Finally, the post I’ve been waiting for.

After starting this site back in early 2012, I dreamt of the day I would write my freedom post.

I imagined it would be published the day after I left my job and would be the grand finale of my pursuit of financial independence.

Well, exactly one year ago today I left my full-time job and yet I’m only now writing about it.

Why?

There are a few reasons but the main one is that early retirement is a lot more complicated than it first appears.

As with everything Mad-Fientist related, I wanted to deeply explore the subject matter before writing about it.

So I decided to capture my thoughts and feelings over the entire first year and write about it after I had the chance to process everything.

It’s been a wild ride and I’ve learned a lot of lessons along the way so let’s dive in…

First Morning of Freedom

On Friday, July 29th of 2016, I finished my final day of work as a normal career man.

Since my last day was on a Friday, the weekend didn’t feel different than any other weekend.

It wasn’t until I woke up on Monday, August 1st that it really hit me.

And boy did it hit me.

You would have expected it to be the best morning ever but it was actually the only time in the entire first year that I freaked out about the whole thing.

I had escaped the normal life script but now I was in uncharted territory.

I was staring into the vast unknown and the immense gravity of the situation freaked me out (much more than I expected).

It’s crazy that I wasn’t mentally prepared for it, considering early retirement was something I had been thinking about and working towards for over five years.

The best way I can describe it is this…

Have you ever planned a really big trip? Maybe it was your honeymoon or a trip to a place very far away that you had to dedicate a lot of time to plan out.

Even though you spent months booking flights, researching hotels, and telling all your friends about your upcoming trip, the reality of what you were doing didn’t actually hit you until you got off the plane.

That’s what happened to us when we moved to China for three months.

We did a lot of research, talked about it all the time with our families, and thought about it daily but when we landed in Wenzhou and got off the plane, I freaked out and thought, “Holy shit, we live in China now…what are we doing?”.

Our Home in Wenzhou, China

This was sort of like that.

FI was something I talked about and thought about so much that it just became this abstract concept in my mind and didn’t relate to anything in real life.

It was a long-term goal that I guess I never actually pictured achieving.

In fact, after writing and talking about it so much, the entire idea of it became condensed into two meaningless letters – FI.

So the first morning of freedom was tough because I couldn’t process it all.

Try it out for yourself right now.

Close your eyes, imagine waking up on the first day after leaving your job, and think about the rest of your life.

You no longer have a normal script to follow and you hopefully have 60+ years of time to fill.

Pretty heavy, right?

First Day of Freedom

Although the first morning of freedom was pretty intense, luckily the rest of that first day got better.

To distract myself from the overwhelming task of figuring out the meaning of life, I just got back to work instead.

I had a lot of Mad Fientist tasks I wanted to complete so I threw myself into that.

It felt great. It felt normal.

I filled the void left behind by my job with other work that I wanted to accomplish.

I was happy to be making progress on things that were important to me and I started getting really excited about the idea of doing that every day.

Maybe life wouldn’t look so different, after all? I would still be working but I’d just be working on things I’m passionate about.

That was the whole reason I pursued early retirement in the first place so I’m not sure why I didn’t think about that when I woke up that day.

Lesson #1: Have a project in place that you’ve already started and are passionate about so it can fill the void in your life after you leave your job.

First Week of Freedom

After getting a lot of Mad Fientist stuff done on that first day, I continued getting even more accomplished the rest of that week.

Since I was working normal hours, that first week didn’t feel any different than the week before when I still had a job.

That made me realize how good of a career situation I had worked my way into. Since I worked from home and had a lot of autonomy, I had achieved 80% of the benefits of early retirement during my last two years of work and yet I still received a full paycheck.

Lesson #2: Use the power your money gives you to make your job as enjoyable as possible (see the Power of Quitting).

First Fortnight of Freedom

Ahh, fortnight…a word I hear often here in Scotland but one that is underutilized in America (it means “a period of 2 weeks”, by the way).

So although my first week of freedom was similar to working life, my second week gave me a glimpse of what my new life could be like.

New Experiences

I decided to start trying new things – things I had always said I wanted to try but just never got around to trying.

There was a climbing wall right next to where we used to live so Jill and I went and had some climbing lessons.

We loved it!

I thought to myself afterward, “Maybe I’ll become a rock climber or a mountaineer”.

That probably won’t happen but it could.

Anything is possible after financial independence and it was very exciting to think about all the possibilities FI provides.

Lesson #3: There’s an exciting world of things you can learn about and explore and FI gives you the energy, freedom, and time to do it.

Richer Experiences

During that second week, I also decided to dive deeper into things that I already enjoyed.

Coffee, for example, was something I liked drinking every day but didn’t really know anything about.

As my experience with beer and wine has shown me, the more you learn about something, the more you enjoy it so I signed up for a coffee tasting during that second week.

Jill and I went to the cafe that was hosting it and we tasted a bunch of different types of coffee. We learned a lot about growing the beans, how it’s made, how you should brew it, etc.

Now, my enjoyment of coffee has increased exponentially and I can appreciate the subtle flavors that I never knew existed before.

So rather than sucking down cup after cup of mediocre coffee every morning just to survive a normal workday, I now drink one or two cups of really good coffee and fully appreciate the experience.

Lesson #4: FI allows you to slow down and appreciate things on a different level (after reading this great post on Raptitude, I’m trying to expand that enjoyment to even more aspects of ordinary life).

First Month of Freedom

After my first fortnight of freedom, I started to see the possibilities of FI and it made me really excited.

To continue my exploration into new things, I decided to get a gym membership.

Health

I had always said I would focus more on my health after I left my job and now there was no excuse. I had all the time in the world so fitting in a few hours at the gym every day was definitely possible.

Losing your excuses is exciting but it’s also scary because you finally have to do what you’ve said you were going to do.

Luckily, the gym near me was offering a special discounted one-month trial so I took full advantage.

I found a one-month weight lifting program online and I stuck to it for the entire month.

The first week wasn’t fun because I was weak, I got sore after every workout, and I didn’t know what I was doing in the gym.

The next week though was easier because I had more confidence and was starting to feel stronger.

By the end of that month, I felt great, I was actually enjoying the workout sessions, and I was happy with the changes I could see in my body.

Surprisingly, going to the gym also had a positive effect on my eating habits.

Once I started to see positive changes in my physique, I wanted to increase those changes even more so I started eating healthier.

It was crazy…in just one month I went from being an unhealthy, wimpy software developer to a healthy-eating, gym rat.

Lesson #5: FI = Rebirth. What you were before FI doesn’t matter. You can be anybody you want after FI so figure out the type of person you want to be and start being that person.

Less Stress

The gym helped my mental state but so did time away from work.

I didn’t realize it when I was working but I had a lot of low-level stress that was with me all the time.

My job was easy and wasn’t very stressful, so I didn’t think I was stressed, but I definitely noticed a big improvement by the end of the first month. I just felt more relaxed and less anxious.

I still had the occasional work nightmare (where I would be called into my boss’s office to talk about a certain Mad Fientist website that he just stumbled upon, haha) but I felt much calmer than before.

It also helped that I kept getting work emails for a few weeks after I left because it was nice to see all the work that needed to be done and all the problems that needed to be fixed, knowing I didn’t have to worry about any of it!

More Present

Another thing I realized during that first month was that I felt more present in my normal life.

Rather than thinking about the Mad Fientist stuff I wanted to get done while hanging out at my in-law’s house, for example, I would instead just enjoy my time there with everyone and not worry about anything else.

Since I had so much more free time, I knew all that things I wanted to do would get done eventually so it allowed me to enjoy the present more.

There’s less urgency when you feel like you have enough time for everything.

First Quarter of Freedom

While my first month of freedom gave me a taste of what normal post-FI life could be like, the next two months were anything but normal.

Instead, I used my newfound freedom to do something I had always wanted to do – travel around the world.

