117,000 – $200,000

– 2.35%: $200,000

My employer doesn’t allow front-loading of the HSA contributions through paycheck contributions. Therefore, it occurs to me that I’m better of front-loading the HSA directly with FICA-taxed funds, rather than pre-FICA paycheck deductions. Assuming I don’t fall into the 7.65% tax rate, the earnings from front-loading are likely to compensate for the potential FICA savings.

Is my thinking correct or flawed?

Hi Eli,

If you make $300,000 a year, for example, you would have to pay 7.65% on the first $117,000, 1.45% on the next $83,000, and 2.35% on the final $100,000. Were you thinking that you’d have to just pay 2.35% on the entire $300,000?

No, but any reduction in taxable income comes from the top tax bracket.

If you make $300,000 a year and you have $3,300 deducted from your paycheck for the year, the result is:

– 7.65% of $117,000

– 1.45% of $83,000

– 2.35% of 96,700 (instead of $100,000 without the deduction)

The savings in FICA taxes is 2.35% * $3,300.

Ahh, I see what you’re saying now.

I think I would still go the payroll-deduction route, since that’s a guaranteed return and I like to minimize my taxes as much as possible. If you’re making more than $200k though, 1-3% of $3300 is likely only a very small drop in your investment bucket so you might as well just go with whichever option is easiest.

I didn’t choose the HDHP/HSA this year, but for future reference… I’ll probably more than max out social security next year. So for example, if I contribute $5000 to an HSA via payroll deduction, the FICA savings is perhaps $72.50 (5000 x 1.45%). Our current HSA charges $24/yr to use the investment option and does offer a Schwab S&P index with a .09% expense ratio. Other low ER choices include Vanguard Total Int’l Stock at .22% and Fidelity Spartan US Bond (AGG) at .22%. If I’m able to max out my 401k this year, and thus dive into the HSA next year, those fees/expenses seem a reasonable price to pay to keep it simple and not maintain separate HSAs for employer vs. employee contributions. Or will I do significantly better, long term, with cheaper funds available at HSABank or Health Savings Administrators?

Obtw, definitely no reason to do a non-deductible IRA prior to funding an HSA, right? Thanks.

Before using payroll deductions, I suggest everyone read http://www.bogleheads.org/wiki/Payroll_deduction and consider the impact lower OASDI taxes has on your social security benefits. The loss of SS benefits may make using payroll deduction less appealing, particularly at lower income levels. YMMV.

In my own case, I’ve done the math and am comfortable with the tradeoff. The website I cite suggests it would take 18 years of SS benefits to outweigh the savings in OASDI and Medicare taxes paid, before calculating either the Federal and State income taxes on SS benefits or the opportunity of investing the saved taxes.

I’ve done the math, for every 1k of income I will receive .80 cents extra in SS benefits per month. At $76.50 in savings, it would take 8 years just to get my money back in benefits. Now, what’s more valuable, $76.50 invested in stocks today, or 8 years of $.80 cents per month, taxable, at ages 62-70? I think the answer is obvious.

Nick (and MF), Thanks for this great information. I’m about to enroll in an HDHP and I’ll be setting up an account on my own, but my employer is fairly progressive. I’d like to approach him with as much information as possible but am having a hard time finding it on my own. Wondering if you could help me out with…

1. Mainly, who would my employer get in touch with to set up a payroll-deductible HSA?

2. Do you know of any that have Vanguard Funds as an option to invest in?

Many thanks,

L.R.

Hey L.R., I’m not sure about how your employer would need to set up the HSA but Health Savings Administrators is a good choice if you want to invest in Vanguard Funds.

Good luck!

I tried looking through the comments, and didn’t see anything, so I thought I would add that some states (California included) do charge taxes on contributions to HSA, including the employer portions. I believe they tax the gains on investments once realized. Hopefully this will change in the future. CA tax is not as high as federal tax, so that is saying something.

Joe, I’m from CA as well and I verified with my employers HSA provider that all contributions if done as a pre-tax payroll deduction are also exempt from FICA and FUTA taxes. All earnings are also tax exempt as long as invested within the choices provided from the HSA provider. All distributions are tax exempt as long as they are QME’s.

