If you are a longtime reader, you know I’m obsessed with minimizing taxes.

Increasing your savings rate by decreasing your taxes is one of the best ways to retire earlier because you don’t have to earn more, spend less, sacrifice anything, or take on any additional risk.

In the example I gave in the Retire Even Earlier article, the lab rat was able to reduce his short career from 11 years to just 9 years, just by reducing his tax burden during his working years.

While the Retire Even Earlier article focused on utilizing tax-advantaged retirement accounts to lower taxes, today I’m going to discuss a powerful tax-reducing strategy that can be applied to your taxable accounts: tax-loss harvesting.

Tax-Loss Harvesting Summary

The basic idea behind tax-loss harvesting is that you sell investments that have decreased in value and then use the losses to decrease your income taxes.

Say you bought 600 shares of VTSAX (Vanguard Total Stock Market Index) for $110 and then, a few months later, the price drops to $100. Since your $66,000 investment is now worth $60,000, you have $6,000 worth of unrealized losses. If you decided to sell your shares and take the $6,000 loss, you can then use that loss to cancel out capital gains or lower your taxable income by a maximum of $3,000 per year (any losses in excess of $3,000 can be carried forward to future years).

Automatically calculate your net worth, asset allocation, and investment fees with this free portfolio manager!

Get StartedStay Invested

You may be thinking, “Mad Fientist, you really are mad. Why are you telling me to buy high and sell low?”

Although I am suggesting you sell your investments at a loss, I’m not suggesting you stay out of the market after you sell.

In the simple example above, the best course of action would be to sell your shares of VTSAX for $60,000 and then use that money to immediately buy shares of an index fund that performs similarly to VTSAX but is different enough to not be considered a wash sale.

Wash Sale Rule

A wash sale is when you sell shares at a loss but buy substantially identical investments 30 days before or after the sale.

In the example scenario, if you sold your shares of VTSAX and then immediately bought more shares of VTSAX, the transaction would be considered a wash sale and you wouldn’t be able to use those losses to reduce your taxes.

Therefore, rather than immediately repurchasing shares of VTSAX, you should instead purchase shares of a fund that performs similarly but tracks a different index (even if two funds contain similar stocks, the fact that they track different indexes should be sufficient enough to avoid a wash sale).

For example, maybe you could buy shares of VLCAX (Vanguard Large Cap Index) instead. That way, your money will still be invested and will still rise and fall in a similar manner but the transaction won’t be considered a wash sale.

Lab Rat Scenario

Let’s use the last 9 years of historical stock data to see how beneficial tax-loss harvesting would have been for the lab rat during his working years.

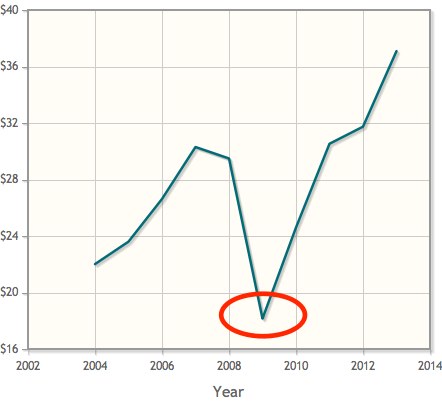

Assuming he only looks at his investments at the end of each year, here is what the adjusted prices of his VTSAX investment would look like.

You can see that the price rises during the first few years, so there are no tax-loss-harvesting opportunities here. In 2008, the price dropped a bit but the majority of his portfolio was bought for less than the 2008 price so it may not be worth the hassle to harvest a small amount of losses at this point.

When he checks his portfolio in December of 2008, however, he’ll be in for a shock! The value of his investments have decreased dramatically. Rather than get scared or upset by this, the lab rat is smart and seizes the opportunity to not only harvest his losses but to use those tax savings to invest more money while the market is down.

To harvest his losses, he decides to sell all of his shares in VTSAX and immediately use that money to buy shares of VLCAX. Based on the lab rat’s numbers in the Retire Even Earlier post, this sale would result in over $14,000 worth of losses.

Note: Check out my article on tax-gain harvesting to see how he could have booked $21,000 worth of losses instead!

Although VLCAX is a fine investment, he prefers VTSAX so after two months, he decides to sell all of his shares of VLCAX and use that money to repurchase shares of VTSAX. Since the market was still falling in early 2009, this generates an additional $800 worth of tax losses that he can add to the $14,000+ that he already harvested.

So with just a little bit of work and two months of being invested in VLCAX, the lab rat now has nearly $15,000 worth of losses that he can use to offset future capital gains or lower his taxable ordinary income.

Since his future long-term capital gains will be taxed at 0%, thanks to his low level of income in early retirement, it makes sense to use those loses to lower his ordinary taxable income while he’s still working.

In this scenario, that means the lab rat can lower his taxable income by $3,000 for the last 5 years he is employed! Since his marginal tax rate is 15%, that means he will be able to invest an extra $450 per year that would have otherwise been spent on taxes!

Transaction Costs

Transaction costs can obviously decrease the benefits of this strategy but you can buy and sell Vanguard index funds without paying any fees, and you can trade Vanguard ETFs for free with a Vanguard brokerage account, so those are great options if you want to harvest your losses for tax purposes.

Dividend Reinvestment

To avoid wash sales and to help make your record keeping easier, you may want to manually reinvest dividends in your taxable accounts. That way, you don’t have to worry about an automatic dividend reinvestment interfering with or complicating your tax-loss harvesting.

Conclusion

By simply harvesting your losses during your working years, using those losses to decrease the taxes on your ordinary income, investing those tax savings, and then happily enjoying your tax-free capital gains during early retirement, you can boost your savings rate and achieve financial independence earlier without much additional effort.

Are you a tax-loss harvester? If so, how much have you saved by harvesting your losses?

I’d never heard of this before and in the UK we have a slightly ‘nicer’ opportunity where we can roll over any amount for future use.

I was struggling to work out how and where to invest money after my SIPP (401k) as I would need it in ER long before I’m 45, nevermind 55. This will assist in that nicely and I can accrue losses that will help in the future.

Though I must check if we have an equivalent of a wash sale rule here

Thanks MF

Glad it was helpful, Connor.

I’d be really interested in hearing your findings regarding the wash-sale rules in the UK. When I lived in the UK, I had just graduated from university and I didn’t make much money so none of this stuff mattered but since my wife and I plan on going back to Scotland soon to live for at least six months every year, that sort of information could come in handy.