Kyoto, Japan

Jill and I spent three months traveling through 14 countries on 4 different continents and we went all the way around the globe!

During our trip, we visited Vermont and I got to drive my old commuting route on a weekday but instead of going into the office, we met the Frugalwoods for beer and barbecue instead.

Much better :)

My New Colleagues

First Year of Freedom

The trip was amazing but it wasn’t until we returned to Scotland that the reality of FI finally sank in completely.

Deep down, I think I expected to return to work after traveling because we had taken multi-month trips in the past and I always had to go back to work after them.

When I realized that I didn’t have to go back this time though, I can’t explain the excitement I felt.

The closest I can get to explaining it is this…

Have you ever woke up thinking it was Sunday morning but it was actually Saturday instead?

It was like that but 1,000 times better because it wasn’t just an extra day off that you didn’t expect but the rest of your life!

Instead of being sad about returning to a job that didn’t interest me, I immediately started making progress on new projects that I’ve been wanting to start for years.

I felt so lucky to be able to dedicate all my time to these things and I can’t remember a time when I felt more invigorated.

Worried Wife

In fact, it was around this time that I started to worry Jill.

I’m normally a solid sleeper and usually fall asleep shortly after laying down and stay asleep until morning.

When we returned from our trip though, I kept getting out of bed multiple times every night and I was also staying up way later than normal.

After a few weeks of this, Jill finally confronted me and asked what was going on. She was concerned that I was stressed about my new jobless life.

In actuality though, it was the complete opposite.

I was so excited about all the things I was working on during the day that I didn’t want to sleep at night!

When I still had a job and was commuting into the office, I hated going to bed because that meant that before I knew it, my alarm would be going off and I’d have to head to work again.

Now, I hated going to sleep even more but it was because it felt like such a waste of time when I could be doing all these other exciting things!

Full-Time Travel is Not for Us

The happiness I felt making progress on the projects I was working on made me realize that perma-travel is not for me.

I had previously assumed that I would be a full-time traveler whenever I finally reached financial independence.

Although eating new things and seeing interesting sights every day is a lot of fun, it’s not as fulfilling to me as being creative and productive.

When I’m on the road, it’s difficult to stay focused and get things done so I now know I need some normalcy in my life every once in a while.

Also, now there’s less need to escape normal life so travel isn’t as appealing as it once was.

Before when I was working, travel was a great change from the boring routine.

Now that post-FI life is so exciting and interesting, there’s no need to break up the monotony of normal life because normal life is so enjoyable.

Lesson #6: What you think you’ll do after FI may actually not be the thing that makes you happiest so don’t fully commit to a new lifestyle until you try it out first.

New Joys

To give you an example of how normal life can be so much better after FI, let’s take a look at food.

Before FI, lunch would be the most annoying and unsatisfying meal of the day because it would be eaten quickly and I would eat whatever was most convenient (when I was in the office, I would usually eat store-bought pita bread and hummus).

After FI, here’s what lunch looks like:

Do I feel like fresh-baked bread today? Sure, I’ll just bake some before lunch.

Poached eggs are so delicious so why not try to learn how to do cook those today?

Since lunch is now a meal to be enjoyed, might as well invest in some of the highest quality olive oil and balsamic vinegar I can find, right?

Health

In addition to cooking more and eating healthier again, my gym activity has ramped up too.

My buddy Doug, who is a professional strength and conditioning coach, put me on a focused weightlifting routine for the last four months.

Since he doesn’t live near me, he just enters my workouts into a free mobile app called Trainerize. The app allows me to see what I need to do each day, watch videos to learn how to do the exercises, message Doug if I have questions, and keep track of my stats while I’m working out (which Doug reviews and uses to plan my next routine).

It’s been great and I like having a virtual coach because listening to podcasts in the gym is much better than having someone bark orders at me.

Bonus: If you want Doug to whip your ass into shape too, he has kindly offered a discounted price for Mad Fientist readers so take a look at the programs he offers here.

I’ve been going to the gym at least three days a week since I got back to Scotland and I feel better than I have in decades so it’s been fantastic!

Lesson #7: When you realize how good life can be after FI, you’ll want to make sure you have as many healthy years left as possible so you start to see fitness in an entirely new light.

Finances

I haven’t even mentioned finances yet but that’s because money hasn’t been an issue.

I was really worried about drawing money out of the accounts I spent so many years building up but I thankfully haven’t had to do that yet.

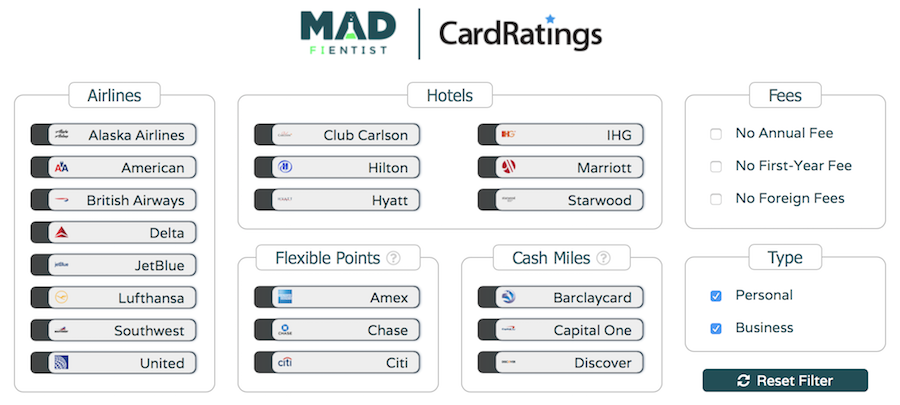

The reason is, all the websites and mobile apps I’ve built over the years have started bringing in more money than we spend (it seems the credit-card search tool I created is getting some traction in the travel-hacking community so it’s been generating a lot more income recently).

Screenshot from my Credit-Card Search Tool

Ironically, the income from this application only increased after I had already quit my job (i.e. when I didn’t need the extra money) but it has made the transition into joblessness much easier to deal with.

I had actually planned to write a lot of articles this past year about various withdrawal strategies but those will sadly have to wait until I actually start drawing down from my accounts.

Lesson #8: Start building a side business while you’re still working (but make sure you do it the right way) so that you have a meaningful project to work on after you leave your job and the potential to generate income without withdrawing from your portfolio.

Biggest Mindset Shift

This leads to the biggest mindset shift that occurred after reaching FI – the realization that money is no longer motivating.

This is quite a shocking and uncomfortable shift for me.

Money has motivated my entire adult life until this point.

I worked hard in high school so that I could get into a good college because I wanted to be able to get a job that paid a lot.

I worked hard at my job so that I could get promoted and earn more money.

I started side businesses in hopes of increasing my income.

I chose where to live, where to travel, and what to do, all based on how much I could earn or how much it would cost.

Now, I have enough money (plus some unexpected income coming in) so it’s not as important anymore.

This is a great position to be in but losing your main source of motivation is incredibly disorienting.

Some of the projects I planned to start after leaving my job were business ideas but now that earning more money isn’t as appealing, I don’t see the point.

If you stop and think about how many of your decisions and plans are motivated by money, I’m sure you’ll find that most of them are.

I’ve had to reevaluate my entire life and all my plans while simultaneously finding a new source of motivation.

Crazy, right?

I still haven’t fully come to grips with this but I’m slowly getting there.

For example, I recently removed all ads from this site. The ads have been annoying me for years because I thought they made my site look cluttered. I left them though because nobody was complaining about them and they were helping to cover the costs of running the site.

Once I realized the money they were generating was no longer necessary, I decided to remove them completely.

It should have been an easy thing to do, now that money is less important, but it was still really difficult. How could I just give up hundreds of free dollars every month?!

Luckily, I was able to power past my old mindset and realize the new reality so I removed the ads and I’m very happy I did.

That struggle showed me that although money is less important to me now, it’s still not meaningless so I still have some work to do.