Ok, I’m not sure what that has to do with my comment about state taxes though. I worked with my CPA and the HSA savings account got treated as a normal taxable investment account for California. You pay state taxes on dollars contributed to an HSA and pay state taxes on earnings from the HSA (realized gains, reinvested dividends, interest earned). For instance, I am in Vanguard Total Stock Market Index Fund which is my only low cost option. I had some dividends for that fund received during the year that were taxable in California. These dividends are not taxable on the IRS side.

Straight from the mouth of the beast – “The deduction allowed and interest earned on Health Savings Accounts(HSA). HSA contributions may not be deducted and any interest earned on the account is taxable to California.” “HSA dividends line 9, column C.”

https://www.ftb.ca.gov/individuals/vita/Training_Course/Catalog/540.4.pdf

My mistake, you are absolutely right. I miss understood and CA is 1/3 states along with Alabama and NJ, where HSA contributions are not state tax deductible as of 2014. You are right again about the earnings as well for CA. Price of our sunshine and blue skies I guess…

Man, California must really be amazing if you guys are willing to pay all those crazy taxes over there!

Well when the mid and East coast were in a sub zero polar vortex with record snows California was in the mid 70’s and sunny. How much is that worth?

I luckily avoided the winter this year but last year was brutal as well so I probably would have paid quite a bit!

The Sierras are also at 6% of their annual snowpack at this point in the year. Guess where your drinking water come from!

Maybe one day they will make this less complicated. Until then, cheers!

I know this is an old thread but I’ve been searching if doing the HSA for retirement makes sense in CA due to the State tax issue.

I respect Madfientists detailed analysis and clear guidance on this stuff.

Any thoughts/recommendations?

TIA

Which HSA custodian do you recommend? Mine is currently at a local credit union since it’s free of fees and I have a small balance thus far.

Hi Nephi, I would recommend a custodian that a) doesn’t charge account fees and b) allows you to invest in low-cost index funds. Hopefully your local credit union has some good low-cost investment options so that you don’t have to worry about moving the money you already have invested and can instead just focus on maxing out the account every year!

Any custodians you would recommend I look at that offer both those? The current is no fees, but only basic interest accounts. (at most, .7%)

Ahh, I see. A basic interest-earning account really won’t let you maximize the HSA as I described in this article.

The first thing I would do if I were you is check to see if your employer offers an attractive HSA option. My employer offers a Fidelity HSA and they pay the annual fee so I’m able to invest in low-cost index funds without paying any fees. Going through my employer also means I don’t have to pay Social Security and Medicare tax on that money, as Nick mentioned in his comment above, since my HSA contributions are deducted directly from my paycheck.

If your employer doesn’t offer a good option, your best bet may be to go with Health Savings Administrators. They charge an annually fee but they allow you to invest in Vanguard Admiral shares, which are the best index funds you can invest in, in my opinion.

You could also take a look at HSA Bank. Their investment option is provided through TD Ameritrade, which offers quite a few commission-free ETFs, including several good Vanguard ETFs whose expense ratios are equivalent to Admiral shares.

Awesome post. I am maxed out on Roth and 401(k) and working toward financial security. This is perfect! I really appreciate the post!

Thanks, David! Thanks a lot for stopping by!

I looked in to my employer’s HSA after seeing this post, but I’m concerned about this statement in the plan:

“All pre-tax funds that are not used for eligible expenses incurred during the plan year will be forfeited. This is mandated under the IRS “use it or lose it” rule.”

What does “forfeit” mean? Does it just mean I’ll be returned the unspent money and taxed on whatever isn’t used for QME? Or does all of the deposited money get swallowed up by the government?

I’m a reservist in the military (single, healthy 26 y/o male) and I have access to Tricare ($51/month premium, only $150/yr deductible). Thus, my reason for looking into this is for the tax benefit, since I spend next to nothing on health care costs.

Ideally I’d like to max out contributions and take the money out at 65 like you recommend, but I’m not sure what the “use-it or lose-it”/forfeit clause means.

Thanks!