Actually, I should start reading more about UK rules in general in preparation for our move so are there any UK FI blogs that you’d recommend?

MF & Connor,

Here is a good summary of tax loss harvesting in the UK.

Monevator is probably the best UK PF blog (useful stuff about cheapest UK index funds, broker platforms, tax). Retirement Investing Today is also worth a look (good for market data).

I’m Scotland-based and (possibly) moving to the US soon, so your site’s been very helpful – happy to return the favour if you have any questions about UK financials or tax.

Cheers!

Excellent! Thanks a lot, Alex.

Where in Scotland are you? Where in the US are you thinking about going? Maybe we could just switch places :)

I’m in Edinburgh, finishing off a medical/cancer PhD. Not sure about location in the US yet – I’m considering options (when I get round to job applications very shortly!)

Vermont looks pretty nice to me – swapping could be a plan! In any case you should give me a shout if you’re in town and fancy a pint :)

I actually just booked my wife’s flight back to Scotland for the holidays today but sadly I’m not going to be joining her this time.

I’ll let you know next time I’m over though and we’ll definitely grab a pint!

This is interesting. So this only applies once you have reached financial independence?

No, not at all. This applies to anyone who invests in a taxable investment account.

One way you could look at it is to think of it as trading a marginal income tax rate for a long-term capital gains tax rate.

Imagine that you are in the 25% tax bracket and the $43,000 worth of shares you bought is now worth $40,000. By harvesting those loses, you are reducing your taxable income by $3,000 and are therefore saving $750 on your income taxes ($3,000 x 25%).

You have now lowered your cost basis for that investment though (from $43,000 to $40,000) so when you eventually sell that investment for $45,000, you have $5,000 worth of long-term capital gains instead of the $2,000 you would have had had you not harvested your tax losses.

Therefore, you are effectively trading a marginal income tax rate (which in this case is 25%) for a lower capital gains tax rate (which would likely be 15% in this hypothetical, non-FI scenario).

That is a great trade to make because you are not only deferring the tax (i.e. getting a free loan from Uncle Sam) but you are paying 15% instead of 25%.

For someone who is FI and is living on a reasonable amount of income, the savings will be even greater. Since an early retiree will likely fall within the 15% tax bracket, all of their long-term capital gains will be taxed at 0% (assuming the tax laws stay the same). This means that they’ve not only deferred paying tax on that $3,000 worth of income, they’ve completely eliminated it because the long-term capital gains on the investment will eventually be taxed at 0%.

Does that make sense or did I just muddy the waters more?

Sorry if this is redundant; I’m a bit new around here :)

Hubs and I file jointly and are in 28% tax bracket (or atleast were for 2014). I have 115 shares of stock IBM stock I when bought when I used to work for them through their employer in their purchase plan. The shares are currently around $160 a share; over the three years I was buying in, they were anywhere from 195-215 a share.

A couple questions:

1) Can capital losses, presumably combined with other deductions, be used to drop you in to a lower tax bracket?

2) Is 3K the limit of loses that can be applied every year? Is there any variance in this (married vs. single, for example?)

3) How will the discount in buying I received through the ESPP (5%) affect the way the loss is calculated?

Thank you so much for any advice!

Did anyone answer this ESPP question? I want to know too!

With the new tax rate, i’m currently in the 12% temporary tax bracket. Would it be beneficial to harvest tax losses if I anticipate that I will end up paying 15% for capital gains tax? Would you expect that even paying a higher tax rate later, having more money to invest now would result in more growth from the additional money than loss from an increase in tax rate down the road? Had this thought because of your post on “how to access retirement funds early” you mention taking the tax penalty for early withdrawal still puts you ahead. Seems to me this would in effect be a similar strategy only with a 3 percent penalty vs. the 10% penalty described there. Let me know what you think. Hope this made sense.

We took advantage of tax loss harvesting to great advantage in the 2008-2009 market crash. Every year since then we have enjoyed a $3000 capital loss that offsets against ordinary income.

Cha-ching! $1,110 in tax and other income-related savings each year (37% marginal tax rate). I think we still have around $16000 tax losses still laying around, waiting for 2013’s 1040, and 2014’s, and 2015’s, etc… :)

The funds I bought back in 2008-09 with the proceeds from all those tax loss sales have now appreciated hugely (most up over 100%) and huge cap gains. But those cap gains aren’t taxed till I sell. So I managed to use the tax benefits of losses immediately (for the last few years and next few years), and the burden of gains will be postponed as long as possible.

Come to think of it, I haven’t checked my tax lots in a while to see if there are any more harvesting opportunities.

Folks, wrapping your head around tax loss harvesting like the Mad Fientist suggests is like picking up free money off the ground. Let the IRS give you a loan today on the losses you book, and maybe you pay them back later when you sell investments when you are FI.

You can control your cap gains better when FI. For example, if you need $40k to live on, you sell an investment with basis of $20k and $20k of gains, you only have $20k of income taxed at favorable cap gains rates. You may owe very little tax or none.

Tax loss harvesting certainly helped me get to FI at age 33. And I doubt I’ll ever have to pay much in taxes now that I’m retired and our income is much lower.

That’s awesome, Justin! The numbers look even better for someone with a 37% marginal tax rate so it’s good to see you’re really maxing out the benefits.

Excellent point about controlling your capital gains after FI. I imagine it will be pretty easy to stay under the 15% income tax bracket so that all long-term capital gains and qualified dividends are taxed at 0%.

I meant to ask you before but whereabouts in North Carolina do you guys live? I went to high school and college down there so I’m curious where you’re located.

Our fed rate will be right at zero. I expect to do some trad IRA to Roth conversions to use up the zero % bracket and make sure I have enough AGI to qualify for obamacare subsidies of some sort.

We are in Raleigh, North Carolina. I grew up in Cary. I went to the two big state universities here for engineering then law. Where were you in North Carolina?

Good call on using up that 0%. I’m looking forward to taking full advantage of it next year after my income drops off.

By the way, I really enjoyed your article on Obamacare.

I went to high school just a bit north of Charlotte and then I went to get my degree in computer science from the same university where I imagine you studied law. It’s been a while since I’ve been back down there though so I’m looking forward to visiting that area sometime next year. We’ll have to get together for a beer at Linda’s or He’s Not :)

Yes, sounds like we attended the same university. I never went to Linda’s (from what I remember!) but went to He’s not a number of times. Look me up if you head this way! First round’s on me.