It’s hard though because I’m trying to undo decades worth of programming and the new mindset seems so unnatural.

Completely Content

Since we have this unexpected extra money coming in, I asked Jill if she could think of anything we could buy or spend money on that would make our lives better.

We thought about it and realized that we love where we live so we wouldn’t want to move somewhere bigger or nicer because our current place is perfect.

Our cheap little car does everything we need it to so no need for an upgrade there.

Our $3,400 Honda Jazz – Best Car We’ve Ever Owned

We eat out enough and wouldn’t enjoy it if we ate out more.

We travel enough and actually plan to cut back on travel next year because less travel will make us both happier.

We racked our brains for a while and the only thing we could come up with was to buy a foam mattress topper and a couple of better pillows.

So we bought those two things for less than $100 and now we have everything we want or need.

Feeling like you can buy or do anything, while simultaneously being completely content with what you already have because you know more won’t make you happier, is one of the best benefits of pursuing FI.

New Motivation

Being content with what you have is great but you still need something to motivate you. Otherwise, what is there to get you out of bed in the morning (especially when that bed is much more comfortable, haha)?

I’m not exactly sure what my new main source of motivation is going to be but here’s what’s been motivating me the past year:

- Quality – I have an image in my head of what I know the Mad Fientist could be so I’m very motivated to make that happen. Producing something that I can be proud of and is as good as possible drives me to work hard.

- Helping People – I save all the emails and messages I get from people whose lives have benefited from Mad Fientist content because it motivates me to do even more.

- Creating – When money doesn’t matter, you can instead create things just because they are beautiful or bring people joy. Most of my time this year has been spent working on an artistic project (which I plan to write more about soon) and the act of creating something new from thin air motivates me to create even more things.

Freedom!

Well, there you have it…my freedom post, one year late.

It’s been an incredible adventure and better than I imagined so I can’t wait to see what year two brings.

How About You?

If you’re already free, what was your first year like? What motivates you these days, now that you don’t need more money?

If you’re not free yet, what do you think you’ll do once you pull the plug on work? What will get you out of bed in the morning?

Let me know in the comments below!

Alright, if I ever need a little financial independence motivation, I am coming back to this post! You just explained and portrayed “life after FI” in probably the most exciting way I have found thus far. I was particularly struck by the “when you wake up thinking it is Sunday, but it is Saturday” example. That happened to me last weekend and I swear I was walking around with an extra bounce in my step all day I was so happy! Mr. Adventure Rich and I hope to pursue passions projects/jobs pre and post-FI, though we are still determining what that might look like. We would like more time with our son (and any other kids that may come along), but we have other interests as well. Maybe coffee roasting, some farming, or a side business teaching cleaning skills for Mr. AR… while I would love to teach/coach skiing, running, biking/cycling to youth and be active in our community. Our dreams are motivating us to save for FI each and every day!

Thank you for sharing these lessons from FI Year 1!

Sounds like you have a great plan. Heading back to northern MI is a great move. I moved from there to So Cal… and only because I had to option to live in a low cost of living area. I’m well established on the financial front and own rentals back home in MI.

I’d highly recommend the Ski Coaching!! I’ve been doing in for years now, both in MI and now in CA.

Awesome progress!!

Oh awesome! I’m glad you found a place in SoCal for a low cost… that is no easy feat! I am definitely on the ski coaching kick right now… it could be a lot of fun :)

In my 30s I was a youth ski race coach at Aspen Highlands, my kids taught me a lot, not only about skiing but about life and taking a chill pill once in awhile. Also taught beginner skiing in Steamboat Springs CO. till I was 51. Still have my condo there, Retired in central AZ at 58 yo. back in 09, actually a little earlier than planned due to the burst, Not really an FI, but close enough to be comfortable. 66 yo now and getting by. A couple health issues have been in the mix, but settled down again. Really enjoyed this narrative , it makes me feel lazy as a retired person. It didn’t start out that way, but gradually I slowed down. Did a lot of volunteer things at first, walking dogs from the shelter, working on organic gardens and a cattle ranch. I ski bummed for 20 years, being an instructor was terribly hard, I don’t really recommend it. They were really much happier days when I just bought a ski pass and skied all I wanted when I wanted. There is a lot of macho mojo in a ski instructors world and performance demands from 7 am till 5 pm sometimes later. No fun when the high temp for the day was -12. As an instructor you are no longer autonomous or anonymous, The ski bum life is the way to go. After the 2000 – 01 season I quit skiing because I thought walking was important too, those little twinges in the hips and knees could turn into surgical demands, didn’t happen and they went away after a while off the slopes. Got a motorcycle at retirement and put on a lot of miles, used up the 1 to 3 day road trips avail. around here, maybe some multi week trips are in order. But I am lazy.

Anyone interested in some OJT, on organic farms, WWOOF.org was good, I went to Reevis school of self reliance as an intern spent a total of 4 months there, could have stayed longer but home life beckoned. It is a bit isolated. No less a paradise. https://www.facebook.com/reevismountain/

your realistic opinions and advice is appreciated. I’m 59, just enjoying being retired, am not all that motivated to continue accomplishing things!

Enjoy!

Congratulations on your first year of F.I.!

I hope I can write a similar blog post once I’m completely FI/RE :)

I concur on the traveling – it can get tiring quick… Nothing compares to a good nights sleep on your own bed.

Cheers.

Exciting post, and worth the wait for the insights that come only with time!

That said, I was sipping crappy office-provided coffee while I read that section on coffee, and I find myself uncharacteristically green.

Haha, I still remember the taste of the “coffee” that came out of the old, overused office Keurig machine so I feel your pain

Your first year’s memoir doesn’t make me any less interested in FIRE. I love the lessons learned along the way.

I’m at least a year out from my Freedom, and I anticipate having some of the same experiences — hopefully most or all of the positive ones. We’re easing our way into it. I’ll be working 7 calendar days a month starting in October, and we’re starting to plan our first extended trip with our boys for November / December. We hope to take three trips of about three weeks (or at least a fortnight) over the course of the first 9 months to experience slow travel as a family.

After FIRE, we can extend those trips out as long as we choose. And get some decent, consistent sleep for the first time in 20 years. Sounds great.

Cheers!

-PoF

Nice use of fortnight ;)

“I filled the void left behind by my job with other work that I wanted to accomplish.”

This is the feeling I can’t wait to feel! That choice to pursue what my passions and personal drives are; and damnit, by the time I go FI, I’m sure going to know what those are!

In October of 2015, I took a few days off of work and went on a climbing trip in Tahoe and Yosemite. When I returned home – the night before work – I sat down and was completely (physically) wrecked and had a bunch of new memories that made me smile so big. I thought “how can I have this feeling all the time?” Usual stories of “dirtbags” entail dropping everything and living on the road as long as their budget will allow, then return to “society” broke and jobless.

It was this thought of broken and jobless that made me somehow search the world wide web for a vague concept of FI. I subscribed to your podcast, made a Reddit account dedicated to FIRE, began cutting back on non-essentials, and started my own spreadsheet to track progress in reducing expenses and increasing investments.

I imagine my first day of FI, I’ll probably be on the road to some awesome climbing location; mainly because that has been the inspiration since day 1.

Your website and podcast were the first FI-personality’s I began following religiously, and have learned a lot from your knowledge and reflections on the path.

I’m so psyched you achieved FI, and have flourished in your first year. Also, I can’t wait to consume the content you continue to release.

If you’re ever in Northern California, and want to go for a climb, please reach out! I’d love to share the experience of what climbing in the Sierra has done for me as a person.

Thank you for all your efforts, and for your future posts.

Sincerely,

FM

As I mentioned in the post, stories like yours really motivate me to keep doing what I’m doing so thanks a lot for sharing.

And I definitely look forward to taking you up on your climbing offer one day :)

We are 20 months into a mini-retirement and ALL of this ring true. I’ve tried to write about it a bit, but it’s hard to wrap your mind around until you have swum in it for a bit. I think we will go back to something that looks a bit more like work after a few more years. But I’m so glad we did this now instead of putting it off for another decade.