Hi enceladus, it sounds like you’re looking at a Flexible Spending Account (FSA) and not a Health Savings Account (HSA). An FSA must be used up by the end of the year or you’ll lose that money forever. An HSA, on the other hand, does not require you to spend the money during any particular timeframe so you can let that money grow tax free, as described in the post, for as long as you want.

Great call maxing out your HSA for the tax benefits but definitely make sure it is an HSA and not an FSA before you make any contributions!

Thanks for the quick reply MF!

On closer inspection, you’re correct. My employer refers to it as a Healthcare FSA in my benefit plan, which I incorrectly read as HSA. Glad I didn’t throw a bunch of money it before I realized this!

I’m glad too!

Hello,

I have the same option from work and it is an FSA, you loose the money if you do not use it within the calendar year, do I have another option or am I stuck with that?

Hi Carlos, you’ll need to check with your employer but it’s possible you only have an FSA option. If your employer doesn’t know for sure, contact your health insurance provider to see if your plan is HSA eligible.

MadFientist – just an FYI about FSAs that you might find interesting. FSAs are use it or lose it, however, there is a provision called the “uniform coverage rule” that requires the annual value of the employee’s election be available on the first day of the plan year. For example, if I’m an employee that wants to deduct $200 / mo (i.e., $2400 / year), I can access the $2400 on day 1. Now, if I’m planning on quitting or leaving my job, my employer will be on the hook for the full $2400, even if I haven’t contributed the full amount. Might be a good thing to call out for those people who know when their FI date will be :D – Van

Loved this article. So glad someone confirmed what I was thinking. I changed to our HSA/HDHP two years ago when I started doing all the math. My company also contributes, and what I pay out of pocket is almost exactly the same — but I now have thousands saved in an HSA account that would have just been ‘my share’ to pay to the insurance company under a traditional plan. We will on occasion ‘max’ out the year due to hearing aids needed by myself and my daughter, and soon my son. But, I plan this to happen all in the same year so we max out our out of pocket. That leaves ‘off years’ as savings years for us. 3 out of 4 years of savings helps out!\

Even without investing, having 20 years of $3000 savings in an account is better than just paying it to the insurance company for a traditional plan and letting them profit from it.

Absolutely! In some cases, the out-of-pocket maximums for high-deductible health plans are actually lower than they are for traditional plans so I bet you save even in the years you have to max out.

Glad you enjoyed the article and thanks for the comment!

Hi there,

very nice post. It made me start to think about the following: would it make sense to pay all medical expenses with after-tax money, i.e. not accessing the HSA at all? Because the HSA money can grow tax-free for a long time, and when I use the HSA money, this obviously stops.

There must be a way to figure out under what circumstances paying with after-tax money is the better solution. Do you have an idea how to run the math?

Thanks

Fubek

Absolutely! That’s exactly what I propose in the article (see the last three paragraphs in the Example section).

I just pay for my qualified medical expenses with after-tax money, keep track of the expenses so that I know how much I could withdraw from my HSA if I need to, and then leave the entire HSA to grow tax free.

I’d argue that most of the time it makes sense to pay with after-tax money. That way, more of your money is left to grow tax free.

I have health insurance through Kaiser at my company. I just got married and I’m in the process of filing for my wife’s “green card.” She needs to get some sort of insurance policy in the near future.

We are in great health and are very motivated to retire early and slow travel! Should we get an HSA in addition to my Kaiser? Where is the best place to buy these policies? Does 2 people mean I can max us out our savings as a family? Lastly, do high deductible HSA accounts require monthly fees? Thanks so much.

Hi Steve, I would first speak to your health insurance provider to make sure your plan is HSA eligible. Next, I would speak to your employer to see if you could automatically contribute to an HSA through a payroll deduction (this will allow you to save on FICA taxes). If your health plan is HSA eligible but your employer can’t help you set one up, I’d take a look at Health Savings Administrators. They charge an annual administration fee but they offer some great Vanguard investment options so it could be a good choice.

If both you and your wife have HSA-eligible health plans, you should be able to max out the family contribution limits.

Good luck and let me know if you have any other questions!

Thanks for the tips. This is a great stepping stone for me! Can you please edit out my last name in the previous post. Keep up the great work!