I’m glad you enjoyed the Obamacare piece. It is one of my more popular posts, and provides a good quick summary of how obamacare can help early retirees (from a subsidy stand point, but honestly more importantly from a stability stand point)

My roommate’s brother was a bartender at Linda’s so that’s why I went there quite a bit. I’ll definitely let you know if I end up making it down that way next fall. Second beer’s on me!

Sounds like a plan!

Glad to see all of the posts recently! Thanks for sharing!

I just had a few comments around this great madness! I have a very similar strategy for my finances, but I think it would be more beneficial to harvest the gains (and reset the cost basis) in 2004, 2005, 2006, and 2007. This would increase the rat’s cost basis and, thus, capital loss in 2008 from approximately $14,000 to $22,000! And, all of the LTCG’s from 2004-2007 would be taxed at 0% as the rat’s taxable income would still be well below the top of the 15% tax bracket when including the LTCG’s. I agree with you and think the rat should use the $3,000 loss each year against his ordinary income until the rat retires. This revised strategy might allow the rat to offset any ordinary income a few more years. Let me know what you think!

Nick, nice to hear from you again! As always, you’ve delivered a thought-provoking and intelligent comment (very much appreciated).

Harvesting the capital gains is a great idea and is something I didn’t think about! So rather than do nothing during the years the value of his investments is increasing, he should instead sell and then immediately re-buy the same investments each year to lock in the capital gains (you don’t have to worry about wash sales with capital gains).

Since the Lab Rat’s long-term capital gains tax rate is 0%, even during his working years, there is no reason not to lock in the capital gains since he doesn’t have to pay any tax on them. As you mentioned, that would allow him to increase his cost basis and then harvest an even bigger loss at the end of 2008! Excellent idea!

I “tax gain harvest” in my kids’ UTMA accounts. It’s chump change (maybe avoiding $200-300 in future tax liability), but it is also an excellent use of a few minutes to save a bunch of money.

Hi MF,

I was doing fine with the capital loss harvesting part, but am getting lost now with this twist of capital gain harvesting.

Do you guys mean the two can be combined to minimize tax liability? If so, can you do some examples please to show how the 2 strategies can be used together? Sorry for being slow here.

Also, sounds like capital gain harvesting only applies under 2 conditions. Please correct me, if I’m off.

1. Assets have to be long-term (held over a year).

2. AGI has to be kept under 15% marginal rate?

Thanks!

Hey Jian,

Yes, the two can be combined to further minimize the Lab Rat’s tax liability (in this case, the tax-gain harvesting is being used to increase the amount of losses he can lock in at the end of 2008).

It’s definitely a bit confusing so you’re not being slow. In fact, I think it warrants its own post so I think I’ll write a follow-up post specifically about tax-gain harvesting. I’ll try to publish it sometime in the next week or two but in the meantime, I’ll answer your two questions…

1) Yes, the assets should be held over a year so that the gains are taxed as long-term capital gains.

2) To have a 0% long-term capital gains tax rate, you need to keep your AGI under the 15% marginal rate. While tax-gain harvesting could still be beneficial in some other scenarios, the 0% long-term capital gains tax rate is the reason tax-gain harvesting would be such a no-brainer in this specific situation.

Hope that helps!

Thanks! I look forward to your follow up piece on this.

I, too, am looking forward to this future post. Particularly what the caveats are around income levels and taking advantage of this, it sounds like you could easily wind up increasing your taxes quite a bit if you did this and had too high a salary.

Hey Justin, I’m currently working on the post and should hopefully publish it early next week.

You’re absolutely right though that you would most likely not want to implement this type of strategy if you had a high salary.

Hopefully the post will clear things up so stop by next week to check it out!

Hey MF, Monevator as posted above has steered me in the right direction on the path of FI. I highly recommend it.

In the UK, we have a generous (cough) pension allowance of £50k this financial year, reducing to £40k next year. This plus an ISA gives £61,520 of tax advantaged accounts. Fabulous I hear everyone shout… But is this really so.

I’m 31 this year and with 24 years before I can officially draw my retirement fund I have a huge problem of being top heavy within my pension and not having income to retire on early.

As it stands, I have my mortgage paid off (£153,000), £8k in my SIPP, £25k in my ISA and about £13k of emergency funds in a cash saving account. Very cash heavy but I’m in business, so when opportunities arise, I have to act quickly.

My plan is to max out my pension for the next two years (£90,000) and then top this up with 10k each year (I’ll have income in retirement from two businesses). Taking a 6% annual gain, this would afford me an £841k pension pot at 55.

This is where the beauty of your post struck a cord. How to best make use of the taxable uses of my money as soon as I max out my pension & ISA. I’ve read through the HRMC site and as far as I can see, we have similar laws about buying and selling shares here in the UK (30 day rule). However we can roll over all our losses indefinitely as long as they are recorded at tax time and then drawdown from them as needed, to keep us within the 10,600 capital gain allowance. BOOM!

If shares are up, the goal will be to sell as many share each year to keep gains within the 10,600 limit. If they are down, then its to sell, move assets and rebuy after 30 days or lump them into a tax advantaged account such as an isa.

One thing I truly havent accounted for until now, is the shortfall between retirement and drawing a pension and this has ruined my best laid plans above. Any thoughts MF?

Hey Connor, sorry for the delayed reply; I have been out of town and am only now catching up on emails/comments/etc.

Monevator may be the best person to ask about dealing with the early retirement shortfall because there could be something you could do to access those UK retirement accounts sooner that he may be aware of.

For example, in the US, it’s possible to convert your other retirement accounts into a Roth IRA and then withdrawal those converted amounts five years after the conversion date, without paying any penalties.

Based on the hassles of trying to move my UK pension money to a US retirement account (I still haven’t figure out a way to do it), I can’t imagine there’d be an easy way to access your pension money before standard retirement age but hopefully you find a way.

Your best bet may be to focus on building your businesses so that they provide the necessary cash flow for your early retirement years.

Or, you could take a semi-retirement approach and simply earn enough every year to cover your expenses by doing something you enjoy.

If you’re like me, you’d probably hate to give up the tax breaks by investing most of your money in a taxable account but if you’re worried of coming up short during early retirement, that may be a good option too.

Definitely keep me posted on what you decide to do!

Re: transferring a UK pension to the US – supposedly it’s possible if you transfer to a ‘qualifying recognised overseas pension scheme’, or QROPS. More info at the HMRC QROPS page, which contains a list of such schemes by country (link on left), of which there are a handful in the US.

In practice, I’ve heard it’s difficult/impossible to do as no one seems to know how to handle it on the US end, or they say the IRS won’t allow it. Would be interesting to hear if you were more successful!