I think mini-retirements are an excellent idea! Are you going to be at FinCon this year? If so, I’d love to chat with you about your mini-retirement.

I’m saving this article and taking some notes. Be prepared – I’m going to go in depth on a few of them when we have our one on one in Ecuador. Good thing is we should be able to drink great coffee while talking! Congratulations again on becoming FI and thanks for taking the time to jot down your thoughts and share it with us!

Oooh, you picked me for your 1-on-1?! I’m honored (and surprised, considering you’ve seen me in my darkest moment…shoveling In-N-Out cheesy fries into my face as fast as my beer-impared hands would allow).

I also picked you for my 1-1 in Ecuador and I want to talk about a mini retirement. Your move to Scotland, working remotely, and general open mindedness around making work “work for you” really resonates. I’ve managed to be stoic and power through the last 10 years but this year will be different, and I’m hoping to build up the courage to make a change in Ecuador with some new friends!

Gwen – I totally want to crash this part of your convo. You should save it for what I envision as whatever is a campfire-esque setting in Ecuador so others can hear you grill Brandon. I seem to recall something about lukewarm hot tubs from others past experiences?

Looks like this year’s place has fireplaces and hot tubs (hopefully of the “fully warm” variety) so no doubt this conversation will go down somewhere fun!

Todd- I am starting a FIRE podcast…. maybe I’ll use the discussion as part of a podcast episode :)

Hey Brandon, I can’t thank you enough for this post.

I’ve just achieved FI and curiously enough, I’m freaking out about the whole retirement idea. I already have a side business and have never been too keen on corporate life, but the fact that I’m now FI is really uncomfortable, when it should be the opposite. It’s just very difficult to deal with the fact that I’m ready to “pull the trigger” whenever I want. It’s pretty scary too (the question “what if we run out of money?” Pops up in my head about 100 times a day:-)). My husband likes his work, so similarly to your wife, he will keep on going for a while (some vesting is near). After that, who knows?

I was actually wondering how it felt when you’d had some distance from your early retirement, and then your post comes up! Thank you!

P.S. I may go to chautauqua (talking to Alan and Katie), so maybe we’ll meet there!

It’d be great to meet you in a few weeks so keep me posted!

If you’re that worried about pulling the trigger, I’d say wait a bit longer and try to work through those feelings/thoughts first. Obviously you’ll want to take the leap eventually but the goal here is happiness and not “not working” so you’d be better to keep going than quit and be terrified and/or miserable!

Hi Kimi,

Once I had enough money that I felt I could be poor but happy if I left my job, I ended up having similar uncomfortable feelings; I worried that I might retire too soon, and (after sailing the seas of working life) I wasn’t quite sure what lay over the horizon—a horizon that felt more like a cliff, it’s so close. Giving up a good career is kind of scary to think about.

My wife fixed most of that by noticing my anxiety, and, after a discussion, simply suggesting that I define a deadline—either a date or an investment threshold—that I could allow myself to retire. Even before I settled on a date (795 days from now!) I felt much better. I have a couple years to research, schedule, and calculate my retirement. So, even though we are technically FI now, having a long transition period with a cut-off date is making me feel much better about my FI future. In the meanwhile I’m enjoying articles like this one, and I’m learning more by reading blogs and books, and discussing retirement with newly retired friends.

“Feeling like you can buy or do anything, while simultaneously being completely content with what you already have because you know more won’t make you happier, is one of the best benefits of pursuing FI.”

Loved that, and the closer I get to FI the less I seem to have a desire to buy things. We have a Honda Fit as well – awesome car!

Although I am still working, I decided to do a lot of traveling this summer. And realize that perpetual travel unexpectedly is really not for me too. Although enjoyable, like you I don’t enjoy missing out on the constant growth and fulfillment I gain from my everyday routine and projects I work on.

Great post!

Congrats on your first year of FI!

Great write up, thanks for sharing your experience.

I’m late to the party and still years from FI, but your discussion about flexibility in perception before/after is good to hear. My biggest worry about FI is what I’m going to do with myself, being so used to the ‘normal’ work schedule…

So many people seem to have elaborate passion projects. I have things I *want* to do, but not necessarily that I *need* to do… so it’s interesting to hear how your plans have shifted and adapted to what you discovered about yourself post-FI.

Looking forward to meeting you in Ecuador, Cheers!

Look forward to meeting you too!

Hopefully my talk in Ecuador will help you find something meaningful to focus on after FI because I think that’s one of the most important things you need to do before pulling the plug on work.

Can’t wait to see you down there!

Thank you for this update! It sounds wonderful. :)

I know one of my goals is to have more time to spend visiting friends and family, but I agree that coming back to “home base” is good too. (My cabinets make sense, my sister’s = utter chaos!)

Keep enjoying it and keep posting so I stay motivated to hit my targets too. :)

A bit too late for FIRE for me, but FI is available any time, right? This article was a big help at reducing my anxiety about retiring, and when to do it.

Absolutely!

I would like to see more infomation about retiring early when you have children. I know Mr. Money Mustache has one child, but what if you have 2 or more children? Thanks.

Root of good may be a site to check out

Here’s someone who is going to retire early with 13 (!!) children: https://www.madfientist.com/how-to-retire-early-with-13-kids/

There are plenty of people retiring early with kids. I retired a year ago at age 40 with 2 kids (ages 5 and 7). Plenty of people blogging have done it or are in the process. Someone referenced Root of Good – a good one. I think 1500 days and Frugalwoods are other examples. Ask around in the MMM forums and you’ll find many people who have retired with kids.

Whether you have kids or not, the basic math/concept is the same. You’ll just need to adjust based on what kind of lifestyle you want for your family. For example, perpetual travel may require homeschooling. You should also give some thought to family-related expenses down the road and how you are going to handle them (e.g. braces, education, activities).

Congrats!

I have just started my fifth year in FIRE and am still loving it. I have several projects I work on and decide what I feel like working on each day. Or I may decide to read a book. Agree with what you say about Lunch. I sat at my desk and ate lunch while I worked for about 26 years. Now I go have lunch at the beach at least 4 times a week or in our cute little town. Lunch takes a minimum of 2 hours. My greatest pleasure is deciding on how I spend my time. Continue to enjoy it!

I can’t remember my first day of ‘freedom’. That’s kind of sad, when you think about it. But it’s been 10 years and we (my wife and I) have spent it in our motorhome exploring all of North America. From Alaska to New Foundland. From Canada to Mexico. It’s been a great ride. But it’s coming to an end. We are about to start a new chapter of our lives. We purchased a townhouse in San Miguel de Allende, Mexico. It’s still under construction and we have a few more items on our bucket list that will keep us on the road in our motorhome for another year, but then the new chapter begins!

And, yes, it’s nice not to have to worry about where the money will come from. We’ve been spending between 5 and 7% of our portfolio for the last 10 years and after all that we have more money than we started with (retired 20 Jan 2008. That was a tough year. Lost about 40% of our portfolio). And now that we’ve finally reached social security age (66) we will begin to collect enough money from that that our draw-down rate will drop to 2-3%, if that. Also, we calculate that our budget will drop from $6k per month to ~$4k per month down in Mexico. So maybe we won’t have any burn rate from our portfolio. Ain’t life grand! 8^)

San Miguel is fantastic so I’ll let you know next time I’m down there and we can grab a margarita or something!

I started planning for financial freedom 30 years ago, back in 1987, first with pencil, paper, and calculator. Then with Lotus 123. Then Excel. Back then my spreadsheets modeled accumulation scenarios. Now they model decumulation scenarios. I’m 61 now. The results of investing, compounding, frugality, and time have exceeded my expectations. Still working but nice to have the peace of mind knowing I can walk away when I decide to.