Your previous comment has been edited, as requested. Good luck getting everything set up!

Brandon,

My DH can get an HSA through his employer this year (literature wit details will be distributed beginning of October during open enrollment).

I am reading on this topic and cannot see a clear answer anywhere: what happens if his employment is terminated?

I assume the HSA would stay active till the end of the contract year?

Suppose next year husband has a different employer and decides to get a traditional health insurance plan.

Is this possible, or is once you start the HDHP, you are stuck forever?

Hi Danielle,

The individual owns the HSA, not the employer, so even if your husband leaves his job, the HSA will stay with him.

You are definitely not stuck with a HDHP forever. You are free to change your health plan as often as you’d like but you can only contribute to your HSA when you are enrolled in a HDHP.

Really interesting. A question: if you’re only earning .1% on your HSA funds (no investment options are available), is there any reason not to pull out the money from your HSA now (tax free) to pay for a medical expense vs paying for the medical expense out of pocket and letting the money sit in your HSA account but earning very little? I briefly looked into HSA Bank & HSA Administators (transferring my HSA dollars there) but the fees & hassle etc don’t seem to make sense for a fairly small HSA balance (~$7000 at the moment). Also, do you know what kind of long-term care premiums can be paid for from HSA accounts? Thanks!

Hi Nancy, it sounds like it may make sense to use your HSA to immediately pay for your medical expenses, since you don’t have any good investment options within your HSA. You’d be giving up tax-free growth but the additional returns could make it worth it, assuming you invest the after-tax money that you didn’t spend on medical expenses.

As far as what kind of long-care premiums can be paid with HSA money, your best bet would be to take a look at this IRS document to see if your specific expense is a qualified medical expense.

Great job Brandon. This is my favorite post, I have reread it many times.

I had a question regarding the medical expenses and delaying their payment. I was wondering if it wouldn’t be safer to “pay yourself” for your yearly expenses and stash that tax free money in a Roth IRA? (I know you would love to max out both of them!)

By “safer” I mean you’re sure that you don’t have to interpret the IRS Pub 502 or rely on an employee’s interpretation of it. Or am I missing something here?

Hi Antonio, glad you enjoyed the post!

If you don’t plan on maxing out both your HSA and your IRA and you feel a bit funny about leaving your money growing inside the HSA, then what you proposed makes sense.

I was working under the assumption that all retirement accounts would be maxed out so what you proposed isn’t an option in that scenario.

Thanks for the answer Mad Fientist.

I wasn’t worried about leaving money in the HSA but I am worried about Uncle Sam :)

My proposal comes from a guy longing to be FI but still on the road to freedom, i.e. I still haven’t maxed out all these accounts :P

Please keep up the great job for all the future FI guys and gals out there that still need a north star.

Thanks for this post. I had thought about joining my employer’s HSA last year but decided against it because I was concerned about the high deductible. What a mistake! After reading your article and looking at things more carefully I’ve decided to switch to the HSA in this year’s open enrollment period.

My employer’s EPO plan was costing me $865/year, with no in-network deductible, a $1000 out-of-pocket max and $10 copays for doctors visits. The HSA plan costs $0/year, furthermore they put $1000 in your HSA account if you take an annual physical (which is free), but it has a $1250 deductible, and a $2400 out-of-pocket max on 10% coinsurance for visits.

The amazing thing here is that even if I use my HSA to pay for medical expenses, in the worst case where my expenses hit the out-of-pocket max, I’d only be paying $1400/year on the HSA after the $1000 company contribution, compared to $1865 on the max o-o-p plus fees on the EPO, a saving of $465. In the best case, if I don’t go to the doctor at all, I save $1865! Neat!

That’s great, Dave! It’s always nice to hear when something I’ve written helps someone save a considerable amount of money so I really appreciate the comment.

Also, thanks for sharing the specific numbers of your company’s available plans because I imagine it will inspire others to look more closely at their own options.

I would add that one should also do their homework on the bank distributing your HSA. Chase charges a monthly fee (I think it was $10 or $15) for maintaining the HSA. So you need to at least gain that much in its tax-deferred growth in order to break even on the tax-deferred advantage.