Yes, there are only a handful of QROPS in the US and sadly, I’m not currently enrolled in any of them (and after speaking with Fidelity a while back about it, I’m not able to enroll in them as an individual because they are employer-based plans).

As you said, even if I could enroll in one, I too have heard it’s difficult to transfer everything over because nobody on this side of the pond knows how to handle the transaction.

I’ve just resigned myself to the fact that I have a chunk of money in the UK, not really doing much, that I will need to remember to take advantage of it when I reach standard retirement age.

I haven’t done much of this over the years, but this year I think I’m going to dump a fund that has been languishing for awhile. I love when I can accomplish two things with one action!

It definitely helps take the sting out of selling something for a loss!

Thanks for stopping by and nice work coming up with the term, “pretired”. It’s fun making up words, isn’t it :)

Just so I’m clear… tax harvesting is a strategy people use on their taxable investment accounts, right? Or can you use this in some way on investments held in IRAs or 401ks?

Exactly. Tax-loss harvesting is for investments in your taxable accounts only.

I know this is a bit random and somewhat unrelated but lets say you have a ROTH IRA you recently opened and bought a stock and then sold it 3 or 4 months later for a loss. Any way to harvest those losses even though its within an after tax retirement account? Sorry if that doesn’t make sense.

Hi Chris, sadly you can’t harvest any losses incurred from buying and then selling a stock within a tax-advantaged account like a Roth IRA.

Chris, I think you have options within the same tax year of the contribution only. Google roth ira horse race. I saw a discussion once on bogleheads about maxing 3 roths at the beginning of the year and then somehow canceling the 2 underperformers and pulling those funds back out at the end of the year.

I actually wrote an article about the Roth IRA Horse Race – https://www.madfientist.com/roth-ira-horse-race/

I’ll be taking advantage of some tax loss harvesting this year :) What a great methodology and the only reason you should ever sell investments at a loss. (that I can think of)

It definitely takes the sting out of selling something for a loss :)

That’s the best feeling! “Crap, I’m taking a bath on this and losing $5000. Oh wait, make that a $3000 loss for me and ole Uncle is making a charitable contribution to cover the other $2000 of loss!” :)

I have a question on this. I’m still relatively new to how taxes interact with investments (as, currently, I’m just getting started on investing and only have a 401K so far), but I’m a mathy person who loves optimizing things, so I love to learn and understand this stuff.

Say you harvest a loss by selling VTSAX at $40k which had a cost basis of $43k and immediately buy VLCAX. VLCAX then proceeds to rebound back to $43k and the price stays high. As I understand things, you would want to wait a year to sell VLCAX and buy back VTSAX so that it is taxed at the long-term capital gains rate instead of ordinary income rate. Am I understanding things correctly?

Yes, you are exactly right. That’s why you should be just as happy investing in your alternate investment (VLCAX) as you are investing in your primary investment (VTSAX).

Let me know if you have any other questions!

Very informative post, I will definitely be doing this in the future.

Is selling for a loss like this still worth doing if you don’t plan on reinvesting the money? I have a bond index fund that continues its downward tumble (down about $1000 so far). I’m considering cutting losses and moving it to a cash account while saving up for a house downpayment.

Am I right in thinking I would get back whatever my tax rate was? For instance, if I sell and claim a capital loss while in the 25% bracket, would I basically be refunded $250 on my taxes (and lose $750)?

If you were planning on moving out of the investment anyway, tax-loss harvesting is a great way to make the pain of the loss a bit less painful.

Your thinking is correct. Based on your tax bracket, tax-loss harvesting should allow you to turn your $1000 loss into a $750 loss.

When tax harvesting, does it matter when filing taxes whether the loss/gains were short term or long term.

Below is an example of what I have done for the 2013 period,

Short-term gain $2,062.29

Short-term loss -$807.17

Long-term loss -$912.41

Thanks,

James

Hi James,

For losses, it doesn’t matter if they’re short term or long term but for gains it does. Short-term capital gains are taxed as normal income whereas long-term capital gains are taxed less.

Looking at your numbers, it seems you will have a net $342.71 short-term capital gain, which will be taxed as ordinary income.

When possible, you should try to hold your assets for longer than a year so that you pay the favorable long-term capital gains rate.

Hi, I’m new to your site so not sure if anyone else has mentioned it, but if you’re planning to spend a large proportion of the year in the UK, you’ll have to be careful you don’t accidentally become UK tax resident. There isn’t a hard and fast number of days rule; it’s more if HMRC decides that the centre of your life is UK-based (amount of in time spent where, if you own property elsewhere, etc). Also look into estate planning – your UK-born wife might want to take steps to ensure she’s not subject to UK inheritance tax, as the tax-free threshold is significantly lower than the US one (although spousal transfers are exempt).

Hey Louise, great points. The last thing I want is to plan my US tax life out perfectly and then be blindsided by UK taxes (I used to live in the UK so I know how harsh the taxes there can be).

Thanks a lot for the comment and I’ll let you know what I find after I’ve had the chance to investigate.

Such a great post, I have revisited multiple times as I have opened up Vanguard fund for myself, my parents and my girlfriend. Over the last few months I have realized that utilizing the ETF’s might be a better option then the mutual funds for some of these accounts. So maybe you know the answer to this question I have been seeking – Example – If i were to sell my shares of VTSAX and buy VTI the next day, would that count as a wash sale? (Assuming the first was at a loss).

Thanks!

Tom

Glad you enjoyed the post, Tom.

Selling a mutual fund and then buying the ETF version of the fund is a bit of a grey area but most people consider that a wash sale.

Therefore, you’d probably be better off either waiting at least 30 days before buying VTI or buying something that has similar performance but would not be considered substantially identical (maybe VOO or VV).

After a few months of deliberations, I converted my cash savings into $25,000 of VTSAX today. I was just wondering if the market took a turn for the worse, how would automatic dividend reinvestment interfere with tax-loss harvesting? And do I have to wait 30 days before I can begin to harvest?

Hi Anthony, here’s how automatic dividend reinvesting could create a wash sale: Say VTSAX drops 20% so your portfolio is now worth $20,000. You decide to sell half your shares to lock in a loss off $2,500. If your dividends get reinvested automatically, it’s possible you could wash out some of those losses. For example, say a week after you sold half your shares, you received a $500 dividend payment and automatically rebuy $500 worth of VTSAX. That would mean $500 worth of your $2,500 would be a wash sale so you’d only be able to claim a $2,000 loss. Make sense?