Thanks – that was a very enlightening article. I’ll share it with our team and will point to it from a FIRE article I wrote last year https://www.newretirement.com/retirement/fire-financial-independence-retirement-early/

I continue to believe that many of the FIRE folks have very useful lessons for the traditional retirement folks that we serve – they just consider them later in life (and with many people living longer healthier lifespans it’s highly relevant). FWIW – I think many more people are doing a phased retirement starting at younger ages where they find better work/life balance and try to get control of their schedule, pursue work/service that is meaningful to them and do it from locations they like (e.g. from home).

Fascinating post! Really great food for thought here.

I’ve recently settled on the idea of making a little dress shop on etsy as my side hustle. Time is my biggest limiting factor these days so I’m carefully choosing how I want to structure this endeavor so that I’m motivated to spend much time as possible on the parts I enjoy the most: actually creating dresses. So that means limiting how much customization I offer and letting go of pressures to optimize the business like spending time hunting down the cheapest fabrics and perfecting things. This does mean it’s not very passive. Developing digital sewing patterns would be an adjacent project that would create passive income but the start-up efforts would take energy and resources that I just don’t have right now after the basic life requirements of a full-time job, gym, and friends. But cutting and sewing a dress a month in a few different sizes? That I can do, and would enjoy doing. It’s not perfect but it will make me happy to create and at the same time move a little faster towards my savings goals. I’m planning to have something listed by the end of September and my hope is that this is a business that I can carry forward to that distant FI period of life.

The great thing about being your own boss is you can go easy on yourself. I too just do the stuff I enjoy and I limit the stuff that I don’t. This blog could be 10x as popular as it is now if I wrote more consistently and published once a week but that wouldn’t be fun for me so I don’t do it. And as the boss, I’m okay with that :)

Excellent post! I especially appreciated #2, staying appreciative in the present with a cushy job with flexibilities and low stress that stills pays a lucrative wage. Overall, I loved your candor and the comprehensiveness of this summary from a full-year prospective. Thanks for letting us share your wild ride!

Awesome article! Read while looking out the window in my office and giving myself a much needed mid morning break. Thanks for being honest and vulnerable about your first year. I have thousand and four days to go and I told my husband: I’m worried about what I’ll do without a job to give me a routine. Your article gave me a lot of things to consider!

THANK YOU for removing those annoying, clutter-up-the-space-and-annoy-the-fuck-out-of-readers ads! Such a pleasure to just read without all that background crap going on.

If this post does not make somebody want to achieve financial independence, I don’t know what would. Very motivating and inspiring.

It’s fantastic that your “New Motivations” of quality, helping people and creation are all things you have already been doing and succeeding at on your journey to fi.

As if we don’t talk about our future FI life enough, this post is enough to get us going for hours! We are on the path to FI though still towards the beginning. We have lists of what we want to do when we get there, but I think we will be totally lost when it happens.

I love that you wrote things through the year. I feel like you really helped us see what the transition is like. Even on vacations, switching the 9-5 mindset off is super difficult. I can only imagine a what it takes for the permanent switch off. I feel like we will be returning for inspiration from this post!

Congrats on your FI-niversary!!

It sounds like you are in a great spot in your life. That’s what FI is all about. Congrats on your FI and thank you for sharing! This is an article to save and look back to when planning for the future.

I have a one-year-old and get zero time to myself. For the past year, if I wasn’t at work, I was taking care of the baby. (My husband has been great about taking on more of the chores to try to balance things out). A couple of months ago, after talking it over with my husband, I switched from a regular 8 hours a day, 5 days a week job to an alternate work schedule where I get every other Friday off (and make up those 8 hours the other days). The idea was that that would be my personal time to read, relax, etc. But so far every time it’s my day off, the day gets filled up with other things – chores, etc. So now I’m afraid that when I finally reach FIRE that all that lovely freedom I worked so hard to achieve will get taken up with chores and other family obligations. Please reassure me that isn’t so! Are you stuck doing all the chores since you’re not working and your wife is? I don’t want to trade a decent-paying job I like for an equal amount of work at home that’s unpaid and less enjoyable.

I’m sure things will be less hectic for you once your baby gets a bit older but if you are overwhelmed by chores and maintaining your house, you may need to simplify. I realized I hate doing home maintenance so we now rent an apartment instead. I hated worrying about and maintaining all our stuff so we don’t own much anymore (our apartment is furnished). Obviously there’s still some cleaning and things to do occasionally but simplifying, downsizing, and getting rid of our stuff definitely cut out most of our annoying chores and obligations.

Mrs. Boss – I bet chores are like money in the sense that you’ll always need a little to get by. I’m sure once you’ve reached FI there will still be those minimal chores but you’ll have more time to do them. That said, simplifying like the Mad Fientist suggested has helped us reduce our stress and responsibilities too so that we can focus more on ourselves.

Hang in there. The first year is tough! Mine is a little over two, and it makes a difference when they can do a little more on their own.

Congrats on being financially independent!!!

We are not ready to FI/RE yet, but will be in about six years. We have a lot of travel plans which mirrors most people wanting to become financially independent.

The difference will be that I won’t have to bargain with my boss about how many days I can take off.

If I want to explore Alaska for a month or two, why not? If I want to go back to Europe for a year or so, not a problem!

It is all about the freedom to do what makes you happy. And that is the biggest motivator.

There’s a good reason why I’m an early riser on weekends and not so much during the week!

Thanks for being honest. Never knew that traveling too much would be too much. I’m a homebody so I think that I would feel the same on my first year of FI. Great pic of your house in China.

Awesome! Just because I am in a “devil’s advocate” mood… What’s the difference between Lesson #3 (appreciating fine coffee), and Lifestyle Inflation / AKA hedonic treadmill?

I mean couldn’t you apply the same lesson to expensive wine, scotch, cigars, faster cards with perfectly tuned engines, and exquisitely crafted furniture? Were you really unhappy drinking your “mediocre” coffee? Are you really that much happier drinking the fancy coffee, or have you just re-baselined?

Just some thoughts!

You raise a good point! There’s no difference, except I’ve chosen to allow the inflation to happen on items that won’t meaningfully impact my finances.

The coffee I usually buy is £3.50 (and one time I bought a bag for £6 when I was feeling really fancy) but normal, cheap coffee is probably £2 for a bag so I’m spending an extra £1.50 every few weeks.

Same with the olive oil (£6 vs. maybe £2.50 for a normal bottle) and balsamic vinegar (£6 vs. £2) but those last a lot longer.

I do the same with wine and beer. I average around £10 for a bottle of wine but it’s infinitely more enjoyable than the £5 bottle and I occasionally buy nice beers from Belgium but those are only €3 a bottle when I could get a can of okay beer here for around £1.50.

I’m also not continuing the inflation indefinitely. I’m sure £40 bottles of wine are fantastic but I really enjoy the £10 bottles I’ve been buying so I’m just going to keep doing that.

Since I only enjoy all these things occasionally and they bring me so much enjoyment, it’s definitely worth it to me.

Maybe you’re a cigar guy and you don’t care about olive oil so you buy the cheap oil but you spend money every now and then on a good cigar. As long as the cigar remains a treat and is not something you just do every night because that’s what you do, I think it’s fine maximizing your happiness-to-money ratio, at whatever level of spending that happens to be!

Yep. Life is too short to drink cheap beer. Great Post!

Congratulations! The first year is awesome, but the 5th year is even better! Ha ha ha, no need to worry. ER gets better with age, like fine wine. Great job with health and eating good food too.

It’s great that you took down the ads. Someday, I hope to do the same.

I’m with you on full time travel. We love travel, but just can’t see ourselves being on the road all the time.

Joe, I’d love to get you on my podcast to hear about your last five years so let me know if you’d be interested!

I’m interested, but it’d have to be after school starts. Kid is keeping me busy in the summer. I’ll contact you in September or October. Thanks!

Where can I heard this podcast

I second that – I would love to hear a podcast with Joe!