Another cool thing about the HSA is some employers (like my last 2) will contribute $1K each year to your HSA just because you’re participating in the HSA. Other wellness incentives abound: $50 for signing up for a mail-order prescription service, $50 for keeping phonecall appointments with “life coaches,” $25 for signing up for a 5K, etc. All of those small amounts are contributed to your HSA by either your employer or the provider.

I’ve been able to “make money” by not needing to spend that free money from my employers. One troublesome thing about HSAs is also the requirement of having a high deductible plan at the time you decide to pull money from it in order to get all the benefits of the HSA (no penalty, no tax).

So while I agree that HSA is a good tool for saving, it’s more of a tax shelter than a strong way to grow tax-deferred money.

Good point about fees, Denise. When running your calculations though, you need to not only factor in tax-free growth but also the amount you save on taxes up front (thanks to your pre-tax HSA contributions).

You mentioned that you need to be enrolled in an HDHP when withdrawing money from an HSA but that is not actually the case. You only need to be enrolled in an HDHP when you contribute to an HSA. Once your money is in there, you can use it for qualified medical expenses (tax and penalty free) whether you’re enrolled in an HDHP or not.

When you put it that way, HSAs DO sound like the ultimate retirement plans. Especially considering how medical expenses will probably go up as we age.

Thanks for your site; learning a lot of good things on here.

Glad you’re enjoying it, Denise!

First off, great article; it pretty much was the tipping point for enrolling in my employer’s HSA plan. Quick question about that though, and a slightly unrelated topic:

How much should I be contributing the HSA a year? My employer matches up to $1,800 a year but the overall limit is $6,450. Should I be contributing as much as I can towards that limit? I just don’t know where to start when it comes to contributing to the HSA versus my 401k, versus my IRA, versus a regular savings account, etc. Thanks.

Thanks, DB!

As far as how much you should contribute, it definitely depends on your personal situation but I, for example, choose to max out my HSA because I already max out all of my other retirement accounts and I have a good HSA custodian with low-cost investment options and low fees (my employer actually covers the fees while I’m employed).

Without knowing anything about what options you have available, I’d probably say it’d be worth funding your HSA at least up until the employer match. If you can contribute via a payroll deduction, you’ll save an extra 7.65% on FICA taxes so it could be worth maxing out the account for those additional savings.

Traditional IRAs and 401(k)s are great too and are a bit more flexible when it comes to withdrawing money from them for ordinary expenses prior to standard retirement age (see my Traditional vs. Roth IRA article). If your employer offers a 401(k) match, you should definitely take full advantage of that.

The important part is to just save as much as you can so it’s up to you how much future flexibility you want to trade for tax savings now.

I literally smacked myself on the forehead — literally — when I read the line in which you pointed out that you don’t have to reimburse yourself for your qualified medical expense immediately; you have the option to continue letting that money grow tax-free.

Of course! (*Head-smack!*) That makes SO much sense! Why didn’t I think of that?!

I’ve had an HSA for many years. I ALWAYS pay for medical expenses with a rewards credit card, and then I reimburse myself from the HSA. It never occurred to me that I could simply choose NOT to reimburse myself, and instead let the money grow.

Why didn’t I think of that?!?! That makes so much sense!!

Brilliant post, Mad FI. It’s not often that I read one single blog post that will immediately and forever cause me to change my behavior. But this post did it. :-)

Haha, while I’m glad you enjoyed the article, I don’t want to be the cause of damaging that brilliant brain of yours so I hope you smacked lightly :)

I’m really glad you enjoyed the post so thanks a lot for letting me know!

This was an amazing article, but after reading it and all the comments I don’t think I saw anywhere how long you plan or think it would be safe or wise to wait before being reimbursed from your HSA.

You mention, and I agree since I’m young and have similarly few medical bills, that $200 a year doesn’t meet the deductible and it doesn’t break the bank to pay it and not get reimbursed right away.

Assuming there is no financial emergency that you’d need the money for, are you planning on just saving all of your receipts for a 3, 5, 10+ years before submitting them for reimbursement? Do you think the institution would guffaw at you for submitting a several year old receipts? Would they accept them without a fight?