As far as needing to wait 30 days, you can sell VTSAX immediately if you’d like but you won’t be able to buy it back until at least 60 days have passed, due to Vanguard’s frequent trading restrictions.

Love this site! Couple questions on this older post: I assume this can be done with stocks in a regular taxable account? Can I do it with just selling a portion of a stock or fund holding – not selling all of it? Is there a max capital loss I can do each year?

Thanks!!

Glad you’ve been enjoying the site, Pete!

Yes, this must be done in a taxable account and you can harvest as much or as little as you want to every year (there’s no max loss you can book each year but only $3k can be deducted from your regular income so the rest has to be carried forward to future years).

Great article and definitely something I’d never thought about!

Have a question, however, about how to deal with this in more long term way where I’m up on my investments overall. Say that someone bought $30,000 of VTSAX at the bottom of the market in late 2008 and early 2009. Let’s also say for the sake of this example that wherever that person bought it is the lowest the market will ever be in their lifetime. Obviously in this case, they could not just hold until it goes below the cost basis, as that will never happen. There will be many smaller market dips in that person’s lifetime, however, so what would the best strategy be for locking in these losses?

If your investments keep going up after buying them, you won’t be able to harvest any losses (great problem to have) but if you continue buying at different points, you should be able to harvest some of those smaller market dips you mentioned. I actually just read an interesting white paper describing the new Tax Loss Harvesting+ functionality that Betterment is now offering. They use complex algorithms to intelligently harvest some of the smaller losses your portfolio incurs throughout the year so you should read through that to see how you could lock in some smaller losses even if your portfolio is marching upwards.

This is good information.

1) I was under the impression that any dividends (qualified and non-qualified) are subtracted from any realized loss. For people that are in the 15% tax bracket and would normally not be taxed on qualified dividends, are now losing some of the loss deduction benefit. Figuratively speaking, for people in the 15% tax bracket, dividends are taxed when claiming a loss.

2) I thought that tax loss harvesting while in the 15% tax bracket only makes sense for short-term losses. Any long-term losses while being in the 15% tax bracket would result in zero deduction since the tax rate is 0% in that bracket. However, I found this post ( http://www.obliviousinvestor.com/capital-gains-and-losses-tax-short-term-and-long-term/ ) with the following example:

”

EXAMPLE 3: In a given year, Jeremy has:

$2,000 net short term capital gain and

$3,000 net long term capital loss.

Jeremy will subtract his LTCL from his STCG, leaving him with a $1,000 LTCL. Because this is below the $3,000 threshold, he can deduct the entire $1,000 loss from his ordinary income.

”

This would suggest that even though this is a NET long-term loss, $1,000 is handled as a short-term loss which can be deducted as such.

Any ideas?

3) In addition to my previous comment, switching back to your preferred fund after 60 days will ensure that any dividends from the temporary fund are treated as qualified dividends. However, I think one needs to hold the fund for 6+ months in order to claim a *full* short-term loss, otherwise dividends will need to be subtracted from the loss and will count as long-term loss.

Any thoughts on this?

It’s probably best to do loss harvesting right in between ex-dividend dates, assuming that the portfolio is still declining.

4) Any experience whether switching from VTSAX to its ETF cousin (or non-admiral fund) will trigger a wash sale?

Hi Tom, harvesting any type of loss makes sense because you can use it to reduce your taxable income (up to $3,000 per year but any excess can be carried forward to future years). I wouldn’t worry about whether your losses are short-term or long-term; you just need to worry about minimizing your short-term gains.

Whether switching from VTSAX to VTI or VTSMX would trigger a wash sale…the guidance on what is and what isn’t a wash sale isn’t very clear but I don’t think I’d risk it (especially going from VTSAX to VTSMX).

Just to verify. Even a long-term loss while being in the 15% tax bracket can be subtracted from ordinary income?

That sounds too good to be true. One could make money even if the stock doesn’t increase in value.

(1) Stock purchased for $100, now falls to $50 -> $50 income reduction.

(2) Stock goes back to $100 -> gain taken at 15% tax bracket (no taxes paid).

(3) Stock falls to $50 -> $50 income reduction, rinse and repeat.

Essentially, while being in the 15% tax bracket, we’ll never pay anything on the gains, yet we’ll still get to subtract any (temporary) losses.

Yes, losses can be used to reduce your ordinary income by up to $3,000 every year no matter what tax bracket you’re in. It’s good to be a fientist :)

Let’s say the lab rat has VTSAX in its IRA and Taxable account. Can you disable dividend re-investing in the IRA so the wash sale rule isn’t triggered when realizing a loss in the taxable account? Where would the IRA dividends go? Let’s assume the lab rat doesn’t have any other fund in the IRA and the dividends will be below the minimum to start a new fund from it.

Hi Steve, you should be able to disable dividend re-investing in your IRA. When you do this, the dividends would likely be placed into a money market account, which you could then use to invest whenever you reach the minimum to start a new fund.

Hi Steve, please help me out here to double check a concept.

The Tax Loss Harvesting (TLH) topic is only applicable to Taxable accounts right?

If I am thinking of rolling a rollover IRA to betterment the TLH won’t help me right?

Sebastian, TLH is only applicable to taxable accounts so you wouldn’t be able to harvest any losses in your IRA.

Just stumbled upon this article. Very informative.

Few questions:

– To claim the losses, wash sale rule requires that you don’t trade the same or similar stock in the 30 days period _before_ and 30 days period _after_ selling the stock in question. So, you have to always consider a 61 day period, isnt it?

– How do you determine “same” or “similar” stock as per the wash sale rule? For example, I have ATT (Ticker: T) for which I want to harvest the losses. Can I “replace” this with, say, Verizon (Ticker: VZ) stock the very next day and still claim the losses? or will buying VZ make it a wash sale ?

I just confirmed this.

– You _are_ required to consider the 61 day period.

– Individual stocks are not considered substantially identical.

Hi Paras, sorry for the delayed reply but glad you found the correct answers!

I bought GoPro when it was at its highest a couple years ago. I think I’m sitting on an 80+% unrealized loss. Since it’s an individual stock, can I sell today, buy it back tomorrow, and still claim the tax benefit?

What happens when one is in the 15% tax bracket (no tax on dividends), and one has earned qualified dividends AND interest from a savings account (hence a short-term gain)? Can a short-term loss be applied toward the interest from the savings account, or does one have to apply the short-term loss toward any qualified dividends (which would mean no taxable advantage since qualified dividends aren’t taxed in the 15% bracket)?