You are a completed Stud. Thank you. I was hanging on each and every word you wrote. What is staying with me from your post as I claw my way to Financial Independence is health benefits, actually enjoying lunch, and joy of being alive.

Congratulations! Sounds like ER is even better than imagined.

I was definitely getting excited for the Man, the Myth, and the Legend to get into the nitty gritty of withdrawal strategy, but guess I may have to wait a long time for that if the businesses are booming (and I say that with no begrudgement, wish you all the best on the FI journey).

However, that leads me to wondering are there bloggers that have the hard facts (from doing it) of withdrawal before 59 out there? Are there any bloggers that don’t have side hustles or rentals or other income (blog/ads) which are withdrawaling before 59 that you would recommend? Just at this point in my life have little desire for a side anything and want to conservatively assume that assumption continue, and am curious what information is in the blog-a-sphere outside of the general theory?

I’m also interested in finding this. My favorite bloggers have all ended up with passive or semi-passive income in retirement, so I see a lack of resources describing the experience of withdrawals. I’m familiar with all the theory, and planning to put it into practice starting next spring when I FIRE. But I do have some anxiety about it.

My greater anxiety may actually be “What if I just become a lazy bum? I don’t want that!”, so I appreciate the advice to already have a project or three started before FIRE. Just 227 days to get that going….

I’m 6 months into FIRE at 40 yrs old (with a couple of youngsters) in U.K., and am also really interested in withdrawal strategies. Great observation that all our favourite and successful bloggers don’t even need the 4% rule (I also do not begrudge them this – they are legends and deserve every success!!)

Hopefully Brandon can post some theory on this at some point (even if he doesn’t put it into practice for another 10 years ;-) )

Although he doesn’t blog anymore, you could check out Jakob’s blog – early retirement extreme – he was the original early retirement blogger and has years of posts about living off 4%.

I’m 59, have been retired for 3 years, have some money but not tons, living in Mexico. I don’t have a side gig, don’t really see it in my future. I’m just living each day, am bored some times, but not really sure what to do to make money, save the world, etc., that the bloggers tell us that we should do with all our options and time. I wonder if they are looking for things to fill an article with sometimes.

Enjoy!

Agreed on excitement on reading about MadFIentist’s withdrawal strategy. Maybe someday.

I’m looking forward to reading what Our Next Life has to say on this. Sounds like they haven’t really monetized their blog. I think they do own a rental though.

I believe Nords (who I interviewed here) donates all his extra income to military charities and just lives on his FI savings.

It’s so hard to find FI people without side hustles because anyone who is able to achieve FI at a young age will normally go on to earn unexpected income after they quit their job. As my buddy MMM recently tweeted, “The secret of very early retirement is that almost everyone makes money after retiring. Too much happy energy to avoid it.”

When you are able to devote all your time and energy to something you’re passionate about, it’s hard not to produce something that generates income (especially when you’re competing with others who focus on profit above all else).

Yeah, I think the people who achieve FIRE are generally pretty productive types, or they wouldn’t make it to FIRE in the first place. It’s not surprising they tend to make money here and there afterward even if they didn’t intend to. My own plans don’t *rely* on me generating income post FIRE, but I have some fun projects in mind that may end up doing that.

I have relatives who definitely would never earn another dime if they were given an income that was enough to live on. But there is also no way they’d ever be able to FIRE unless they won the lottery, because they don’t see the world as a place where their own choices can shape the path of their lives. Very external-locus-of-control. People who can FIRE are the opposite of that, and don’t sit around and wait for the world to happen to them. *We* happen to the *world*!

Yes…. the site is awesome without ads.

Thank you

I left my job one and a half years ago (at age 49, not that young for this crowd). For me, it took a long time to get over the feeling that I’m just on vacation and tomorrow I will have to get up early and go to work. I still occasionally have dreams where I’m back at the office. Annoying! At any given time, I have a big lists of projects to tackle. My biggest problem some days is deciding where to start. Some days are more productive than others. I have to remind myself that that is okay.

That’s a great point that I should have included in my post. It’s easy to beat yourself up when you have an unproductive day but I’m starting to get better at just giving myself a pass every now and then.

Hearing about your experiences in FI does motivate me to create a game plan when I reach FI. As a glorified service worker, I’m probably better suited to wind down instead of stopping completely.

Keep it up!

I took the leap two years ago and my experience was eerily similar to yours. Not only the feelings, but also the motions. I ended up with regular strength training, daily cooking, grinding my own coffee, started to notice all the small things that what was happening around me, and my sleeping patterns changed radically.

The biggest surprise for me was how much better I felt, both physically and emotionally, but it took more than six month for my body to get back to what I now consider to be a fully healthy state. On the one hand, we have an incredible ability to adapt to hostile and stressful environment, but we are also really bad at gauging the damage. In fact, I actually enjoyed my work and didn’t feel terribly stressed out.

The very first day of FI, I woke up pretty early and went for a walk watching people hurrying on their way to work. My strongest memory is talking to a guy who had checked out in different way — by consuming way too much alcohol for way too many years. He told me he would be happy to buy me a cup of coffee: “I can pay, I have money you now.”

Since you already found how amazing strength training can be, you should take a look at the Strength Training Pyramid by Eric Helms. He is the Mad Fientist of strength training. His nerdy interests cover both medicine and the practice of coaching and training. You’ll love his writing.

I wouldn’t worry about losing interest in finance. It happened to me as well. Nowadays, I look at my finances once or twice a year. The rest of the time I don’t even think about it. I believe that’s the way it should be. When the money problem is solved, it’s time to look for other interesting and exciting pursuits.

It’s amazing to be completely content, isn’t it! And with a little bit of Stoic negative visualization you can take it ever further.

Nice, I’ll definitely check out Eric Helms. Thanks!

Thank you for posting this thoughtful summary. It reminded me that there are so many ways that I can be happier and more at peace and grateful for exactly how life is right now — making time to stay healthy, savoring meals, and being fully present with friends and family and not obsessing about work.

I especially enjoyed your reflections on travel. “To be happy at home is the ultimate result of all ambition, the end to which every enterprise and labor tends…” — Samuel Johnson

Congrats on year one with decades to come. I love a lot of the things that you point out in this article. There are to many people in the FI space with their heads down plowing toward the number they have set for independence and forgetting to look up and smell the roses along the way. All of the benefits you spelled out through your first year are all the things people should be enjoying while working for their freedom number. I have come to the realization over the last couple months that I would rather add two or three years to my working life, slow down a little and live a little more free on a daily basis. I have, like you, increased my time spent working on my fitness because if I get to FI but can’t enjoy it what’s the point, right?

Thank you for all the work you do for the community at large and having the integrity to remove the ads now that you are truly FI. I think it shows true moral character. So thank you for setting the example and keep up the great work.

Yeah, it’s definitely not a race…the point is to just maximize happiness as much as possible (including the time before FI) so slowing down, even if it pushes FI out a bit, seems like a fine plan to me.

I really enjoyed your article. I have been fire since April 7, 2016. After working for 50 years I decided I would live on the internet taking classes, listening to pertinent broadcasts and teaching myself all about security. I grew out my hair and beard which was not possible when needing to present a good business front. I married the woman of my dreams 11 years ago and since we are in those “Golden Years” my ambition is to spend as much time as possible being with her. After 6:30 PM we go to the opposite sides of the house and immerse ourselves in our favorite projects and meet at midnight for sleep. I have developed a program of spiritual growth which has increased my contentment and lowered my stress. After being laid off at the last 4 major recessions I placed reaching FIRE my primary goal. I bought a small home which I paid for in 6 months. I paid off my 2 vehicles leaving no debt what so ever. I worked till I was 63 and went totally fire. Living totally on Social Security was turned into a science which gave me a lot of enjoyable FIRE applications of its principals which paid off more than I had planned. I have not had to touch our nice Facebook stocks and emergency fund. IN the past I was always stressed to ave a certain amount of money in the checking account to cover drafts to different bills. I use my local bank’s credit card to pay our bills now because I am not obliged to keep up with the stress full bank drafts. I pay the balance monthly and use the reward points for my wife to go on shopping sprees which gives me extreme joy to see her return home in a gleeful mood giving me a fashion show of her new purchases. in my reading I have found that tithing has a similar thread in most of the world’s religions so I give 10% of my gross income to charity with no financial bad side effects. I want to credit God and Mister Money Mustache and all the members of the MMM Facebook groups for new methods to enjoy my retirement success.

Very inspirational Earl!

Thank you Nevada!

Great post. It’s about 3 o’clock here and I am jumping on my bike to join my son at the pool.

It’s so true about the little things you don’t appreciate, like making a high quality lunch, or trying out a new fitness plan. Even if you spend four hours a day on personal projects, you’re done before lunch and you have the whole day open in front of you. It really took me a while to wrap my head around that, and your post describes that feeling perfectly.

Very good article. I love the first day of FI panic attack. I did not realize that our FI day was almost exactly the same.

My first year of retirement has been more of a challenge for me. Much of my self worth was wrapped in my job title and now I feel like a bit of a nobody. My wife still works and has no intention of quitting ever. She has her own business and it is a great business which she would do for free if need be. I have spent my time doing Genealogy research, transcribing my Diary’s onto a word document, playing the stock market, doing various adventure’s (biking long distances, kayaking, sailing, hiking the PCT etc) and traveling around the world.

I agree with you that finding motivation is very important once money is taken out of the equation. I have the desire to sail around the world but going without my wife has little interest and I believe that this has put my first year into a holding pattern. Unfortunately, I do not seem to be able to get out of the holding pattern and instead find myself engaged in many small adventures, which I am enjoying.

I completely agree with you that being FI is the most liberating thing that has ever occurred to me and I highly recommend it to everyone.

Thanks for the great post Brandon and wish you continued good luck in year two.

Stew

I just switched to working remotely and that alone has given me some of the same thoughts. Compared to being in the office I love it….I can only imagine how much better being fully retired would be!!

I FIREd in 2012 at 52. I’m older than you, so maybe that’s why my experience was a little different. I went through several stages:

1) Ecstasy (1st 6 months): Wow, I can do whatever I want. I’m so free! I think I’ll try this, that, and the other thing.

2) Hedonic Adaption (6 months – 2 years): Well, I’m free and I’m really glad I’m no longer a Wage Slave, but what the hell do I do now? I need some challenges.

3) Balanced (2 years until now): I don’t even remember what it’s like to work at a job that I hate. I’ve found some good physical and mental challenges. Everyday I try to do something that makes me a little uncomfortable. Life feels very satisfying and balanced.

Ha! Like “The Vigilante”, I was sipping a cup-o-joe as I read through your post, and the coffee-bit struck a cord as well. However, it was a slightly different cord. I just transitioned to a work-from-home scenario, and have begun to notice how much better my coffee tastes every morning…especially as I’ve been experimenting with the different roasts and blends. I think my wife secretly cracks up every time I smell my coffee and comment on it’s bitterness…or smoothness :)

Thank you for this post. My wife and I are knockin’ on the door of FIRE and I too have been freaking out a little bit. I’m fairly new to the FI community here, but a common worry and/or hurdle seems to be the “what’s next?” question. I’m trying to heed the warnings and rediscover my passions. Working from home certainly gives you that quiet time to think… and reflect …and explore …and read great blogs and stories for inspiration. Your post here inspires and gives me great peace. Your lessons are invaluable. Thanks again.

Very cool post! Bedding was a great idea for a treat to spend your surplus on – a good night’s sleep can really contribute to happiness :)

PS: I’m looking for side hustle ideas to help turbo charge my savings. Does anyone have any ideas? I have strong programming and writing skills.

Here’s what worked for me as far as side hustles are concerned:

1) Pick something you are really interested in and want to learn more about, create your own site about that topic, do some research to learn more, write about what you learned, interact with others who are interested in the same topic, and repeat the research-write process as much as you can (and also, don’t expect to make any money because it won’t come quick, if it ever comes at all). That’s my Mad Fientist story.

2) Notice when you say to yourself, “I wish there was a x that did y” and then use your coding skills to make that. I really wanted a good way to find the best credit-card signup bonus for specific airlines but it was always a huge pain in the ass figuring out which points transferred to which airlines and at what ratios. I thought to myself back in 2011, that’d actually be a pretty easy web app to write so I just did it over a couple of weekends. That turned into my card tool that I mentioned in the post.

The important thing is to pick something you’re interested and enjoy so that it doesn’t feel like work (after all, who needs another job?). If you don’t enjoy it, you’ll likely quit before you ever make a penny.

Very interesting article….I find my thoughts are different from yours and other bloggers, and maybe I wish they were more in line with yours, I don’t know. I retired 3 years ago, live a simple life in Mexico, not with tons of money but likely will be enough. I don’t have any side hustles, not opposed to one but just can’t think of one. I don’t wake up trying to find a way to accomplish things, or save the world. I do get bored some times, enjoy reading finance blogs and some travel blogs and enjoy living in different parts of the world, not to travel but to stay for a while and really see what it’s like. I enjoy the simple life, eating healthy, light fitness etc. I used to work like a maniac and never developed many side interests. I wonder if many others are like me?

At times I wonder if I should be doing more.

Thanks, I love no ads

I love the part about how there was nothing the two of you wanted to buy to make you happier. It speaks volumes for why you were able to achieve Financial Independence.

Thank you for sharing and inspiring us to keep working towards reaching our own goals. I can’t wait to see what you do with your second year of early retirement

I completed my Freedom! spreadsheet this morning, as I do on the first day of each month. My second best month since I began tracking it all earlier this year. Then I shut the computer, threw a suit on and rushed the kids through breakfast so I could drop them off on time to get to work. Life.

Because of you, MMM, Root of Good, Mr. 1500, PoF and Jim Collins, in exactly 27 months, I expect to find the freedom that you write about so eloquently in this post. You all have helped bring a focus and purpose to all of the savings I have done for the past 12 years — and helped inspire me to save more than ever. More important, you’ve helped me realize that the script that society prescribes can be thrown out the window in exchange for a life of Freedom!

I too am looking forward to exploring my passions in retirement, primarily artistic passions such as music. I’ve been planning to set-up a home recording studio to make music for years but just those excuses of daily life get in the way. I’ve also began to curate my post-work “work” as a charity auctioneer, which is a totally exhilarating experience for me and it helps a bunch of charities raise more money to do good things.

I also expect that first day, week, month, fortnight to be filled with long, drawn-out breakfasts (as well as video games, summer travel, etc…) with the kids and my significant other. The poached eggs especially sound delightful.

Thank you! Keep on writing!

What kind of music do you want to make?

I’m an electronic music nerd from the 80s influenced heavily by Depeche Mode, Yaz, Front 242, Skinny Puppy, Nine Inch Nails, etc. I’ve played synth in bands over the years going back to the mid 80s. I have so many ideas but just haven’t made the time to get an in-home studio together.

Look forward to hearing about your artistic venture in a future post.

Nice!! I love Depeche Mode and NIN. I tried to get tickets for Depeche Mode’s show in Glasgow recently but they sold out before they were even meant to go on sale :(

What’s the holdup on the home studio? Do you have a lot of gear or something?

I’ve had to limit myself to just my laptop and a midi controller for now because I needed to remove all barriers so that I’ll actually get some shit done. Plugging in my analog synth and getting it set up obviously isn’t hard but it’d be enough to just push me to Twitter or something instead, haha.