Example:

Short-Term Loss: $100

Qualified Dividends: $200

Interest from savings account: $200

Tax Bracket: 15% (no tax on qualified dividends).

Could one apply the short-term loss toward the interest earned from a savings account?

Thank you

Hi Mike, interest is treated as ordinary income so you can’t just offset that with capital losses like you can with capital gains. If you have a net loss for the year though, you can use up to $3,000 of those losses to reduce your taxable income (including your interest income) so you could do it that way and then roll over all excess losses to future years.

Just to clarify if I bought a Mining Company’s Stock 2 years ago and I want to sell it at a 1000 loss now, would I need to buy a different Mining Company’s stock?

No, definitely not. If you want to get out of owning mining stocks, you can just sell the stocks, book the loss, and then move your money into a better investment.

I remember reading this article a few months ago and not quite getting it. Now it makes perfect sense to me.

In a way, using this is sort of like guaranteeing you get to buy “near the bottom” if the market goes lower in the future!

If you had a big sum to invest, choosing to lump sum over DCA would make even more sense if you were able to make use of tax loss harvesting – because if the market went down later, you could always tax-loss harvest to rebase it at the lower price!

Well, you don’t get to buy near the bottom because although your cost basis changes for tax purposes, you still bought the stock when it was higher so that’s what will affect your profit when you finally sell for good. This definitely makes market dips a lot easier to deal with though.

You’re right about lump-sum investing. Dollar-cost averaging is a suboptimal strategy to begin with but when you have tax-loss harvesting in your arsenal of tools, lump-sum investing makes even more sense.

I need to study this concept (and your great blog entry!) in much, much greater detail, but it does give me a slight bit of hope. I have been looking with dismay (and a bit of exasperation) at the (my) pre-tax IRA money my late (beloved) husband bought a (single) stock with back in 2011. (He believed he’d figured out a ‘hot stock tip’ from some hugely expensive newsletter without actually buying the newsletter…) He put $44,358 into this stock. It is now worth a whopping $2,027. {sigh}

I have not done anything with it; partly because the money is gone ANYway and what diff if the last $2k bleeds out; and partly because he was so excited and pleased to have IDed this stock which he was SURE was going to make us millionaires… (and, you know, the money is gone anyway). He bought it in early 2011, and died suddenly in July 2011 — you’ll understand that dealing with this stock has been EXTREMELY low on my list of things to get done!

I had two 7-yr pre-tax IRA CDs (at 6.5% — ah, the good-old days!) that came mature in early 2012, and I socked that money away in two Vanguard Admiral funds (REIT and stocks); but since the bad stock had already dropped to pennies, I’ve left it alone — pretty much betting it WILL go to zero and (only then) I will have to figure out how to handle dead stocks.

I’ve been working my butt off since his death to save the manufacturing company I inherited from him; and I DO see a light at the end of the tunnel and it is NOT an oncoming train. (So, YAY me!) I’m still in survival mode (I was a kept wife: No insurance, and no retirement money from him. He said — and I allowed — that the company would be our retirement… Live and learn? Oh, no, die and leave learning behind? Whatever.). I do finally see a secure(-ish) future ahead with the company and have finally this year been able to throw $6.5k into the Vanguard IRA. Oh, and the sucky part (well, another sucky part) is I’m 59!

So, two questions:

1. does this tax-harvesting mean I might be able to pull some small (or maybe even ~$40k?!?) tax benefit out of a tragedy? (Well, two tragedies — the bad stock, and his death.)

2. Can I ‘spend’ the loss going back in time as well as against future taxes ($3k a time)?

And folks, take my painful lesson as an example of what not to do! I had owned my own house and business before I met him (he’d never owned a house!). (That’s where all the pre-tax IRA money came from: my past employment!) We both “preferred” that I not continue working, but instead be a lady of leisure and help out in his company when he asked. (Thankfully, over 17 years I had learned a lot more about the company than I realized! I was able to pick it up (over the past few years) and put it back into operation!)

I was content to let him manage our money, even when he did things I would not have done. {shrug} He gave me a fantastic life for 17 years; I do not regret it one bit! *I* would have done things differently, but I don’t regret relying on him (even with the hard several years since his death!). (He gave me a monthly status sheet, but I paid little attention because I trusted him, and he took such good care of me. And then he died.) Best-laid plans, eh?

(Sorry this is so long!)

Hi Elenor, I’m sorry you’ve had such a tough couple of years but I’m glad things are looking up.

Sadly, you won’t be able to do anything with those massive losses because that money is in a tax-advantaged account. Since you don’t pay any tax on gains within an IRA, you can’t use any losses within an IRA to reduce your taxes either.

Since $2k is still quite a bit of money, I’d just sell and invest that into something more productive. I know it will be hard but what’s lost is lost so there’s no point following a bad past decision with another bad decision in the present. It’s easy to think about how much it was worth before but if you say to yourself, “Would I invest $2k in this stock right now if I had an extra $2k laying around?” and your answer is “No”, that’s a pretty good indication you should sell and invest that money somewhere else.

Good luck and I hope things keep getting easier for you!

Thanks! This, especially,:

“It’s easy to think about how much it was worth before but if you say to yourself, “Would I invest $2k in this stock right now if I had an extra $2k laying around?” and your answer is “No”, that’s a pretty good indication you should sell and invest that money somewhere else.”

is BRILLIANT!

Thanks, I finally understand this concept now. I had an adviser try to convince me this was a good idea and he couldn’t explain why selling low was a good thing.

Glad it was helpful!

Thought I’d update y’all. I went over to Scottrade this week and told them to sell the (poor) dog of a stock. (It doubles the pain that they’ve been court-ordered to add some mgmt layer or something, so I got hit with TWO $20 Mgmt fees. Argh. And my 7,800 shares are now 32 shares of something…) The plain-brokerage acct is sending my ~$200. I was filling out the gummint paperwork for the IRA, figuring losing the 10% penalty was worth it just to be done — and the paperwork had checkboxes for “normal distribution: must be 59-1/2”!! I look at the kid and said, “Oh! But you’ve already sold this, right? Or can it wait — cause I will BE fifty-nine-and-a-half in June this year!!” (It was already sold, but he can keep it in an acct till June — NO PENALTY!! Whoo hoo!) (Well, so I’m “saving” a whopping $85.50 — but any money kept from the govt is good!)

And I am going to pull out of the “IRA acct total” the money that they folded in from my late husband (which was not IRA money, just plain-old money) and add it to my the non-IRA $6.5k and apply this tax break to it! Thank you again!

Thanks for the update, Elenor!

I just made some moves with my money this week that I should have made a while ago and it feels good to finally get everything sorted out, doesn’t it?

I’m trying to figure out how do some Tax loss and Tax Gain Harvesting with some cash I have in VWIAX, I want to simplify this process and you recommended not to automatically reinvest the dividends (which I’m doing with VWIAX ) and I think also to ask Vanguard to do specific identification of the lots, please remind me if I forgot any other suggestions.

Buy investing in an ETF Fund instead of an index fund would that eliminate the wash sale problems and the need for special identification or do all the same rules apply in an EFT.

Does Vanguard have a service that helps with the harvesting to avoid the wash sale rules and is the charge worth it or is there is a software out there that helps.

What are the advantages of an ETF .

Do you recommend a couple Tax efficient funds to do these Tax Gain and Tax loss Harvesting correctly and not end up with a lot of non-qualifying dividends .

Hey,

Quick question: Do you know if wash-sale applies to re-buying in a Trad IRA? So, if in my brokerage, I realize loss of $7,000, but re-buy that equity in my traditional IRA, if the wash-sale applies? Thanks.

Yes, the wash sale would apply because it doesn’t matter what type of account you buy it in.

Brilliant. Just brilliant.

And to make things deeper (or more complicated)? I just (on 3 July) got paperwork from some law firm up North about a class action suit something-or-other, and fill out this paperwork to get (some apparently SMALL amount back (due to malfeasance)… But the legal form ALSO says it has to be returned within 90 days BY JUNE 22nd!?!? So, idiotic, but I’m trying to find out what’s going on. I’m sure the lawyers are making out like high-end bandits, but looks like I will get around $25?! (yippee?) (Probably not even worth doing the paperwork… {sigh})

Regarding Dividend Reinvestment:

“To avoid wash sales and to help make your record keeping easier, you may want to manually reinvest dividends in your taxable accounts. That way, you don’t have to worry about an automatic dividend reinvestment interfering with or complicating your tax-loss harvesting.”

Should I manually reinvest dividends in my IRA too?

I have shares of VTSAX in a taxable account and an IRA account.

If I sell VTSAX to purchase VLCAX (taxable account) then will there be in wash-sale implications if my IRA automatically reinvests dividends to purchase more shares of VTSAX?

There would be wash-sale implications so that’s why I do my tax-loss harvesting in between VTSAX’s 3-month dividend cycles (for example, I’m planning another big tax-loss harvesting for the middle of February so that I don’t have to worry about pausing all my dividend reinvesting in my tax-advantaged accounts).

Does it make any difference if what you’re selling at a loss is a short-term or long-term holding? Is there anything I should take into consideration when selling one type or the other?

Short-term/Long-term only matters for selling gains.

Can you only use this technique in taxable accounts? I am new to the investing game and have a couple of retirement accounts that I invest in. Would I be able to use this technique on those retirement accounts?

Tax-loss harvesting only works in taxable accounts.

Thank you. Been digesting all from you, jlcollins, MMM, ERE, etc. for a couple weeks. Each article or podcast is slowly painting the picture of my own financial future. I hope I can repay your generosity someday. Please keep it up!!!

Thank you so much for this detailed explanation and all the other great topics you post. Yourself, GCC, MMM, and Mr. Collins are true mentors and inspirations to me. Unfortunately, I browsed outside of your site(s) to research this topic and am now I’m left confused. Truthfully I trust you more, so I wanted to ask what is correct based on my situation.

I have sold VTSAX at a loss and wish to buy VTI. As I understand from your post, for me to avoid the wash sale, I can buy VTI on the 31st day after selling (Since it’s the exact same holdings). My confusion stems here from this article. https://www.kitces.com/blog/the-wash-sale-problem-when-tax-loss-harvesting-almost-substantially-identical-mutual-funds-and-etfs/.

My confusion and take away from the article is that if I move forward with a purchase of VTI before 60 days I will take a wash. My take away from you is that I can wait 30 days, but on the 31st. Can you provide some clarification, so I can avoid the wash sale? Appreciate your time and assistance!

Some additional information that may change your response. 30 days PRIOR to this sale of VTSAX I have purchased VTI shares (Essentially the same security). The amount of shares I purchased is approx. 32% of the value of VTSAX that I sold. Will that trigger a wash sale for that portion of the VTSAX sale in which I am trying to tax harvest? IE: 32% will be a wash, the other 68% will not be as long as I wait X number of days before purchasing anymore VTI.

A complicated matter, I know, but trying to take advantage of the market, like a newb. :)

Yeah, looks like you have a wash sale on your hands for that 32%. As I said in the post, “A wash sale is when you sell shares at a loss but buy substantially identical investments 30 days before or after the sale.”

Make sure you wait 30 days after the sale to buy again so that you don’t have a wash sale for the other 68%!

Fair enough. Rookie mistake made, lesson learned. Thanks for your response!

It happens! Not a big deal so just learn from it and move on :)

This is awesome, you learn something new every day!

I currently max out a Roth IRA and contribute to my 401k so I get my company match but not to the max allowed. I love this idea of harvesting tax losses and gains but what are you thoughts on opening a taxable account if you aren’t maxing out your retirement accounts yet?

Thank you for your awesome post MF. You are obviously the expert at this and I’m definitely coming back for more.

After reading the entire post and also your replies in the comments section, I think I got the concept but still nervous as I don’t want to make any mistakes that will result in more taxes. Can you please help me out?

Currently in my VTSAX:

Short-term loss

– $4,227.41

Long-term loss:

– $1,944.02

Total

– $6,171.43

It’s May 6th right now and I currently have this fund in automatic reinvest dividends. A few questions:

1. Is the process on Vanguard.com as simple as clicking on “exchange” and exchanging VTSAX to VLCAX? I’m asking mainly because you mentioned “realize lost” and I’m just being careful to not miss a step to realize this loss. (I’m assuming it’s documented withing Vanguard.com and therefore automatically realized)

2. Please check my math here. If I bought back VTSAX in 61 days and if during that time VLCAX increased in value. The value would then be counted towards the capital gain for this year. Correct? So if it gained for example $4000 in 61 days and if I exchanged it back to VTSAX, the real harvested amount would be back to 2171.43.

3. Should I wait until after the June dividend payout before I make this loss harvest so I can avoid a possible wash sale? Or is May a safe period to perform this? Obviously I should remove automatic dividend reinvest from here on. Is this correct?