Get your studio set up ASAP and send me some sweet synth sounds! And if you haven’t guessed by now, my artistic venture is probably extremely similar to your own :)

Awesome! Look forward to hearing what you create. I will prioritize my studio. Need that creative outlet. Not a lot of gear at all. A Mac, a Roland Fantom X-7 and a new Steinberg UR22. And a set of Roland V-Drums. My limitation is that I’ve never set up a home studio before. Always just played live. So a bit of a learning curve.

Going to see Mode on August 30th in Chicago. Maybe my 14th or 15th Mode show dating back to their 1984 Some Great Reward tour.

Hit me on my email if you want to share tracks.

As usual, awesome post. It’s really helpful for those who are close to FIREing to see the process post-FIRE as you laid it out. And waiting a year was definitely the right choice.

This is awesome and really hits home. I had abreak this summer for about two months and I really started to get into the groove and I went through a mini version of what you did. It was amazing, and I was busier then when I was working. Alas, it came to and end. But it certainly motivated me to make this happen sooner and strive to accomplish it as soon as we can.

This is so motivating. Thanks.

I am almost two years into FI. Did a round the world trip and it was the best thing I ever did for myself but now that I am back to reality I have to admit I am still struggling to find the purpose. I do enjoy many of the benefits you have described but no strong motivation to push me forward. I guess I wasn’t prepared for FI life at all, could be because I was let go at work just as I hit my FI target.

Awesome first year! I gotta say, these are a lot of the same experiences I had my first year. Especially the part about no longer having excuses, and being present. I’ve hung out with way more friends and been there for family because I don’t have work as an excuse. The biggest thing I’ve taken from starting meditation is being present. Before I wanted time to fly by, now I want it to stand still so I can enjoy each moment.

We are still doing a lot of travel, but I think we may have found our limit at 2-3 weeks on the road. I still love it, but am also happy to spend 90% of my time around the house and neighborhood working on projects and hobbies.

I’ve also been eating better, and am in the best shape of my life. While I had some plans to try doing some contract work, it’s just not appealing since we don’t need the money and there are more interesting/rewarding projects to work on.

Glad to hear it’s going great for you too! Often times I think it’s too good to be reality, it’s nice to hear someone else experiencing the same thing. Now to just get more friends on board :)

Cheers!

Great wisdom: that’s exactly the type of thing I intend to do with early retirement. I’ll use it to pursue more fulfilling things. In fact, that’s what got me started – the desire to do other things as “work” (even though they don’t pay much/anything). And that’s what I blog about: orienting finances in a way that helps achieve purpose and add value to others’ lives.

There’s a wide gulf between working to be *free* of something and working *towards* something better.

This post gave me goosebumps. This is what I want!

We’ve had similar experiences in our first year of freedom; we are still over-scheduled with triathlon training, real estate investing, some part-time consulting for fun, traveling, hanging out with our adult children, blogging (http://www.declaringfreedom.com), and learning/doing new things. I think the one lesson from my experience is to schedule LESS, do LESS, and enjoy MORE – it’s not a race any more, it should be a time to delve more deeply into fewer things, and not be as frenetic as we were in our old lives. Love your site, looking forward to more!

I know that once I hit our number (both my wife and I are FI’ers in the making) I will want to do nothing. I’m so busy at this point that I cannot wait for the day where I can be the guy from Office Space: “I did absolutely nothing, and it was everything I thought it could be.” That said, travel is on the docket for year one and I cannot wait to really spend some time brewing. I don’t think I’ll be able to turn it into a business, even though I live in one of the more lax states as far as those laws are concerned (Live Free or Die!). I would be real interested in hearing some real life FI stories to see what it’s like to turn a hobby you enjoy into a business. I feel like it would structure the hobby too much and add in the stress you worked so hard to lose.

Hello Mr. Mad Fientist! What do you suggest for those who are not in the US and don’t have access to a free Personal Capital account to track net worth, monthly spending, etc.

I have used the FI Laboratory for a year but I was never sure I had added up my figures correctly, especially my net worth. I did some research on it but I felt the directions were too general, I never knew if I had either added too much or left out important info.

I really admire your life journey and the fact that you share it and help others achieve it too.

Thanks.

Net worth is just your assets minus your liabilities so just add everything up and calculate it manually!

I love that you waited a year for everything to sink in before writing about being FI. I’ve been trying to develop the mindset of living like I’m already retired as a way to test out my life post FI. So many of the lessons you mentioned are also some of the lessons I’ve been learning over the past 2 years.

In fact, I started a year-long Sustainably Happy Project this year to further explore what I want out of my life (since I agree with the idea that we should all retire to something, rather than just from something). Focusing on a new topic each month (this month is mindfulness and last month was friends and family) has helped me to finally prioritize all the little things I think I want more of in my life.

And I recently decided to take this a step further by taking a 4 month sabbatical from work. It’s easy to think that if I had more time I would do all of these things, so I wanted to fully test some things out by temporarily removing work from my daily life. I’m sure my 4 month break will go by very fast, but either way, I’ve committed to coming back to work part-time afterwards. That’s because through my happiness project I’ve learned that my time is my most valuable and finite resource!

Thanks for the great post!

Very cool project. What have been some of your biggest takeaways so far?

Hope you enjoy your 4-month sabbatical (I’m sure you will)!

It has been a really great project and has fundamentally changed how I view and approach my life. There have been so many interesting takeaways from this project, but here are a few that seem constant regardless of what I’m focusing on:

1. Busyness is relative – it’s about what we prioritize and make time for. (In fact, I’ve stopped using the excuse that I didn’t “have” time for something and instead say that I didn’t “make” the time)

2. Happiness is a daily choice and it’s easier to enjoy my life when I focus on being present (rather than focusing on what happens next)

3. Making myself happy rarely costs money, but it does requires time

4. Embracing who we are (quirks and all) takes less energy and usually makes us more fun to be around :)

great reminders, thank you

Sounds like a busy and rewarding first year! I’m about to complete year #4 of early retirement and I still have trouble wiping the stupid grin off my face. I’m sure others wonder why I’m smiling so much :)

We’re entering phase #2 of early retirement – so far we’ve been “stay at home parents” taking care of the youngest one during the day. Once we return from our 9 week trip in Europe in a few more weeks, our youngest will almost immediately start kindergarten (and the older 2 kids return to school full time as well). So we’ll be kid-free from 8:30 am to 3 pm every day which means tons more free time to do… well, I’m not sure yet :) I’m sure I’ll fill the time with something interesting, engaging, and fun. I’m looking forward to see how our daily routine changes this fall though.

Anyway, best of luck in year #2!

Thanks, Justin! Hopefully we’ll get to finally meet in person somewhere in the world this year.

I have been retired for 21 yrs and not really FI. But do have an investment portfolio. I found that it was a good idea to have several Hobbies to help fill the time. Life has been good health not too bad, though aging has its problems.

Incredible read, and the timing couldn’t have been better for me personally. I am in my third month (or fifth fortnight!) of FI. It’s awesome to hear your detailed experiences because I’ve been going through a lot of those same emotions and experiences. It was somewhat reassuring to know that the outright gravity of the freedom affects many of us in the same way. My first day was glorious. The feeling of new found freedom was incredible and at the same time absolutely terrifying. I’d worked for 25 years, and I’d spent the last 9-10 years really pressing toward FI, so it wasn’t like I was unprepared for the actual day. But it wasn’t exactly like I’d imagined. It’s hard to explain it, but your article came as close as I can capture in words. It’s euphoric and somewhat gut wrenching all wrapped up together. My wife left her job about six months earlier, so we’ve spent much of our last five fortnights ;) catching up on healthier activities (running, walking, biking, kayaking, tennis, etc.). We will likely start more traveling next year, so just a few short trips so far. It is wonderful…the freedom each day to choose whatever is next! I’m still wrapping my mind around it, nearly three months later. My favorite days are days spent just creating something new around the house or working in the yard. And I had to laugh at your coffee point, though it has been craft beer for me (but I do love a good coffee stout!). We’ve become quite the experts on our local craft breweries (and we have quite a few really good ones!). You are also right about the meals!