Thanks for this great intro! Some questions:

– Does tax-harvesting work if you purchased the “losing” security in a previous year? For instance, if I purchase a single stock in my taxable portfolio in August 2015, then sell it in March 2016 at a loss, can this loss be harvested by buying a similar security in 2016?

– Do you have to re-invest precisely the same dollar amount in a single transaction? ie, if I sell my “losing” security at $6500, then purchase $10,000 of a similar security, can this be counted as harvesting? Or would I need to show paper trail of a purchase of $6500?

– How similar does the “replacement” security need to be? ie, If the losing security were CHK and the replacement security were CVX? (Both oil production companies)

– Is there a maximum time to re-purchase a similar stock? Or is it just within the calender year (or tax year?) of the sale at a loss?

– Where does the actual harvest calculation take place? Is this on Schedule D?

Thank you!

Mad Fientist, huge fan of your writings and podcast. Thanks for all of your great work. Is investing in a taxable account with a robo advisor like Betterment or Wealthfront which practices TLH possible, if I’m currently holding VTSAX in a Roth and VIIIX (s&p 500 institutional) in a 401K? It seems like the TLH which would occur within the the taxable robo-advisor account might create a series of wash sales along side the non-retirement accounts due to being involved in similar fund selections. Betterment even advises having the retirement accounts in target funds as a strategy to negate any potential wash sales. Any thoughts on this being an issue with IRS rules?

Hi Mad Fientist,

I am really enjoying your podcast and blog. I am one of those people who needs to find every tax break I can get *now* since I am single, self employed and on track to have my third year in a row of $100k adjusted gross income. I have large quarterly tax estimate payments too.

If I can reduce my tax bill during the year, I have more to save after I max out my 401k.

I ran this tax loss harvesting concept by my CPA, who said that because I was in the 21% marginal tax bracket in 2016, it would only save me about $630 on my tax bill for 2017 if I wind up in the same bracket.

I am considering a two-step approach where I transition over the next three years out of my “day job” business into rental properties. I am not sure if that will help me drop into a lower bracket, assuming I am still getting a healthy income from the rentals.

In addition to Frugalwoods-esque extreme frugality, any other articles you could direct me to to help me discover ways to reduce my tax liability while I’m still working?

Thank you!

Anyone know if I sell FNMA at a lost and immediately buy FMCC, would it trigger a wash sale?

So how do I determine if another fund is different enough from what I am selling to not be a wash sale?

The other fund cannot be “substantially identical” and purchased 30 days before or after the sale. Ultimately ask your financial adviser whether the new investment purchased will trigger a ‘wash sale’. The broker should know because they are the ones reporting the sale on the 1099-B which will have a “W” code which is a disallowed loss.

If I only have about 3000 in my brokerage account with about 150 in losses for the year is it worth the trouble to harvest? Thinking of doing it just for the practice?

Thanks for the informative article!

I’m concerned I may have made a big mistake in my first attempt at tax loss harvesting and I was hoping you could help me out. In my taxable brokerage account I sold all of my VTSAX and most of my VOO at a short term loss of ~$2700, I then repurchase VLCAX directly with the cash from that sale. However I had an automatic contribution in my Roth IRA go through two weeks before this sale and purchase VTSAX. Have a created a wash sale even though these transactions were in separate accounts and the Roth IRA fund has no tax implications anyway?

If I have I understand there is a way to roll over the losses and add the $2700 to the cost basis of the new shares. Which shares am I allowed to roll the cost basis into VLCAX or the Roth IRA VTSAX (which means I essentially lost the losses). Vanguard hasn’t flagged me for a wash yet but I fear it’s coming, is there anything I can do to reverse this such as sell the shares I bought two weeks ago in the Roth IRA? Thanks.

Great Article!

I do have a question: For example: Say I originally bought 1000 shares of XYZ on Feb 2018 ($30/share), and then decided to buy more XYZ for another 300 shares of XYZ on Nov 2018 ($20/Share). The market has taken a hit, I decided to sell the 1000 shares of XYZ before 2018 year end (december). I keep the 300 shares of XYZ.

Am i safe from tax loss harvesting for keeping the 300 shares that i didn’t sell and deduct the loss from the 1000 shares.

I cant seem to find an example on the internet similar to mine, all i see is that full shares being sold for tax loss harvesting qualification and not half shares being sold….

Thank you,

Thanks for an amazing post! I used this method at the end of 2018 and exchanged all my shares of VTSAX for VFIAX, logging a huge long-term capital gains loss worth tens of thousands of dollars.

My question is, what should my strategy be to get back into VTSAX, which I prefer slightly over VFIAX?

For this to continue to be advantageous from a tax perspective, would I need to either A) wait for the price of VFIAX to dip below what I paid in December; or B) wait until my taxable income is under $78,500 (married filing jointly) to get the 0% capital gains rate and follow the tax gain harvesting strategy?

Thanks again for the clear explanation of this concept.

So my decades old shares in GE may not be worthless after all???

Hello! I am just starting to research FIRE so I am a little new. I understand that idea and it sounds great but I assume you would need some sort of form when filling your taxes to actually be able to benefit from this. The Mad Fientist gives great advice but I haven’t been able to find any blog that talks about how to actually file your taxes to incorporate such ideas. If anyone knows I would greatly appreciate it.

You’ll receive a 1099 from your broker which will show your losses for the year. You’ll input this into your tax return just like every other 1099 you’ve received in the past, the losses will offset other cap gains and up to $3k of ordinary income. If you have more than $3k in losses you can carryforward the remainder for future years.

Any basic tax software will figure this out for you, I like Credit Karma tax.

Capital gains, losses, and carryover losses are reported on Form 1040’s Schedule D.

https://www.irs.gov/forms-pubs/about-schedule-d-form-1040

I tax loss harvested when the coronavirus crash happened, switching from VTSAX to VLCAX. Now I have VLCAX, which is very similar, but has a slightly higher expense ratio, and so I’d like to switch back to VTSAX. However, I am above the line for 0% capital gains tax, and likely will be until I retire. Should I switch back once I’ve held them for a year (to avoid the short term capital gains tax) and eat the taxes, or just sit on this until I retire and hope the higher expense ratio isn’t a bigger negative in the long run?

good morning sir,

thank you for writing this article.

I have a question if I bought vtsax at 1/5/2022 and exchange it to vfiax on 1/26/2022 will this be considered a wash sale?

thank you!